ETH Technical Analysis

Key Insights

- Ethereum (ETH) maintains its rank as the second-largest cryptocurrency by market capitalization, with a valuation of $372.7 billion.

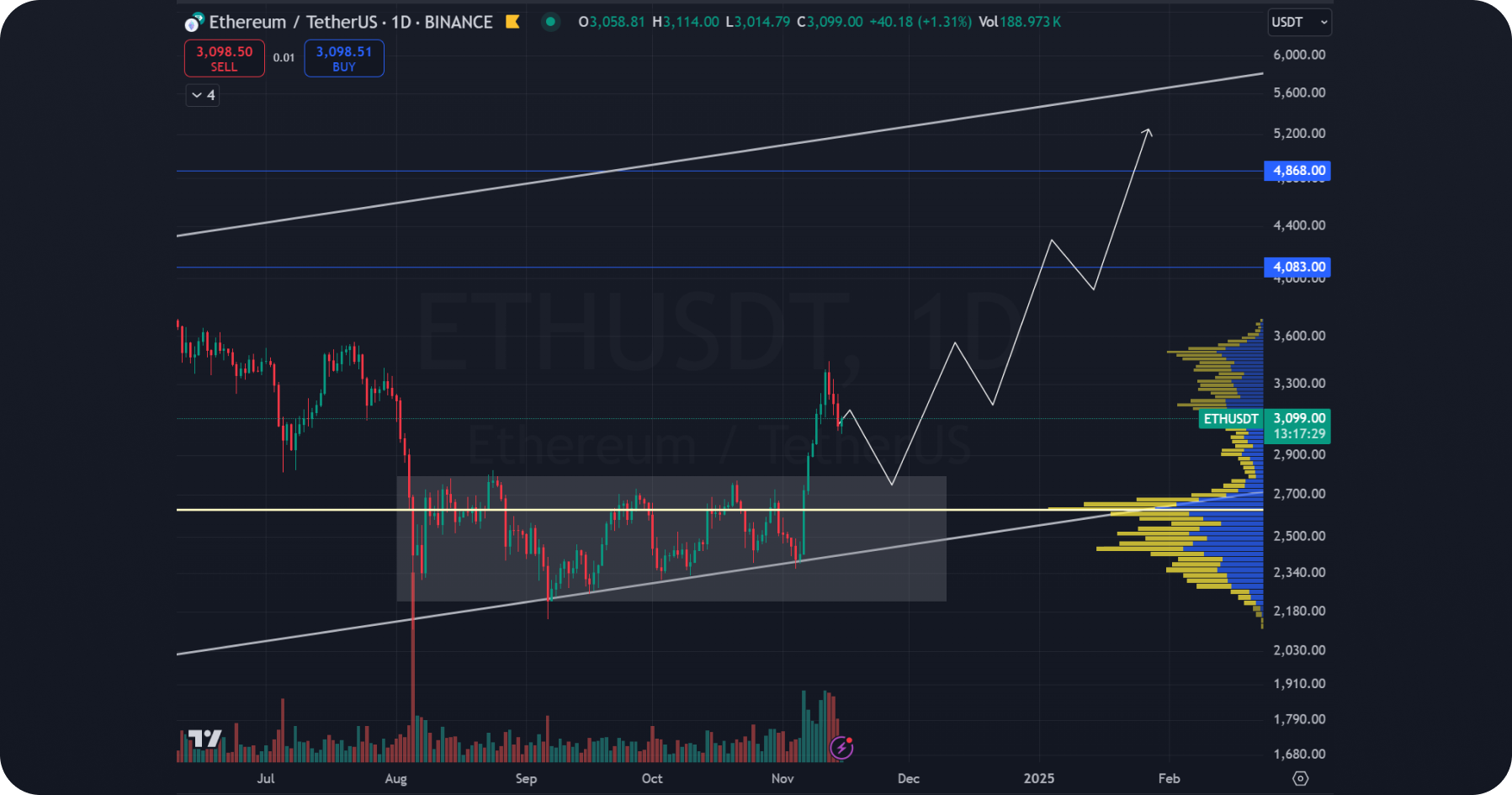

- ETH has been in a long-term growth phase since March 2020, despite corrections. After falling to a low of $881 following an 81% retracement from its $4,868 all-time high (ATH), ETH has shown steady recovery within an ascending trend channel on the daily chart. Recent consolidation and surges, especially the 44% increase in November 2024, suggest bullish momentum.

- ETH is expected to target $4,100 and revisit its ATH at $4,880. Breaking past this could lead to a price discovery phase, with potential targets of $8,000 or even $11,000 in an optimistic scenario. Strong support levels at $2,800 and $2,650 underline a stable foundation for further growth.

Ethereum (ETH) continues to hold its position as the second-largest cryptocurrency by market capitalization on CoinMarketCap, boasting a market capitalization of $372.7 billion. This consistent market standing highlights ETH's leadership and steady interest among investors.

ETH Tech Analysis

On the weekly time frame (TF), ETH shows signs of a long-term correction while remaining in a broader growth phase that began in March 2020. Starting from a low of $86, ETH witnessed remarkable growth, achieving an all-time high (ATH) of $4,868 in November 2021. Following this, the asset underwent an 81% correction, touching a low of $881.

On the daily chart, ETH’s recovery trajectory appears more measured, suggesting an ongoing accumulation phase. From its low of $881, ETH has developed an ascending trend channel, with the price steadily climbing within this range. Over the past months, ETH has tested the lower boundary of this channel six times, each time demonstrating a strong reaction, reinforcing the trend line's significance.

Since August 2024, ETH has been consolidating between $2,260 and $2,800. In November, ETH experienced a 44% surge within days, fueled by election-related news in the U.S., climbing from $2,380 to $3,440. This rally was accompanied by high trading volumes, hinting at the possible beginning of a new bullish trend.

Notably, ETH bypassed testing the $2,800 resistance and the Point of Control (POC) at $2,650, jumping directly to higher levels with strong daily candles. This indicates robust support at $2,800 and $2,650, levels where the price may eventually retrace.

ETH Price Prediction

Further growth for ETH is anticipated, potentially following a corrective phase. Short-term targets include $4,100 and the ATH of $4,880. Upon breaking its ATH, ETH will enter a price discovery phase, which could lead to impulsivegrowth.

Should ETH break above the upper boundary of the trend channel, it may accelerate its upward movement, targeting $8,000 and, in an optimistic scenario, surpassing $11,000.

Users can get ETH and any other cryptocurrency for fiat or crypto on SimpleSwap.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.