Market Overview: October 2024

This blog post will cover:

- State of the Market in October

- Bitcoin Dominance

- Trading Activity and Volumes

- Market Sentiment in October

- Meme Coin Trend Continues

- The Telegram Mini-Apps Trend

- End of the Retrodrop Era

- November Expectations

- Conclusion

Historically, October has been one of the most positive months for Bitcoin and the cryptocurrency market as a whole. This reputation has earned it the nickname "Uptober". However, October 2024 began on a troubling note: amid macroeconomic uncertainty and heightened geopolitical tensions, the crypto community even coined an alternative term, "Rektober." Despite fears and instability, October eventually met expectations, returning to the typical upward trend for this time of year.

In this review, we'll look at the main trends and changes that impacted the market in October. The analysis will cover Bitcoin and altcoin movements, BTC dominance growth, and trading activity trends. We'll conclude by looking at key events that could influence the market in November.

Source: CoinGlass

State of the Market in October

The month started with uncertainty, and Bitcoin's price dropped to $58,946. Nevertheless, by month-end, Bitcoin showed solid growth, closing at $70,292 and reinforcing its "October bull" reputation. Overall, the price rose 10.76% from the open and 19.2% from October's low to the month's close, again demonstrating the asset's strength during a historically favorable period.

Source: Cryptorank

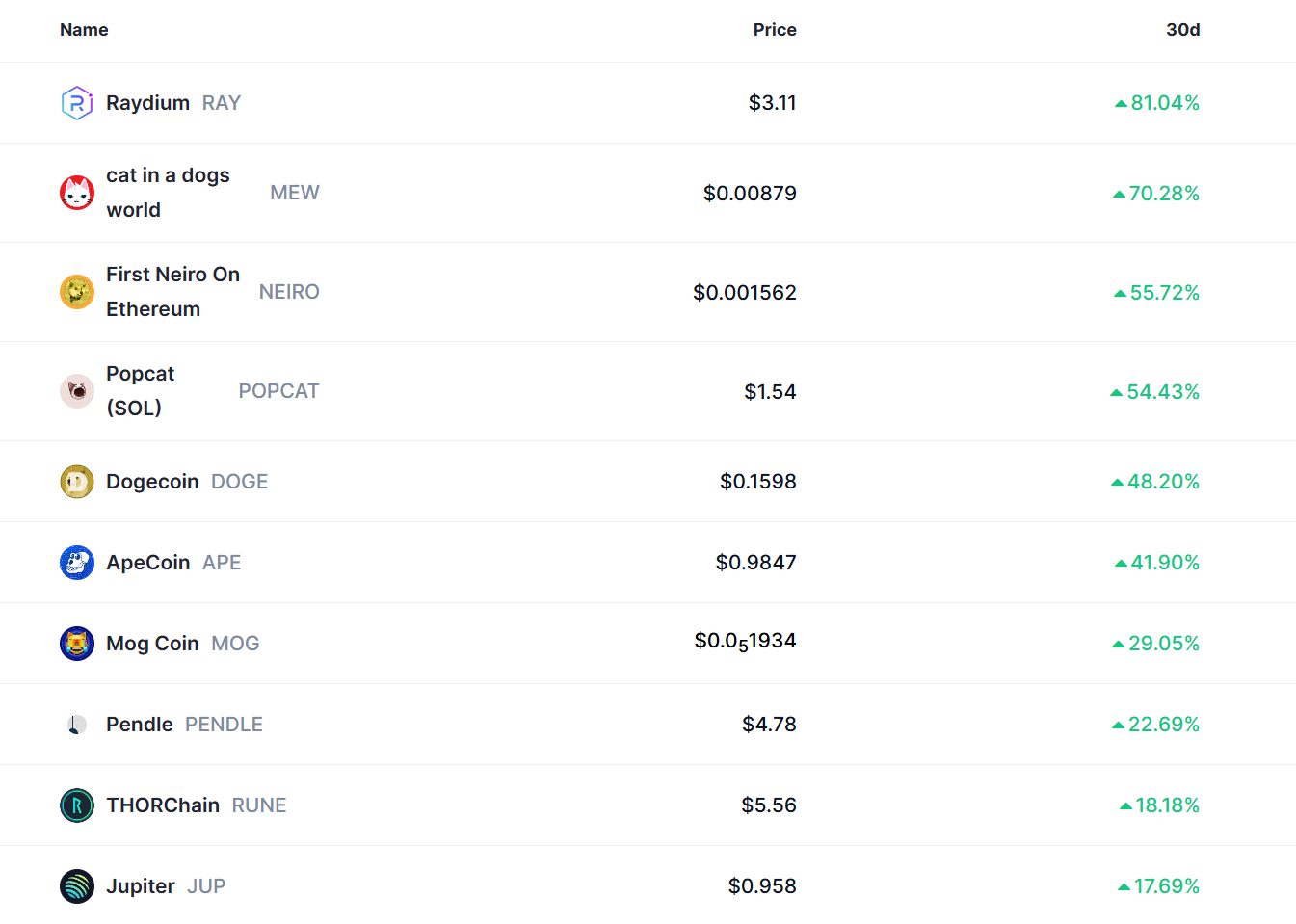

Alongside Bitcoin's uptrend, some major altcoins also showed confident growth. Among the top 100 cryptocurrencies, the following stood out:

Raydium (RAY): +81.04%

Cat in Dogs World (MEW): +70.28%

First Neiro on Ethereum (NEIRO): +55.72%

Popcat (POPCAT): +54.43%

Dogecoin (DOGE): +48.20%

Source: Coinmarketcap

Bitcoin Dominance

In October, the altcoin market did not show strong growth momentum, despite the fact that the TOTAL3 chart (the indicator of the total market capitalization of altcoins excluding BTC and ETH) broke out of a descending channel and crossed the trendline, as noted in our September review.

As long as Bitcoin’s performance remains high, altcoins will continue to feel the pressure, with investors opting for the main cryptocurrency. Bitcoin dominance is now near the Fibonacci retracement level at 0.61, a critical moment that could become a turning point, potentially creating more favorable conditions for altcoin growth.

Source: TradingView

Trading Activity and Volumes

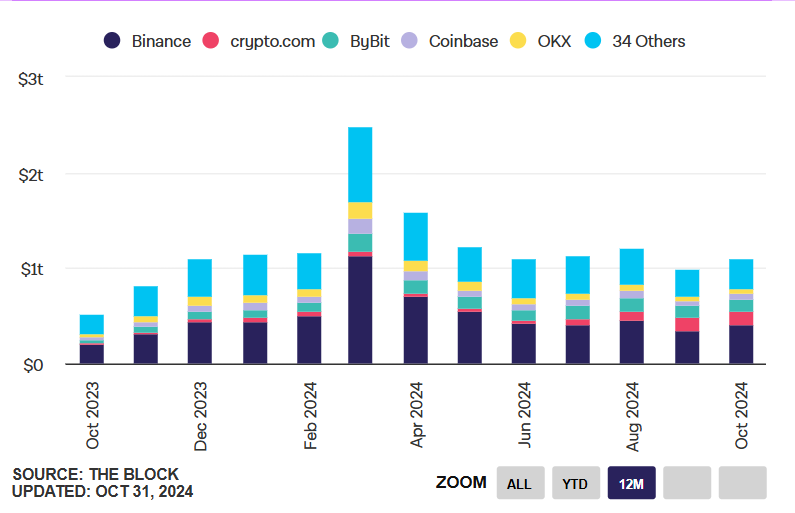

Spot trading volumes in October were weak despite Bitcoin's price increase. On centralized exchanges, spot trading volumes barely exceeded $1.1 trillion, a slight improvement over September but still low for 2024. Interestingly, volumes started to rise near the end of the month, hinting at a continuation of positive momentum into November.

Source: The Block

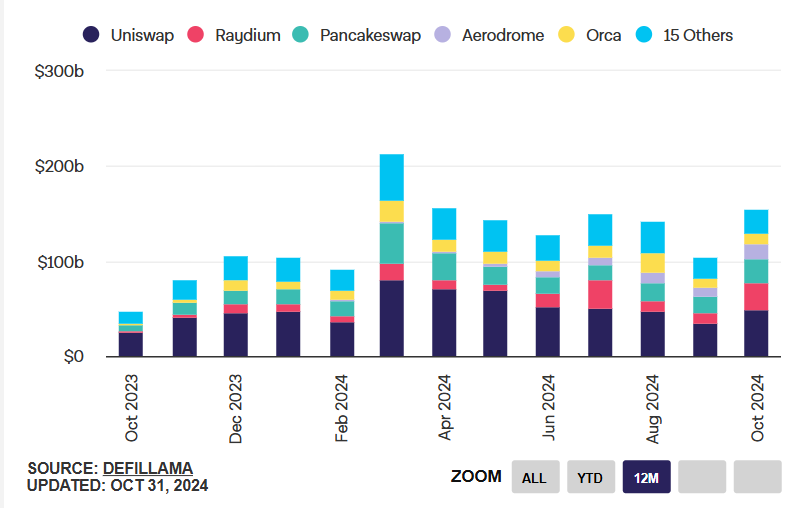

On decentralized exchanges, trading volumes remained consistently high, reaching $154 billion for the month, which is a high point for the year. Notably, DEX volumes made up 14% of CEX volumes, indicating strong interest in decentralized platforms as alternatives to centralized solutions.

Source: The Block

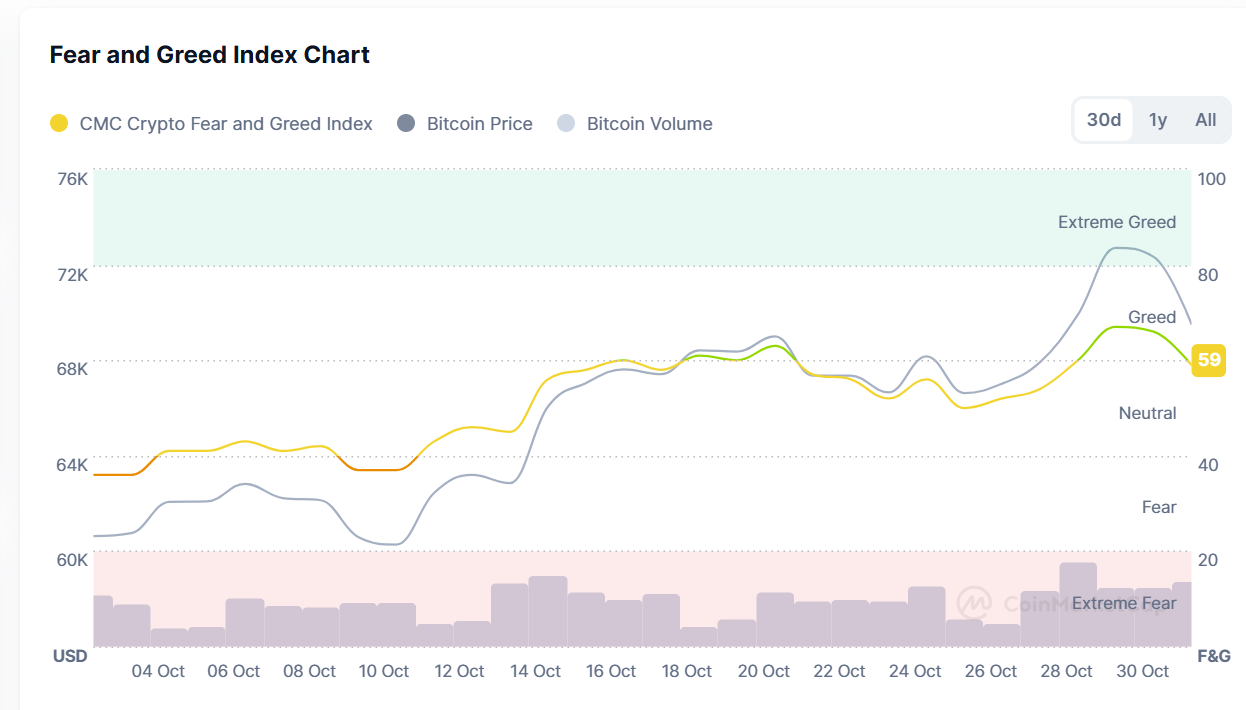

Market Sentiment in October

Throughout October, the Fear & Greed Index remained in the neutral zone, reflecting cautious investor sentiment. However, by the end of the month, the index entered the greed zone, reaching 68, indicating growing optimism. This increase was supported by Bitcoin's price rise and overall sentiment, despite high BTC dominance and caution towards altcoins. On the last day of October, BTC experienced a correction, with the index dropping back to neutral at 59.

Source: Coinmarketcap

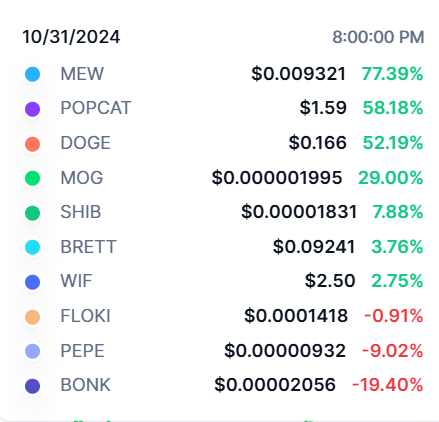

Meme Coin Trend Continues

Meme coins keep surprising us with impressive results. As seen in October's top gainers, meme coins took notable positions. Goatseus Maximus (GOAT) was particularly noteworthy. The meme token achieved explosive growth and showed a unique marketing strategy.

Launched on October 10 on the Solana blockchain through the Pump.fun platform, GOAT surged over 200,000% within 18 days. The number of holders reached 41,529, and its market cap peaked at $860 million before settling at $660 million, keeping it in CoinMarketCap's top 100. GOAT’s popularity grew thanks to an AI that interacted with users on X, stirring interest in the project. Terminal of Truths endorsed GOAT on X, boosting confidence. On October 24, Binance added GOAT futures trading, driving daily volumes above $330 million in just 18 days.

Source: dexscreener

Overall, October was positive for meme coins, with projects like GOAT, Popcat, Mew, Doge, and others showing steady growth, attracting new investors thanks to strong community support and fast growth, affirming meme coins' significance in the crypto market.

The Telegram Mini-Apps Trend

Mini-apps on Telegram, popular since early 2024, continue to disappoint users. A highly anticipated token listing in October was X Empire (X), which garnered attention thanks to its active user base: 2.8 million followers on X and 21.5 million on Telegram. More than 30 million users engaged with the game, but after listing, the X token lost over 50% of its value within days. Currently, its market cap stands at around $30 million, despite listings on major exchanges.

Source: Сoinmarketcap

Despite recent disappointments with major projects from the Telegram ecosystem, like Hamster Combat (HMSTR), Catizen (CATI), and X Empire (X), the Telegram and Ton blockchain ecosystem remain key players in the crypto space. These technologies deserve close attention, and we will continue to monitor their developments.

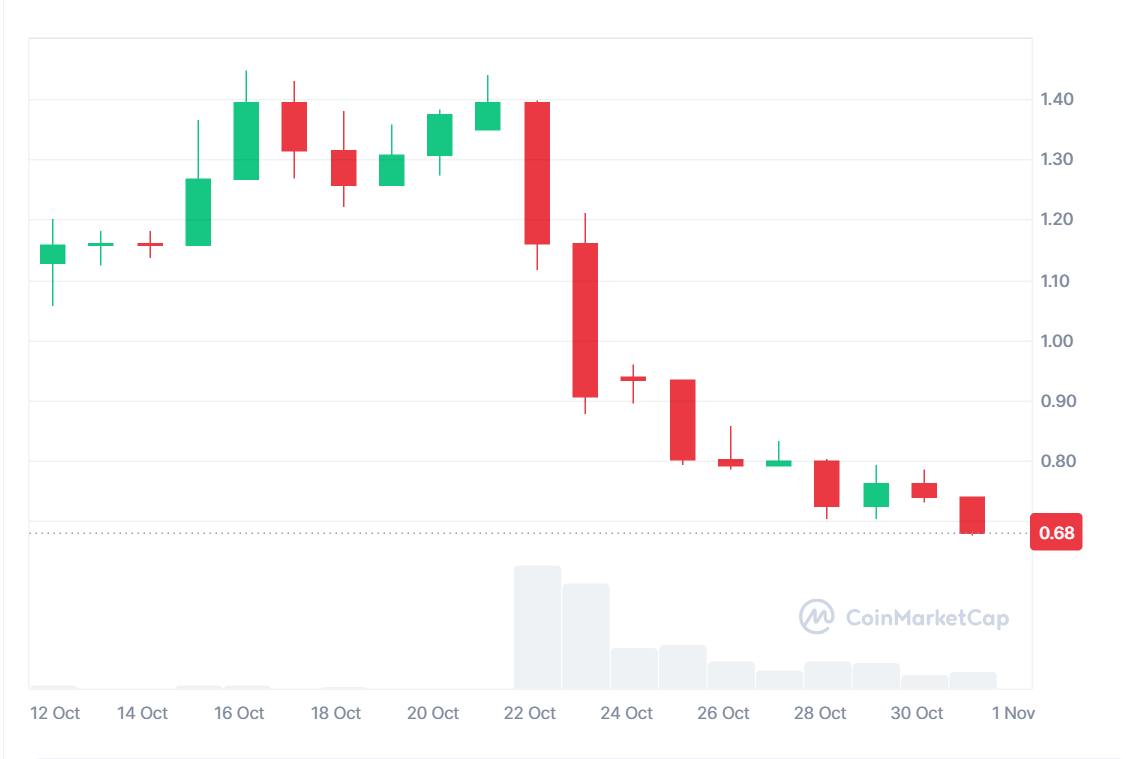

End of the Retrodrop Era

In recent years, the crypto community has experienced a wave of airdrops, spawning a culture of drop-hunters — users actively engaging with projects in hopes of generous rewards. However, as we noted back in June, this year has been disappointing for drop-hunters. First, listings of eagerly awaited projects zkSync (ZK) and LayerZero (ZRO) showed modest results, failing to meet community expectations.

In October, history repeated itself with the listing of Scroll (SCR), based on zkRollup technology to improve Ethereum network scalability and reduce transaction costs. Despite interest, the airdrop disappointed again, with SCR’s price falling 53% from $1.44 to $0.68 just days after listing, highlighting weak demand and disappointment among drop-hunters.

Source: Сoinmarketcap

The current situation raises questions about the future of drop-hunting, as projects are pressured to find new ways to balance the interests of teams, investors, and the community. The era of generous retro-drops may be ending as the crypto industry moves toward more transparent and measured reward models.

November Expectations

November 2024 promises events that could significantly influence the cryptocurrency market. One of the most anticipated is the Federal Reserve’s rate decision. In September, the Fed cut the key interest rate by 0.5 basis points, which could impact further monetary policy. Rate cuts generally create a positive environment for riskier assets like cryptocurrencies, as investors become more inclined to pursue high-risk strategies for greater returns.

Additionally, the upcoming U.S. presidential election will see candidates Donald Trump and Kamala Harris face off. Trump has publicly supported Bitcoin and cryptocurrencies, potentially adding further optimism to the market. He also announced the creation of a new committee, the D.O.G.E. (Department of Governmental Efficiency), with Elon Musk agreeing to head it, which symbolically aligns with Dogecoin's October growth. This could boost interest in meme coins and other cryptocurrencies.

In summary, these events are expected to have a significant impact on the cryptocurrency market in November, and investors should pay close attention to the developments.

Conclusion

October 2024 lived up to its "Uptober" nickname, reaffirming the positive trend for Bitcoin and the cryptocurrency market as a whole. Despite early challenges, BTC prices rose steadily, and Bitcoin dominance reached new highs, overshadowing altcoins. Meme coins and community-driven projects, such as Goatseus Maximus (GOAT), showed unexpected growth, drawing renewed attention to this segment despite investor caution. Drop-hunter disappointments also contributed to shifting expectations and strategies for airdrops, signaling a market transition toward more mature and transparent reward models.

As November approaches, market participants’ focus will be on the upcoming U.S. elections and the Fed's rate decision. These events could become key market drivers, significantly impacting crypto assets and investor sentiment.

SimpleSwap reminds you that this article is provided for informational purposes only and does not provide investment advice. All purchases and cryptocurrency investments are your own responsibility.