What is Bitcoin Dominance

This blog post will cover:

- What is Bitcoin Dominance?

- Historical Perspective

- Market Outlook

- How Does Bitcoin Dominance Affect Altcoins?

- Use in Trading

- How to Use Bitcoin Dominance Chart?

- Conclusion

Bitcoin Dominance acts as a crucial marker in the cryptocurrency space, illustrating the percentage of the total cryptocurrency market capitalization that is dedicated solely to Bitcoin. It’s important because it can offer valuable insights into Bitcoin's proportion in relation to other crypto - altcoins. This article is on a path to elucidate the complexities associated with this concept, thereby enhancing comprehension of it.

What is Bitcoin Dominance?

Bitcoin Dominance is a method of assessing Satoshi Nakamoto’s token circulation in comparison to the combined value of all other crypto that is available for traders. This process entails calculating Bitcoin's market capitalization (which signifies the total value of all Bitcoins) and dividing it by the combined market capitalization of all cryptocurrencies. The resulting number is then multiplied by 100 to display it as a percentage, indicating the share of the total cryptocurrency market value that Bitcoin constitutes.

This metric's significance lies in its capacity to offer a comprehensive insight into the cryptocurrency landscape. It serves as an indicator of market sentiment towards Bitcoin when compared to alternative cryptocurrencies, covering all cryptocurrencies except Bitcoin.

A rise in Bitcoin's dominance implies a favoritism towards it over other cryptocurrencies, potentially driven by factors like increased investor confidence in Bitcoin, a downturn in the altcoin market, or noteworthy advancements related to Bitcoin. Conversely, a decline in Bitcoin market dominance signifies a growing interest and value in alternative cryptocurrencies relative to Bitcoin, indicating a bullish phase for these options as investors aim for higher potential returns through portfolio diversification.

Nonetheless, it's important to recognize that this tool is just one among numerous metrics in the cryptocurrency realm. Prudent investors should consider integrating it with other indicators and information to make informed investment decisions. For instance, a low dominance does not necessarily suggest robust performance across all alternative cryptocurrencies; some may contribute to the decrease in the value, while others may lag behind.

Historical Perspective

Throughout its history, the concept has undergone notable changes in value. During the nascent stages of digital coins, the first currency on the market stood as the only contender. Therefore, its value was held at 100% dominance. Yet, with the evolution of the cryptocurrency market, the rise of new digital currencies, commonly known as altcoins, led to a gradual decline in Bitcoin's dominance.

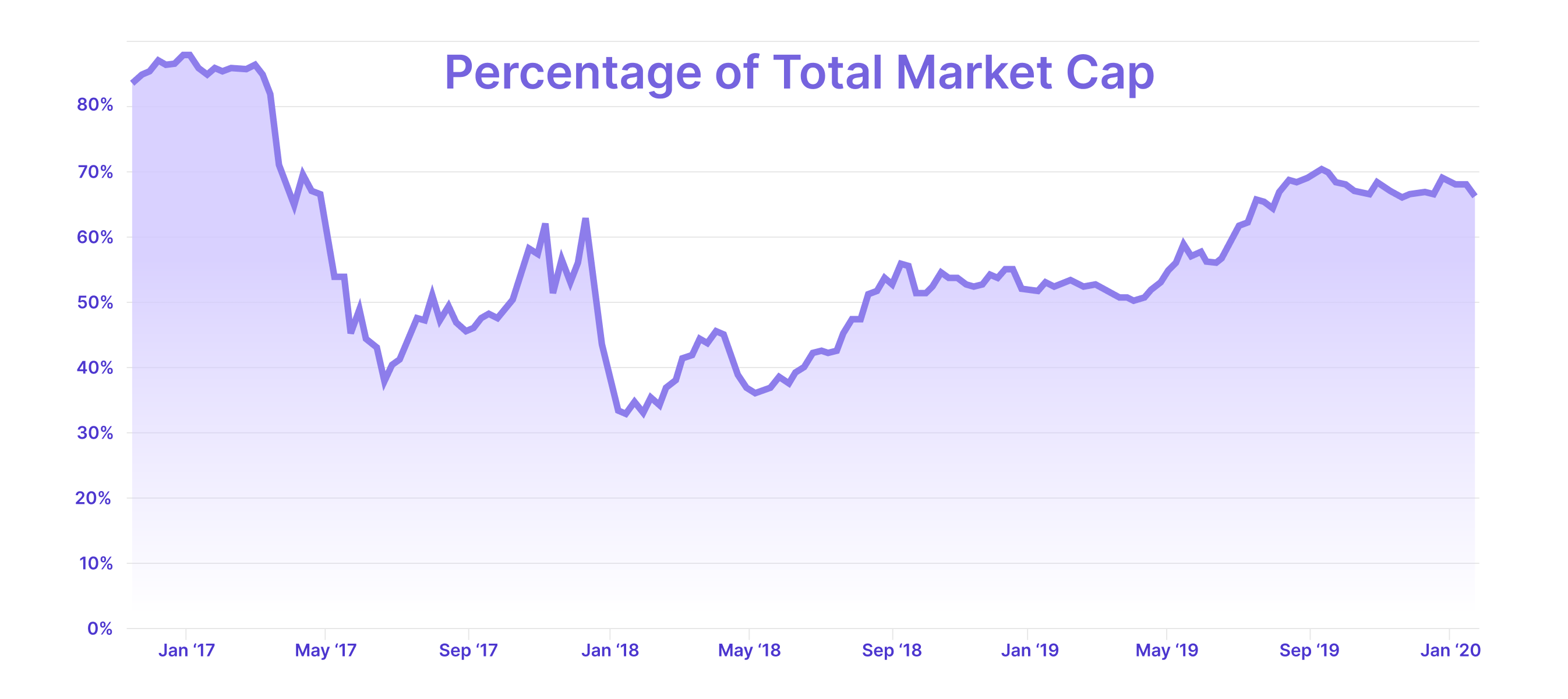

The pivotal year of 2017 heralded a notable transformation in the crypto sphere. It witnessed an unprecedented bull run, not limited to Bitcoin alone but extending across the entire crypto market. A plethora of altcoins entered the scene, many experiencing remarkable growth. Consequently, this period witnessed a sharp decline in Bitcoin’s dominance. By January 2018, Bitcoin's dominance had plummeted to an unprecedented low of approximately 33%.

This decline in Bitcoin Dominance stemmed from heightened investor enthusiasm towards altcoins, fueled by their potential for substantial returns. Nevertheless, it's imperative to acknowledge that phases of diminished value are frequently succeeded by a consolidation period, during which Bitcoin recoups some of its lost traction.

Market Outlook

Bitcoin Dominance serves as a valuable gauge for evaluating market sentiment. Elevated dominance often indicates a risk-averse market, as investors lean towards Bitcoin for its renowned security and stability.

In contrast, diminished value typically mirrors a bullish sentiment towards altcoins. This inclination is rooted in investors' readiness to accept heightened risk in exchange for the potential for greater returns offered by alternative cryptocurrencies.

What is the Current Bitcoin Dominance?

Presently, Bitcoin accounts for roughly 50.72% of the total market cap, indicating its proportion of the overall value.

How Does Bitcoin Dominance Affect Altcoins?

This relationship operates in an inversely proportional manner. An increase in dominance typically suggests a decline in the value of altcoins relative to Bitcoin. This shift could be driven by various factors such as a downturn in the altcoin market, growing investor trust in Bitcoin, or notable advancements within the Bitcoin ecosystem.

On the flip side, a decline usually implies an increase in the value of altcoins relative to Bitcoin. This shift may signal a positive period for altcoins, encouraging investors to spread their investments across different alternatives in hopes of achieving greater returns. This phase, often referred to as an "alt season" is marked by a substantial rise in the value of altcoins compared to Bitcoin.

Forecasting the beginning of an "alt season" is sometimes complex, yet those involved frequently analyze the Bitcoin altcoin dominance trend for indications. A sustained decline may suggest the imminent onset of an "alt season." Nevertheless, it's crucial to recognize that these patterns are not definitive and can be impacted by various factors.

Use in Trading

There are several approaches to integrating this metric inside trading strategies, including:

- Identification of Patterns: an increase in the dominance of a currency often signifies a market inclination towards Bitcoin. Traders might view this as a chance to invest in Bitcoin, expecting its continued growth compared to alternative cryptocurrencies.

- Altcoin Prediction: lower interest in Bitcoin after a period of expansion could indicate the beginning of an "altcoin season." Traders might perceive this as an indication to allocate their investments towards altcoins.

- Risk Management: high Bitcoin Dominance might indicate a cautious market stance. In such situations, traders may choose to boost their Bitcoin holdings, considering it a more secure asset. Conversely, Bitcoin dominance decreasing could suggest a riskier market environment where altcoins may present opportunities for higher potential returns, albeit with added risk.

- Diversification: the value can inform portfolio diversification strategies. During times of high values, allocating a larger portion of the portfolio to Bitcoin may be prudent. Conversely, when the dominance is low, diversifying into altcoins may prove advantageous.

It's crucial to recognize that while Bitcoin Dominance offers valuable insights, thorough research and consideration of other factors are necessary before making trading decisions.

How to Use Bitcoin Dominance Chart?

Bitcoin Dominance chart helps in graphical depictions of these fluctuations over time. These visual representations are instrumental in discerning patterns and trends.

Analyzing such charts necessitates comprehension of upcoming and past dynamics and technical analysis principles. Critical data markers, including peaks and troughs, offer valuable insights into market sentiment and potential alterations in dominance trends.

Conclusion

In conclusion, grasping the concept of Bitcoin Dominance holds paramount importance for every cryptocurrency investor or trader. Serving as a barometer for the broader cryptocurrency landscape, it offers a holistic perspective that aids in making informed investment choices. With the situation undergoing ongoing evolution, Bitcoin Dominance still persists as an important value to monitor. Its fluctuations will continue to offer invaluable insights, guiding stakeholders in navigating the ever-changing terrain of the cryptocurrency realm.

Disclaimer: SimpleSwap reminds you that this article is provided for informational purposes only and does not provide investment advice. All purchases and cryptocurrency investments are your own responsibility.