Long and Short Positions Explained

This blog post will cover:

- Long position and short position defined

- Long position in crypto

- Short positions in crypto

- How to short Bitcoin and other crypto

- Long vs. short position in crypto

- Conclusion

The world of crypto trading can be both challenging and rewarding, so knowing the intricacies of various trading strategies, such as long and short positions is highly beneficial for investors. These approaches are based on the prediction of the way prices will change and can be used in one’s portfolio separately or together.

Today, we are going to find out what makes the long and short positions different, which instruments can be used, and what crypto traders should bear in mind.

Long position and short position defined

Both terms originate from the traditional financial markets. The strategies rely on predictions about future price fluctuations of various assets.

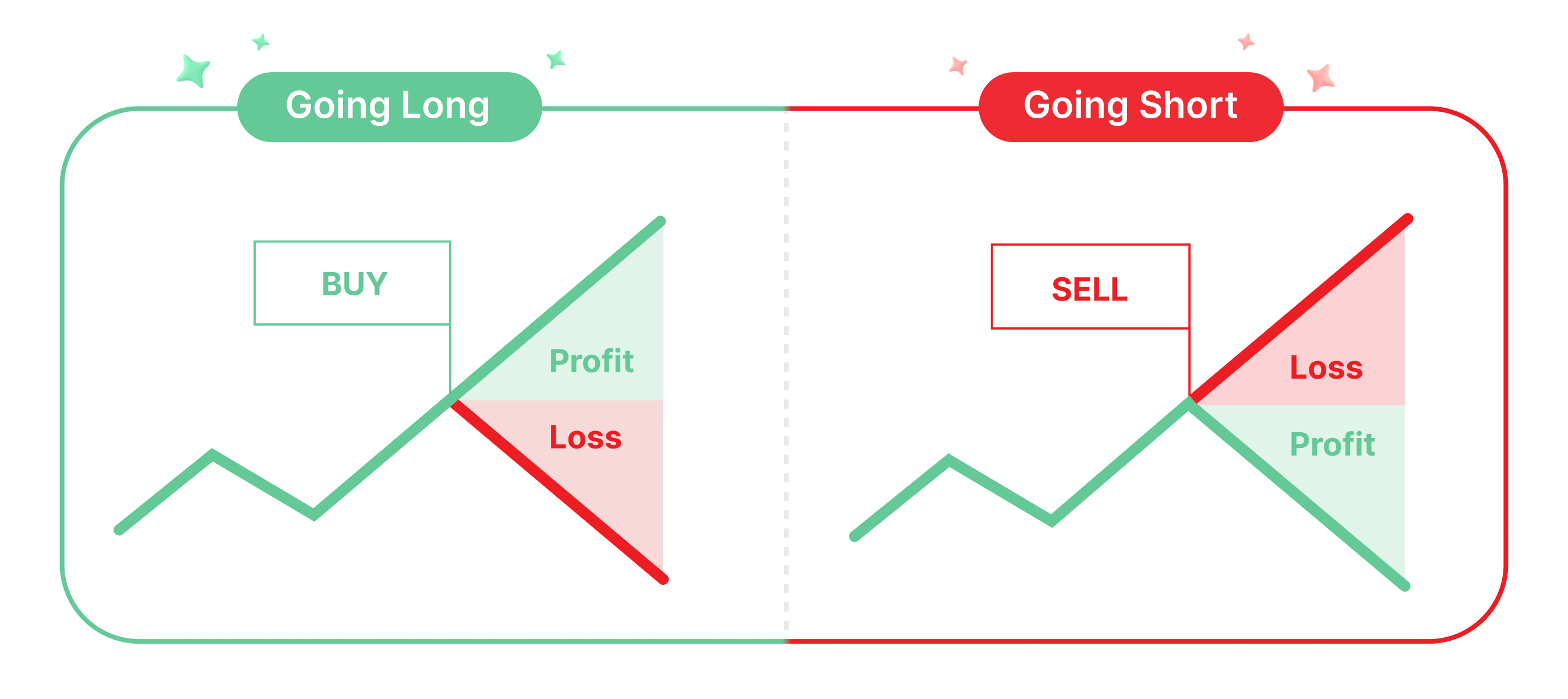

In a long position, investors expect growth in the value of the assets, patiently holding them until the expected rise occurs. Success relies on a positive outlook and favorable instrument performance.

On the other hand, a short position is taken when an investor predicts a value decline. This calls for borrowing and quick selling of securities, as investors aim to repurchase them at a lower value. Profit this type of trade depends on accurate predictions in a market with negative tendencies.

Long position in crypto

In the Crypto World, a long position is basically the same concept as in the traditional markets, but it has some specific features. To start, the investors purchase crypto and expect that it will grow in price.

When the cryptocurrency's value rises like the trader forecasted, they benefit by selling the coins or tokens at a higher price than they bought them. Using a long position is in a way similar to expressing faith in the future of a specific cryptocurrency. Long positions also reflect user’s bullish sentiment about the crypto market overall.

Unlike traditional financial markets, crypto markets function around the clock, providing users with the flexibility to monitor and engage in trading activities at any hour. This flexibility can be advantageous for investors who want to stay active in a constantly changing market. However, given the volatility of the crypto market, sometimes it is difficult to react to all price movements in time.

You should also consider another important thing if you are going to long crypto assets. Crypto market is much more volatile and affected by the news field compared to traditional markets. Some assets’ prices or even the entire market can drop significantly for a short period of time, causing liquidation of the overleveraged long positions. You should bear in mind such “short squeezes” while developing your trading strategy.

Short positions in crypto

“Can you short crypto,” is one of the frequent questions investors have. Put simply, short positions also work similarly to traditional markets in crypto. At the same time, several different instruments can be used with this approach. We will look into those in the next part of this article.

Shorting has a key advantage in the crypto sphere: the strategy makes it possible for investors to capitalize on falling prices, which is beneficial in a market with bearish trends.

Engaging in short positions can contribute to effective risk management, offering investors a means to capitalize on unfavorable trends. Opting for short positions enables investors to diversify their portfolios and safeguard against potential losses in alternative investments.

Successfully shorting crypto requires precise timing in predicting market movements, which is challenging and inherently risky. Additionally, borrowing assets may involve fees, which can have an effect on the overall profitability of the short position. You should have enough knowledge and expertise to short crypto assets without significant losses.

How to short Bitcoin and other crypto

There are a few ways to short crypto, in this section, we will mention some of them.

Margin trading

This is a strategic way to leverage, which gives traders an opportunity to use bigger positions with less actual capital. It essentially means borrowing assets to enlarge the trading position.

Someone borrows crypto from a lending pool of a platform, sells it, and hopes that the asset’s value decreases. If the forecast is wrong and nears a set limit, the crypto platform may issue a margin call. The trader must add more collateral or close it. If the situation does not turn in the trader’s favor and the price hits a critical point (liquidation price), the platform may automatically sell the borrowed tokens to cover the debt.

The pros of the strategy include the chance of getting higher returns in the case of a successful trade. Utilizing leverage enables the management of larger positions with reduced actual capital. Additionally, it provides flexibility for implementing various strategies, such as capitalizing on market declines or employing short positions as a safeguard against losses in other segments of the portfolio.

Futures

Utilizing the futures market to short crypto offers an avenue to get profit from both upward and downward market movements. To initiate this form of crypto shorting, users are required to deposit funds into a trading account, select the cryptocurrency along with the corresponding futures contract, and then execute a short position by selling the chosen futures contract. This decision is rooted in the anticipation that the cryptocurrency's price will decrease before the contract reaches its expiration. Futures can have various expiration periods: quarterly, yearly, etc., but the most popular type on crypto markets is perpetual futures. This type of futures has no expiration date.

As soon as the market conditions align with their trading strategy, users proceed to sell the assets. This entails repurchasing the equivalent futures contract initially sold, preferably at a lower price.

This type of trading frequently incorporates the use of leverage, a tool that can increase both profits and losses, so caution is highly advised.

Options

Options is a popular instrument in many investment strategies. They offer holders the choice (however, do not oblige them) to purchase or sell a particular asset at a set price, or the strike price, within a specified time frame.

These are the two most common kinds of options:

- Call options. This type permits the holder to buy the underlying asset at the agreed-upon price before the moment when the option's expiration date comes.

- Put options. These options grant the holder the ability to sell the underlying asset at the strike price even before the expiration date arrives.

The second type is essentially an alternative way of shorting crypto. What is more, put options are utilized in several practical ways.

- Hedging. Purchasing put options on particular assets gives investors a chance to hedge their long positions against possible price drops.

- Speculation. Traders buy put options to capitalize on downward crypto asset trends when they anticipate a market decline.

Options act as a valuable risk management tool, shielding assets from market volatility. For long-term investors, options represent a useful mechanism for portfolio management.

Contracts for difference (CFDs)

CFD gives traders an opportunity to benefit from price changes in assets, including cryptocurrencies, without possessing them. Shorting crypto via CFDs is a strategy aimed at taking advantage from a decrease in the cryptocurrency's value.

This type of trading is facilitated through CFD brokers, providing a range of cryptocurrencies for traders. Investors deposit funds into their trading accounts, acting as margin.

Subsequently, traders search for the "short" or "sell" option associated with the chosen cryptocurrency. This allows them to potentially gain from a decline in the cryptocurrency's value. Following this, investors specify the amount they are prepared to invest in the trade. Upon reaching the profit target, they initiate a "buy" order for the same quantity initially sold.

CFDs are more flexible than some other trade instruments, for instance, futures contracts. Traders can choose the size of their position and do not have to worry about expiration dates or contract rollovers.

Long vs. short position in crypto

Choosing between these two trading strategies hinges on one’s market outlook and goals.

The dynamics of market conditions significantly impact trading decisions, favoring long positions during upward trends and short positions in declining markets. Understanding risk tolerance is a must for investors; long positions are often deemed less risky over the long term, while short positions can prove profitable in volatile markets. The right timing aspect is vital for successful shorting.

Many investors find success in adopting a balanced approach, incorporating both long and short strategies based on evolving market conditions. It is crucial to emphasize the importance of thorough research and a clear understanding of financial objectives before committing to a specific trading position or any cryptocurrency investments in general.

Conclusion

In conclusion, both long and short positions offer a number of advantages and considerations.

A long position reflects optimism and confidence in the potential growth of a specific digital currency, allowing investors to capitalize on upward market trends. This strategy is well-suited for those anticipating sustained positive momentum and seeking profits through the appreciation of the cryptocurrency's value over time.

Conversely, short positions empower investors to capitalize on declining markets, leveraging accurate predictions to benefit from a cryptocurrency's diminishing value. Shorting functions as a strategic risk management tool, offering a hedge against potential losses in other segments of an investment portfolio during market downturns.

Many investors find success in adopting a diversified approach, using both long and short strategies based on evolving market dynamics. This flexibility allows them to adjust strategies to ever-changing conditions, get profit from various opportunities, and manage risks successfully.

SimpleSwap reminds you that this article is provided for informational purposes only and does not provide investment advice. All purchases and cryptocurrency investments are your own responsibility.