The Evolution of Digital Transactions: Devices and Systems in Wallets

This blog post will cover:

- The Dawn of Electronic Payments

- Mobile Payments and E-Commerce

- The Era of Cryptocurrencies

- The First Crypto Wallets

- Crypto Wallet Innovations

- How Do Crypto Wallets Adapt to User Needs?

- Great choice of wallet options

- Conclusion

Despite the crises of transitional periods, today's extensive economic progress positively impacts the social structure of society. The advent of cryptocurrencies as an entirely new means of payment has addressed several issues, initiating the formation of a more convenient, up-to-date, and adaptive economy.

Digital transactions, or electronic transfers, have allowed people to exchange resources without using cash. This approach revolutionized transactions, though it wasn't universally accepted at first. Users needed time to understand that their physical money and the numbers on their mobile banking screens were essentially the same and could be equally trusted.

In recent years, e-commerce and digital payments have reached new heights. Continuously evolving technologies like online banks, contactless payments, instant transfers, etc., attest to this growth. This article explores the evolution of digital transactions, the key stages in the development of digital payments, their increasing acceptance among users, and the functionality of modern crypto wallets.

The Dawn of Electronic Payments

During the birth of the Internet in the late '90s and early 2000s, a significant technological breakthrough occurred. The World Wide Web introduced numerous ambitious projects, innovative technologies, and bold ideas, many of which did not succeed. All that led to the Dot-com bubble burst and massive losses. However, many innovations from that period have survived, transformed, and propelled the technological world forward, like cryptocurrency.

By the end of the last millennium, the first digital payment systems began to emerge, with PayPal being the most notable. PayPal attracted customers with an enticing offer – users could make online payments without sharing their credit card information with sellers. These initial steps towards anonymity and confidentiality were successful: within a few years, the company surpassed all major competitors, leading them to either sell out or shut down.

Key advantages of PayPal identified by users included:

Security. Developers established strict security measures, aiming to make PayPal the leading service among its peers. This goal was achieved, and PayPal remains a safe method for financial transactions today.

Convenience. Transfers between accounts were quick and straightforward, facilitated by linking bank accounts, credit, and debit cards.

Buyer protection program. This program allowed refunds for poor service and participated in dispute resolution, fostering user loyalty and increasing the user base.

Ease of use. PayPal's interface was designed to be intuitive even for untrained internet users.

International transfers. Opportunity to transfer funds around the world.

Subsequently, other systems in the same field started to follow PayPal's example. Modern crypto wallets – programs for exchanging crypto-assets – also adhere to these principles.

Mobile Payments and E-Commerce

At a certain point, internet marketing pioneers began developing mobile banking, as it could significantly boost sales of electronic goods and services. Mobile payments opened a vast world of online shopping and accessibility to various products for smartphone owners. In recent years (especially during and post-COVID-19), the popularity of mobile payments has surged due to external factors (global lockdowns) and internal developments such as enhanced security systems (e.g., biometric authentication).

The ability to make payments with a single touch on a mobile device has impacted social life significantly. Speed became a critical requirement for internet shops and commercial systems – from loading product catalogs to processing payments and delivering goods. Companies met this demand, and now paying for goods via mobile payments can take less than a minute.

Digital payments brought much-anticipated freedom to the world. Exchanging goods became easy, simple, and fast, eliminating the need for banks and their employees. However, intermediaries between sellers and buyers remained, albeit less visibly. By the end of the first decade of the 21st century, society was ready to enter a new era – the era of decentralization.

The Era of Cryptocurrencies

In 2009, Bitcoin (BTC), the first cryptocurrency, was launched. This event necessitated the urgent creation of supporting elements: exchanges, wallets, banks, trading platforms, etc. The system developed gradually, initially accessible only to progressive enthusiasts and well-versed developers. Over time, interest in cryptocurrencies surged to the point where they were dubbed the new gold and the most reliable global asset.

Storing cryptocurrencies in traditional digital wallets proved impossible. Thus, major crypto systems developed specialized crypto wallets – new digital tools designed for working with crypto assets for storage, recognition, and management. Digital crypto transactions use public and private keys:

Private key. This key is known only to the wallet owner, it acts as an electronic signature.

Public key. Also known as the account number, it is required to identify the user’s address on the blockchain. A transaction opens with the public key and closes with the private key.

The First Crypto Wallets

The creation of the first crypto wallet logically coincides with the release of Bitcoin. In 2009, Satoshi Nakamoto not only developed blockchain and introduced a new payment method. Along with a team of specialists, he created the necessary conditions for the convenient use of this new technology.

Early crypto wallets lacked the extensive functionality of today's counterparts. Fifteen years ago, their tasks were limited to two basic functions: sending and receiving Bitcoin. Protective mechanisms like two-factor authentication, KYC procedure and biometric data protection appeared later.

Crypto Wallet Innovations

With technological advancements and the gradual acceptance of cryptocurrencies, developers started to improve crypto wallets with new resources and opportunities that have emerged. Security systems were enhanced first. Specialists then worked on simplifying and streamlining the tools' interfaces, making them more user-friendly for the general public.

Cryptocurrencies already intimidated people with their unconventional nature, lack of analogs, and complicated interfaces. Enthusiasts might navigate tabs and copy/paste complex addresses for a transaction, but newcomers needed to feel safe and comfortable in the new space. Crypto World needed to become more convenient than traditional financial systems in every possible way. Due to this grand idea, today's crypto wallets assist traders in their work. This technology encourages users to try multiple functions, to interact with different crypto exchanges and assets, and to learn new crypto features that constantly appear.

The industry's growth attracted users with diverse needs, habits, and working methods. Some joined the crypto community out of curiosity, cautiously depositing small amounts and observing. Others aimed to increase their capital effortlessly, favoring passive income. Active earners, who plan to profit from trading and dealing with cryptocurrencies, entered the crypto space with specific requests. Comprehensive crypto wallet functionality should be developed for all these users.

How Do Crypto Wallets Adapt to User Needs?

Since there are so many people with their own unique ways and approaches to cryptocurrencies, wallets had to match their desires. That is why there are so many types of wallets on the market today. Let’s discuss some of the most popular types below.

#1 Cold wallets

Passive crypto investors benefit most from cold wallets, the safest type. These can be described as the digital age’s wallets – devices bought online to store all cryptocurrency. These devices, usually offline, make users' digital assets inaccessible to fraudsters and hackers.

Advantages of cold wallets:

High security due to offline storage

Resistant to hacking and malware

Can be stored in a physical safe for added security

Easy to use with most computers and mobile devices

Disadvantages:

Cost of purchasing the hardware

Risk of physical damage, loss or theft

Inconvenient for frequent transactions

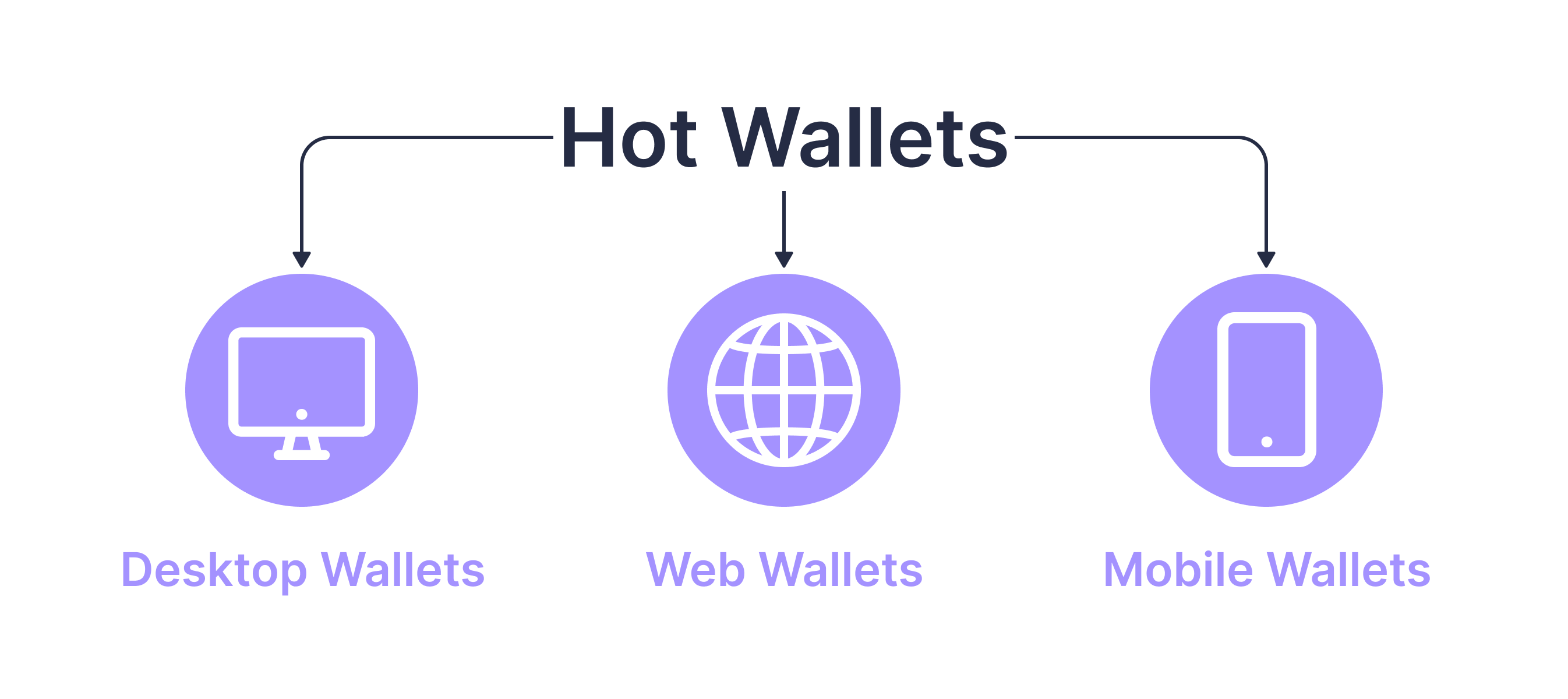

#2 Hot wallets

Active users of the crypto space, however, find cold wallets unsuitable. Their needs are met by hot wallets – online versions of digital wallets that allow easy storage, retrieval, sending, receiving, and exchanging of cryptocurrencies. Mobile crypto wallets and web applications are the most popular among hot wallets.

Hot crypto wallets are less secure than cold ones but are not inherently susceptible to fraud. Online crypto wallets are as safe as traditional digital wallets or mobile banking apps. Significant investments are made in security systems, and companies prioritize their users' asset protection. Without these efforts, the industry would have collapsed under hacker attacks in its early years.

Advantages of hot wallets:

Easy access from any device with an internet connection

User-friendly interfaces

Integration with various exchanges for quick transactions

Support for various cryptocurrencies

Disadvantages:

Higher risk of hacking

Vulnerability to phishing attacks

Security relies heavily on the phone's security measures

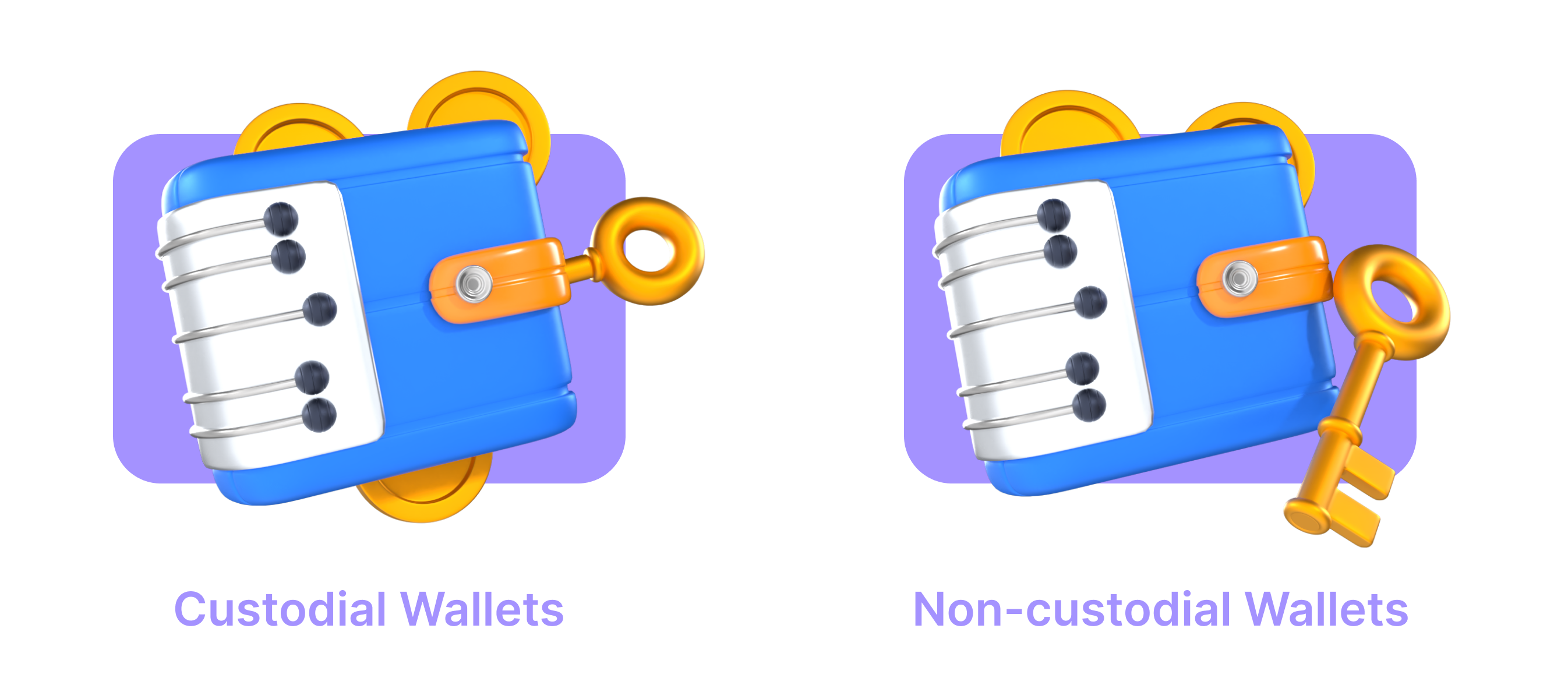

#3 Custodial and non-custodial wallets

A custodial wallet is like a bank account for digital money. When someone uses a custodial wallet, they're trusting a company to keep their cryptocurrencies safe. It is similar to how people trust a bank with their cash. In this case, exchanges hold user’s private keys and manage the security for them. This makes it easy and convenient, especially if the user is new to crypto. However, user don't have full control over assets.

A non-custodial wallet is more like carrying cash in your own wallet. Users hold their private keys, which means they have complete control and responsibility over their digital assets.

Great choice of wallet options

Сrypto wallets are an important part of working in the crypto space. For active market participants, like traders, wallets are crucial not only for securely storing assets but also for protecting and verifying transactions. This technology keeps all the info about transfers, which can be helpful in resolving disputes.

Digital wallets are composed of both digital wallet devices and digital wallet systems, each offering unique benefits and catering to different needs. Hot wallets give users easy access to funds, which is just perfect for daily transactions. Cold wallets focus on security and are good solutions for long-term storage of significant cryptocurrency amounts.

When market options increase, consumers tend to scrutinize the quality of the available products more carefully, and the greater the variety, the more challenging the selection process becomes.

By 2024, the cryptocurrency market has expanded to encompass over 10,000 distinct cryptocurrencies. This statistic alone indicates the significant recognition and popularity digital assets have achieved. In such a competitive environment, subpar products will not endure for long and will be swiftly replaced.

As one of the fundamental components of the emerging crypto economy, crypto wallets are under continuous scrutiny by the public. The prudent selection of a wallet is crucial, since security of assets depends on it. This in turn facilitates efficient crypto activities by alleviating concerns regarding fund safety.

The transition from a traditional economy to a digital and crypto format has unlocked numerous new opportunities for clients, primarily by making payments more flexible and faster. Within this new system, crypto wallets have emerged as one of its central and most crucial elements. Therefore, choosing a wallet should not be taken lightly – the more convenient, reliable, the wallet is, the easier it will be for users to navigate the world of cryptocurrencies.

Before choosing a crypto wallet, it is essential to understand its intended purpose. This could include:

Trading

Crypto transfers and exchanges

Investments

Risk diversification

Fiat transactions

Each of these purposes requires a specific set of features in a crypto wallet. However, two key parameters – convenience and security – must remain constant.

Conclusion

The advancement of information technology simplifies life on multiple levels, particularly economically and socially. The creation of a digital payments sector with decentralized management demonstrates that the infrastructure has reached a point where a higher controller is unnecessary. Trust in the IT sector has grown, leading to the realization of its program – freeing people from redundant tasks.

Cryptocurrencies require trust as a confident market segment, and recent years have seen positive changes in this regard. This new payment method was developed alongside a new economic system based on the internet and the latest technological inventions. Hence, crypto exchanges, wallets, and subsequently DeFi communities and applications emerged. Today, we witness the integration of AI technologies into the cryptocurrency space, a step analysts believe could accelerate progress significantly.

The primary issues for maintaining stable digital transaction systems – confidentiality, security, anonymity, and ease of use – remain crucial. Developers and major company owners are highly invested in resolving these issues, and their efforts are already evident.

Overall, the prospects for this sector's development in 2024 are highly favorable. We should stay informed about news and trends and navigate the rapidly evolving space confidently.

SimpleSwap reminds you that this article is provided for informational purposes only and does not provide investment advice. All purchases and cryptocurrency investments are your own responsibility.