Crypto Market Overview: May 2024

This blog post will cover:

- Key Market Stats of May 2024

- State of DeFi

- On-Chain Activity

- Projects Worth Noting in May 2024

- Conclusion

May marked a period of recovery for the crypto market following the sharp selloff in late April, during which BTC prices fell below $60K and altcoins returned to 2023 price levels. Despite the absence of significant internal growth drivers, the news feed once again fueled optimism in May. Speculation regarding the approval of ETH ETFs and potential changes in US crypto regulation policy spurred Ethereum (ETH) to rise above $3800, raising investors' hopes for a "hot summer" with the potential start of ETH ETF trading.

A new trend, "tap-to-earn" also emerged in the crypto industry, with the pioneering project Notcoin (NOT) achieving remarkable success in May, evidenced by record trading volumes and listings on major centralized exchanges.

Read our monthly report to learn more about the key developments that shaped the crypto landscape in May.

Key Market Stats of May 2024

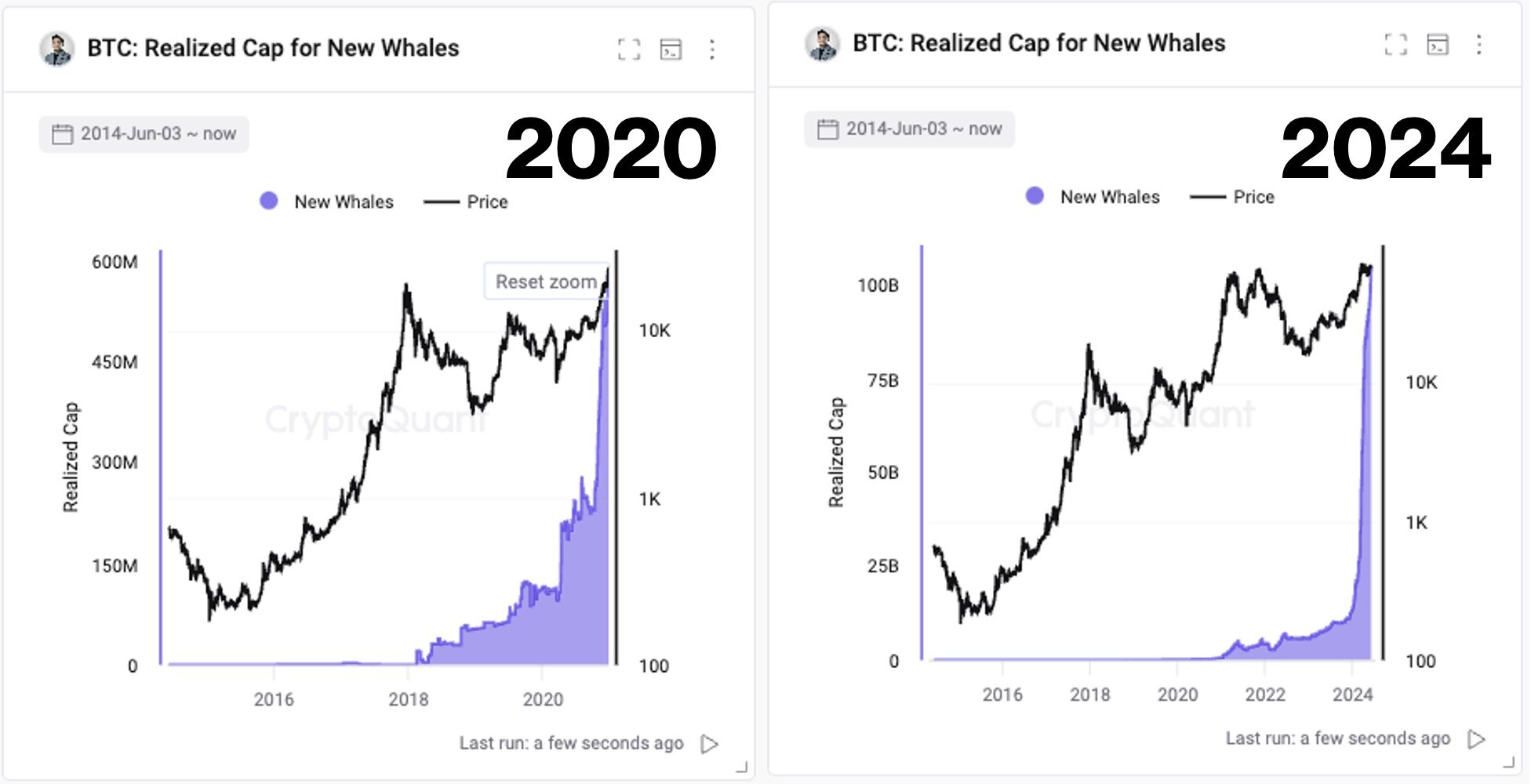

BTC finished May with a 11% gain after dropping below $60K in late April. Such performance reflects the BTC historical price pattern after halvings with a short-term correction and growth in the next months. Interestingly, the 2024 cycle seems to have similarities with 2020 when BTC traded near $10K with high on-chain activity. Currently, the first cryptocurrency hovers around $67K-$70K with the number of new whales skyrocketing ($1B added daily to whales wallets).

BTC Cycles Comparison. Source: CryptoQuant, @ki_young_ju

BTC price growth was accompanied by inflows in BTC ETFs with record inflow registered on May 3rd ($378M). ETFs remain one of the drivers of the first cryptocurrency growth and an important fundamental factor impacting the crypto industry.

BTC ETF Flows and BTC Price. Source

Following BTC growth total crypto market capitalization also increased in May by 13.3% and amounted to $2.55T. Solana (SOL) and Ethereum (ETH) showed the largest growth among the top-10 crypto assets with 30.5% and 24.7% gains respectively.

Total Crypto Market Cap. Source: Coinmarketcap

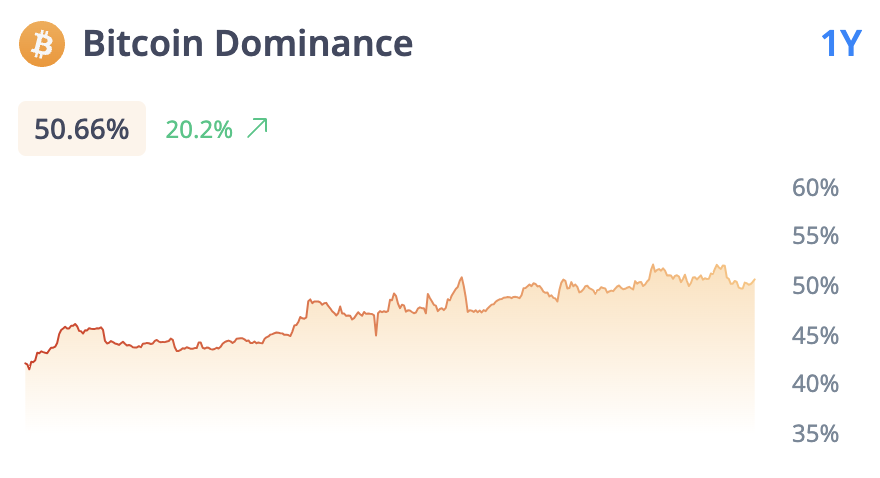

Despite total market capitalization growth, many altcoins did not show impressive growth in May with price stagnation near the levels of 2023. Such performance reflects a high dominance of BTC that steadily stays above 50% in 2024. Decrease in BTC dominance may be a sign of the highly anticipated altcoins season that traditionally is a part of the bull run on the crypto market.

BTC Dominance. Source: CryptoRank

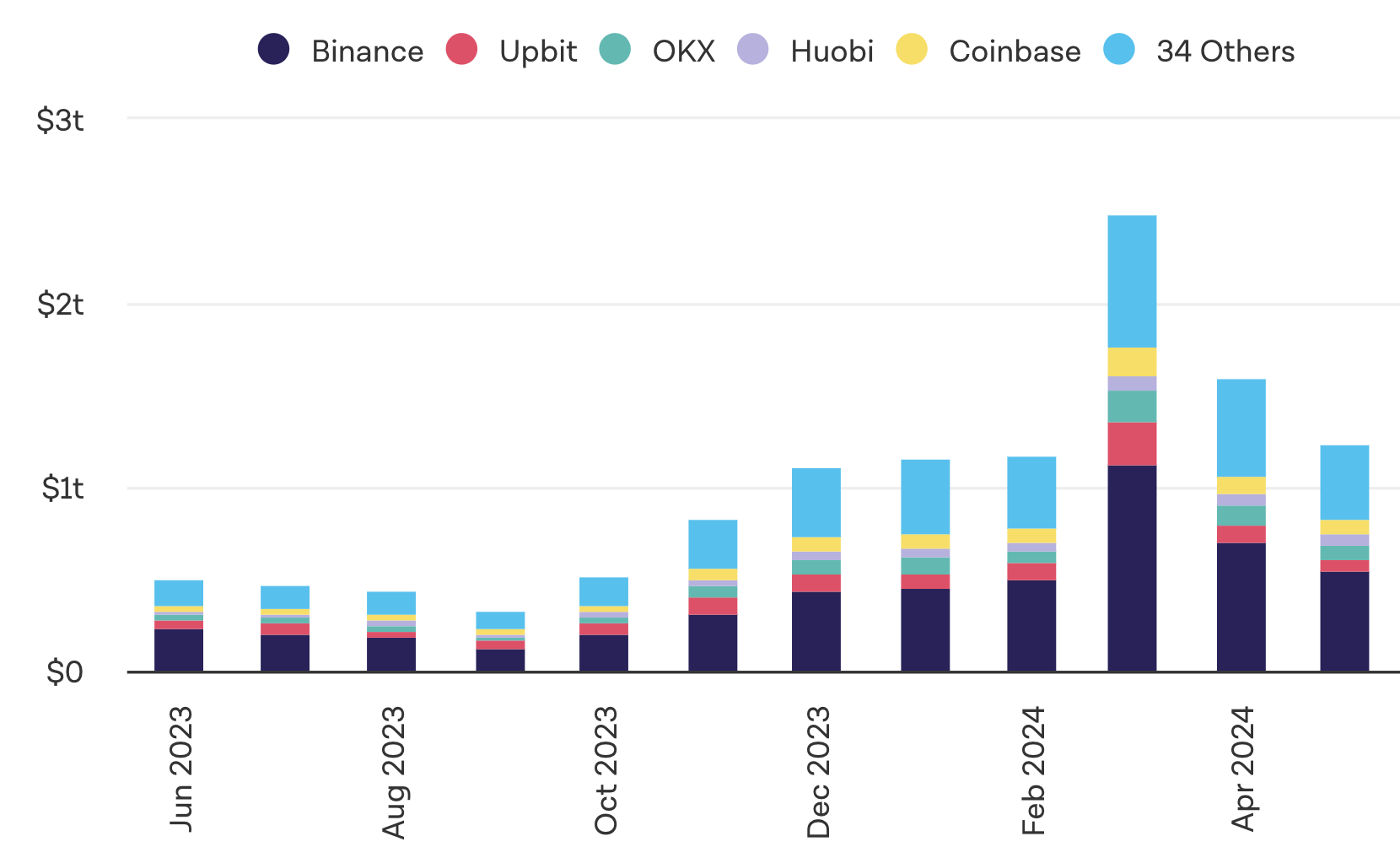

In May, spot trading volume on leading centralized exchanges continued the downward trend. Following record-breaking numbers in March, May marked the second consecutive month of declining volumes, with a total of $1.24T traded, which is 22.5% lower compared to April. This decrease highlights investors' uncertainty about the performance of crypto assets in the coming months and the weak positions of many altcoins, which are still trading far from their all-time high prices.

Monthly Spot Trading Volumes. Source: The Block

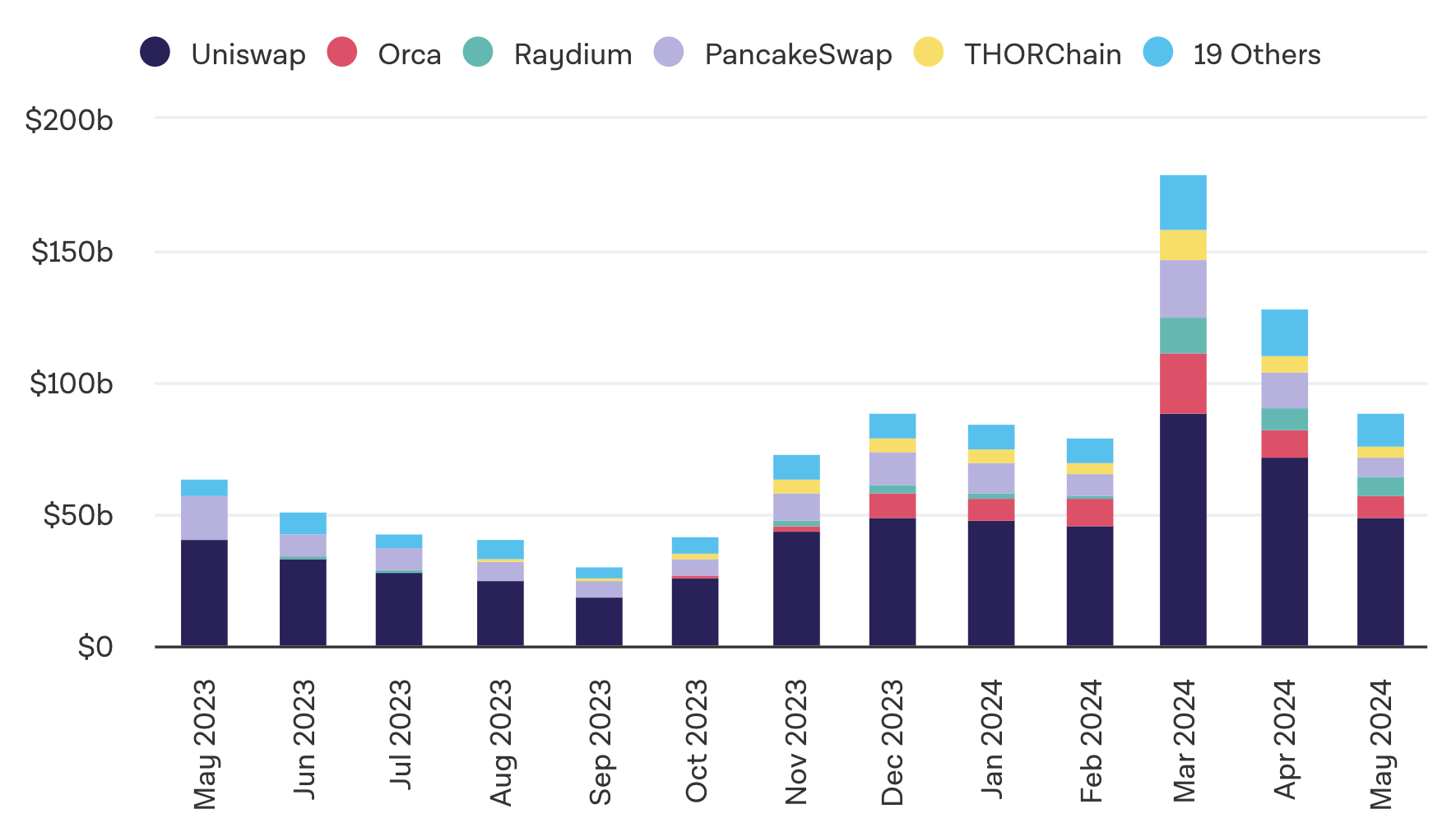

DEX trading volume mirrored the downward trend of CEX, decreasing by 31% from $127B in April to $88.7B in May. Uniswap led the decentralized exchange space with a $7.1B volume, capturing a 55% market share. Notably, Solana-based DEXs, Orca and Radium, secured the second and third places with 10% and 8% market share, respectively, driven by the rising popularity of Solana and the launch of new tokens on this network.

DEX Monthly Trading Volumes. Source: The Block

State of DeFi

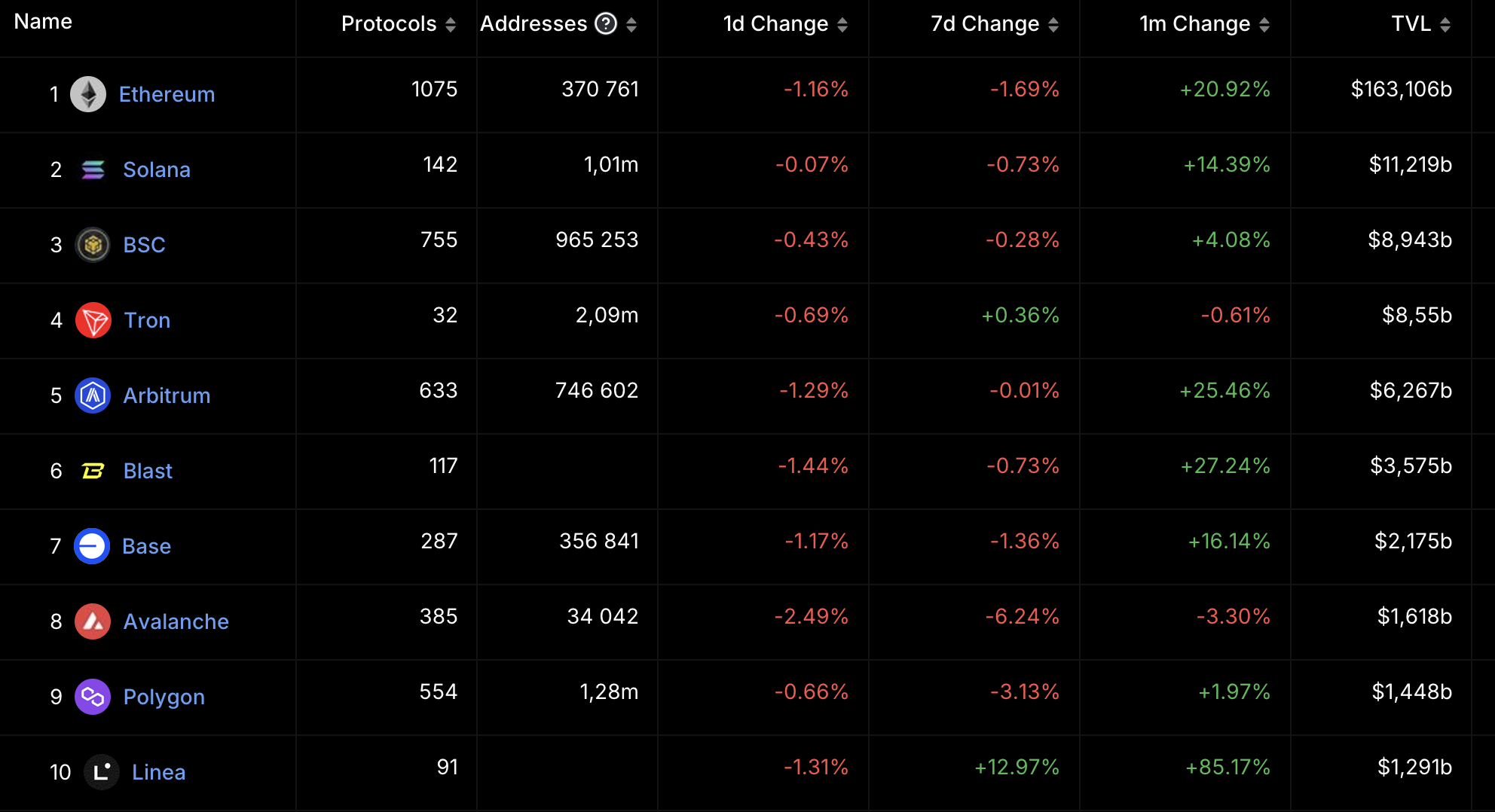

Despite the stagnation in altcoin prices and decreasing trading volumes, the DeFi sector demonstrated sustainable growth in May. The total value locked (TVL) in DeFi reached $226.6B, reflecting a 24.5% monthly increase. This growth was primarily driven by the rise of Layer 2 ecosystems.

Linea's TVL saw an impressive 85% growth, spurred by its "Linea Surge" program, which aims to bootstrap liquidity in the network. Other L2 networks also experienced notable growth: Arbitrum's TVL increased by 25.5%, Blast by 27.2%, and Base by 16%. This robust performance underscores the growing significance of L2 solutions in the DeFi landscape.

Top-10 Blockchains by TVL. Source: DefiLlama

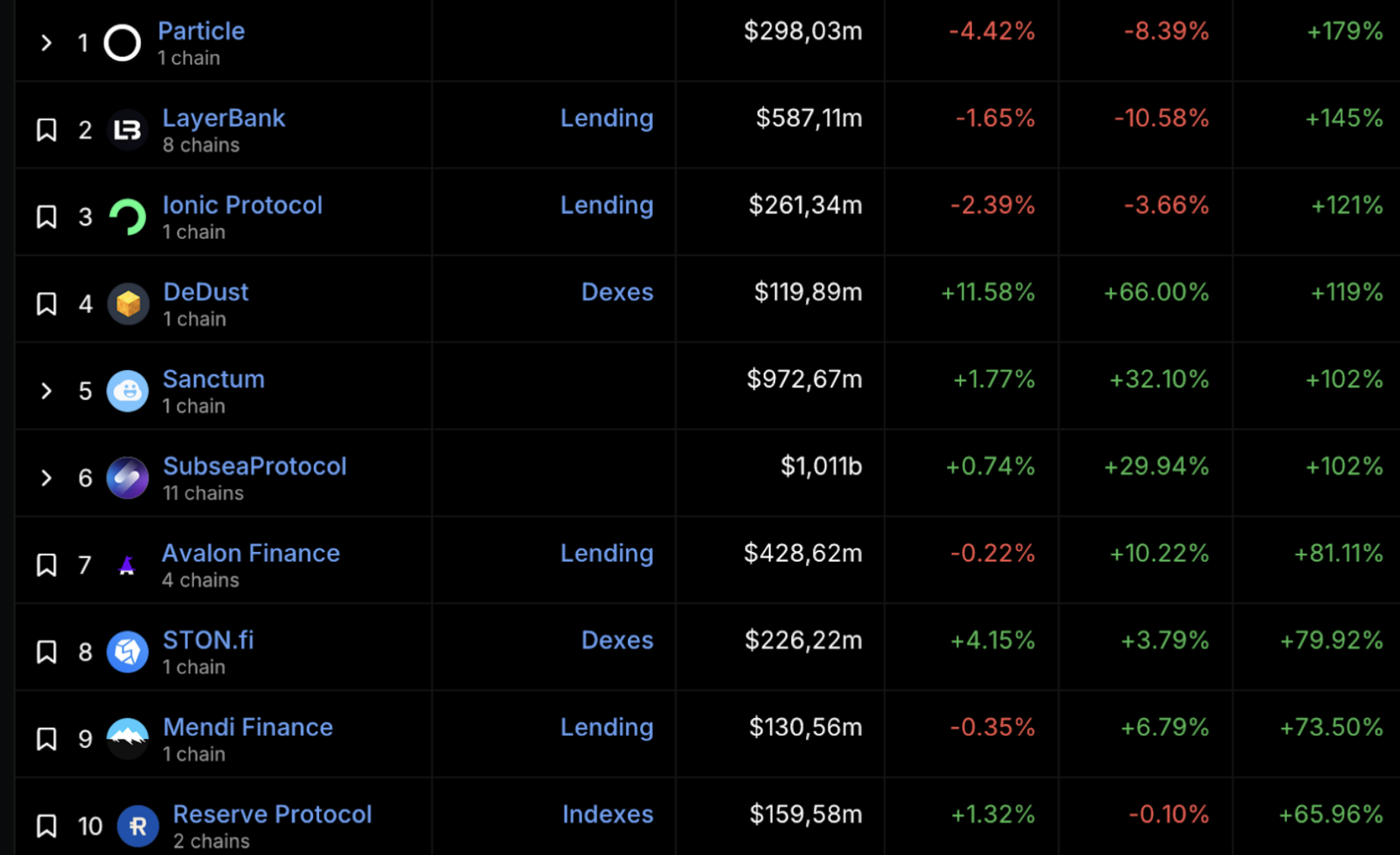

L2-based protocols also became the leaders by TVL growth in May. Particle, a permissionless protocol for leveraged trading of digital assets built on Blast, leads the way with 179% monthly growth. LayerBank, a universal DeFi hub for any EVM layer, took second place with 145% TVL growth last month. Ionic, a decentralized non-custodial money market built on Mode and Base, closes the top three with 121% monthly gain.

Top-10 DeFi Protocols by Monthly TVL growth (TVL>$100M). Source: DefiLlama

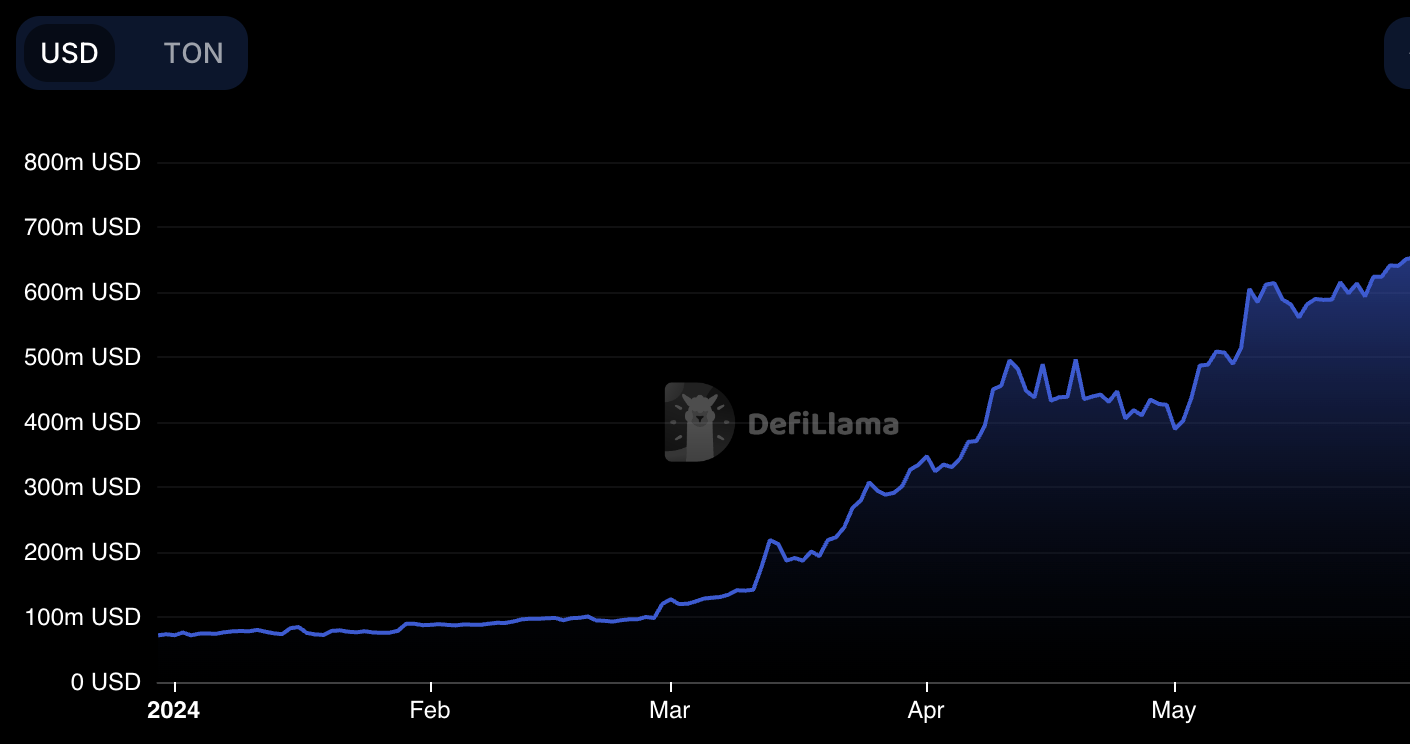

In 2024, the Ton Network is emerging as a significant DeFi hub among non-EVM chains, experiencing rapid expansion and substantial user base growth. In May, Ton's TVL reached $650M, marking a 67% monthly increase and an impressive 803% growth since the beginning of the year. This growth can be attributed to several factors, including a successful marketing campaign and a strategic partnership with Telegram. Additionally, the rise of new projects like Notcoin (NOT) and StonFi (STON) has played a crucial role in attracting millions of new users to the Ton ecosystem, further bolstering its position in the DeFi sector.

Ton TVL Growth. Source: DefiLlama

On-Chain Activity

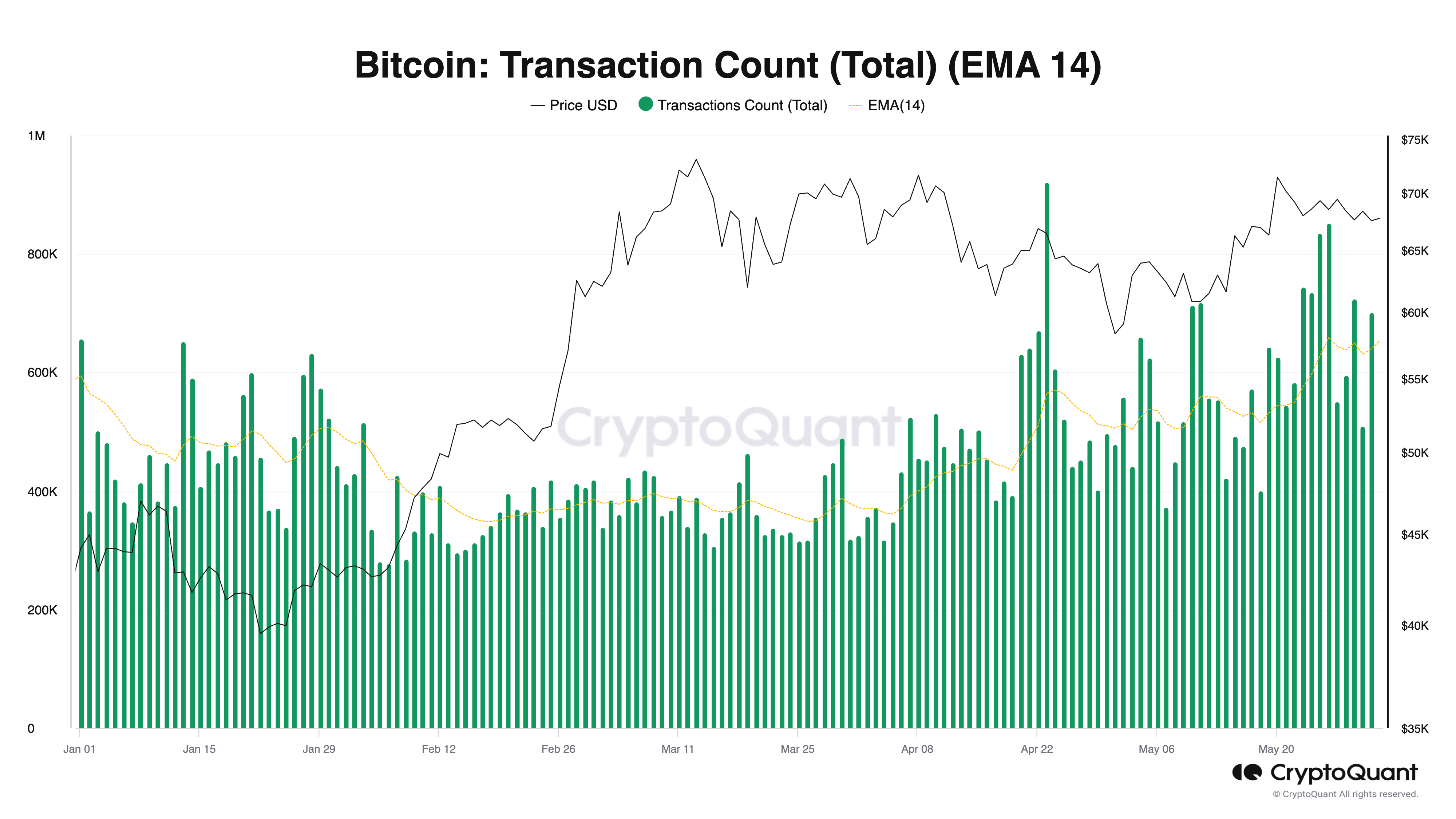

Despite significant price growth, the number of active BTC addresses has remained relatively stable in 2024, reaching 1.1M in May. Concurrently, daily transactions on the Bitcoin network have been on the rise. Since the beginning of the year, the 14-day exponential moving average for daily transactions has grown by 7.7%, increasing from 595K to 641K.

This transaction growth can be attributed to the increasing DeFi activity on Bitcoin, with new projects and users entering this sector. Additionally, the introduction of Bitcoin Runes has simplified the process of creating and trading assets on the Bitcoin network, further contributing to the uptick in transactions.

BTC Transaction Count. Source

Amid the news of ETF approvals, the Ethereum blockchain experienced a significant surge in on-chain activity. On May 28th, total transactions reached a record high of 9.8M, signaling a heightened interest in the most popular L1 network.

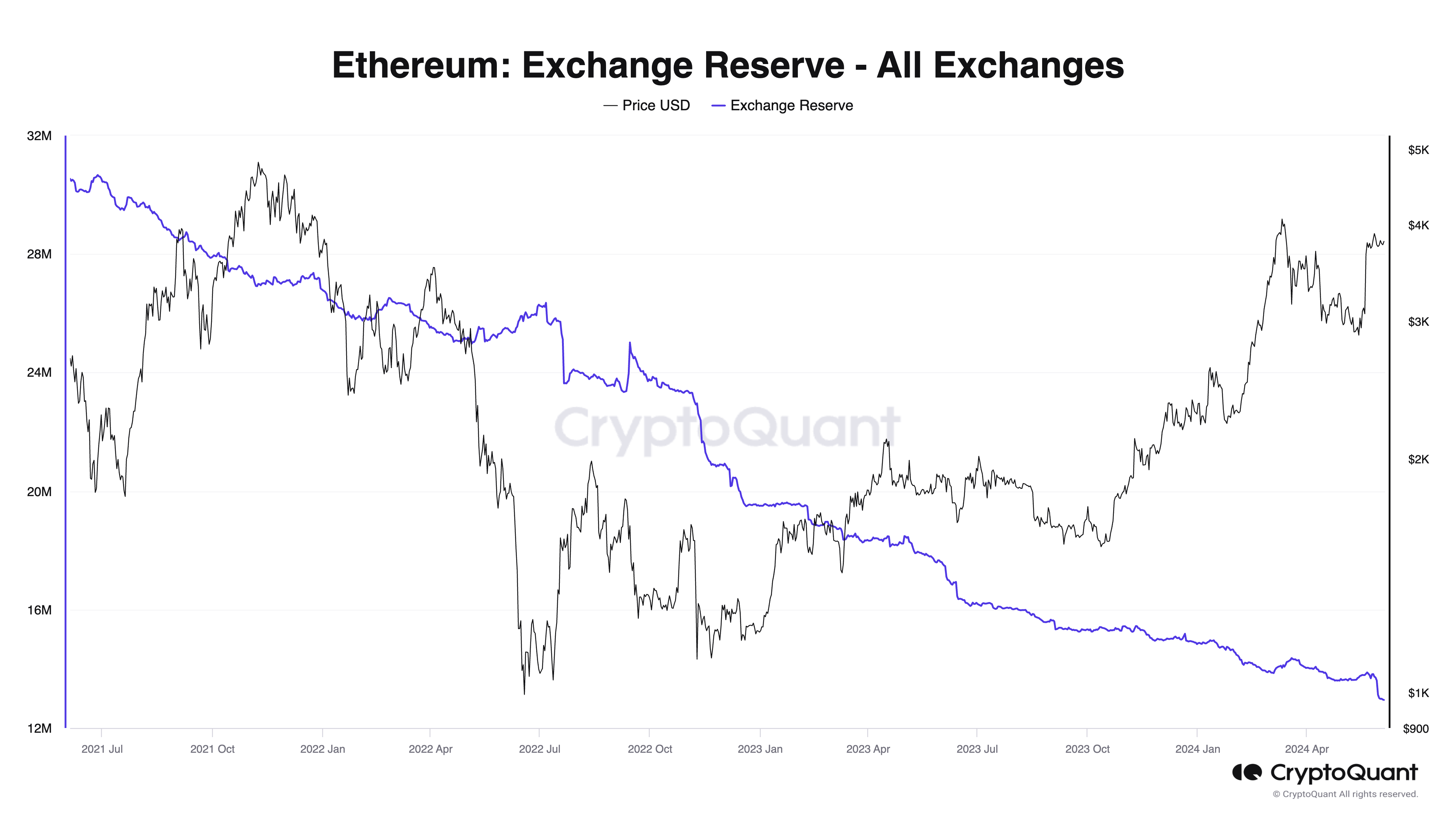

Moreover, the trend of decreasing ETH reserves on centralized exchanges continued in May. This trend remains stable since 2021 reflecting the high interest and investors trust in the future of ETH and its price. Approval of ETFs has further strengthened community confidence and led to massive ETH outflows in late May.

Ethereum Exchange Reserves. Source

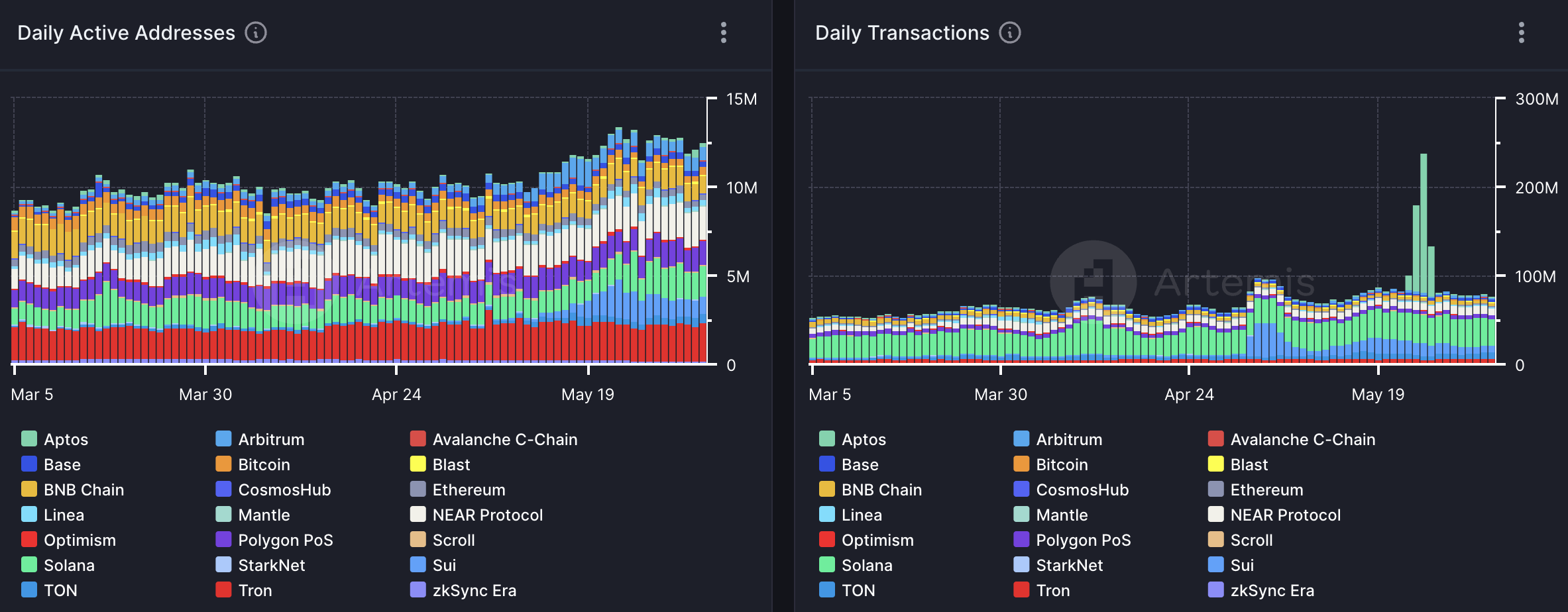

Among other blockchain solutions, Sui (SUI) demonstrated the highest monthly growth of daily transactions from 1.9M to 8.5M (+357%), followed by Linea (+219%), and Ton (TON) (+31%). Tron (TRON), Solana (SOL), and Near (NEAR) led by active addresses in May with more than 1M daily active wallets.

Daily Active Addresses and Transaction of Popular Blockchains. Source: Artemis

Projects Worth Noting in May 2024

ETH ETFs

In May, Ethereum captured significant attention within the crypto community and analysts due to a dramatic change in the US Securities and Exchange Commission's (SEC) approach to spot ETH ETFs. After a history of delaying approvals, the SEC unexpectedly requested potential issuers to update their applications and swiftly approved ETFs from eight companies, including BlackRock, Fidelity, and Grayscale. This sudden policy shift came amidst broader discussions about cryptocurrency regulation in the US and coincided with positive legislative developments. One possible reason for this move could be the upcoming elections, with presidential candidates seeking to attract crypto-community support.

The SEC’s unexpected ETF approval sparked a wave of optimism in the crypto market, propelling Ethereum’s price to new heights. ETH closed the month with a 25% gain. Analysts suggest that Ethereum’s price could continue to climb in the coming months, especially with the start of ETFs trading.

ETH Price. Source: TradingView

Notcoin (NOT)

Notcoin became another beneficiary of May. Starting off as a simple meme token, Notcoin has revolutionized the market with its innovative "tap to earn" concept. This novel approach has made Notcoin one of the key projects within the Ton ecosystem, contributing significantly to the network’s expanding user base. Notcoin's rise was further accelerated by its listing on the leading centralized exchanges, including Binance, Bybit, Kucoin, OKX, and others. Notcoin trading drew the attention of speculators, driving trading volumes to unexpected levels. The success of Notcoin's listing has been one of the most notable in recent months. The triumph of Notcoin has also catalyzed a new wave of crypto projects with Telegram miniapps running on Ton and other blockchains.

Notcoin Price. Source: Coinmarketcap

Conclusion

May saw the crypto market rebound following April’s correction, with Bitcoin (BTC) recovering to $70K and Ethereum (ETH) trading above $3700, spurred by news of ETF approvals. Despite this positive movement in major cryptocurrencies, many altcoins did not experience significant growth and remain far from their all-time highs.

Decreasing trading volumes on both centralized and decentralized exchanges reflect the ongoing uncertainty about the future performance of crypto assets. However, the DeFi sector exhibited steady growth, driven primarily by Layer 2 ecosystems.

Summer typically brings reduced activity and volatility in financial markets, and the crypto industry is no exception. It remains to be seen whether the adage “sell in May and go away” will hold true this year, as the market navigates these seasonal trends and underlying uncertainties.

SimpleSwap reminds you that this article is provided for informational purposes only and does not provide investment advice. All purchases and cryptocurrency investments are your own responsibility.