Crypto Market Overview: April 2024

This blog post will cover:

- Key Market Stats of April 2024

- State of DeFi

- State of L1 and L2

- Projects Worth Noting in April 2024

- Conclusion

After experiencing record-breaking numbers in March, including Bitcoin all-time high and record inflows into BTC ETFs, April marked a period of cooling down for the crypto industry. This included corrections in crypto asset prices, decreased trading volumes, and a slowdown in DeFi activity. The highly anticipated Bitcoin 4th halving was a focal point of April, potentially signaling the start of a new bullish cycle. However, post-halving performance for both BTC and altcoins was disappointing for some investors, with BTC seeing a 14.7% price decrease and the total crypto market cap (excluding BTC) dropping by 20.6%. However, such price movements align with historical patterns, where BTC often undergoes a correction shortly after the halving, followed by explosive growth in the next 12 months.

The SimpleSwap team has prepared a monthly report, analyzing key market statistics for April, the state of DeFi protocols, L1 and L2 network performance, and highlighting important project updates from the month that you should be aware of.

Key Market Stats of April 2024

After reaching its all-time high price in March, Bitcoin experienced a correction in April, resulting in a 14.7% decline - the largest monthly drop since the beginning of the year that was accompanied by significant outflows from BTC ETFs. The market cap of the first cryptocurrency also decreased by 14.3% accordingly. Correction followed the 4th BTC halving on April 19th that reduced miners' rewards from 6.25 BTC to 3.125 BTC per mined block. This performance aligns with historical post-halving price trends, when Bitcoin typically undergoes a short-term correction followed by parabolic growth over the next 12 months.

BTC Price in 2024. Source: CryptoRank

Following the BTC price decline, altcoins market was also in red. The total crypto market cap excluding Bitcoin decreased by a significant 20.6%, with all major altcoins seeing price drops: Ethereum (ETH) by 17.2%, Solana (SOL) by 37.3%, Dogecoin (DOGE) by 39.5%.

Crypto Market Total Market Cap (Excluding BTC). Source: Coinmarketcap

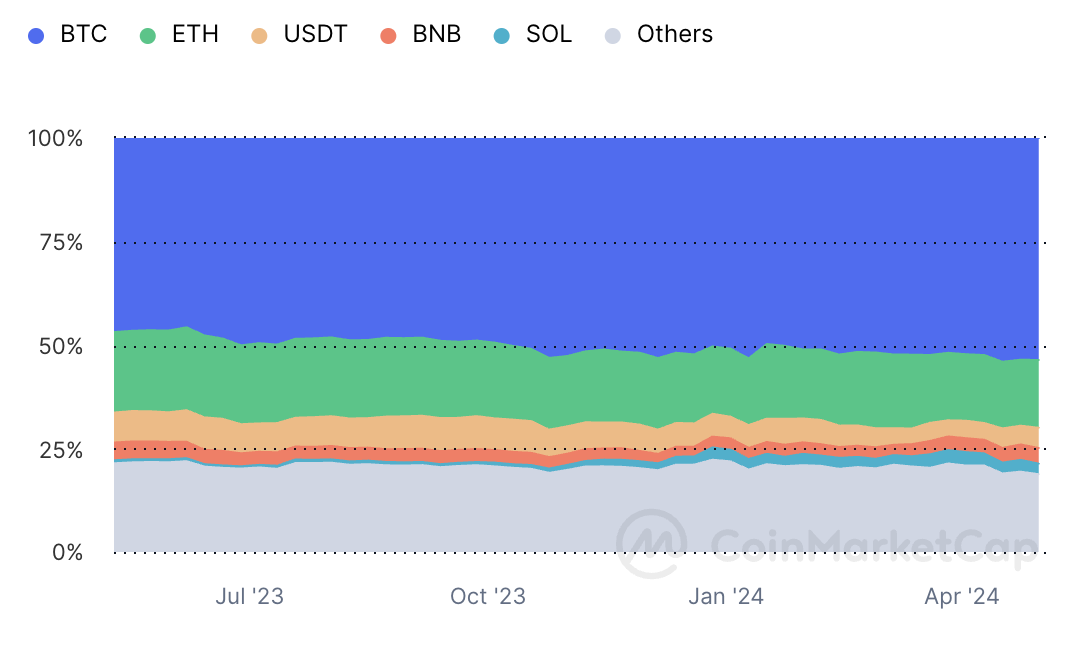

The sharp reaction of altcoins can be attributed to the high BTC dominance that impacts the performance of all altcoins. Historically, a drop in BTC dominance signals the start of altcoins season, however, as of 2024, we do not see any signs of it so far. Since the beginning of the year BTC dominance has increased by 2.7% and remained near 53.6% at the end of April. This figure reflects investors' sentiment in the crypto market, as they still prefer investing in the first cryptocurrency rather than purchasing riskier crypto assets.

BTC Dominance. Source: Coinmarketcap

Following crypto assets correction, trading volumes on the leading centralized exchanges experienced a decline in April. Compared to the record numbers seen in March, spot trading volumes dropped by 35.9% in April. Binance remains the leader on the CEX landscape with 50% market share in April.

CEX Trading Volumes (Monthly). Source: The Block

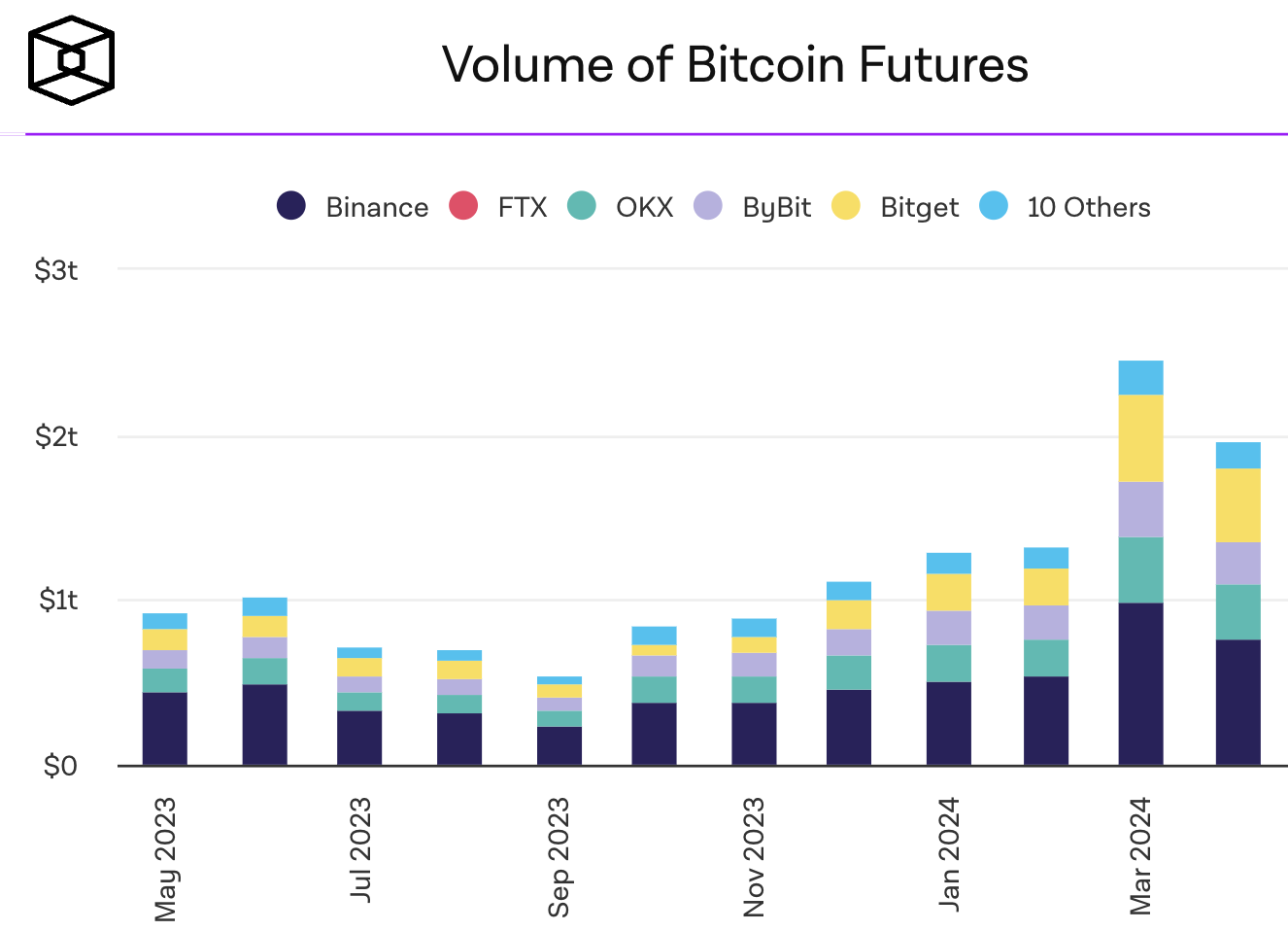

Trading volume of BTC futures also declined in April. Compared to March, trading volume on the leading centralized exchanges dropped by 19.6%. This decrease in trading volume indicates a “cooling off” of the market following the bullish start of the year. Some investors opted to take profits rather than opening new positions, contributing to the decline in trading activity.

BTC Futures Trading Volume (Monthly). Source: The Block

State of DeFi

Total value locked in DeFi protocols exhibited steady growth since the beginning of the year, peaking at $216.5B in early April. With the rise of new DeFi primitives such as restaking, liquid restaking, RWA together with growing activity in lending protocols, bridges, and other Dapps there is a potential of “DeFi summer 2.0” this year. However, at the end of April DeFi TVL decreased by 10.3% from its peak signaling the outflow of funds from the DeFi sector. Daily transactions in DeFi protocols also decreased from 7.2M in March to 6.4M in April. This signals that the market is “cooling off” from the explosive growth shown in the Q1 2024. Important factor contributing to DeFi activity drop was Solana blockchain congestion in the mid April.

DeFi TVL in 2024. Source: DefilLama

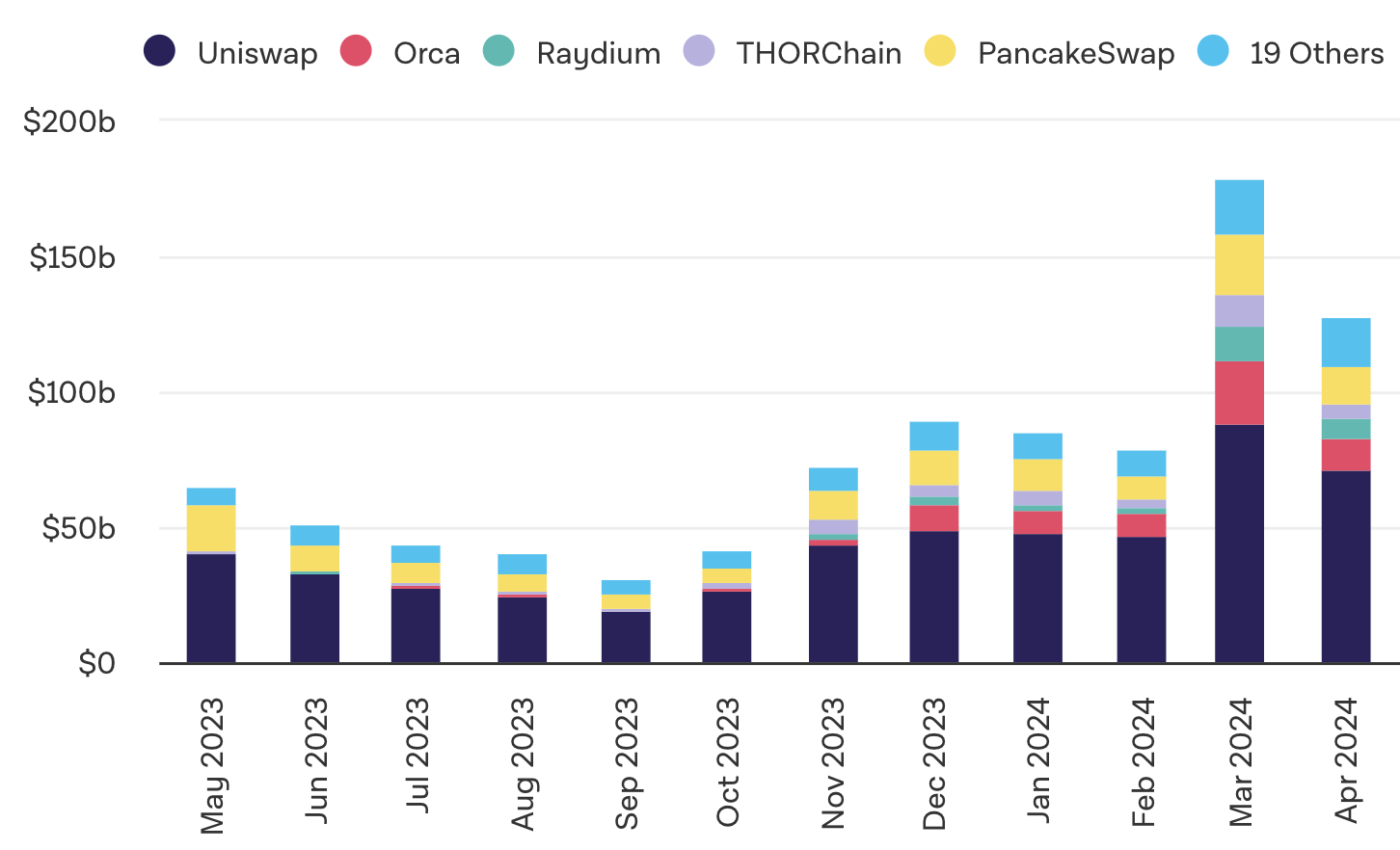

Decrease in DeFi activity was accompanied by decreasing trading volumes on decentralized exchanges that dropped by 28.5% compared to March. Uniswap remains the leading decentralized exchange with almost 56% market share in April.

DEX Trading Volumes (Monthly). Source: The Block

In April, Ethereum Layer 2 solutions Base and Blast stood out as the sole chains among the top-10 networks by TVL to show growth fueled by heightened community interest and the emergence of new DeFi protocols operating on these blockchains. Base showed a substantial 19.8% increase in TVL, while Blast experienced a more modest growth of 3.4%. In contrast, other blockchains witnessed outflows in TVL, with Solana recording the most significant decline at 21.4%.

Top 10 Blockchains by TVL. Source: DefiLlama

EigenLayer, building an ETH restaking infrastructure, showcased remarkable growth among the top-10 protocols by TVL with 25.8% monthly gain, followed by Ether.Fi (+13.8%), and Pendle (+7.9%). EigenLayer now ranks 3rd among all DeFi protocols by TVL trailing only behind AAVE and Lido.

Top 10 DeFi Protocols by TVL. Source: DefiLlama

State of L1 and L2

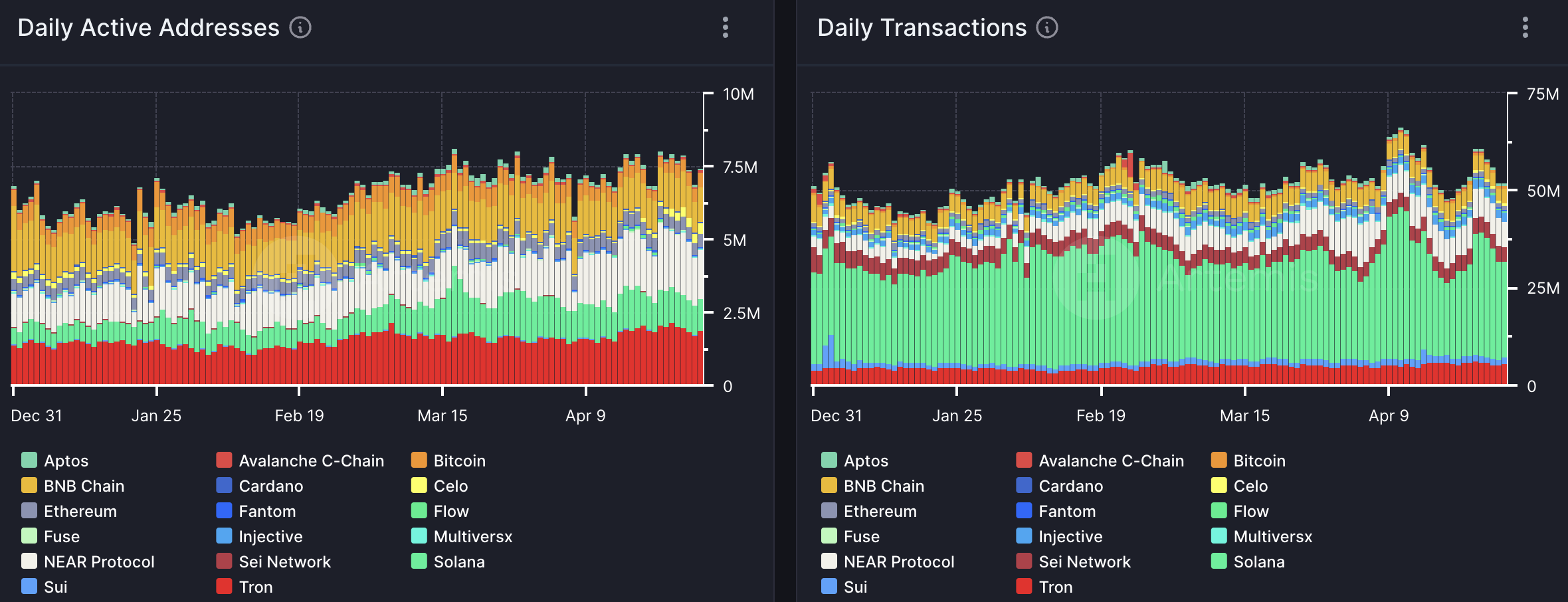

Despite market correction in April, on-chain activity on the leading L1 blockchains remained high. Daily active addresses on L1 networks showed an increase by 7.1% from 7M to 7.5M by the end of April. Tron and Near lead the space with 1.9M and 1.7M active addresses respectively, followed by BNB Chain (1.2M), Solana (1.1M), and Bitcoin (497K).

Solana dominates the L1 landscape by daily transactions accounting for almost half of total transactions on L1 networks with nearly 24.4M daily transactions by the end of April (52.3M total). Near ranks second with 6.3M, followed by Tron (5.9M), Sei Network (4M), and BNB Chain (3.8M). Overall, the average daily transaction count on L1 networks is near 52.3M since the beginning of the year.

L1 Daily Active Addresses and Transactions. Source: Artemis

In 2024, L2 solutions witnessed significant growth in active addresses and daily transactions, contributing to enhanced blockchain scalability, faster transaction processing, and reduced fees. However, after the growth in Q1, active addresses on leading L2 chains saw a slight decrease in April, dropping from 3.1M to 2.9M.

Polygon PoS leads the pack with 1.2M active addresses, followed by Base and Arbitrum. In terms of daily transactions on L2 chains, in April there was a 24% decrease from 15.2M to 11.6M. The leading networks by daily transactions in April are Polygon PoS, Arbitrum, Base, and zkSync, each with over 1M daily transactions. Interestingly, Blast, a newcomer in the L2 landscape, quickly garnered a user base and secured the sixth position by daily transactions in April, totaling 461K daily transactions by the end of the month.

L2 Daily Active Addresses and Transactions. Source: Artemis

Projects Worth Noting in April 2024

Make sure to check out these crypto projects and stay updated on the eye-catching titles of the industry.

Ethena (ENA)

Ethena is a DeFi protocol developing a crypto-native synthetic dollar, USDe. USDe is backed by collateral owned by the protocol and is secured by derivatives positions against this collateral. USDe holders have the opportunity to earn native yield from staked assets in the collateral pool, as well as funding derived from derivatives positions.

Ethena's innovative approach to stable asset creation ensures USDe stability while also rewarding holders with additional income. The protocol has amassed a TVL of $2.3B, with the sUSDe APY hovering around 15%. In April, Ethena launched its native ENA token, conducting an airdrop to early protocol participants and subsequently listing it on leading exchanges including Binance, Bybit, Kucoin, and others. The current price of ENA stands at $0.82, with a market capitalization of $1.17 billion.

ENA Price Chart. Source: Coinmarketcap

Renzo (REZ)

Renzo is a liquid restaking protocol operating on EigenLayer infrastructure with the goal of streamlining the process of ETH restaking and utilization within the EigenLayer ecosystem. Renzo introduced ezETH - liquid restaking token minted for every LST or ETH deposited to the Renzo protocol. Renzo TVL reached an impressive $3B in April that makes it one of the leading restaking protocols. In April, 30 REZ tokens were listed on the leading exchanges including Binance with current price $0.15 and market cap $177M. Additionally, 7% of the total supply was distributed as a reward for protocol’s early supporters.

REZ Price Chart. Source: Coinmarketcap

Bitcoin Runes

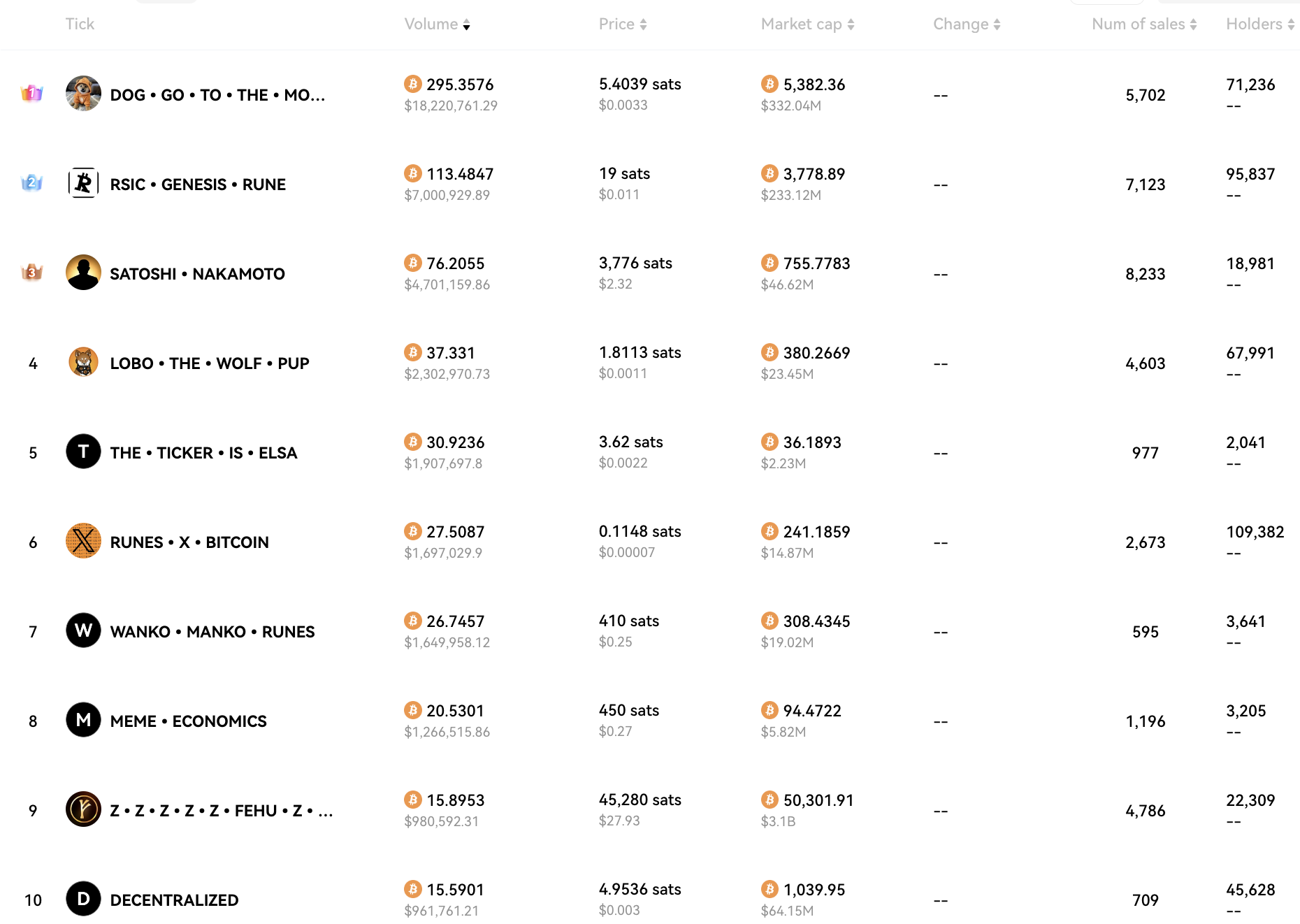

Runes Protocol, introduced by Casey Rodarmor, revolutionizes the creation of fungible tokens on the Bitcoin blockchain. Launched on April 20, 2024, shortly after the 4th Bitcoin halving, Runes leverages the Bitcoin UTXO model to generate tokens without network congestion. In contrast to earlier Bitcoin asset standards like Ordinals and BRC-20, Runes offer superior efficiency. Since Runes launch, its ecosystem has rapidly expanded and now includes a suite of tools for Runes minting, explorers, wallets, marketplaces, and more. This growth signifies Runes' potential to transform the Bitcoin blockchain into a new hub for DeFi and NFT activities, potentially injecting millions of dollars in new liquidity into the industry.

Popular Bitcoin Runes. Source

Conclusion

Crypto industry faced a slight decrease of activity in April following the correction of BTC and investors taking profits. Corrections are an integral part of market cycles and provide an opportunity for investors to reassess their strategies, learn, and analyze market dynamics. As we move into May, we anticipate new events, developments, and projects that will influence the industry development. It remains to be seen whether the adage "sell in May and go away" holds true for this month.

SimpleSwap reminds you that this article is provided for informational purposes only and does not provide investment advice. All purchases and cryptocurrency investments are your own responsibility.