Crypto Market Overview: March 2024

This blog post will cover:

- News and Updates of March 2024

- Key Market Stats of March 2024

- Projects Worth Noting in March 2024

- Conclusion

Ready to face the crypto updates of March? Jump in to discover the market news with SimpleSwap.

News and Updates of March 2024

Bitcoin reaches a new all time high price above $73K

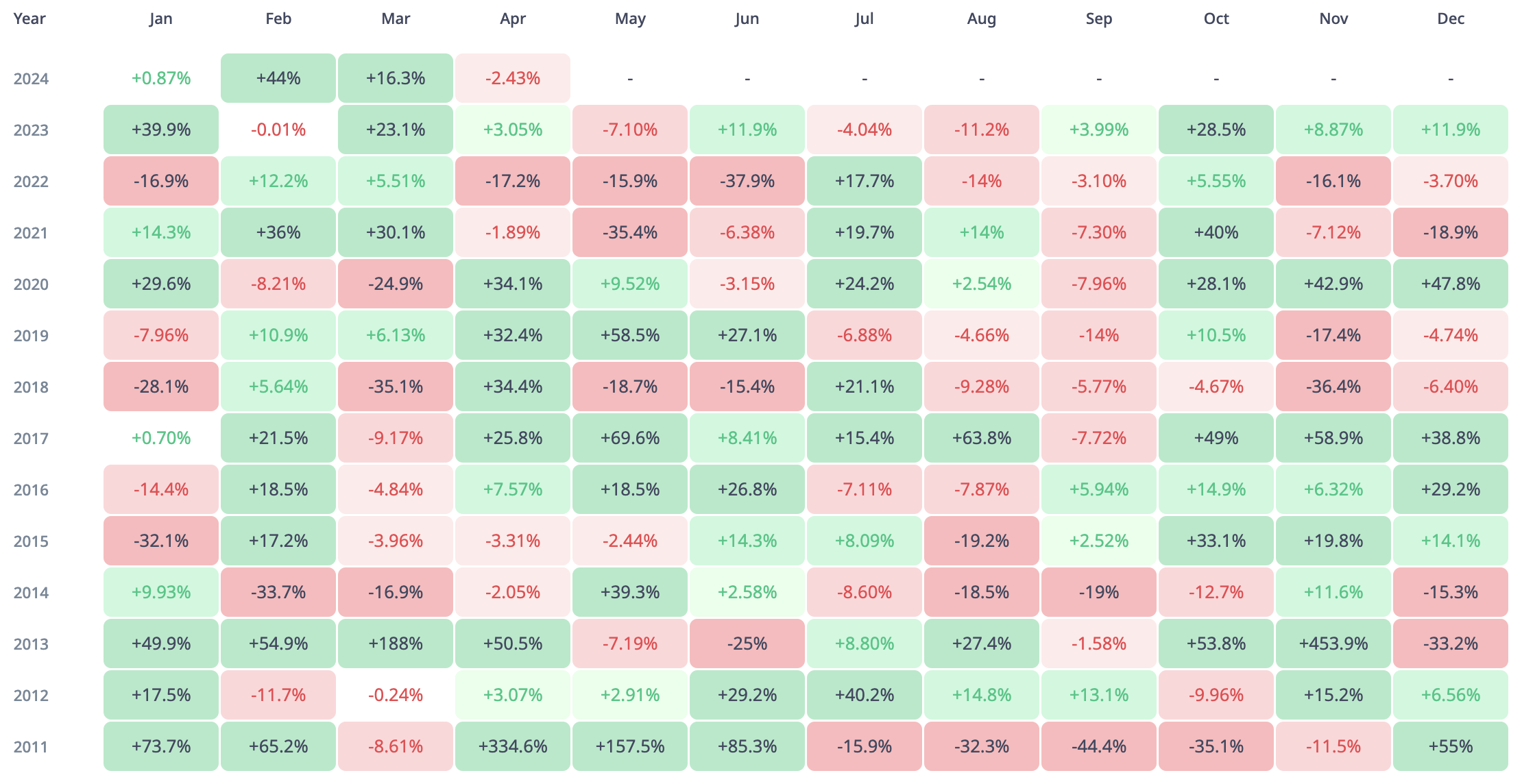

On March 4, 2024 BTC price climbed above $66K. Next day, the first cryptocurrency renewed its ATH price above $69K and a few days later, on March 14 the new ATH surpassed $73K. Overall, in March BTC rose by 16.3%, showing a more moderate growth compared to February.

BTC ATH is a significant event for the crypto industry, marking that bull run is going on. BTC price surges amidst the investment boom following spot ETF approval as financial heavyweights accumulate more BTC on their balances and share optimistics outlooks for the Crypto World.

BTC Monthly Returns. Source

Solana meme coin boom leads to record on-chain stats

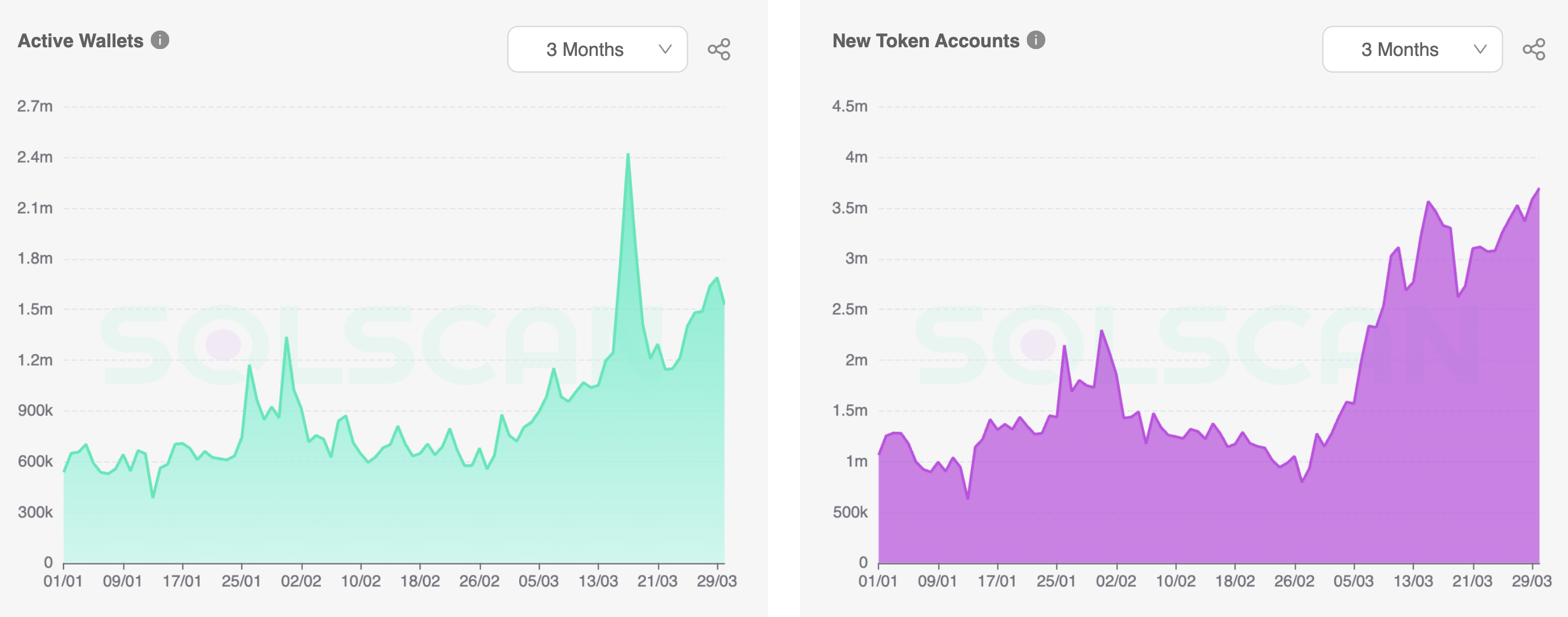

In March, the Solana blockchain experienced a surge in meme coin related activity, driving a substantial uptick in on-chain activity. This influx of meme coin projects significantly bolstered trading volumes across decentralized exchanges operating on Solana. As a result, DEX trading volumes soared to a record $60.3 billion for the month. Along with DEX volumes, Solana faced a surge of active wallet accounts and new token accounts. By the end of March, Solana had 1.5M active wallets and 3.7M new token accounts, reflecting a high users and developers activity in the network.

Solana Active Wallets and New Token Accounts. Source

Sam Bankman-Fried sentenced to 25 years in prison

FTX co-founder and ex CEO Sam Bankman-Fried will spend 25 years in prison according to the sentence announced in the US federal court in Manhattan on March 28. SBF was found guilty of fraud and manipulation of client funds. In addition to the prison sentence SBF will repay more than $11B.

FTX was one of the leading cryptocurrency exchanges with billions of dollars AUM. In November 2022 FTX collapsed following the investigation about client’s funds manipulation and high debt of FTX affiliated firm, Alameda Research. In December 2022 the US authorities opened civil and criminal charges against Bankman-Fried and FTX top officials for mismanagement of $8B of clients funds. FTX collapse had a damaging effect on the crypto industry, leading to drop of liquidity and crypto assets prices.

Dencun upgrade cuts L2 fees to historical lows

Deneb-Cancun upgrade became the most significant Ethereum upgrade since its transition to Proof of Stake in September 2022. Dencun solves the urgent issue of high transaction fees on Ethereum L2 solutions by introducing new staking and validation mechanics. After Dencun activation on March 13 L2 solutions saw a significant reduction of transaction fees up to 99%. Ethereum L2 solutions play a pivotal role in Ethereum scalability, providing faster and cheaper transactions, while preserving privacy ensured by layer 1 blockchain (Ethereum).

Key Market Stats of March 2024

BTC ETFs

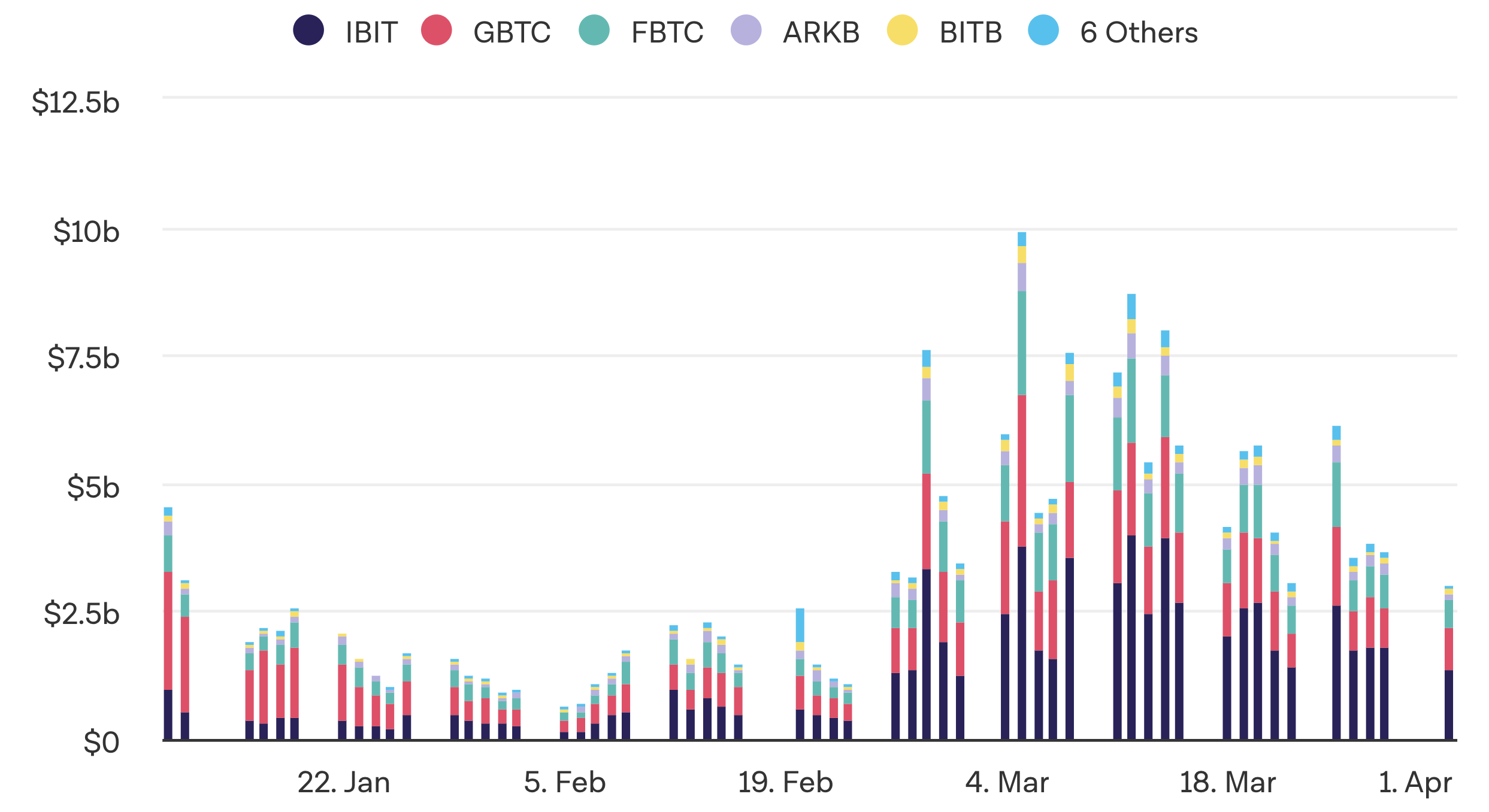

In March, spot BTC ETFs set new records, propelled by Bitcoin's new all-time high prices. By the end of the month, the cumulative trading volume of spot BTC ETFs had exceeded $180B. Notably, the highest daily trading volume of $9.9B was recorded on March 5th.

Spot BTC ETF Volumes. Source

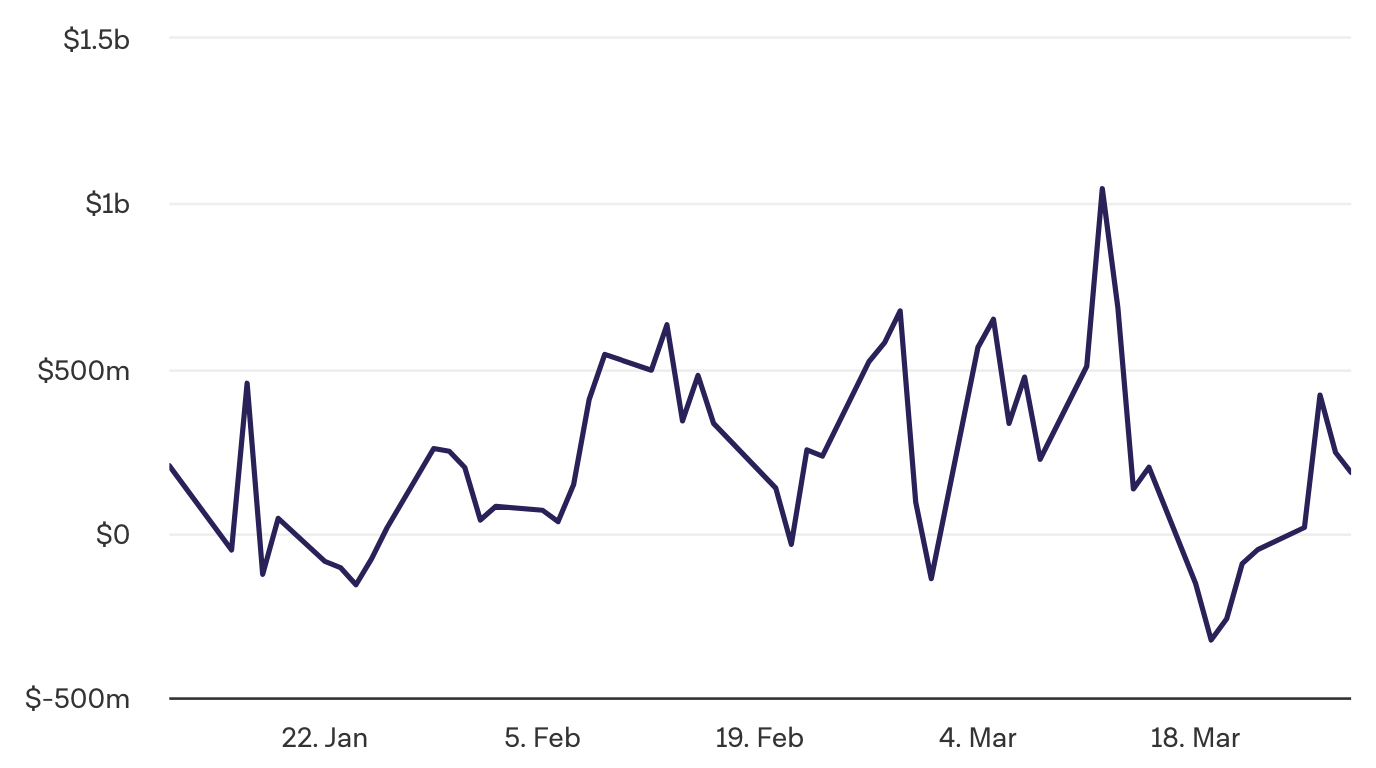

In March, total net flows to BTC ETFs also reached unprecedented levels. On March 12, net flows to BTC ETFs surpassed $1B, marking the highest daily influx of funds to the product since its launch in January 2024. However, as BTC underwent a correction from all-time high prices, ETFs experienced several days of net outflows. The most significant outflow took place on March 19, with withdrawals exceeding $326M.

Spot BTC ETFs Total Net Flows. Source

Trading Volumes

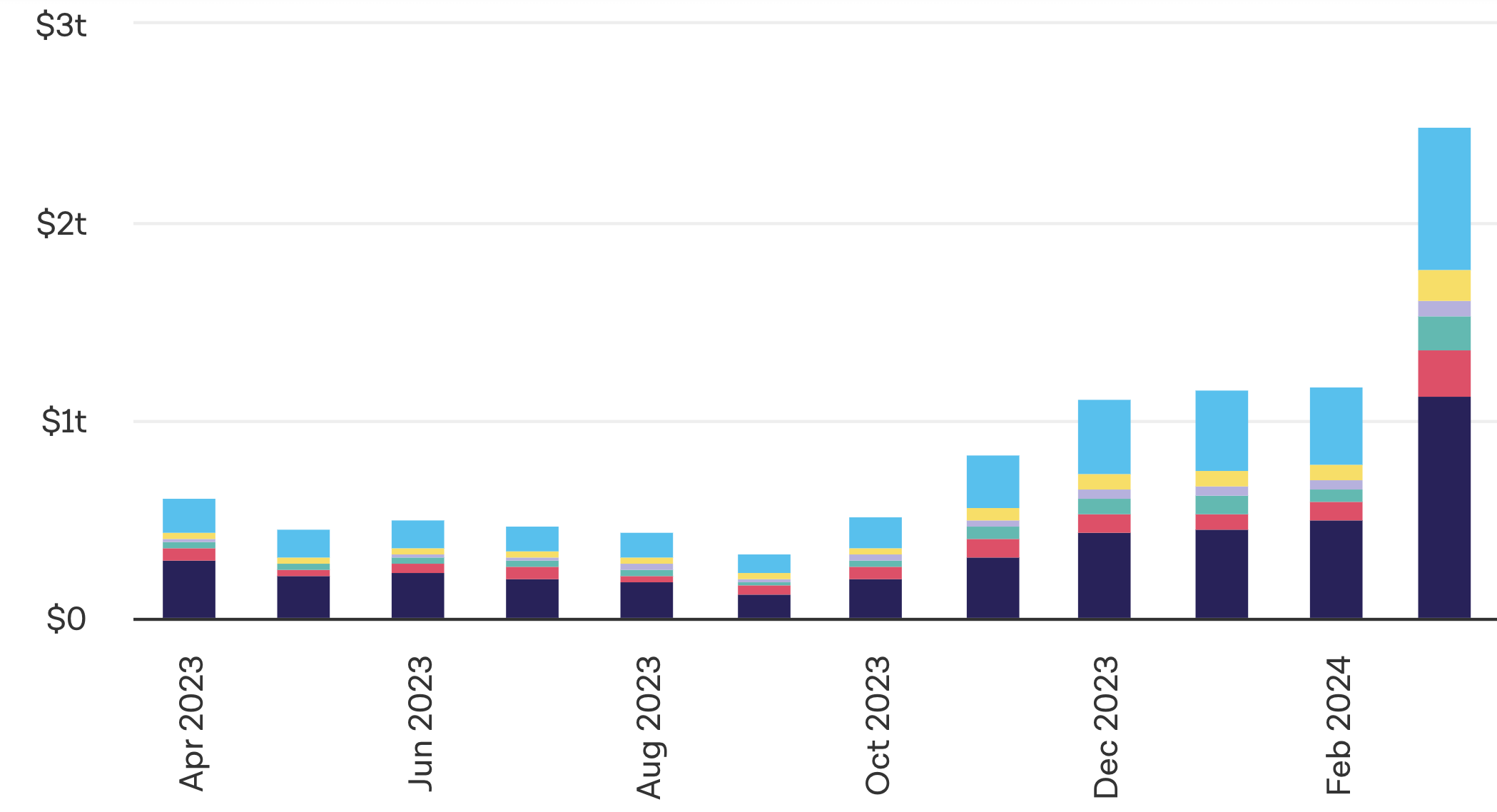

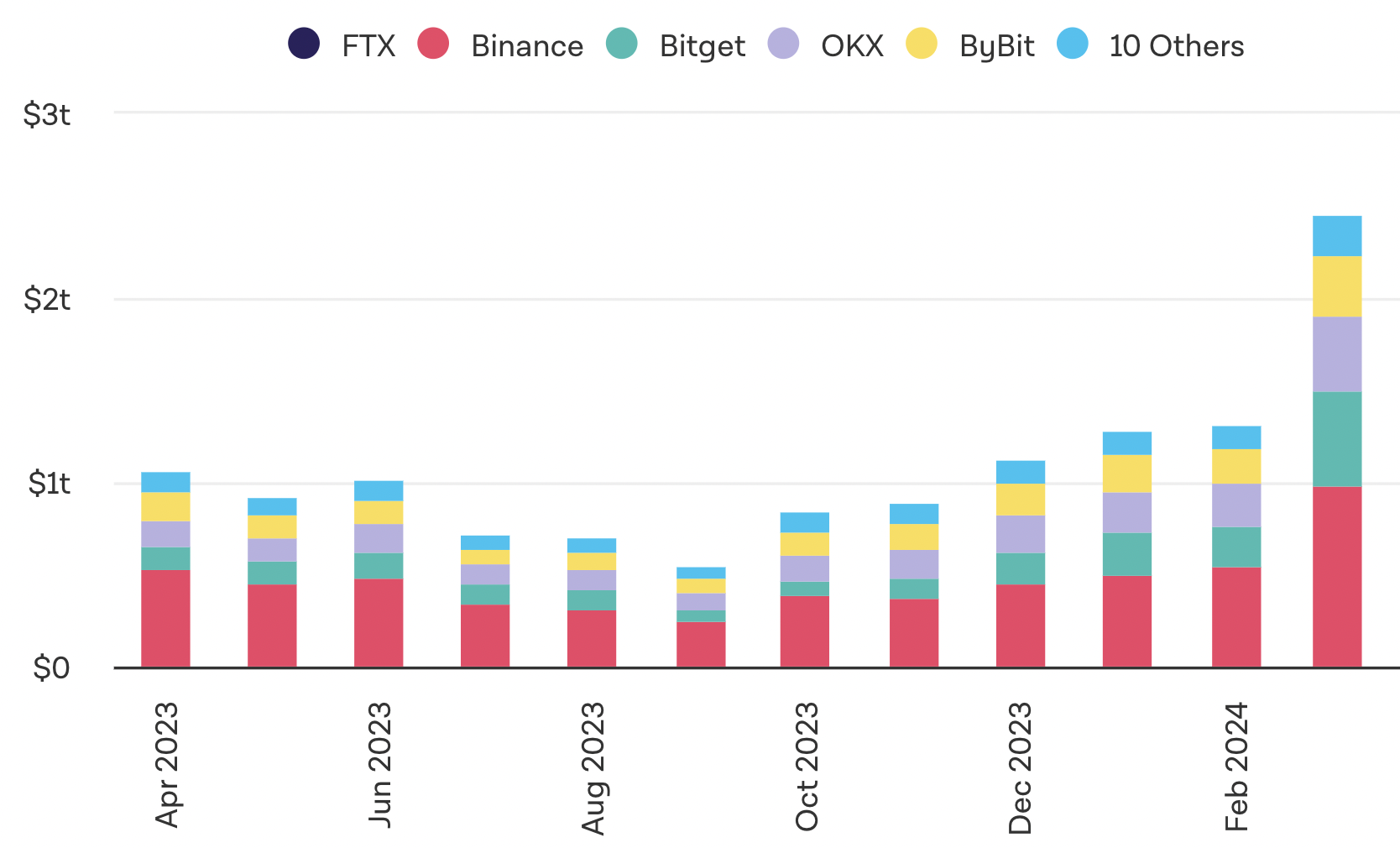

March became one of the most active months for crypto assets trading, witnessing unprecedented spot and futures volumes across centralized and decentralized exchanges. Bitcoin's surge to an all-time high prompted significant investor interest, driving substantial buying pressure. Spot trading volumes in March soared to $2.48T, marking the fourth largest monthly result since 2017 and showcasing a remarkable 112% increase compared to February.

Monthly Trading Volumes on CEX. Source

Following the spike of interest from investors and traders, BTC futures also showed record numbers in March. Trading volumes of BTC futures on the leading CEX amounted to $2.45T. It is the second largest result after an impressive $2.79T in May 2021 and 85.6% growth compared to February.

BTC Futures Monthly Volumes. Source

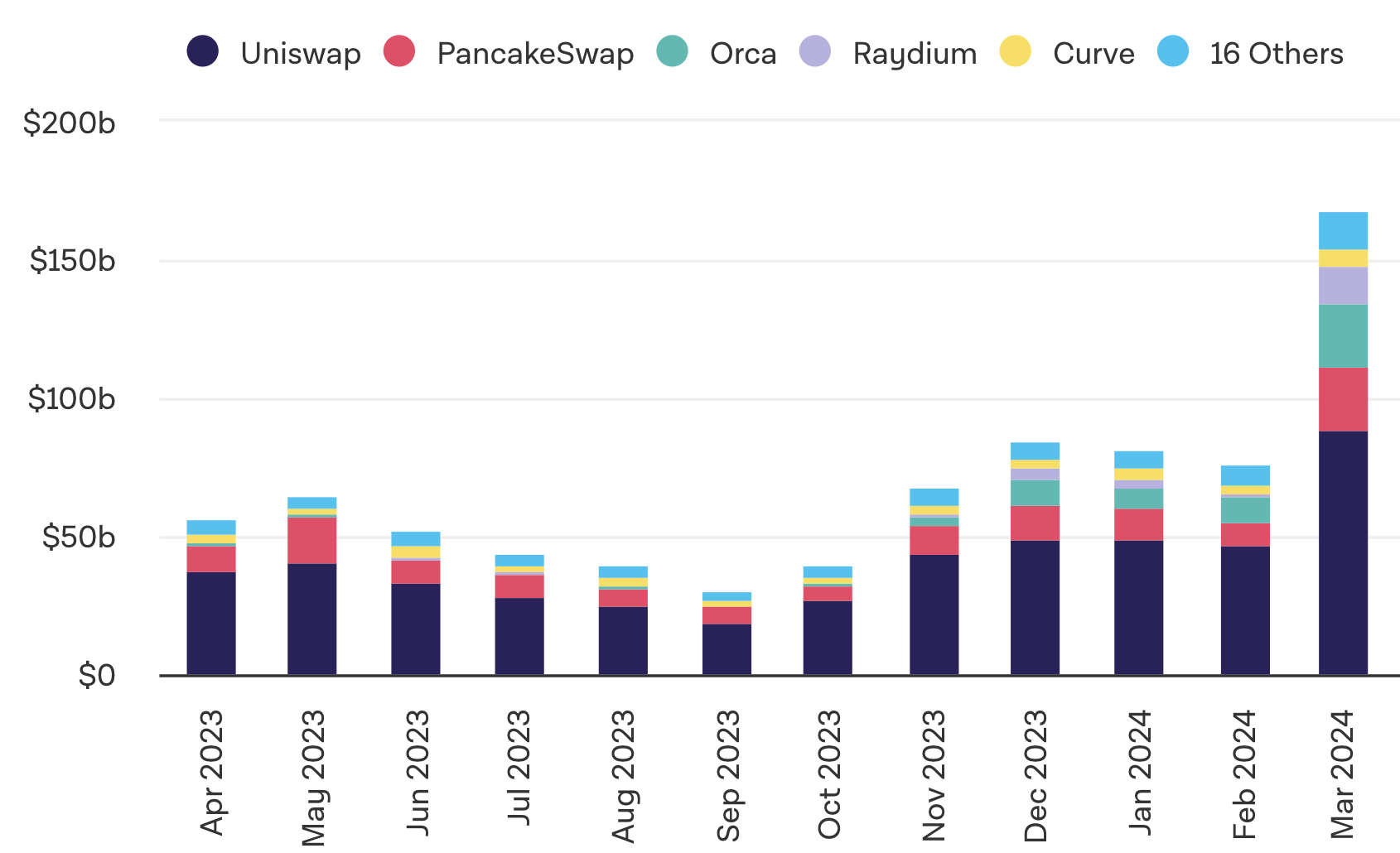

DEX trading volume has also reached its highest point since November 21. In March, it amounted to $168B, which was the third largest result in history. Uniswap stands as a market leader with $89B volume, while Solana-based Orca takes second place with a $23B result.

DEX Trading Volumes. Source

State of Layer 1 and Layer 2

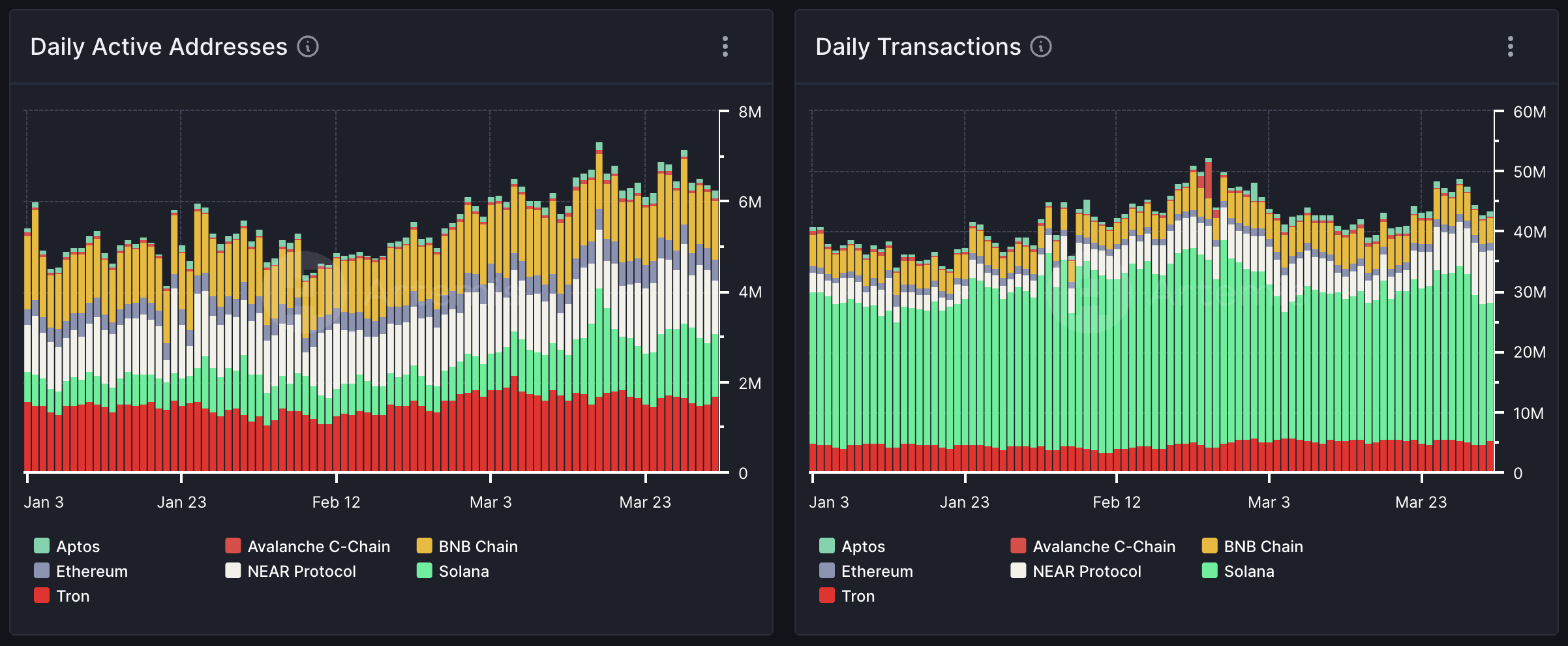

During March, on-chain activity across several major Layer 1 blockchain networks remained high. Notably, four prominent L1 chains — Near, Solana, Tron, and BNB Chain — had more than 1M daily active addresses. Solana, in particular, experienced a significant surge, with its active addresses doubling since the start of the year, fueled by the platform's increasing popularity and the meme coins boom. Solana also maintained its dominance in transaction volume, recording an impressive daily transaction count of over 20M throughout March. Across a broader spectrum encompassing seven popular L1 chains, the cumulative daily transaction count surpassed 48M on March 28, illustrating the sustained activity within the blockchain landscape.

L1 Active Addresses and Daily Transactions. Source

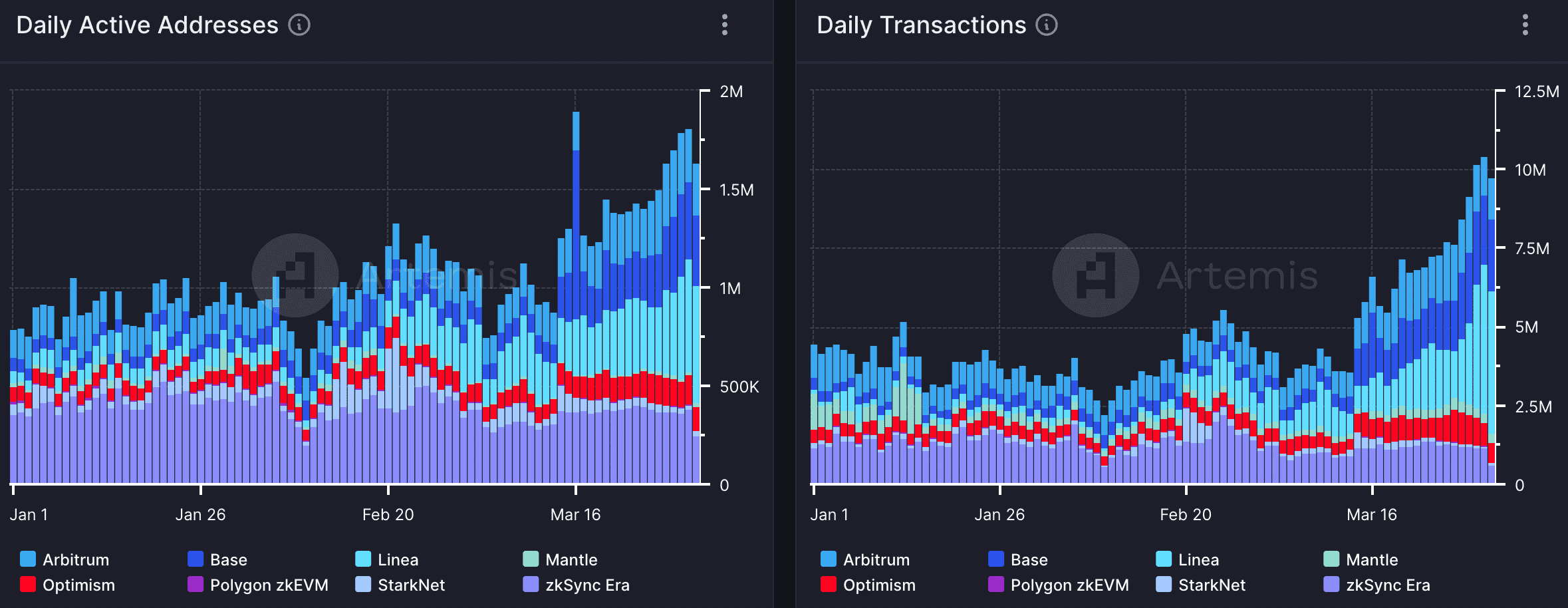

Following the Dencun upgrade that significantly reduced transaction fees on the Ethereum layer 2, they demonstrated an impressive on-chain activity growth in March. Daily active addresses on 8 popular L2 networks grew by 64% last month from 1.1M to 1.8M with Linea, Base, and zkSync leading the space. Daily transactions on L2 chains surged by 174% indicating a strong interest of users and developers in this sector. Linea and Base became the most popular L2 chains by daily transactions. Base user growth is connected with the new meta of meme coins launching on Base, while Linea announced Linea Voyage program aimed to bootstrap network liquidity to $3B during the next 6 months.

L2 Active Addresses and Daily Transactions. Source

State of DeFi

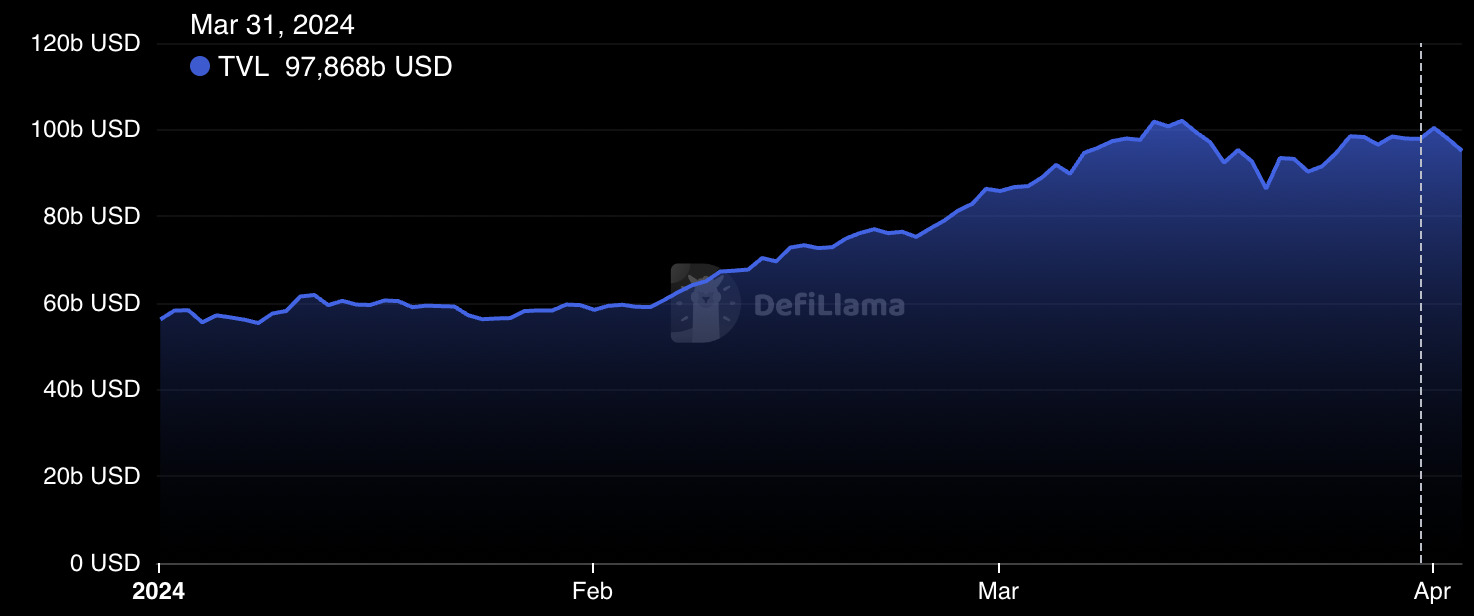

Total value locked in DeFi protocols continued to rise in March and reached $203.8B at the end of the month, showing a 12% monthly growth. However, it is still far from its highs reached in 2021 when total DeFi TVL exceeded $300B. This result indicates that we are still early in this bull market cycle and there is a potential for further growth that may be driven by the DeFi sector.

DeFi TVL Growth in 2024. Source

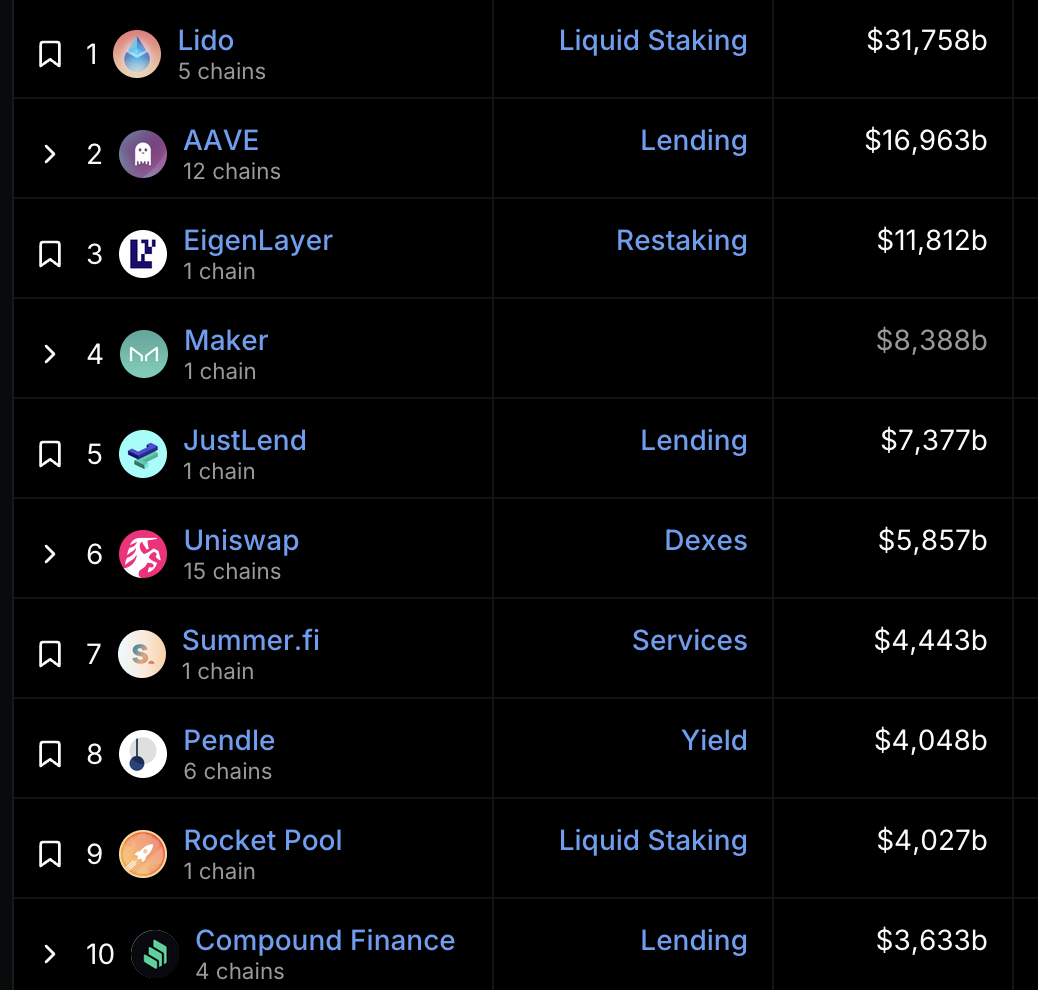

Lido, AAVE, and EigenLayer preserved their positions as the leading DeFi protocols by TVL in March. Among top-10 projects, Pendle demonstrates the best dynamics of TVL growth that almost doubled within the last 30 days.

Top 10 DeFi protocols by TVL. Source

Projects Worth Noting in March 2024

Toncoin (TON)

Toncoin emerged as one of the best performing L1 blockchains in 2024. In March, TON price surged by 118% making it the 11th cryptocurrency by market cap. The main driver of TON's recent growth became a positive news feed. Ton's strategic partner, Telegram, recently announced IPO plans and reassured its commitment to use TON in the Telegram ecosystem. Partnership with Telegram is a cornerstone of Toncoin development strategy. Also, TON Foundation announced the launch of an incentivized program to boost activity in the network, The Open League. Users now are rewarded with $115M in TON by participating in the Toncoin ecosystem.

Ton Price Performance in March. Source

dogwifhat (WIF)

WIF is a meme token on the Solana blockchain that became a new star in the meme coin podium. Showing a +449% growth in March WIF reached a market cap of $3.8B ranking 35 among all cryptocurrencies and 3rd among meme tokens, surpassing Pepe (PEPE), FLOKI (FLOKI), and Bonk (BONK). WIF was listed on major exchanges including Binance and spotted its place as a “blue chip” meme coin. The key to WIF success was the perfect use of memes narratives to grab the attention of the community and attract thousands of loyal users to the project.

WIF Price Performance in March. Source

ether.fi (ETHFI)

ether.fi is a non-custodial Ethereum restaking protocol. The project was backed by prominent investors including ConsenSys, OKX Ventures, CoinFund, and others. In March ether.fi was listed on major exchanges including Binance, OKX, Bybit, and others. ether.fi has also allocated 68M ETHFI (6.8% of the total supply) for airdrop to early protocol participants. ether.fi is the leading LRT protocol with estimated value of LRT tokens (eETH) near $3.25B.

ETHFI Price Performance in March. Source

Conclusion

March was a significant month for the crypto industry with BTC as a frontrunner of the ongoing bullish cycle. Rising trading volumes and on-chain activity signals a positive sentiment for the crypto market. Solana meme coins became the hot narrative in March with a new star in the meme coin family and Solana DEXes trading volume soaring. Overall, March was a positive month and now we expect the most important event in April — Bitcoin halving that brings us to the new reality.

SimpleSwap reminds you that this article is provided for informational purposes only and does not provide investment advice. All purchases and cryptocurrency investments are your own responsibility.