Crypto Portfolios: Aggressive, Defensive, Hybrid Scenarios

Key Insights

- Volatility ranking for each portfolio with the highest one being the high risk portfolio’s

- Comprehensive intel on every coin in each portfolio

- Moderate portfolio offers the highest potential profit with medium level of risks

In this article we take a deep look into three crypto portfolios based on their risk level, so that investors could make informed decisions in risk management.

SimpleSwap’s analysts will be renewing the following portfolios and keep an eye on their development as the market’s circumstances change.

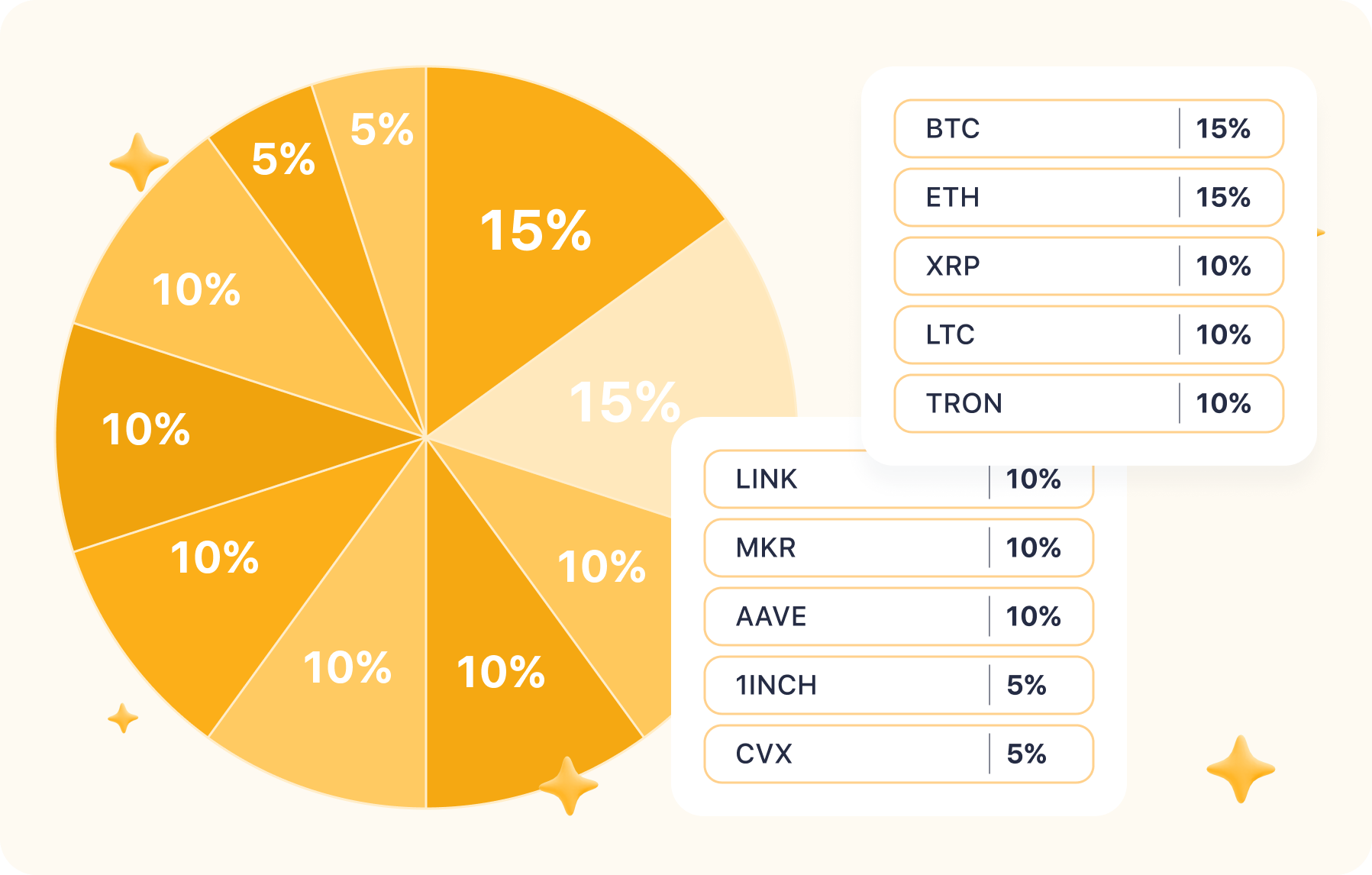

Low-Risk Portfolio

Featured Coins: Bitcoin (BTC), Ethereum (ETH), XRP (XRP), Litecoin (LTC), TRON (TRX), Chainlink (LINK), AAVE (AAVE), Maker (MKR), 1INCH (1INCH), Convex (CVX).

All the most famous and old coins suitable for a conservative portfolio. Mainly L1 blockchains and well-established DeFi projects that are leaders in their segment. Demonstrating less volatility, so they are suitable for conservative investing.

To compare the three portfolios, we use average portfolio volatility over 30 days, half a year and a year.

Conservative portfolio volatility:

30 days - 2.6%

Half a year - 34.6%

Year - 49.2%

- BTC – 15%

Bitcoin has become a staple of the conservative crypto portfolio as the best known cryptocurrency with the highest trading volume and interest from both institutional and retail investors. It is now becoming part of portfolios of a wide range of investors through accepted ETFs. Bitcoin is less volatile than other coins and investing in this asset is less risky.

- ETH – 15%

Ethereum is also one of the leaders of the cryptocurrency market and the second largest by market cap. It reflects the value of smart contract technology and decentralized applications based on them. This crypto asset is also included in the portfolios of a wide range of investors and is a rather conservative investment aimed at expecting stable, albeit not explosive growth.

- XRP – 10%

XRP is one of the most prominent blockchain projects aimed at providing payments and transactions through its blockchain. XRP has partnered with many financial and technology companies outside of the crypto industry. XRP is often part of conservative portfolios for investment.

- LTC – 10%

Litecoin is another project that appeared in the early days of the crypto industry and is a decentralized cryptocurrency for making payments with low fees. The project appeared in 2011 and since then has attracted the attention of users due to the development of its technology and the advantages of the Litecoin network, such as a high level of privacy and low commissions.

- TRX – 10%

Tron is one of the leading and most famous L1 blockchains focused on the creation of decentralized applications. TRON has traditionally been at the top of blockchains in terms of active addresses and daily transactions. A large number of decentralized applications have been deployed on the blockchain. Another advantage of Tron is lower fees (compared to Ethereum).

- LINK – 10%

Chainlink is the most famous decentralized network that acts as an "oracle" - a provider of data from external sources that allows smart contracts to fulfill their functions. Chainlink performs a critical function by enabling cross-chain data exchange between blockchains and decentralized applications.

- MKR – 10%

Maker is one of the leading DeFi protocols issuing the DAI stablecoin. The Maker protocol is the 3rd largest blockchain protocol in terms of blocked assets (TVL) according to DefiLlama rankings. Maker is also actively developing the use of real-world assets (RWA) in its mechanics, which may drive the protocol's development in the future.

- AAVE – 10%

AAVE is the leading DeFi lending protocol in terms of TVL volume. AAVE allows you to borrow and lend cryptocurrencies using smart contract technology without third parties. AAVE is one of the pioneers of decentralized finance, developing lending based on smart contracts and he data chane.

- 1INCH – 5%

1INCH is a leading aggregator of decentralized exchanges, providing users with the best quotes for exchanging cryptocurrencies with low fees. In addition, the protocol provides the ability to set limit orders and track your crypto portfolio with 1INCH Portfolio.

- CVX – 5%

Convex is a pioneer in optimizing and increasing yield in DeFi protocols and allows users to increase the yield from their Curve protocol tokens. Utilizing Convex allows you to generate yield from CRV tokens by placing them in the Convex protocol and restacking the income to generate additional commissions from the platform.

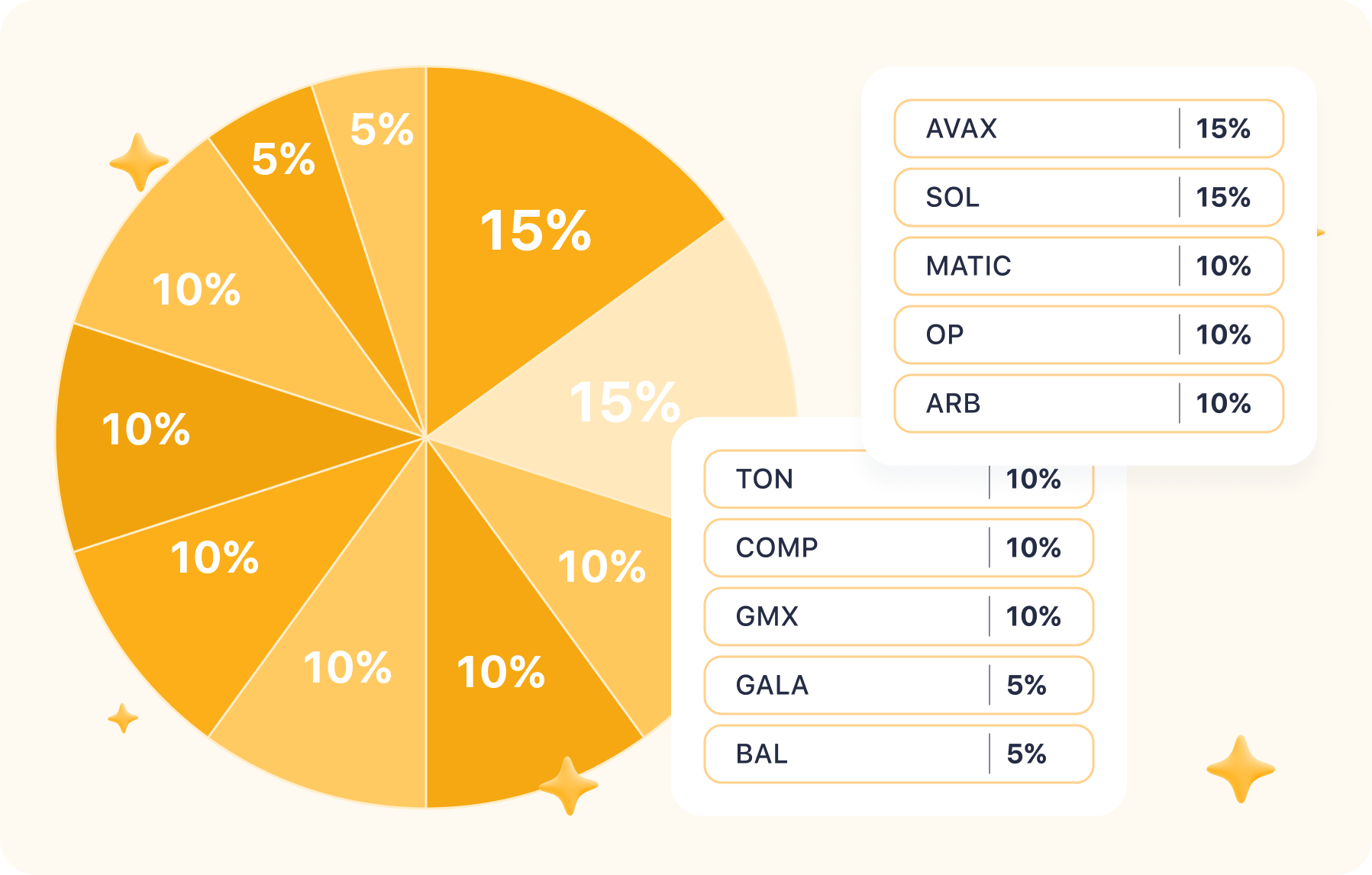

Medium-Risk Portfolio

Featured Coins: Avalanche (AVAX), Solana (SOL), Toncoin (TON), Polygon (MATIC), Optimism (OP), Arbitrum (ARB), Compound (COMP), GMX (GMX), Gala (GALA), Balancer (BAL).

This portfolio contains assets that are also widely recognized and are among the leaders in their segments. There are L1 solutions that have already shown excellent results in 2023, as well as L2 projects that have great growth potential and have not yet shown themselves. Also added are several DeFi projects and GALA as an exposer on the GameFi segment.

The difference from the conservative portfolio is higher volatility, so this portfolio has more potential profit, but also increases the risk of drawdown. Portfolio volatility figures:

30 days - 3.2%

Half a year - 42.6%

One year - 60.7%

- AVAX – 15%

Avalanche is one of the leading Tier 1 blockchains, compatible with Ethereum and providing better scalability and speed. The blockchain's feature is the creation of custom chains (subnets) for different purposes. Avalanche is suitable for long-term investment and will become one of the main crypto assets in our portfolio with moderate risk.

- SOL – 15%

Solana is a Tier 1 blockchain that provides one of the fastest transaction speeds among L1 solutions while keeping fees low. Solana has shown significant growth in late 2023, which has spurred the active development of the blockchain ecosystem and the emergence of new, promising DeFi protocols based on Solana.

Solana Blockchain has great potential for development and growth, but higher volatility is possible for SOL compared to BTC and ETH. Therefore, we have included Solana in the portfolio with moderate risk.

- MATIC – 10%

Polygon is a Proof-of-Stake blockchain that is compatible with Ethereum and provides the ability to create a wide range of decentralized applications. In addition, L2 solutions such as Polygon zkEVM are also being actively developed based on Polygon. Inclusion of the project in the portfolio will allow to participate in the development of the fast-growing Polygon ecosystem.

- OP – 10%

Optimism is one of the leading Ethereum-based L2 solutions that provides high-speed transaction processing and scalability while maintaining Ethereum-level security. Inclusion of this project in the portfolio gives us the opportunity to invest in the development of one of the most promising areas in the crypto industry - the development of L2 solutions and their ecosystems.

- ARB – 10%

Another representative of L2 solutions based on Ethereum, which is an "optimistic" rollup. ARV token is traded not so long ago and has not yet shown such growth as older projects, but it has a great potential for growth, given the development of Arbitrum as one of the key L2 blockchains.

- TON – 10%

Toncoin is a Tier 1 blockchain aiming to achieve a record high number of transactions per second. The key feature of Toncoin is its cooperation with Telegram and integration of the blockchain into the messenger's functionality. Inclusion of the project in the portfolio allows to participate in the mass-adoption of cryptocurrencies by integrating Toncoin into Web2 messenger.

- COMP – 10%

Compound is one of the leading DeFi lending protocols that allows you to borrow against cryptocurrencies and earn interest on your crypto assets by adding them to lending pools. The inclusion of the project in the portfolio gives an exposer to the DeFi Lending sector, which is one of the leading areas of decentralized finance development.

- GMX – 10%

GMX is a decentralized derivatives exchange based on Arbitrum. Against the backdrop of falling trust in centralized exchanges, users are increasingly opting for decentralized trading solutions. Including GMX in the portfolio allows you to capitalize on this process.

- GALA – 5%

Gala represents the GameFi sector, a promising trend in the crypto industry that has yet to realize its potential. Gala aims to give players more freedom, control and earning power on its platform with AAA quality games. Including Gala in the portfolio gives us exposure to the GameFi sector and allows us to diversify our portfolio.

- BAL – 5%

Balancer protocol is an AMM-based DeFi protocol seeking to optimize liquidity on Ethereum. Balancer can be used to exchange ERC 20 tokens, supply liquidity, and generate additional returns from assets already in use.

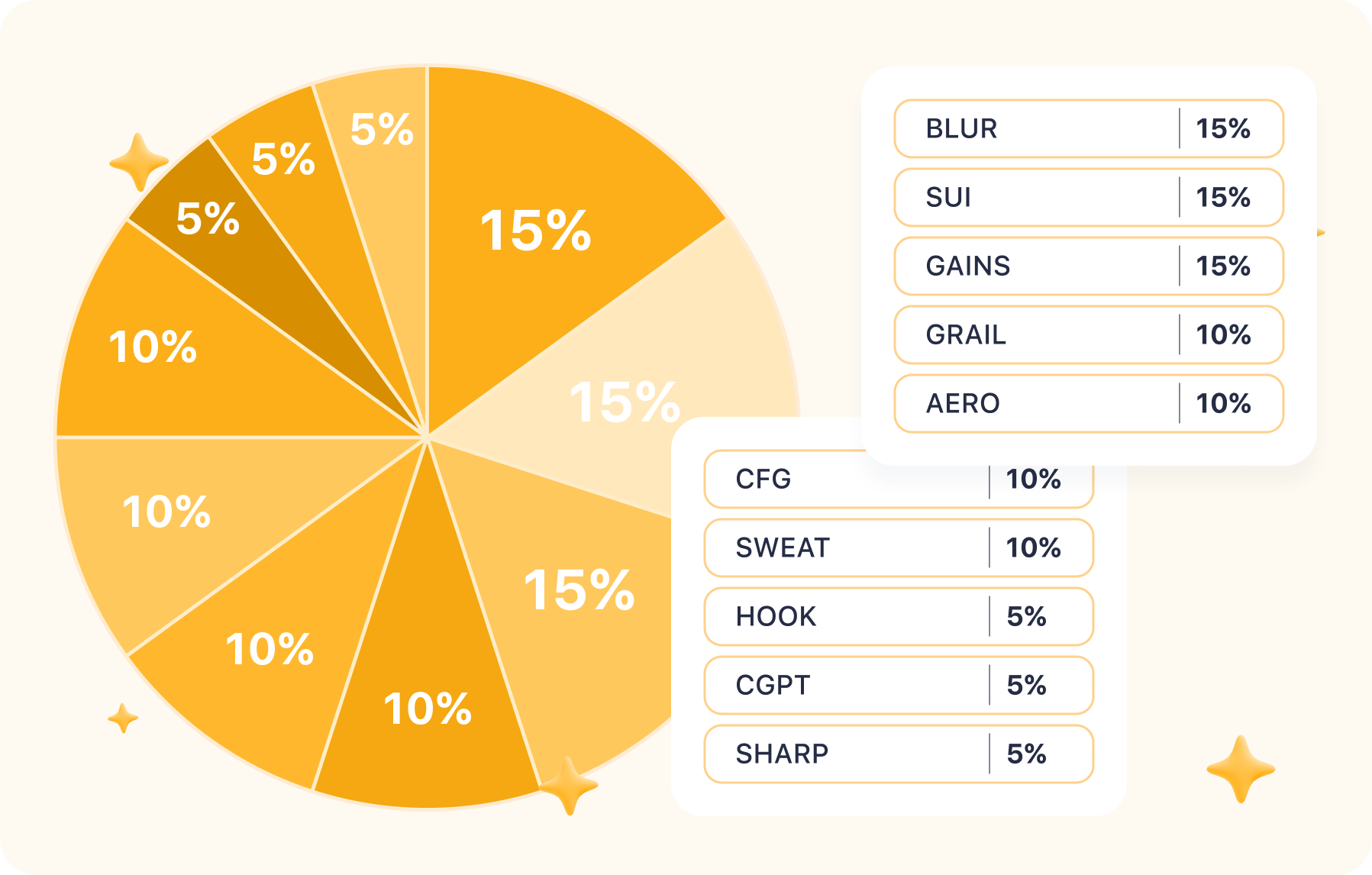

High-Risk Portfolio

Featured Coins: Shrapnel (SHRAP), Blur (BLUR), Aerodrom (AERO), Gains Network (GAINS), Camelot (GRAIL), Sweat Economy (SWEAT), Hooked Protocol (HOOK), Centrifuge (CFG), ChainGPT (CGPT), Sui (SUI).

This portfolio includes various projects, both niche projects (Gains, Camelot) with significant growth potential and early stage projects (Shrapnel, Chainflip). In addition, the portfolio i more diverse "by sector", with almost all major crypto segments represented: DEX, GameFi, SocialFi, Layer 1, NFT.

Such diversification allows you to bet on the growth of several sectors at once, taking the most promising projects in each. However, investing in such projects carries a much more significant risk than in a conservative and moderate portfolio due to the high volatility of the assets and their lack of strong fundamental growth drivers (because they have not yet found their niche in the market). Portfolio volatility performance:

30 days - 5.9%

Half a year - 78.8%

Year - 112%

- BLUR – 15%

Blur is the leading NFT marketplace by trading volume. Blur's inclusion in the portfolio allows us to participate in the development of a promising trend in the crypto industry, which is NFT tokens.

- SUI – 15%

Sui is a level one blockchain created using the Move programming language. Sui offers a solution for creating smart contracts, providing high network bandwidth combined with low fees. The project is in the top 50 by market cap and has significant growth potential.

- GAINS – 15%

Gains is a decentralized leveraged trading platform. The key feature of Gains Network is the ability to trade not only cryptocurrencies, but also Forex and other assets (commodities). The platform received a grant under the STIP program from Arbitrum.

- GRAIL – 10%

Camelot was one of the first decentralized exchanges launched on Arbitrum. In addition to allowing token exchanges, Camelot has its own lunchepad, as well as various liquidity farming and yield enhancement programs. The project's inclusion in the portfolio will benefit from the growth of the Arbitrum ecosystem and increased trading volume on the network.

- AERO – 10%

Aerodrom is an AMM-based decentralized exchange built on the Base blockchain. The Aerodrom protocol enables token exchanges on the Base network, as well as receiving commissions for providing liquidity. The inclusion of Aerodrom will benefit from the development of the Base ecosystem and the growth of onchain activity on this network.

- CFG – 10%

Centrifuge is developing DeFi, which is based on real assets. With the protocol, users can make loans lending secured by real assets. The RWA segment is one of the fastest growing segments in DeFi, and Centrifuge's inclusion in the portfolio provides an opportunity to participate in the growth of this area.

- SWEAT – 10%

Sweat Economy is a popular game app that allows users to earn while moving: walking, running and other activities. The app is one of the leaders in the GameFi segment in terms of unique users.

- HOOK – 5%

Hooked Protocol is a Web3 social learning platform that aims to simplify learning and promote mass adoption of cryptocurrencies. Hooked offers users a new learning experience by utilizing the concept of learn and earn. Hooked allows for portfolio diversification and expansion into another segment, SocialFi.

- CGPT – 5%

ChainGPT develops Web3 infrastructure for the crypto industry based on artificial intelligence. ChainGPT's products include bots, NFT generators, smart contract builders, shopping assistants and its own lunchepad. The products can be used by both retail investors and institutional players. ChainGPT will allow the portfolio to cover the promising AI technology sector, which may become one of the main areas of crypto services development in the near future.

- SHRAP – 5%

Shrapnel is another representative of the GameFi segment in the portfolio. It is a triple-A shooting game that introduces blockchain and cryptocurrency into its economy, which makes gameplay more exciting and provides players with control over their equipment and items.

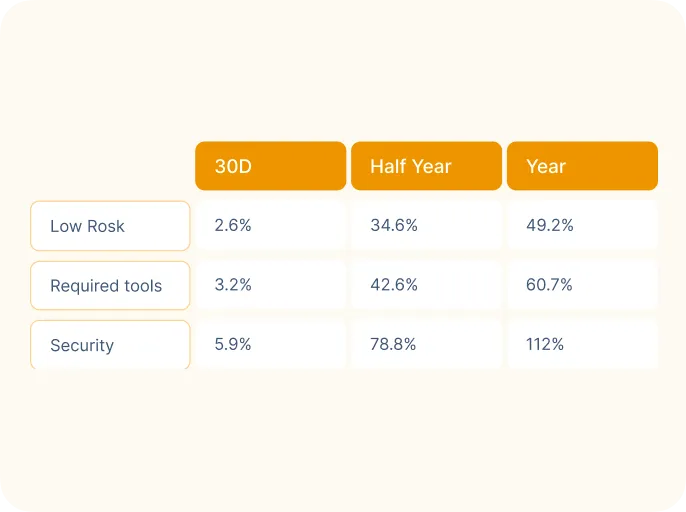

Portfolio Volatility Table

Summary

In this article, we observed three types of crypto portfolios based on potential risks. Each portfolio includes several coins and provides analysis for financial risk management.

A conservative (low-risk) portfolio includes the most stable and old coins and offers stable returns with low volatility. The moderate (medium-risk) portfolio has higher volatility but also offers the possibility of higher income. The high-risk portfolio has the highest volatility, but also a high growth potential.

Users can get any of the portfolio coins on SimpleSwap or via the widget below this article.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.