Litecoin Fundamental Analysis

Key Insights

- This analysis of Litecoin metrics demonstrates several key trends and dynamics in the ecosystem of this cryptocurrency

- While Litecoin and Bitcoin share many similarities, Litecoin differs from Bitcoin in a number of important technical features and advantages, such as greater speed and cheaper transactions

- The participation of retail investors in Litecoin emphasizes the wide availability and attractiveness of this cryptocurrency

What Is Litecoin

Litecoin (LTC) is a cryptocurrency that was introduced in 2011 by Charles Lee in response to the limitations of Bitcoin. He created Litecoin in order to improve certain aspects of Bitcoin, including faster transactions and mining based on the Scrypt algorithm.

The initial distribution of LTC tokens occurred through block mining rather than an ICO. This contributed to a more widespread and decentralized network. Over time, Litecoin has gained significant market capitalization, reflecting investor and user interest. Currently, Litecoin has a market capitalization of $7,828,631,435.

Litecoin aims to provide an efficient medium of exchange for instant payments and transfers, and to support the development of innovation in blockchain technology. Litecoin sees its mission to become one of the leading cryptocurrencies, the use of which will become commonplace in everyday life.

Litecoin continues to develop and strengthen its position in the cryptocurrency world, attracting both users and developers. Thanks to its reliability, speed and active community, Litecoin remains an important player in the cryptocurrency market, continuing to improve and expand its capabilities.

Users can get LTC on SimpleSwap.

CoinMarketCap Rating (as of writing):

- Market cap: 20th place($7,838,040,034)

- Volume (24h): 7th place($649,814,120)

- Total supply: 84,000,000 LTC

Litecoin’s Competitors

- Bitcoin (BTC)

As a major competitor, Bitcoin is also a cryptocurrency with a huge market capitalization and wide acceptance. While Litecoin offers faster transactions and lower fees, Bitcoin remains the leading player in digital currencies.

- Ethereum (ETH)

Ethereum offers not only a cryptocurrency but also a platform for deploying smart contracts and decentralized applications. This makes Ethereum a direct competitor to Litecoin in the development of dApps and smart contracts.

- Bitcoin Cash (BCH)

Bitcoin Cash was created as a result of a split (hardfork) of the Bitcoin network to improve scalability and reduce fees. It also competes with Litecoin to be a fast and cheap means of exchange.

- Dash

Dash, like Litecoin, aims to become a convenient medium of exchange for everyday transactions. Dash offers additional features such as instant and anonymous transactions, making it a direct competitor to Litecoin in this niche.

- Monero (XMR)

Monero is known for its focus on privacy and anonymous transactions. While Litecoin focuses on fast and cheap transactions, Monero offers additional features, making it an alternative in the realm of confidential transactions.

Litecoin notably continues to carve out a niche for itself as a fast and cheap way to make transactions, but competition in the cryptocurrency market is ever-increasing and it needs constant development and innovation to overcome challenges.

Litecoin Technology Research

- Mining Algorithm

The Litecoin mining algorithm plays a key role in securing the network and creating new blocks containing transactions.

- Scrypt

Litecoin's main mining algorithm is Scrypt. This algorithm was chosen by the creators of Litecoin to increase decentralization and prevent the monopoly of large mining farms that could efficiently mine the cryptocurrency using specialized ASIC miners.

- Transaction Processing

In Litecoin mining, miners collect unconfirmed transactions from the mempool and group them into a new block. They then attempt to solve a math problem to add this block to the blockchain. Successfully solving this problem (Proof-of-Work) allows the miner to add the block to the blockchain and be rewarded with new Litecoin, as well as commissions for the transactions included in the block.

- Mining Complexity

Litecoin mining complexity is automatically adjusted by the network every 2016 blocks to ensure a stable block generation time of approximately 2.5 minutes. This keeps the network stable and prevents blocks from being created too fast or too slow.

Thus, Litecoin's Scrypt mining algorithm provides a more decentralized and accessible mining process for the general public, which contributes to the stability and security of the Litecoin network.

Segregated Witness (SegWit) In Litecoin

SegWit is the same technology found on the Bitcoin network that separates a transaction's signature from its underlying data. SegWit was introduced to the Litecoin network in 2017. The main purpose of SegWit in Litecoin is the same as in Bitcoin - to improve network throughput, increase security, and address scalability issues.

How it works on the Litecoin network:

- Separating the signature from the data

SegWit changes the structure of transactions so that the transaction signature is moved outside the main data block of the transaction. This reduces the size of each transaction and increases the number of transactions that can be placed in the block.

- Increased network capacity

By reducing the size of transactions, SegWit increases the capacity of the Litecoin network. This allows more transactions to be processed per unit of time, which reduces latency and transaction fees.

- Lightning Network support

SegWit also paves the way for the implementation of a scalable secondary Lightning Network on the Litecoin network. Lightning Network provides the ability to conduct instant and low-cost transactions outside of the blockchain, further increasing network capacity and functionality.

All in all, Segregated Witness on the Litecoin network represents the same concept as the Bitcoin network and brings similar benefits in improving network throughput, scalability and security.

Lightning Network In Litecoin

Lightning Network’s support on the Litecoin network is the implementation of a secondary scalable network that enables instant and low-cost transactions outside of the main blockchain. Here are the main aspects of Lightning Network’s support on the Litecoin network:

- Instant transactions

The Lightning Network allows Litecoin network participants to conduct transactions instantly, with virtually no latency. This is achieved because transactions take place off the blockchain and do not require confirmation on the blockchain itself.

- Low fees

Using the Lightning Network allows for lower transaction fees on the Litecoin network. Because transactions do not need to be processed on the blockchain at every step, fees for using the Lightning Network are typically much lower than for regular transactions.

- Speed and Efficiency

The Lightning Network increases the throughput of the Litecoin network because a large number of transactions can be conducted secondary within the Lightning Network without having to write each transaction to the main blockchain.

- Routing Network

The Lightning Network uses a routing mechanism to route transactions through network nodes. This allows network participants to send payments to each other even if they do not have a direct link, making the network more flexible and scalable.

- Ecosystem development

Support for the Lightning Network on the Litecoin network encourages the development of applications and services that utilize the technology. This may include various mobile wallets, exchanges, payment systems and other infrastructure solutions that facilitate the use of instant transactions.

Lightning Network support for Litecoin represents an important step towards improving the scalability, efficiency and functionality of the blockchain, making Litecoin more attractive for everyday use and the development of decentralized financial services.

Litecoin Project Team

Charles Lee, a former engineer at Google and Coinbase, became a key figure in the cryptocurrency world when he introduced Litecoin in October 2011. In his paper, he emphasized the importance of open source and decentralization as the main principles of the Litecoin project. These principles inspired Lee to create a cryptocurrency that could offer an alternative to Bitcoin while maintaining public accessibility and transparency.

Litecoin Foundation is an organization created in 2017 to support and develop the Litecoin cryptocurrency. Its tasks include Litecoin promotion, financial support for developers, ensuring network security, cooperation with partners and educational activities. It is the spiritual center of the project, seeking to unite and inspire the community to new achievements in the world of cryptocurrencies.

Bitcoin vs Litecoin Comparison

While Litecoin and Bitcoin share many similarities, there are key differences between them:

- Hashing Algorithm

Litecoin uses the Scrypt algorithm to validate transactions, while Bitcoin uses the SHA-256 algorithm. Scrypt requires more RAM, which makes Litecoin mining less costly.

- Blockchain speed

Due to the peculiarities of the Scrypt algorithm, block confirmation in the Litecoin network is much faster, on average every 2.5 minutes, while in Bitcoin this process takes about 10 minutes.

- Maximum number of coins

Litecoin issuance is limited to 84 million LTC, which is in contrast to Bitcoin, which provides for a maximum of 21 million BTC coins.

- Atomic transactions

Litecoin was one of the first to introduce atomic token exchange technology between different blockchains, which allows you to safely and quickly convert LTC to other cryptocurrencies directly on the blockchain.

- Wallet addresses

Litecoin wallet addresses are 33 characters long and begin with the letter L or the number 3, while Bitcoin addresses range from 27 to 34 characters long and begin with 1 or 3.

Litecoin's Economic Model

- Token distribution mechanisms

Litecoin started its journey without an ICO or prior token distribution. Its tokens were created as a result of blockchain mining, which facilitated decentralized and even distribution to miners and users.

- Economic stimulation models

Mining: Litecoin's mining mechanism is based on the Proof-of-Work (PoW) algorithm, which incentivizes miners to validate transactions and secure the network. Miners are rewarded in the form of new Litecoin tokens for creating new blocks.

Block Rewards: Rewards for creating a new block on the Litecoin network also include transaction fees, providing motivation for miners to continue their work even after all tokens have been mined.

Inflation: Inflation on the Litecoin network is also a result of new tokens being mined. As with most cryptocurrencies, Litecoin inflation gradually decreases over time, which helps create a deflationary effect and maintains the value of the tokens.

So, Litecoin's economic model is based on decentralized mining, where tokens are distributed through a block creation process. Miners are remunerated for validating transactions and securing the network, as well as transaction fees. Litecoin inflation is driven by the mechanism of mining new tokens, which gradually declines over time, creating a deflationary effect and maintaining the value of the tokens.

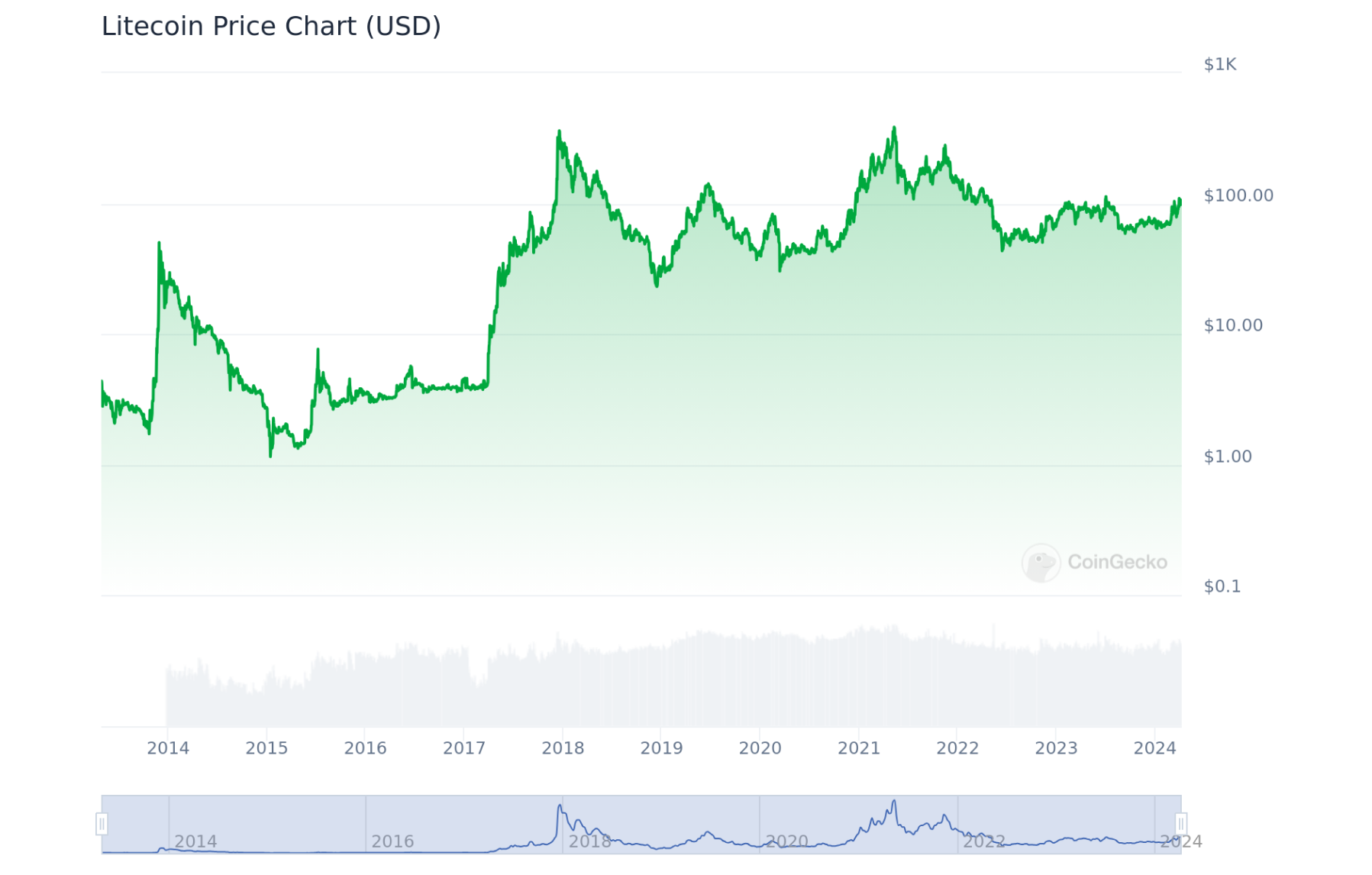

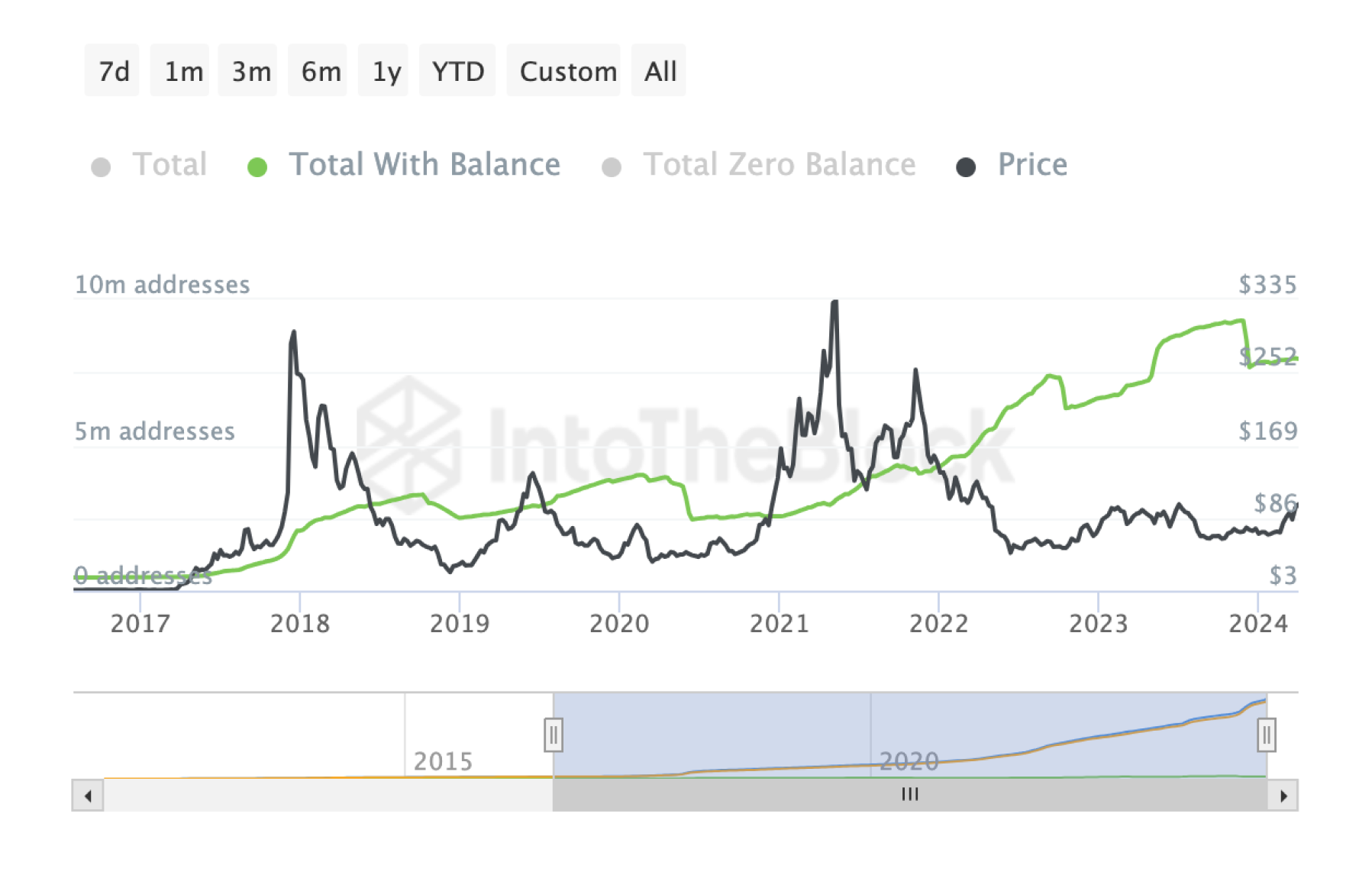

Analyzing Litecoin Online Activity

The growing number of addresses with LTC balance indicates the ever-increasing interest in this cryptocurrency and the expansion of Litecoin's user base.

The said increased interest may indicate the growing popularity and acceptance of Litecoin among users.

Litecoin Transactions Volume

The steady increase in the volume of transactions on the Litecoin network indicates an ever-growing interest in this cryptocurrency from users, investors and trading platforms.

This increase in transaction volume may indicate the growing activity in the Litecoin network and its increasing use in various fields.

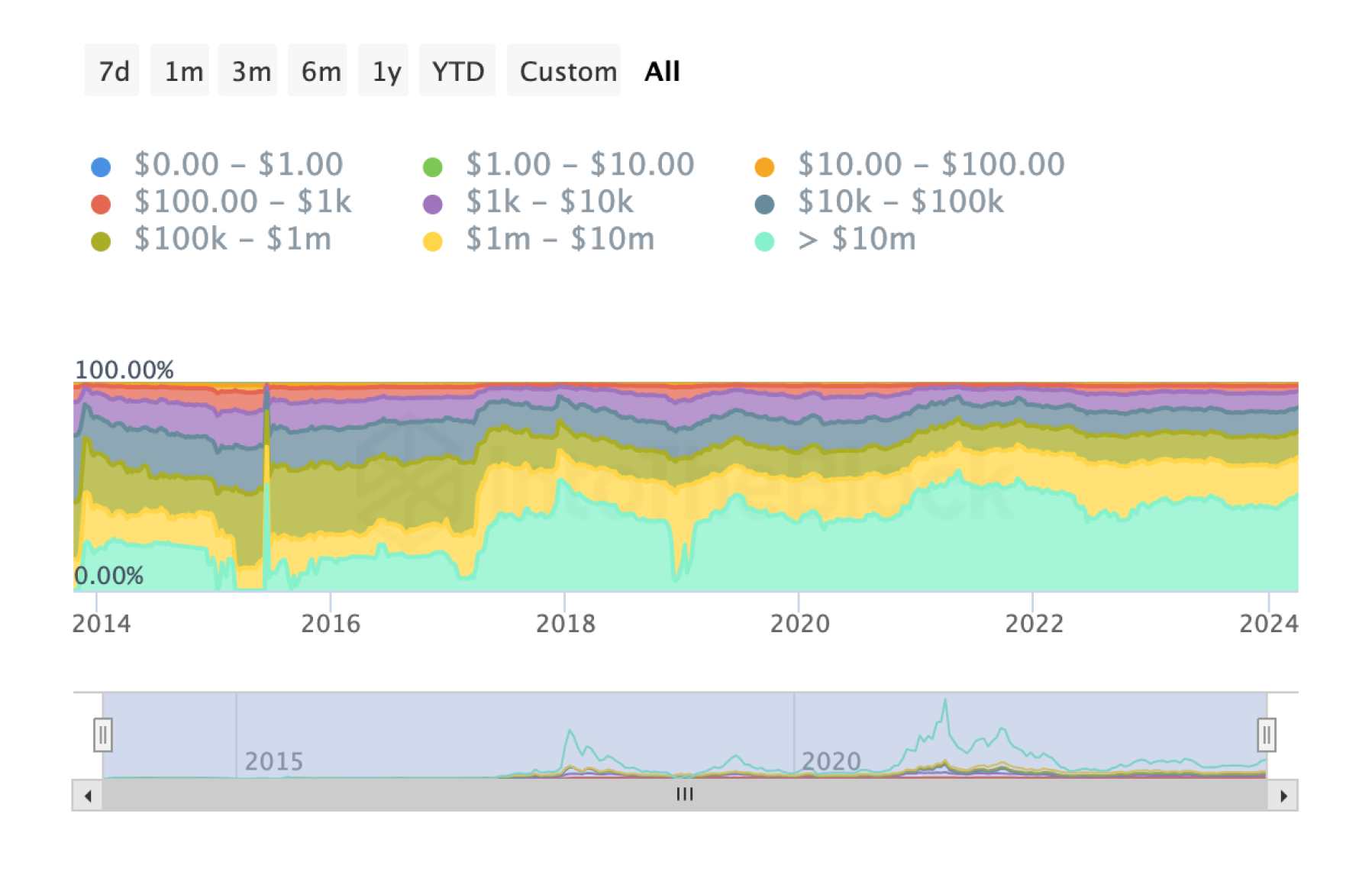

Litecoin Balance By Holdings in USD

The stable level of balances on this Litecoin chart indicates that LTC holders prefer to hold their assets on a long-term basis.

This may indicate confidence in Litecoin as a long-term asset and investment instrument.

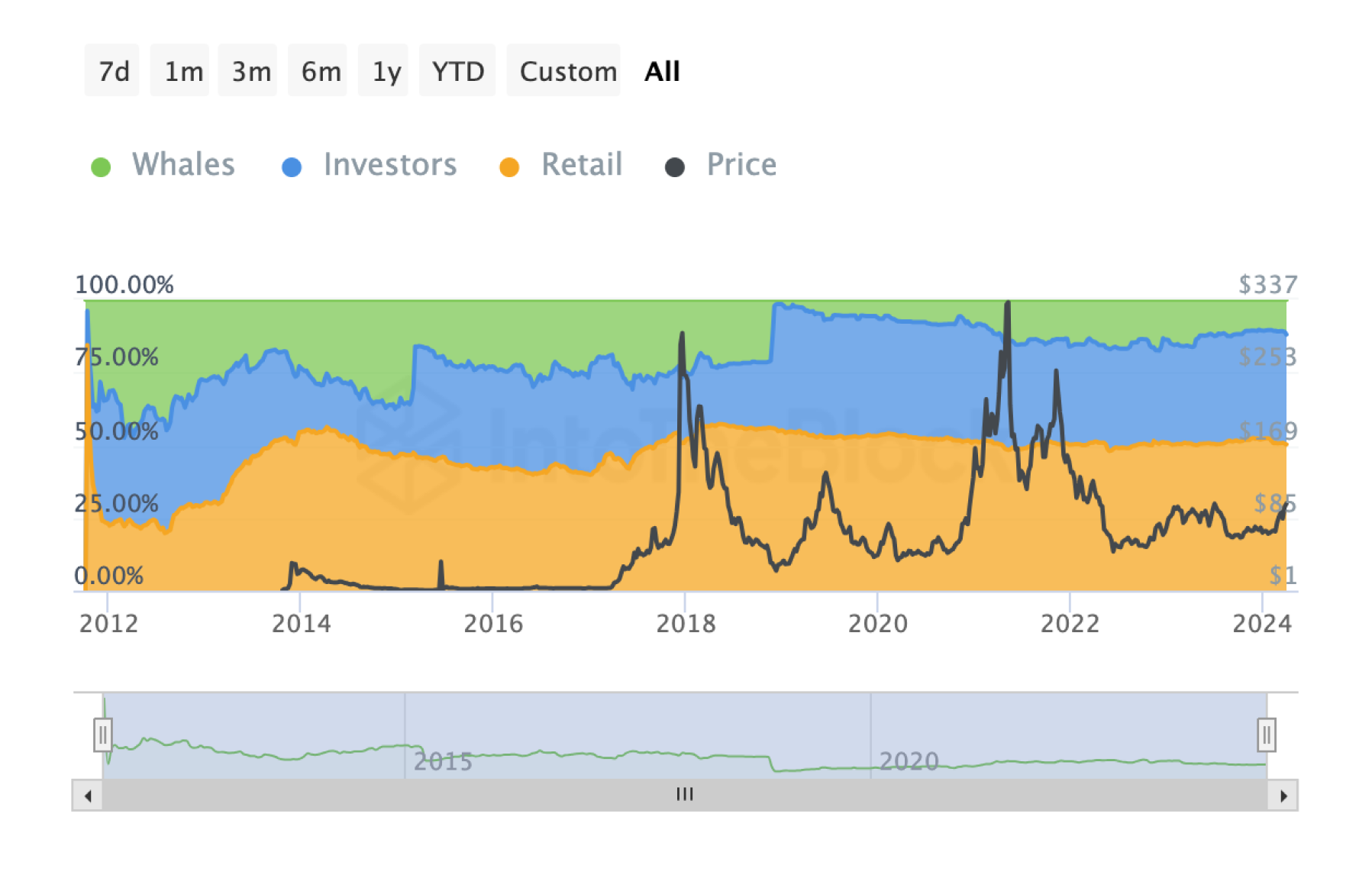

Litecoin Historical Concentration

The distribution of Litecoin cryptocurrency among market participants is broad and a substantial share of LTC is in the hands of retail investors.

This indicates the decentralization of asset ownership and participation of a wide audience in Litecoin, which may contribute to the sustainability and security of the network.

De facto, greater participation of retail investors may help raise awareness and popularize Litecoin among a wider audience, thus contributing to the growth and development of the project.

The analysis of the above metrics indicates a growing interest in Litecoin as a payment system and investment asset, as well as increased activity in its network and participation of various categories of users.

Litecoin Mining Analysis

Hash Rate

The growth of the Litecoin network hash rate indicates an increase in the total computing power used to secure the network and conduct transactions.

This is a positive signal that indicates a growing interest in Litecoin mining and an increase in network security.

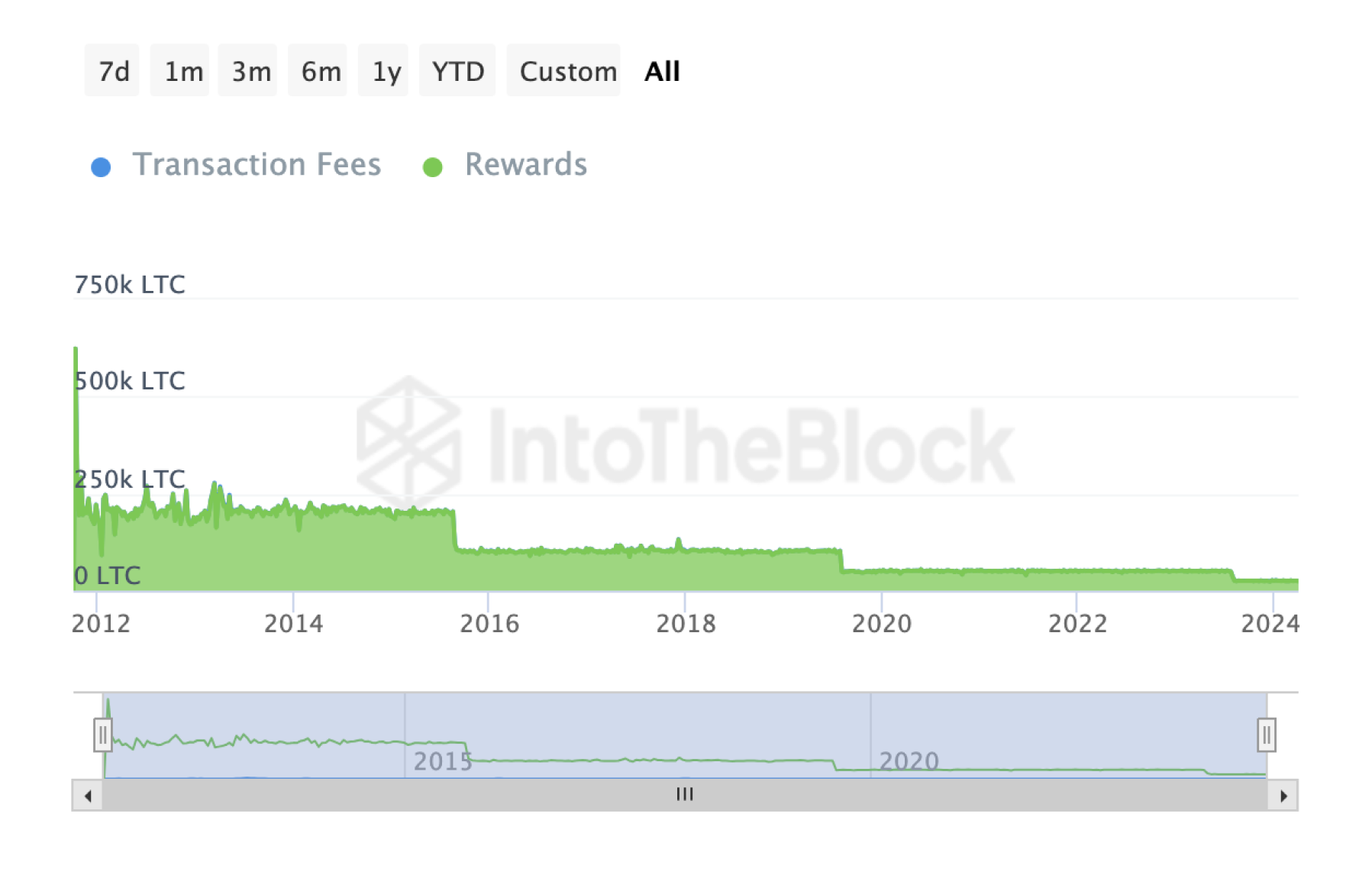

Miner Rewards

The miners' reward for each block in the Litecoin network is decreasing due to the halving process. Litecoin halving occurs approximately every four years and leads to a halving of the reward. This is aimed at controlling inflation and keeping the Litecoin price stable.

Reducing the reward can affect the profitability of miners as they have to mine more blocks for the same level of reward. However, it could also drive the price of LTC up in the long run, as a reduced supply of new coins could increase their price in the market.

Litecoin Community Analysis

Search Trends

Search queries related to Litecoin show stability and increasing interest in this cryptocurrency as its value rises.

This indicates an increased demand and activity in searching for information about Litecoin.

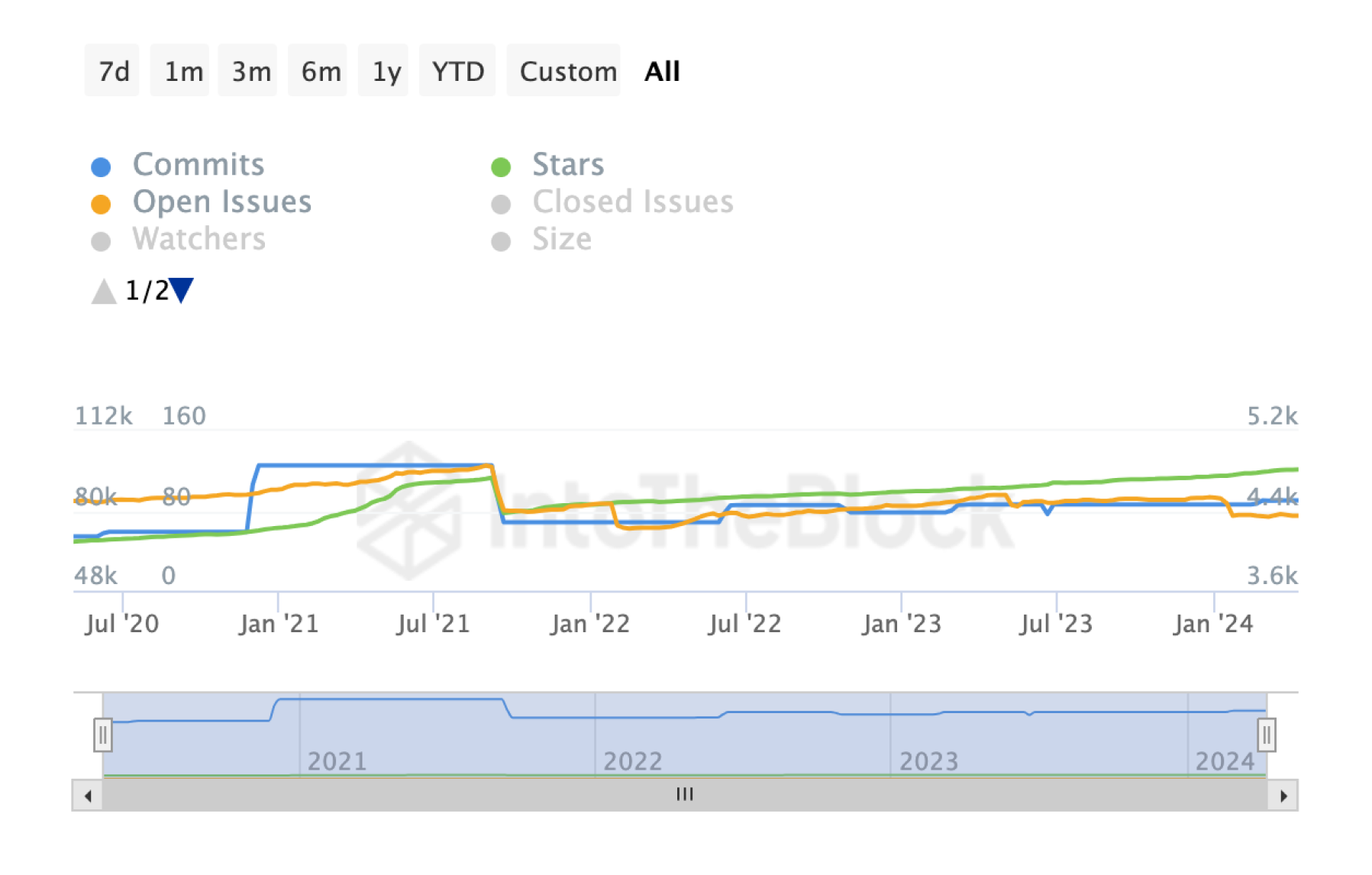

Github

Litecoin developer activity metrics on GitHub indicate lively activity within the project on this platform.

This indicates an ongoing process of developing and implementing changes to Litecoin code.

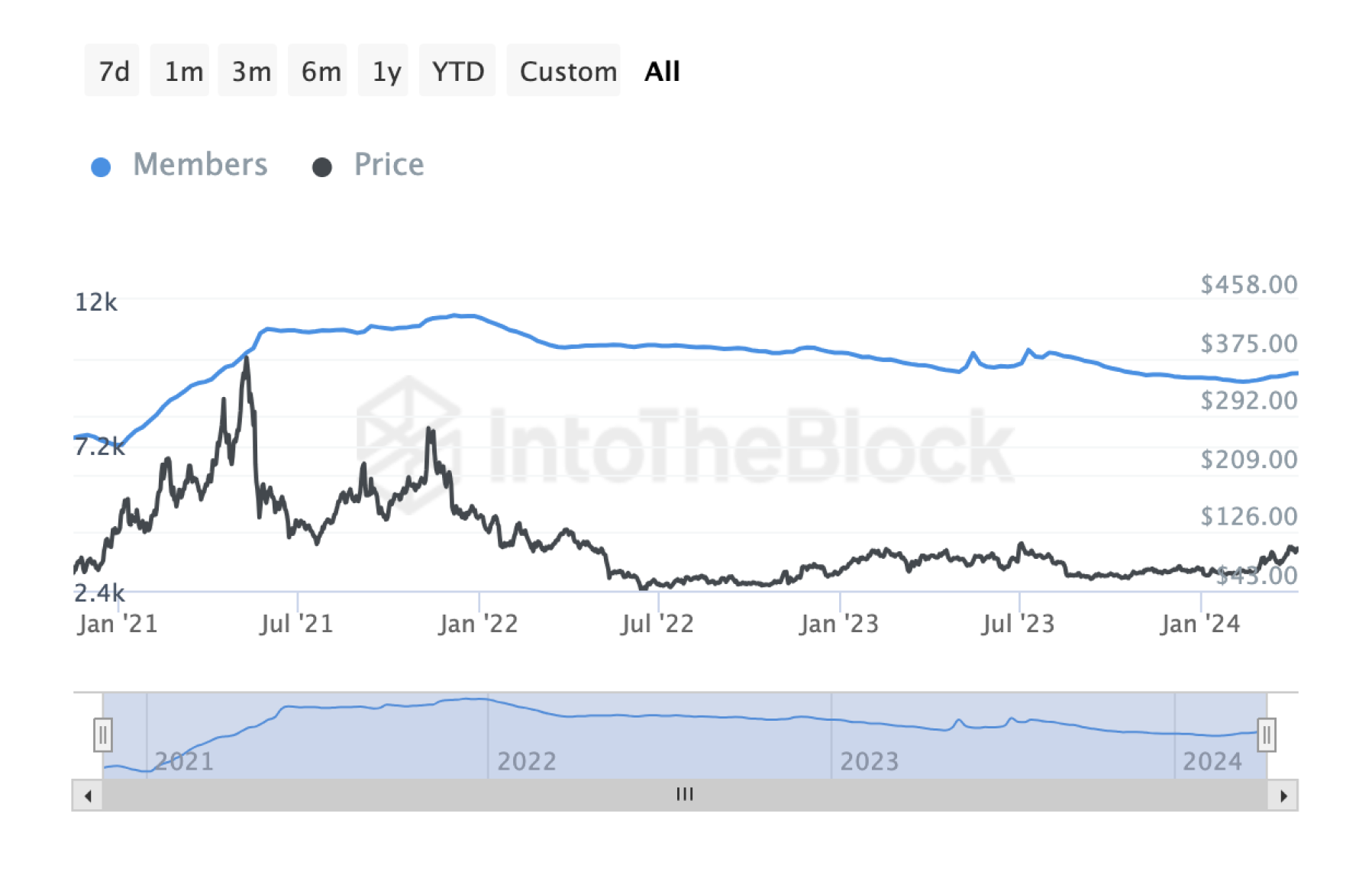

Telegram Members

The number of subscribers in the Litecoin Telegram channel is relatively stable and continues to increase as the value of LTC increases.

This indicates continued or growing community interest in the cryptocurrency and possibly an increase in the number of participants in the Litecoin community.

Overall, analyzing these metrics indicates a vibrant activity and interest in Litecoin from various groups including users, developers, and community members.

Summary

While talking about Litecoin’s key trends and dynamics, then initially there is a steady and even growing interest in Litecoin, which is reflected in the steady increase in the number of addresses with LTC balances. This indicates the attractiveness and sustainability of this asset in the eyes of users and investors.

The second important observation is related to the volume of transactions. The stable growth of this indicator indicates a constant increase in activity in the Litecoin network and its importance as a payment instrument.

The next aspect concerns the long-term strategies of the participants. The stable level of balances indicates that many LTC holders prefer to keep their investments on a long-term basis, which shows confidence in Litecoin's potential as a long-term asset.

When considering the distribution of the Litecoin cryptocurrency, the decentralized nature of asset ownership can be noted, which contributes to the resilience and security of the network.

In the context of mining, the growth in hash rate and miner activity indicates an increased interest in Litecoin mining, despite the changes in rewards caused by the halving process.

Finally, community analysis shows a steady increase in interest in Litecoin, reflected in search queries, activity on GitHub, and an increase in Telegram followers.

Litecoin continues to attract attention as an investment and payment instrument, maintaining the trust of its community and showing steady trends in its development.

Users can exchange all cryptocurrencies mentioned in this article for fiat or crypto on SimpleSwap.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.