Litecoin Crash Explained: Why Is Litecoin Down Right Now?

This blog post will cover:

- Introduction

- Litecoin in 2025

- Why Is Litecoin Down: The 3-Layer Drop Reason Framework

- Litecoin ETFs Approval

- LTC Price Perspectives: What Might Happen After the Crash

- Common Myth: Litecoin Is Dead After Every Crash

- Meaning for Different Types of Crypto Users

- Swapping In and Out of Litecoin on SimpleSwap

- Round-Up

- FAQ

Introduction

Over the past few weeks, Litecoin (LTC) has traded in a rough band around $60 to $90, depending on the day and the exchange, with a drawdown in the ballpark of 20% to 40% from a recent local high. Price trackers like CoinGecko or CoinMarketCap can show slightly different prints, yet the story looks similar: a fast slide, sharp bounces, then more choppy trading.

If you’re asking “why is Litecoin down,” you’re not alone. A Litecoin price drop often feels abrupt, especially for a coin that’s been around for years and has a reputation for being “boring” compared with newer tokens.

This guide breaks the Litecoin crash into clear parts. You’ll get the short-term triggers that can hit the entire market, the mechanical stuff that makes drops accelerate, plus Litecoin-specific cycle factors that show up again and again. The goal is not a prediction, but a plain explanation.

Disclaimer: This is educational content, not financial advice. Crypto markets are volatile and speculative. Always do your own research (DYOR), consider risk tolerance and time horizon, and never invest money that you can’t afford to lose.

Litecoin in 2025

Litecoin has been around long enough that it’s easy to assume it “shouldn’t” crash anymore. Yet mature coins can still move hard, mainly since they sit inside the same global risk engine as the rest of crypto.

Litecoin Overview

A quick Litecoin overview: Litecoin is one of the earliest Bitcoin-derived networks, launched in 2011, designed for payments and transfers. It uses Proof-of-Work, and it aims for quicker block times than Bitcoin, which can make confirmations feel faster in everyday use.

LTC is widely listed, widely held, and frequently used as a practical transfer coin. It’s mature, yet LTC price can swing sharply even if the Litecoin network is running normally.

It helps to separate terms. A “crash” usually means a rapid, scary drawdown. A “correction” can be milder. Intraday Litecoin volatility is one thing, as a multi-week slide hits sentiment much harder.

Litecoin’s Current Market Position

Looking at Litecoin price today across major trackers, LTC often sits well below its prior cycle peaks. Its all-time high was around $410 in 2021, so trading at $60 to $90 puts it under one-quarter of that peak (give or take).

Litecoin market cap rank has drifted over the years. It’s commonly outside the top 10 now, yet still in the upper tier of widely traded assets. Daily LTC trading volume can jump sharply during stress, since long-time holders, short-term traders, and automated strategies all show up at once. Litecoin price history is cyclical, and 2025 has not been an exception.

Litecoin’s Role as “Digital Silver”

Litecoin’s long-running “digital silver” label comes from its origin story: a Bitcoin fork that kept the core idea of sound, scarce money, with tweaks aimed at faster everyday use. The simple pitch still lands for many users: Litecoin payments can be quick, fees are often low, and the chain has a long operating record. Crypto investors appreciate that.

That utility shapes expectations in a strange way. A payments coin sounds “practical,” so newcomers expect calmer price action. Markets do not work like that. A coin can have steady usage and still get dragged into boom-and-bust cycles driven by trading, headlines, and shifts in risk appetite.

Put differently, LTC transaction speed and low fees may support real use cases, yet price discovery still happens in a speculative arena.

Why Is Litecoin Down: The 3-Layer Drop Reason Framework

Most “why is Litecoin down” explanations focus on a single trigger. Real drawdowns tend to stack causes. Think of it as three layers: the macro layer (everything sells off), the market plumbing layer (moves get amplified), and the Litecoin-native cycle layer (LTC’s own incentives and narratives).

Layer 1: Macro & Market-Wide Risk-Off Triggers

Litecoin often falls during a broader crypto market crash. That’s correlation in practice: when Bitcoin drops hard, many large-cap altcoins follow, even with no specific bad LTC news. In risk-off windows, traders cut exposure across the board, and correlations across crypto can tighten fast.

Macro pressure can add fuel. Rate expectations, sudden moves in the dollar, or equity weakness can push speculators to de-risk. Even political and trade-policy shocks can matter. For example, tariff headlines tied to Donald Trump have, at times, tightened global risk appetite in many markets, and crypto can get pulled into that wave.

Layer 2: Market Microstructure: Liquidity, Leverage, and Large Flows

Some crashes are less about “news” and more about mechanics. Crypto liquidity is not uniform. There are pockets where order books are thin, and price can gap lower if a few big market orders hit at once.

Leverage makes it sharper. In plain terms, a Litecoin liquidation cascade happens when traders borrow to take positions, price drops, and forced sells kick in. Those forced sells push price lower, which triggers more liquidations. It’s a chain reaction.

Add whale selling or large fund rebalancing, and you can get a volatility spike that feels disconnected from fundamentals, at least in the moment.

Layer 3: Litecoin Cycle Drivers: Halving Aftershocks & Miner Economics

Litecoin has its own recurring cycle dynamics, and they can deepen a drawdown after the market’s mood turns. The Litecoin halving impact is a good example. Halvings cut the block reward, and that event often pulls attention months in advance. Traders position for the “halving narrative,” media coverage ramps up, and price can lift on expectation alone.

After the event, the story can fade. Profit-taking shows up, late buyers get nervous, and the market looks for the next catalyst. A post-event pullback is not guaranteed, yet it’s common across assets with heavily anticipated “scheduled” events.

Miner economics matter too. Litecoin mining profitability depends on price, network difficulty, and energy costs. If LTC price falls for an extended stretch, some miners may sell more of their coins to cover expenses, which can add miner selling pressure. Other miners may shut off machines, and the network adjusts over time. None of this “breaks” Litecoin cryptocurrency, yet it can influence supply behavior during an LTC cycle downturn.

Litecoin ETFs Approval

An ETF is a fund that trades on a traditional exchange and tracks an asset’s price. A spot crypto ETF, where permitted, holds the underlying digital asset rather than futures contracts. News about a Litecoin ETF or LTC ETF approval can shift sentiment, since investors start to imagine new access points and different sources of demand.

Source: Polymarket

The catch is that ETF developments do not move markets in one direction every time. If major spot crypto ETF headlines center on larger-cap names like XRP, SOL, or DOGE, capital can rotate in unexpected ways. Sometimes it lifts the whole market via improved sentiment, and sometimes it pulls attention away from LTC. The second-order effects often show up as volatility, not a clean trend.

LTC Price Perspectives: What Might Happen After the Crash

After a sharp Litecoin price drop, it’s tempting to look for a single “next move.” Markets rarely cooperate.

Three Post-Crash Paths: Bounce, Base, or Deeper Capitulation

Post-crash price action often falls into three buckets.

A bounce is the classic snap-back rally after heavy selling. You’ll often see fast green candles, rising spot volume, and a drop in panic language on social feeds. Bounces can be tradable for short-term participants, yet they can fade quickly if the broader market is still weak.

A base (consolidation) shows up when volatility cools and price starts carving a range. Signs include volatility compression, fewer violent wick moves, and a slow shift toward higher lows. This path can feel boring, which is exactly why many people miss it.

Deeper capitulation is the harsher route: another leg down with a sudden volume spike, forced selling, and a sense that “everyone gave up.” It can happen if macro conditions worsen or if leverage rebuilds and then unwinds again.

What to Watch Next

Day-to-day candles can distract. A short checklist often gives a clearer read on LTC risk conditions.

BTC trend and Bitcoin correlation, since Litecoin often follows market leaders during stress.

Macro calendar items like central bank meetings, inflation prints, major policy headlines.

Funding and leverage conditions, since crowded positioning can unwind fast.

ETF headlines and regulatory signals.

Miner context: hash rate shifts, profitability pressure, and broader Proof-of-Work sentiment.

None of these items “guarantee” a direction. They simply help explain why the tape feels calm one week and chaotic the next.

Common Myth: Litecoin Is Dead After Every Crash

“Litecoin is dead” is one of crypto’s most durable storylines, and it tends to resurface right after a big red week. The pattern is familiar: LTC sells off, social posts declare the end, then the market moves on to the next narrative.

History shows repeated heavy drawdowns followed by periods of recovery or stabilization. After the 2017 peak, Litecoin fell dramatically in the following year. Later cycles saw similar pain around 2019 and again after the 2021 surge cooled off. Each time, LTC remained widely traded, and it kept a place in exchange listings and wallet support.

Utility is not the same as price strength, yet it matters. Litecoin continues to see transaction activity, and it remains integrated across payment tools, on-ramps, and crypto infrastructure that favors older, well-supported assets. That doesn’t remove risk. It simply makes “dead” an inaccurate label for a network that still functions and still gets used.

Meaning for Different Types of Crypto Users

Not everyone experiences an LTC market crash the same way. The time horizon changes everything, and so does your reason for holding or using Litecoin.

Long-Term Holders and Believers

People who hold Litecoin long term tend to view drawdowns through multi-year cycles. They often compare current weakness with prior periods where LTC dropped hard, then later recovered or stabilized. That context can reduce emotional decision-making, even if it doesn’t make the drop feel good.

Common non-prescriptive approaches include periodic reviews of the original thesis, position sizing limits, and diversification across coins rather than relying on a single one. Some people think in terms of dollar-cost averaging, though any buying plan still carries risk and needs personal fit. For long-horizon holders, the key question is whether the LTC conviction case still matches reality.

Active Traders and Short-Term Participants

For short-term participants, Litecoin volatility is the main event. Crashes create large ranges, fast reversals, and frequent fake-outs. That can attract traders who try to trade Litecoin volatility through quick entries and exits.

The same conditions raise risk. Thin liquidity pockets and leverage can amplify both gains and losses, and liquidations can move price faster than expected. High-level risk management practices often start with defining timeframes, setting clear invalidation points, and avoiding excessive leverage. Traders who survive tend to respect that “high opportunity” days are often “high damage” days too.

Miners, Builders and Payment Users

Litecoin miners feel crashes through profitability. Lower price can squeeze margins, prompt hashrate adjustments, and shift how much mined LTC gets sold versus held. Over time, network difficulty reacts, yet the transition period can be uncomfortable for marginal operators.

Builders and businesses using Litecoin payments see a different picture. Lower prices can reduce transaction costs in fiat terms, which may encourage experimentation, even if treasury holdings look worse on paper. For everyday users, the Litecoin network can remain usable during drawdowns, since market price and network uptime are separate things.

Swapping In and Out of Litecoin on SimpleSwap

Some readers want the theory, and some readers want the practical path: “How does a swap usually work on a crypto exchange interface?” This section shows the basic flow a typical user encounters on the SimpleSwap exchange platform, sticking to the assumption of them not needing any advanced extra tools.

Volatility often pushes people to rebalance, diversify, or convert LTC to another crypto that better fits their current risk comfort. SimpleSwap is one of the ways users can swap Litecoin by choosing an LTC pair, entering a receiving address, and confirming the exchange amount.

LTC is available for purchase or exchange on SimpleSwap, just as nearly 1,500 other cryptocurrencies. The process is fairly straightforward:

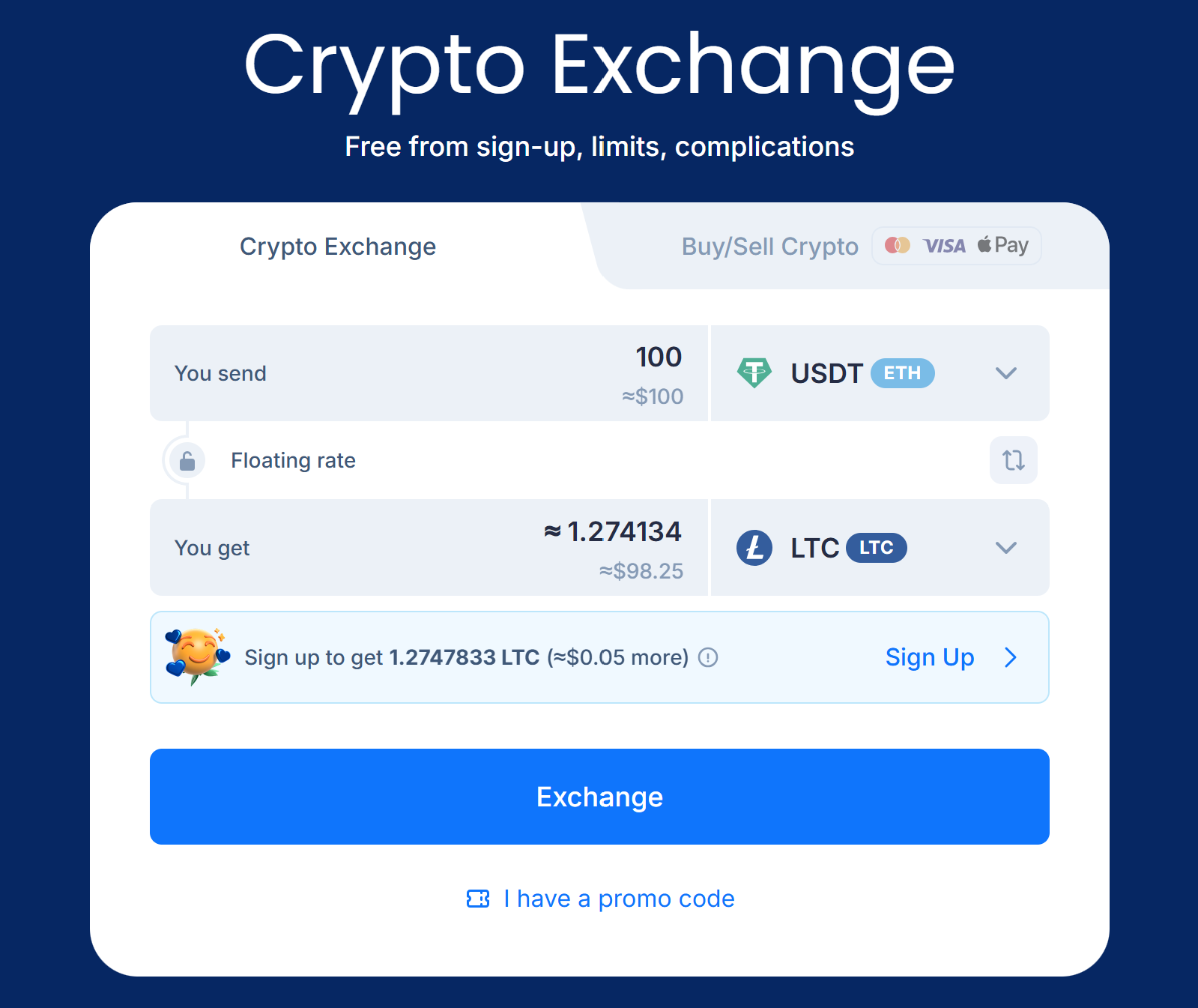

1. Open SimpleSwap and choose Crypto Exchange.

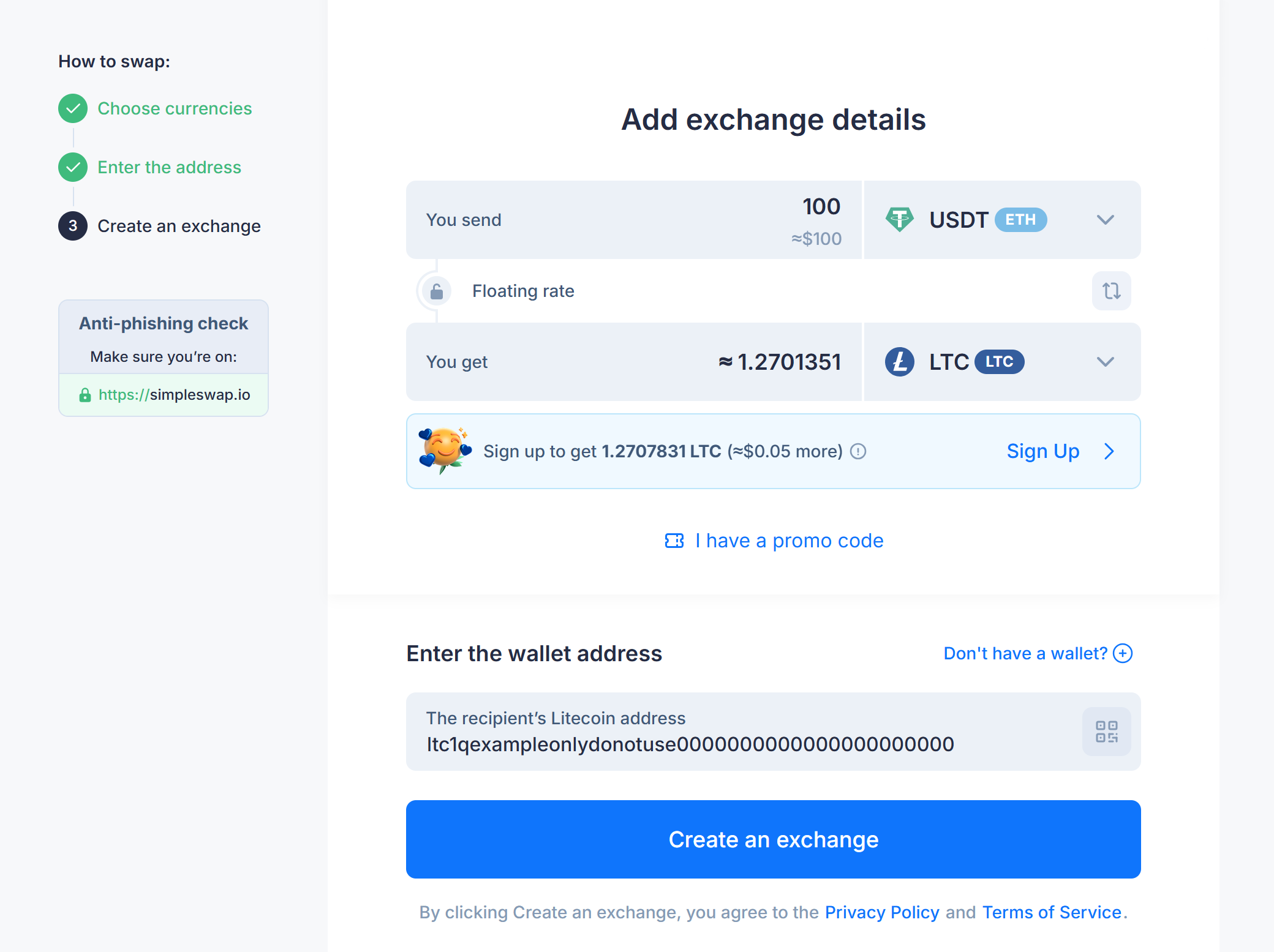

2. In You Send, pick your coin (for example, USDT). In You Get, select LTC, or any other coin of your choosing.

*The LTC wallet address on the picture is provided for example purposes only, it is not a real address.

3. Click Exchange, paste your receiving address (so funds land where you’ll use them).

4. Confirm the rate and send your deposit.

5. Receive LTC (typically within minutes), no registration required.

Users can also buy cryptocurrencies on SimpleSwap with fiat using debit or credit cards.

Be vigilant! A cautious mindset applies to everyday swaps: verify ticker, verify chain, verify the receiving address.

Two small habits reduce errors:

Match the blockchain network on the sending side to the one shown in the swap instructions. Sending the right coin on the wrong chain is one of the most common causes of stuck swaps.

If it is the first time using a new token, consider a small test transfer. That might feel cautious, yet it is a standard self-custody habit.

It’s still worth treating every conversion as a real market decision, with fees, spreads, and price movement all playing a role.

Round-Up

A Litecoin crash rarely has one clean cause. Most of the time, Litecoin is down for a blended set of forces: macro risk-off moves, correlation with Bitcoin, liquidity gaps, leverage unwinds, and large flows that hit thin order books.

Layered on top, Litecoin’s own cycle drivers can matter, including halving-related narrative timing and miner economics that influence selling behavior during prolonged downturns.

That mix explains why LTC can fall sharply even with no obvious “Litecoin disaster” headline. It also explains why the same coins can look stable for months, then suddenly trade like a roller coaster for a few weeks. LTC volatility is not a bug of the network. It’s a feature of how markets price risk.

The recurring “Litecoin is dead” talk tends to confuse price pain with network relevance. Litecoin has survived multiple cycles, remained widely traded, and kept real payment-style utility for users who value fast transfers and often-lower fees.

None of that removes uncertainty, and no framework can eliminate risk. Clear goals, realistic expectations, and disciplined risk limits tend to matter more than perfect timing during a crypto market downturn.

FAQ

Why is Litecoin Down?

A Litecoin price drop usually comes from stacked drivers: market-wide risk-off selling, strong bitcoin correlation, and mechanical factors like liquidity gaps plus leverage liquidations. Litecoin-specific cycle dynamics can contribute too, such as post-halving narrative fade and miner profitability pressure that changes selling behavior. In many crashes, several factors hit in the same window, which is why moves can feel sudden and outsized.

Can LTC Avoid a Breakdown?

A “breakdown” often means price falls through a well-watched support zone and fails to reclaim it quickly. Conditions that can reduce breakdown risk include broader market stabilization in Bitcoin, calmer macro headlines, and less stressed leverage indicators like funding rates and liquidation activity. Healthier spot volume and fewer sharp intraday wicks can hint that selling pressure is easing, not that risk vanished.

Is Litecoin a Good Investment?

Litecoin can fit some portfolios, yet it carries real risk, and price swings are part of the package. Over the past year, LTC has ranged roughly from $63 to $141, so drawdowns can arrive fast. Many people weigh Litecoin’s long history, liquidity, and payments use case against competition, regulation shifts, and its tendency to move with broader crypto cycles. Common guardrails include small sizing, diversification, and a written plan for rough markets.

How High Can Litecoin’s Price Go?

No one can responsibly pin a maximum price on LTC. Litecoin’s upside range depends on scenarios: a strong crypto bull cycle, renewed demand for payments-focused coins, favorable regulation, and improved market access via products like spot ETFs where permitted. Timelines are uncertain, and catalysts can arrive in unpredictable order. Treat any exact target as speculation rather than a dependable forecast.

What will Happen with LTC after the Crash?

After a crash, LTC often follows one of three paths: a quick bounce, a longer base (consolidation), or deeper capitulation. A bounce tends to show fast rebounds and rising volume. A base shows tighter ranges and volatility compression with gradual higher lows. Capitulation shows another sharp leg down with heavy volume and forced selling. The broader crypto market trend often shapes which path dominates.

Does Litecoin use Proof-of-Work?

Yes, Litecoin uses Proof-of-Work (PoW), like Bitcoin, though it uses the Scrypt mining algorithm. PoW matters since miners secure the network by spending energy and competing to add blocks. It also ties market price to miner economics: if price drops far, some miners may reduce activity or sell more coins to cover costs. Over time, difficulty adjusts as network conditions change.

Will Litecoin survive?

Litecoin has a long operating history, broad exchange and wallet support, and ongoing use for transfers and payments, which supports the case for long-term survival. It has already lived through multiple large drawdowns and “altcoin obituary” phases. Still, survival is never guaranteed in crypto. Competition, regulation, and market structure shifts can change demand, liquidity, and developer attention over time.