The Challenges of Crypto Adoption in LATAM

This blog post will cover:

- Crypto Landscape in LATAM

- Challenges of Crypto in LATAM

- What is the role of governments and regulators in promoting crypto adoption?

- Opportunities and Solutions for Crypto in LATAM

- How can cryptocurrency help people in underdeveloped countries access financial services?

- Conclusion

Сryptocurrency has been experiencing notable growth in Latin America (LATAM) in recent years. According to multiple reports and expert assessments, LATAM holds the second position globally in terms of cryptocurrency adoption, with Africa being the only region surpassing it.

This article seeks to offer a comprehensive examination of the present status of cryptocurrency in LATAM, discussing the challenges it encounters and exploring the opportunities it brings. Additionally, it will present some case studies of both successful and unsuccessful crypto projects in the region, addressing inquiries for individuals looking to delve further into the topic.

Crypto Landscape in LATAM

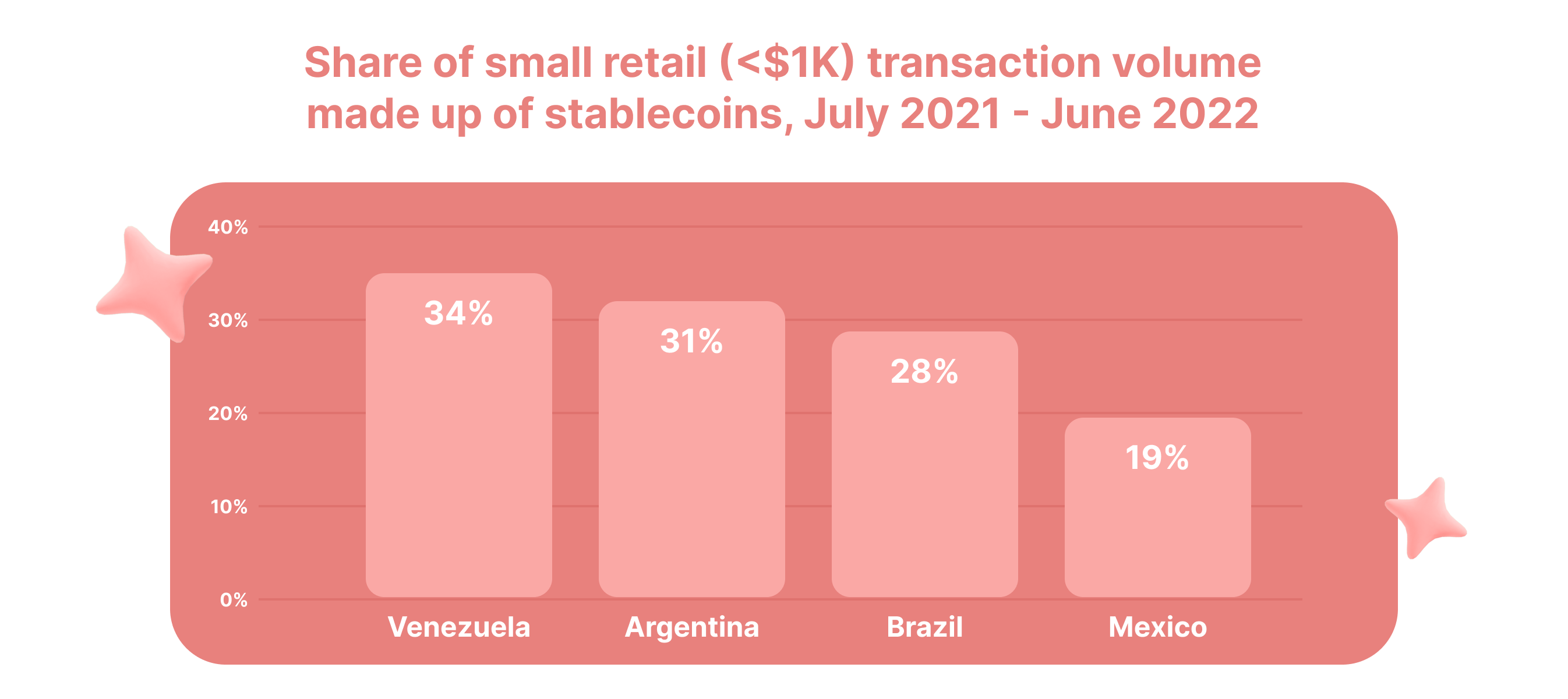

The current landscape of cryptocurrency in LATAM is dynamic and swiftly changing. There has been remarkable growth in cryptocurrency adoption, with citizens of Latin American countries receiving $562.0 billion in crypto from July 2021 to June 2022, marking a 40% increase from the previous year. This surge is primarily fueled by factors such as remittances, cross-border trade, savings, and speculative activities. Notable countries leading in crypto adoption include Venezuela, Colombia, Argentina, Brazil, and Mexico.

Several noteworthy crypto projects in the region exemplify this trend, including Bitso, the second Mexican unicorn; Ripio, based in Argentina; and Mercado Bitcoin in Brazil. Bitso operates as a crypto exchange and wallet platform across Mexico, Argentina, and Brazil, boasting over 2.5 million users. Ripio, another crypto exchange and wallet platform, serves more than 1 million users spanning Argentina, Brazil, Mexico, Uruguay, and Spain. Mercado Bitcoin, as the largest crypto exchange in Brazil, has garnered over 2.8 million customers and facilitated a traded volume exceeding $5 billion.

Challenges of Crypto in LATAM

Despite its observable growth, the cryptocurrency landscape in LATAM encounters several challenges. Regulatory hurdles stand out prominently, with only Mexico having established clear regulations governing cryptocurrencies as of 2021. Mexico's Fintech Law, enacted in 2018, provides a legal framework for crypto platforms to operate under the supervision of the central bank and financial authorities. However, in other countries in the region, crypto has either been banned, restricted, or overlooked, resulting in legal risks and regulatory uncertainty.

Technical challenges, such as a lack of education about blockchain technology and inadequate infrastructure, contribute to a trust deficit. Many individuals in LATAM remain unfamiliar with how crypto operates, how to use it securely, and the benefits it can offer. Moreover, the region grapples with low internet penetration, poor connectivity, and frequent power outages, all of which impede the adoption and functioning of crypto platforms.

Security threats, volatility, and scalability issues present additional challenges. Crypto platforms in LATAM have been targeted by hackers, scammers, and cybercriminals, leading to financial losses and data breaches. The prices of cryptocurrencies are also subject to significant fluctuations, potentially discouraging prospective users and investors. Furthermore, existing crypto networks like Bitcoin and Ethereum face limitations in capacity and speed, resulting in delays and high fees.

Socio-economic challenges, encompassing concerns of accessibility and education, along with cultural factors, further complicate the landscape. Despite the high demand for crypto, many individuals in LATAM encounter barriers to access, such as a lack of bank accounts, identification documents, or digital literacy. Additionally, there is a need for increased education and awareness campaigns to inform the public about the benefits and risks of crypto and dispel myths and misconceptions. Cultural factors, including a preference for cash, distrust of institutions, and resistance to change, also impact the adoption and perception of crypto.

What is the role of governments and regulators in promoting crypto adoption?

Governments and regulators play a pivotal role in advancing the adoption of cryptocurrencies. Some of their responsibilities include:

- Providing Regulatory Clarity: governments can offer clear and consistent regulations for cryptocurrencies, mitigating legal risks and regulatory uncertainty. For example, the UK government has outlined plans to regulate crypto asset activities, instilling confidence and clarity for consumers and businesses.

- Protecting Consumers and Investors: governments are tasked with safeguarding consumers and investors from potential risks associated with cryptocurrencies. This involves implementing rules on crypto-asset promotions to ensure fairness, clarity, and transparency, enhancing data-reporting requirements, and introducing new regulations to prevent market manipulation.

- Promoting Innovation: governments can foster innovation in the crypto space by embracing technological change and innovation, creating an environment conducive to crypto innovation and adoption.

- Ensuring Financial Stability and Inclusion: governments must preserve financial stability by mitigating risks related to illegal digital assets and ensuring the operational resilience of firms. Additionally, they can promote financial inclusion by facilitating access to crypto technologies, thereby democratizing finance.

- Coordinating Domestic Departments: governments should focus on coordinating among domestic departments to address cross-sector risks and develop guidelines and best practice frameworks for proportionate regulation within the ecosystem. By addressing these areas, governments and regulators can contribute to fostering a secure and resilient environment for the growth and adoption of cryptocurrencies.

By addressing these areas, governments and regulators can contribute to fostering a secure and resilient environment for the growth and adoption of cryptocurrencies.

Opportunities and Solutions for Crypto in LATAM

Despite the challenges, the cryptocurrency landscape in LATAM presents numerous opportunities. Innovation and collaboration in the crypto space are thriving, with various initiatives and projects addressing regional needs. These include stablecoins, decentralized applications, peer-to-peer platforms, and blockchain-based solutions. For instance, Dai (DAI), a stablecoin tied to the US dollar, is widely used in Argentina and Venezuela to hedge against inflation and currency devaluation.

Decentraland, a virtual reality platform powered by Ethereum, attracts users and developers from LATAM, creating and exploring digital worlds. LocalBitcoins, a peer-to-peer platform connecting Bitcoin buyers and sellers, facilitates millions of transactions in LATAM, especially in Venezuela and Colombia. RSK, a smart contract platform compatible with Bitcoin, enables the development of blockchain-based solutions for social impact, such as financial inclusion, identity, and governance.

Standardization and regulation of crypto present potential solutions to current challenges. A harmonized regulatory framework could offer legal certainty, consumer protection, and market stability for the crypto sector, fostering innovation, investment, competition, and cross-border cooperation. Steps have been taken in this direction, including the establishment of the Ibero-American Blockchain Alliance, a network promoting blockchain development and adoption in the region.

Moreover, the adoption and inclusion of crypto have the potential to drive economic growth and financial inclusion. Cryptocurrencies offer an alternative and more efficient means of transferring value, reducing costs, and increasing transaction speed. They also provide access to financial services like savings, credit, and insurance for the unbanked and underbanked populations, constituting approximately 50% of adults in LATAM. Additionally, crypto empowers individuals and communities, granting more control over finances and facilitating participation in the global economy.

How can cryptocurrency help people in underdeveloped countries access financial services?

Cryptocurrency can play a pivotal role in enabling individuals in underdeveloped countries to access financial services through various means:

- Accessibility: Cryptocurrencies are accessible to anyone with an internet connection, proving especially advantageous for individuals in remote areas or countries with limited financial infrastructure.

- Cost Reduction: Traditional banking and money transfer services often incur fees and charges. Cryptocurrencies have the potential to minimize these costs, making transactions and money transfers more affordable.

- Cross-Border Transactions: Cryptocurrencies allow for seamless cross-border transactions without the need for currency exchange or intermediaries, making them well-suited for remittances.

- Alternative Financial Services: Cryptocurrency and blockchain technology offer alternative financial services, such as peer-to-peer lending, with fewer requirements than traditional financial institutions. This can broaden access to financial services for the underbanked population, contributing to poverty reduction and enhanced economic opportunities.

By granting access to digital financial services, individuals can gain knowledge about financial management and investing in a secure and accessible manner. Educating people about these technologies can promote greater financial independence and empowerment. Cryptocurrency holds significant potential in advancing financial inclusion and providing banking services access to the unbanked population.

Conclusion

LATAM has embraced cryptocurrency as a viable alternative to traditional financial systems, influenced by factors like remittances, trade, savings, and speculation. Despite this acceptance, the crypto landscape in LATAM faces various challenges, encompassing regulatory, technical, security, and socio-economic issues. To overcome these challenges and promote a sustainable and inclusive crypto ecosystem, increased dialogue and collaboration are necessary among stakeholders, including governments, regulators, crypto platforms, civil society, and users. The establishment of a clear and supportive regulatory framework, improvements in technical infrastructure, enhanced security measures, educational initiatives, and respect for cultural diversity are crucial steps. By addressing these aspects, LATAM can harness the opportunities presented by crypto and position itself as a global crypto hub. Achieving this requires governments to find a balance between regulation and innovation to ensure the secure and beneficial use of cryptocurrencies in the region.

SimpleSwap reminds you that this article is provided for informational purposes only and does not provide investment advice. All purchases and cryptocurrency investments are your own responsibility.