Crypto Tax Compliance in the USA

This blog post will cover:

- How does the IRS handle crypto asset taxation?

- The scheme of taxation

- Filing your taxes

- Do cryptocurrencies incur capital gains tax?

No one looks forward to paying taxes. Nevertheless, if you are one of over 50 million Americans that currently hold cryptocurrencies, you mustknow how crypto taxation works.

After all, the U.S. Internal Revenue Service has been working day and night to catch up with the crypto sector in recent years as far as taxation and compliance are concerned – and that trend won’t end anytime soon as wider mainstream adoption beckons.

We’ve already touched upon the crypto taxes in various countries, but today we will discuss in detail on how the taxation system works in America.

How does the IRS handle crypto asset taxation?

Cryptocurrencies are categorized as digital assets in the U.S.A., and as such, the IRS handles it as it would conventional capital assets like stocks and bonds.

Thus, any earnings you realize from cryptocurrency are treated as income or capital gains, mostly based on how you obtained your funds and how long you’ve been holding. However, the same treatment makes cryptos hard to use as a medium of exchange to buy products and services.

As such, the failure or omission of accurately monitoring and reporting crypto transactions can hit you with a monumental tax bill or an excruciating regime of fines and penalties.

That said, crypto investors must understand the legal and tax obligations associated with their crypto assets. Whether you invest in popular cryptocurrencies, trade meme coins, or NFTs, it's crucial to know how taxes apply to your tokens.

The scheme of taxation

The act of buying crypto alone is not taxable — and neither are their price swings (e.g. increase or reduction in value) while they sit in your digital wallet. You will only be liable for taxes upon disposing, selling, investing the underlying digital asset for profit and a couple of other situations described below.

Under the existing regime of the U.S., crypto assets are subject to taxation in the form of 1) capital gains and 2) income tax.

The tax on your crypto varies according to the way it’s used. If your transactions fall under taxable events, you'll be subject to taxation. On the other hand, non-taxable events are free from taxes. We’ll observe both terms below.

Taxable events

Crypto incomes are taxed as usual income, determined by the market value of the token at the time the taxpayer receives it as compensation. The IRS identifies several common types of taxable crypto income, including:

- Getting paid in crypto as compensation or in exchange for goods and services;

- earnings on mining cryptocurrencies;

- claiming staking rewards on crypto;

- obtaining crypto caused by hard fork;

- getting an airdrop;

- receiving incentives or rewards related to crypto (e.g. crypto earned on referrals to centralized exchanges, free crypto giveaways, marketing gimmicks, etc.)

Non-taxable events

Here’s is a list of non-taxable crypto transactions that fall out of scope for taxation:

- Purchasing crypto, taking custody/ownership of it, and holding it;

- donations to eligible non-profit organizations or tax-exempt charities;

- receiving crypto as a gift from other parties;

- giving crypto as a gift to another party up to a threshold of $15,000 per recipient per year – any gifts given as crypto exceeding this amount requires a gift tax return;

- transferring crypto between wallets, exchange accounts, or custody services that you own.

Filing your taxes

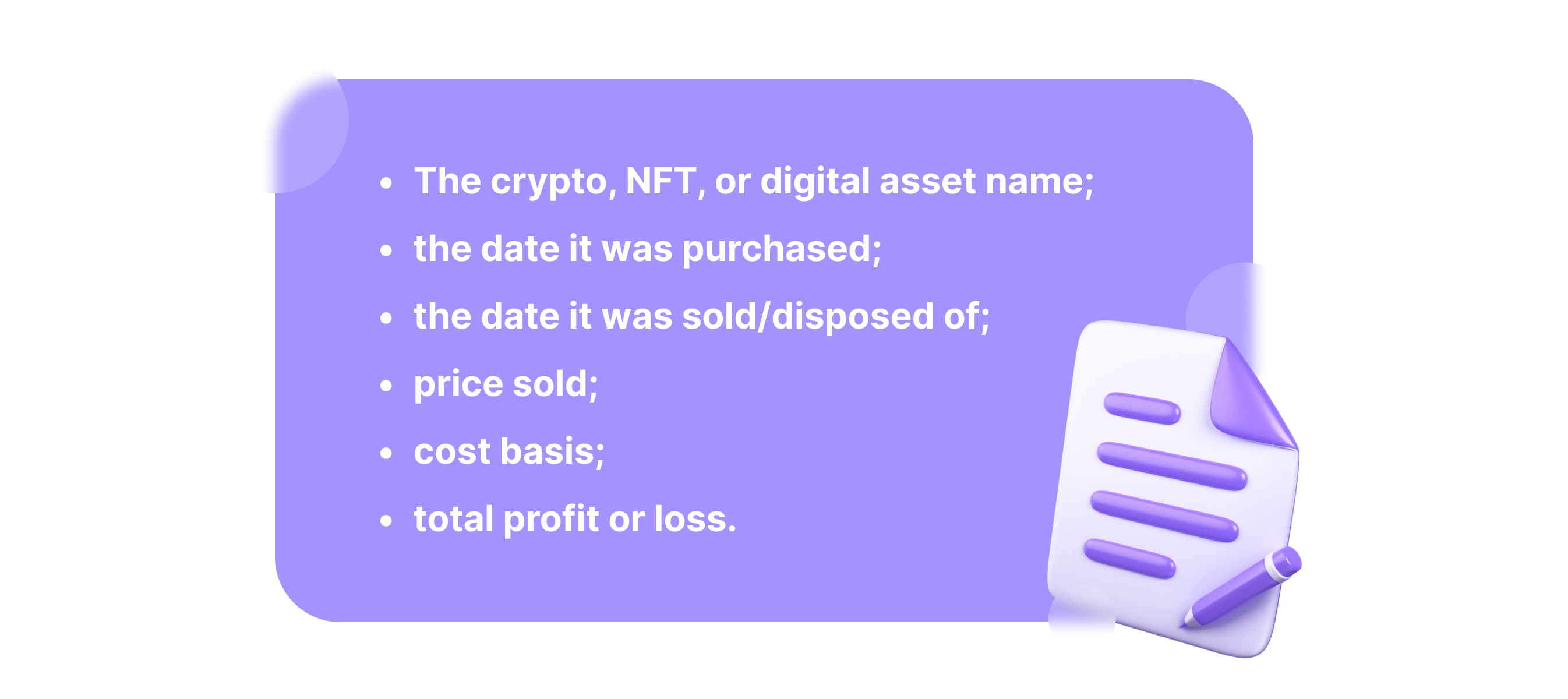

You have to report both profits and losses made with crypto. This is done via the IRS Form 8949. Here’s the info you need to fill out:

Do this for all taxable crypto events within the year the form pertains to, and voila! You’re all set and compliant, reducing your risks of getting audited or raising any red flags from the IRS.

If all this sounds intimidating, a crypto tax calculator can make the process simpler and more accurate. A good crypto tax calculator can help you:

- Accurately calculate taxes. Automatically calculate your capital gains and income from various crypto transactions, ensuring you pay exactly what you owe.

- Save time. Import your transactions from multiple exchanges and wallets in minutes, instead of manually tracking each one.

- Stay compliant. Keep up-to-date with the latest tax regulations and guidelines from authorities.

Koinly is an example of such a service. This crypto tax calculator is popular among crypto users because it integrates with thousands of crypto platforms, making it easy to import your transactions and work out your tax obligations. It can help you ensure your crypto taxes are accurate and compliant.

Do cryptocurrencies incur capital gains tax?

Ultimately, crypto is taxed like any other capital asset, whether it’s stocks, bonds, real estate, and others that fall under this classification. Each time you execute gains (or ring up some losses), you’re obliged to pay taxes commensurate with the amount of your profits. As we have mentioned earlier, the same taxes that apply to capital gains on stocks and bonds are equally applicable to crypto.

Correctly reporting your gains and losses, as well as paying the required capital gains taxes, are essential aspects of crypto investing. And yes, we get it – as every investor does, you’ll want to reduce your tax burden as much as possible.

That said, to conclude, let us share several tried-and-tested options to minimize your tax burden on your crypto asset investments:

- Hold high-potential investments for at least 1 year before selling or otherwise transacting with them. Capital gains taxes on long-term investments are significantly lower than those on short-term gains or swing trades.

- Harvest your tax losses. For instance, if your portfolio has an eclectic mix, you can sell them both so that you can write off your losses while maximizing your gains.

- Contemplate the idea of investing in a crypto IRA, which offers the benefit of tax deductions on your contributions and defers the tax liability until you decide to withdraw your funds.

In case you are a citizen of another country, you may get acquainted with the list of SimpleSwap’s articles concerning crypto regulation all over the world: South Korea, Brazil, UAE, Australia, Nigeria, Mexico, India, Russia, Germany, Israel, Turkey, Argentina, Indonesia, Netherlands, UK, Ireland, Spain, Vietnam, Canada, Finland and many more.

SimpleSwap reminds you that this article is provided for informational purposes only and does not provide investment advice. All purchases and cryptocurrency investments are your own responsibility.