Farming crvUSD on Convex: A Complete Guide

Key Insights

- Convex allows users to maximize their yield farming potential on Curve Finance by pooling veCRV, boosting rewards without the need for individual users to lock their CRV.

- crvUSD is a stablecoin used in Curve liquidity pools, providing an opportunity to earn CRV and CVX rewards through liquidity provision and staking on Convex.

- While crvUSD farming offers attractive returns, participants should be cautious of risks such as impermanent loss, the volatility of CRV and CVX tokens, and potential smart contract vulnerabilities in both Convex and Curve protocols.

Farming crvUSD via the Convex crypto platform is one of the popular strategies for earning yield on stablecoins and DeFi tokens.

The strategy focuses on using crvUSD in Curve liquidity pools to provide liquidity and earn rewards in the form of CRV and CVX tokens.

What is Convex Finance?

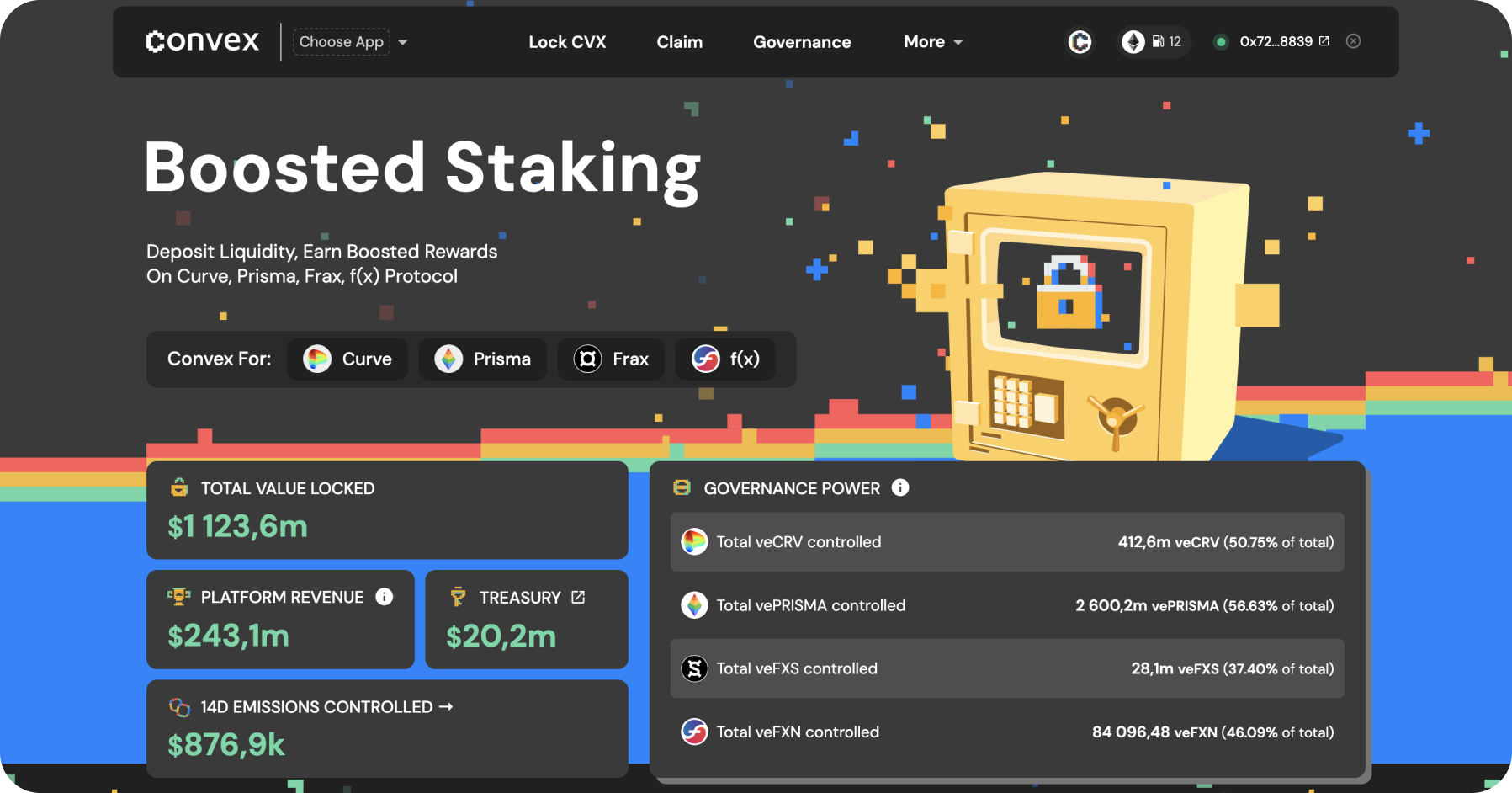

Convex Finance is a decentralized finance (DeFi) platform built on top of the Curve Finance protocol. Its primary purpose is to enhance the yield farming process for liquidity providers on Curve by offering higher rewards without requiring users to lock their own CRV tokens for veCRV.

Convex simplifies the process of staking Curve LP tokens, allowing liquidity providers to maximize their returns through the platform's automated reward aggregation and Boost feature.

By staking LP tokens on Convex, users can earn CRV (Curve’s governance token), CVX (Convex’s governance token), and veCRV-enhanced rewards without directly interacting with the Curve protocol.

Convex essentially pools the veCRV of all users, boosting rewards for everyone, without requiring individual users to lock up their CRV for long periods. The Convex Finance platform has gained significant traction due to its simplifieduser experience, high returns, and the ability to stake Curve LP tokens with little hassle.

Key Functions of Convex Finance

Convex Finance primarily functions as a yield optimizer for liquidity providers on Curve Finance crypto. Here’s how it works:

Boosted Rewards

Convex pools veCRV from its users, offering higher reward boosts for CRV without requiring each user to lock CRV individually.

Staking and Yield Aggregation

Users can stake their Curve LP tokens or CRV tokens directly on Convex and receive rewards in both CRV and CVX tokens.

Auto-compounding

Convex automatically compounds the earned rewards, allowing users to maximize their yield without needing to claim and reinvest manually.

Governance

The CVX token allows holders to participate in Convex platform governance decisions, including the direction of yield distributions and platform updates.

Convex's growth is tied directly to the success of Curve Finance crypto, as it leverages Curve’s liquidity pools to provide competitive yield farming opportunities. It has quickly become one of the most popular yield farming platforms in DeFi.

Step-by-Step Strategy for crvUSD Farming on Convex

1. Asset Exchange for Strategy Implementation

Before beginning the strategy, you need to acquire the required assets. Platforms like SimpleSwap can assist in exchanging assets like BTC, ETH, XRP, LTC, EOS, or XLM to the necessary stablecoins or tokens to participate in crvUSD farming.

2. Obtaining crvUSD

To start farming, you need to acquire crvUSD. This stablecoin is issued by the Curve protocol and can be obtained in two main ways:

Minting crvUSD through Curve Finance

If you hold collateral assets such as ETH or stETH, you can use them as collateral to mint crvUSD.

Buying crvUSD on an exchange

Use a platform like SimpleSwap to exchange stablecoins like USDC, USDT, or DAI for crvUSD.

3. Selecting a Liquidity Pool on Curve

Curve Finance crypto is the platform where crvUSD is used in liquidity pools. You need to choose a pool where you will provide liquidity to earn yield. Popular pools with crvUSD include:

crvUSD/USDC

crvUSD/DAI

crvUSD/stETH (ideal for users looking to engage with ETH-related assets)

By adding liquidity, you will earn interest from liquidity provision and receive additional CRV tokens as rewards.

Adding Liquidity to a Curve Pool

Once you’ve selected a pool, follow these steps to provide liquidity:

Go to Curve Finance.

Find the pool containing crvUSD, such as crvUSD/USDC.

Select the Deposit option.

Enter the amount of crvUSD and the corresponding token (e.g., USDC) to add to the pool.

Upon adding liquidity, you will receive LP tokens that represent your share of the liquidity pool.

5. Staking LP Tokens on Convex

After receiving your LP tokens from Curve, you can stake them on Convex to maximize your rewards:

Visit the Convex Finance platform.

Navigate to the section for staking Curve LP tokens.

Select the pool where you added liquidity (e.g., crvUSD/USDC).

Stake your LP tokens on Convex to earn additional rewards.

Benefits of Staking on Convex:

Bonus CRV rewards

Earn extra CRV tokens for participating in Curve liquidity pools.

CVX rewards

In addition to CRV, you will earn CVX tokens—Convex’s governance tokens.

Optimized yield

Convex allows you to maximize CRV and CVX rewards by automating the reward collection process.

6. Boost and veCRV for Yield Optimization

Convex provides a mechanism called Boost, which increases your rewards based on the amount of veCRV you hold.

However, Convex users can benefit from the Boost even without purchasing or locking CRV tokens themselves, as Convex pools veCRV from all users and shares the benefit across all participants.

If you want to further increase your yield, you can:

Stake CRV tokens and convert them into veCRV on Curve.

Purchase CVX tokens and participate in Convex governance to boost your earnings.

7. Monetizing Your Rewards: CRV and CVX

After staking your LP tokens, you will regularly receive rewards in the form of CRV and CVX tokens. There are several options for utilizing these rewards:

Selling CRV and CVX

You can sell CRV and CVX tokens on exchanges like SimpleSwap to obtain stablecoins such as USDC, DAI, or crvUSD.

Reinvesting rewards

Use the CRV and CVX tokens to buy more assets and increase your liquidity, thus boosting future rewards.

Locking CRV for veCRV

To further boost future earnings, you can lock your CRV tokens on Curve to obtain veCRV, increasing your rewardsand governance rights within the Curve ecosystem.

Risks of the crvUSD Farming

While farming crvUSD can be profitable, there are risks to consider:

Impermanent Loss

Providing liquidity in pools like crvUSD/USDC or crvUSD/DAI, especially in volatile markets, can expose liquidity providers to impermanent loss.

If the prices of the assets in the liquidity pool diverge significantly, the value of your deposit could decreasecompared to holding the assets individually. For crvUSD, this risk may be reduced because it's pegged as a stablecoin, but volatility in paired assets may still lead to losses.

Volatility of Rewards

Another risk is the fluctuation in the value of CRV and CVX tokens. These tokens' prices can swing significantly, affecting the profitability of your Convex farming strategy. It’s important to monitor market conditions, as sudden drops in the price of rewards tokens like CRV and CVX can negatively impact overall returns.

Smart Contract Risks

As with any DeFi protocol, there is a risk of smart contract vulnerabilities or hacks. Although Convex and Curve have undergone audits, these risks cannot be completely eliminated.

Summary

Farming crvUSD through Convex is an effective strategy for earning yield in DeFi.

By providing liquidity on Curve, staking LP tokens on Convex, and leveraging Boost or veCRV, users can maximizetheir CRV and CVX rewards.

However, users should also be aware of the risks, such as impermanent loss, token volatility, and smart contract vulnerabilities, before committing to this strategy.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.