Balanced Crypto Portfolio in the 2024 Crypto Market

Key Insights

- The current sentiment in the crypto market is characterized by uncertainty among participants regarding the growth prospects of cryptocurrencies.

- Portfolio diversification is backed by the consideration that there are many factors that can positively affect the market in the medium and long term, while also there are factors that negatively affect the sentiment of market participants.

- A diversified portfolio with coins ranging from Layer 1 projects like BTC or TON, to cutting edge AI projects.

In the face of crypto market uncertainty, it is important to apply portfolio management that will preserve the assets and in the long run can provide acceptable returns for the crypto portfolio.

In the current crypto market cycle, we believe the most rational solution is to bet on fundamentally strong assets that have intrinsic value, are backed by proven technology, and have long-term growth prospects.

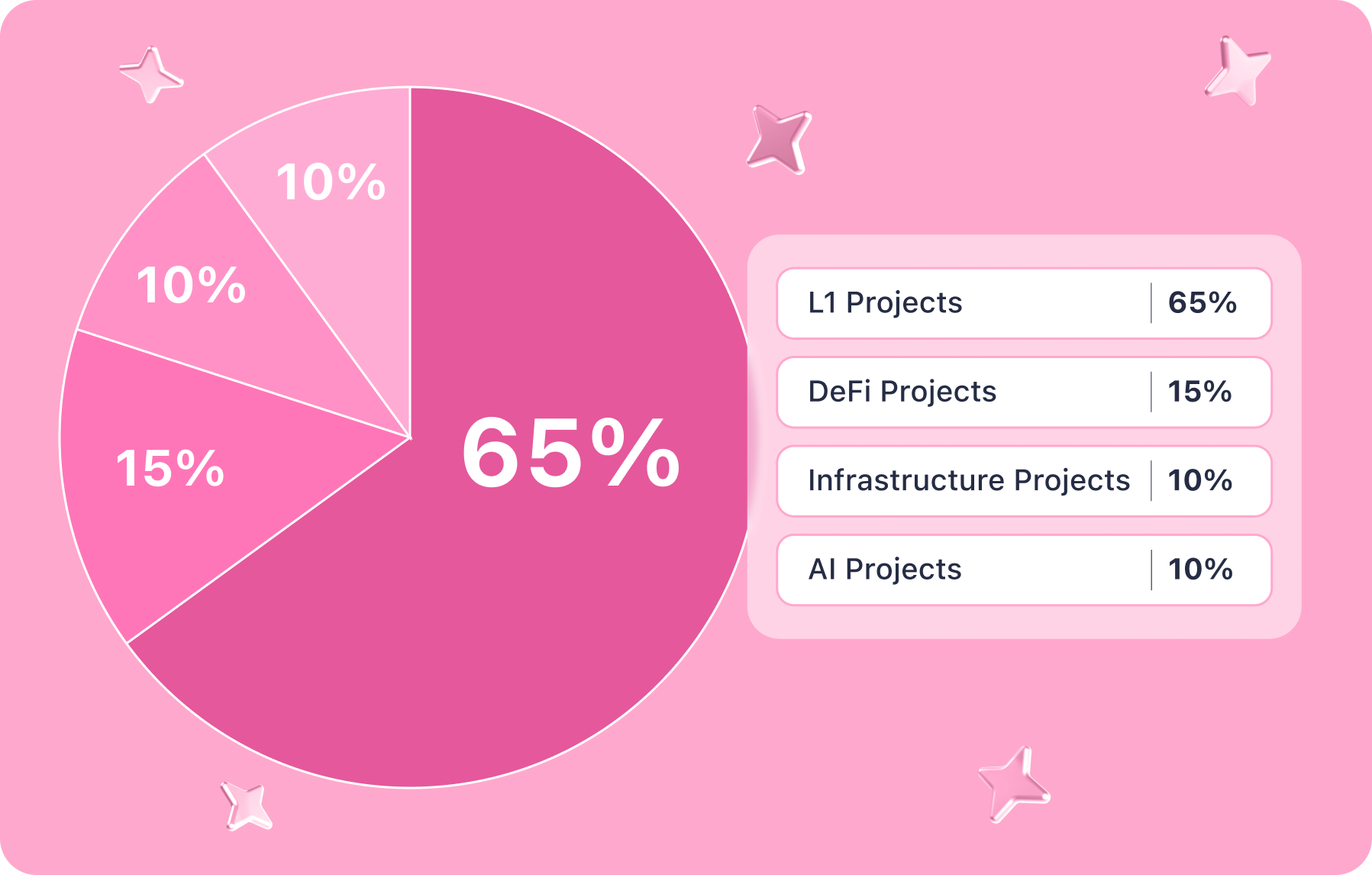

This crypto portfolio is organized into several project categories to provide diversification:

- L1 projects (65%)

- DeFi projects (15%)

- Infrastructure projects (10%)

- AI projects (10%)

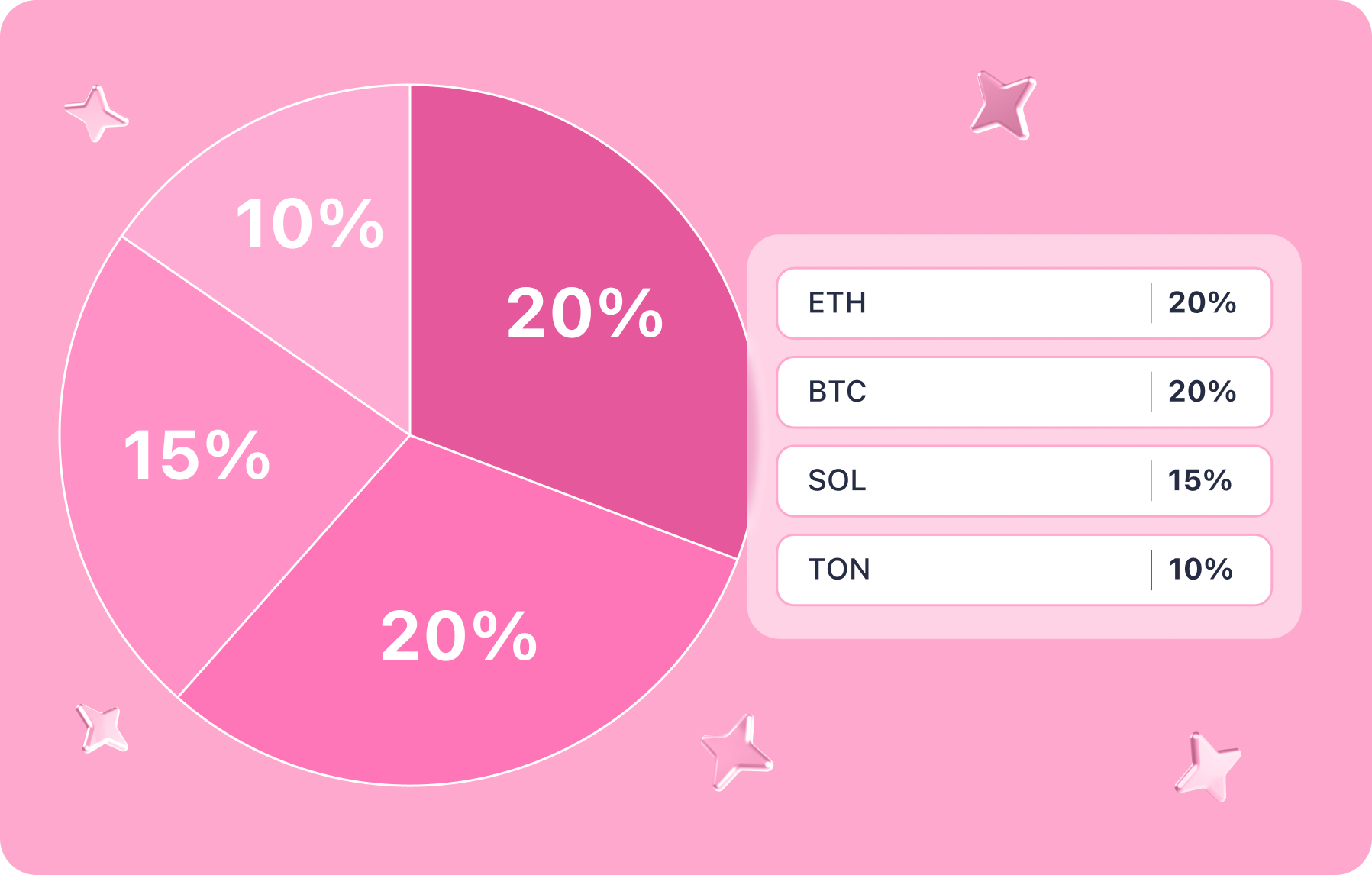

L1 Projects (65%)

- Ethereum (ETH) - 20%

Ethereum is a platform for creating smart contracts and decentralized applications that can be used to diversify portfolios. The transition to Proof of Stake (PoS) in Ethereum 2.0 is expected to enhance efficiency and scalability, which could facilitate the growth of the DeFi ecosystem.

Ethereum continues to be one of the leading L1 solutions and the largest DeFi hub. Adoption of spot ETFs is another important growth trigger for the asset, so it earned a top place of this crypto portfolio.

- Bitcoin (BTC) - 20%

Bitcoin is the benchmark of the entire crypto market and also has good upside potential in the medium to long term, given the continued interest in the asset from institutional investors.

Bitcoin is the first and best known cryptocurrency. It is a global standard of digital value and a symbol of resilience in the investment world. Bitcoin offers investors stability and reliability. As the first decentralized digital currency, Bitcoin provides a reliable store of value and liquidity benchmark.

- Solana (SOL) - 15%

Solana shows steady growth in 2024 and has significantly strengthened its position among L1 solutions, ranking second in terms of trading volume on decentralized exchanges (Ethereum ranks 1st).

Given the growing popularity of blockchain, Solana has excellent growth prospects. The possibility of spot ETF approval in the long term will also act as a growth trigger for SOL.

- Ton (TON) - 10%

Ton has become one of the discoveries in 2024 on the back of its successful partnership with Telegram, launching mini-apps in Telegram that integrates TON into its services. Ton has become one of the conduits for onboarding Web2 users into the crypto economy and services.

Taking into account the potential of cooperation with Telegram, Ton may become one of the most successful projects in the next 12 months, and it earned it a solid place in this diversified portfolio.

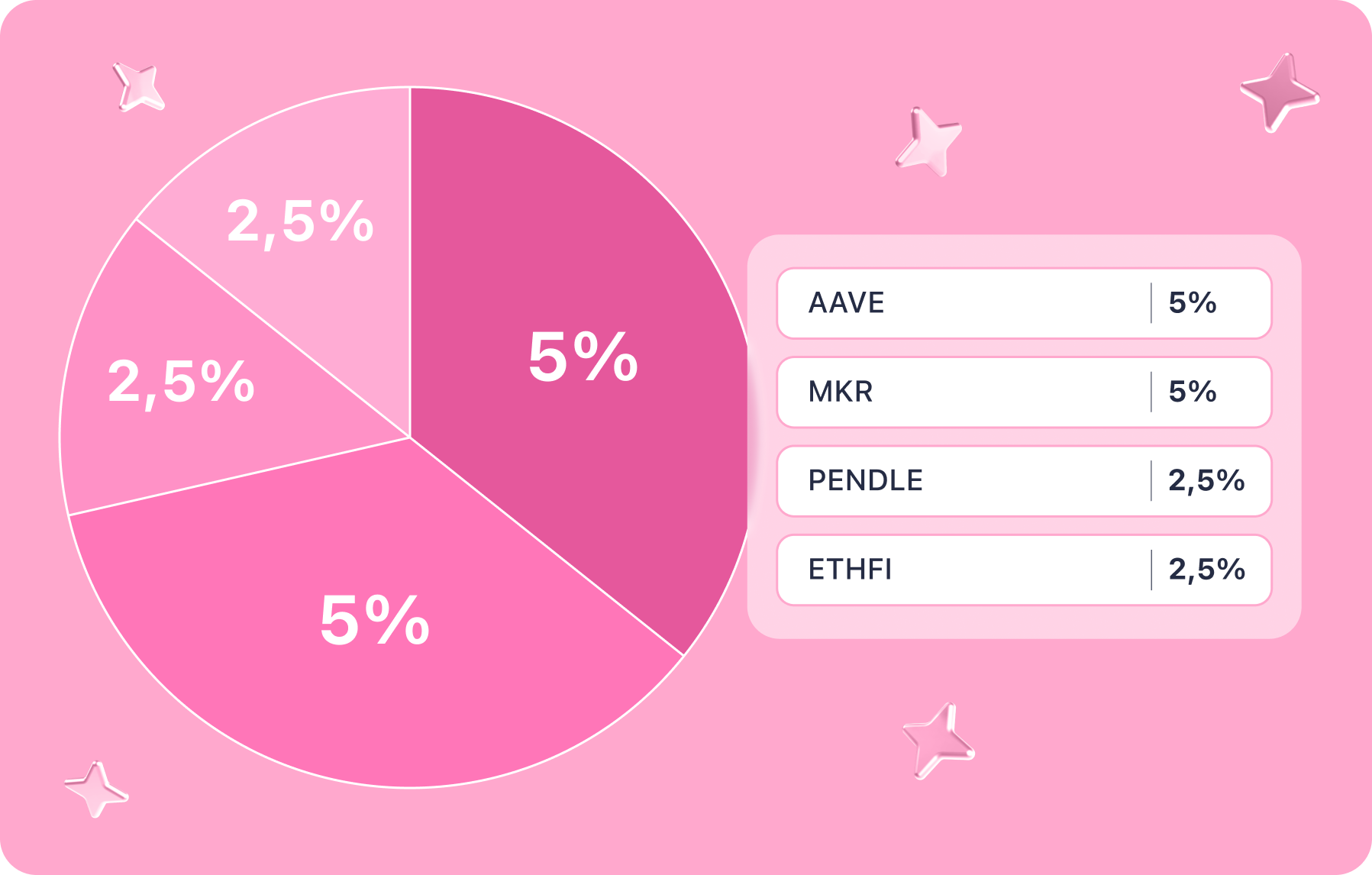

DeFi Projects (15%)

- AAVE (AAVE) - 5%

Largest lending protocol, second in value of blockchain assets (TVL), AAVE supports all major blockchains. Allows borrowing/provisioning of a wide range of assets and their use in other DeFi protocols.

As DeFi continues to evolve, AAVE will remain at the forefront of innovation by offering new financial options to users, and add to crypto portfolio diversification.

- Maker (MKR) - 5%

Maker is one of the leading DeFi protocols and demonstrates a clear product market fit. The Maker protocol is the 3rd largest blockchain protocol in terms of blocked assets (TVL) according to DefiLlama rankings. this makes it perfect to include MKR in the diversified crypto portfolio.

In addition, it generates high revenues (among the top 10 projects by earnings) and covers promising areas such as tokenization of assets and issuance of stablecoins.

- Pendle (PENDLE) - 2.5%

Pendle allows to develop optimized strategies for obtaining returns with varying degrees of risk. An important feature of the protocol is the ability to generate fixed income from some assets.

PENDLE is used to manage the protocol through a Vote-escrowed system, as well as for rewards in some Pendle pools.

- Etherfi (ETHFI) - 2.5%

One of the leading liquid restacking protocols, Etherfi gives exposure to several other major projects at once: EigenLayer, Symbiotic, Karak, and others.

ETHFI is used to vote for proposals in DAO and can be staked for Etherfi points and partner projects. Crypto portfolio diversification is made possible by including in it ETHFI as well as other DeFi projects.

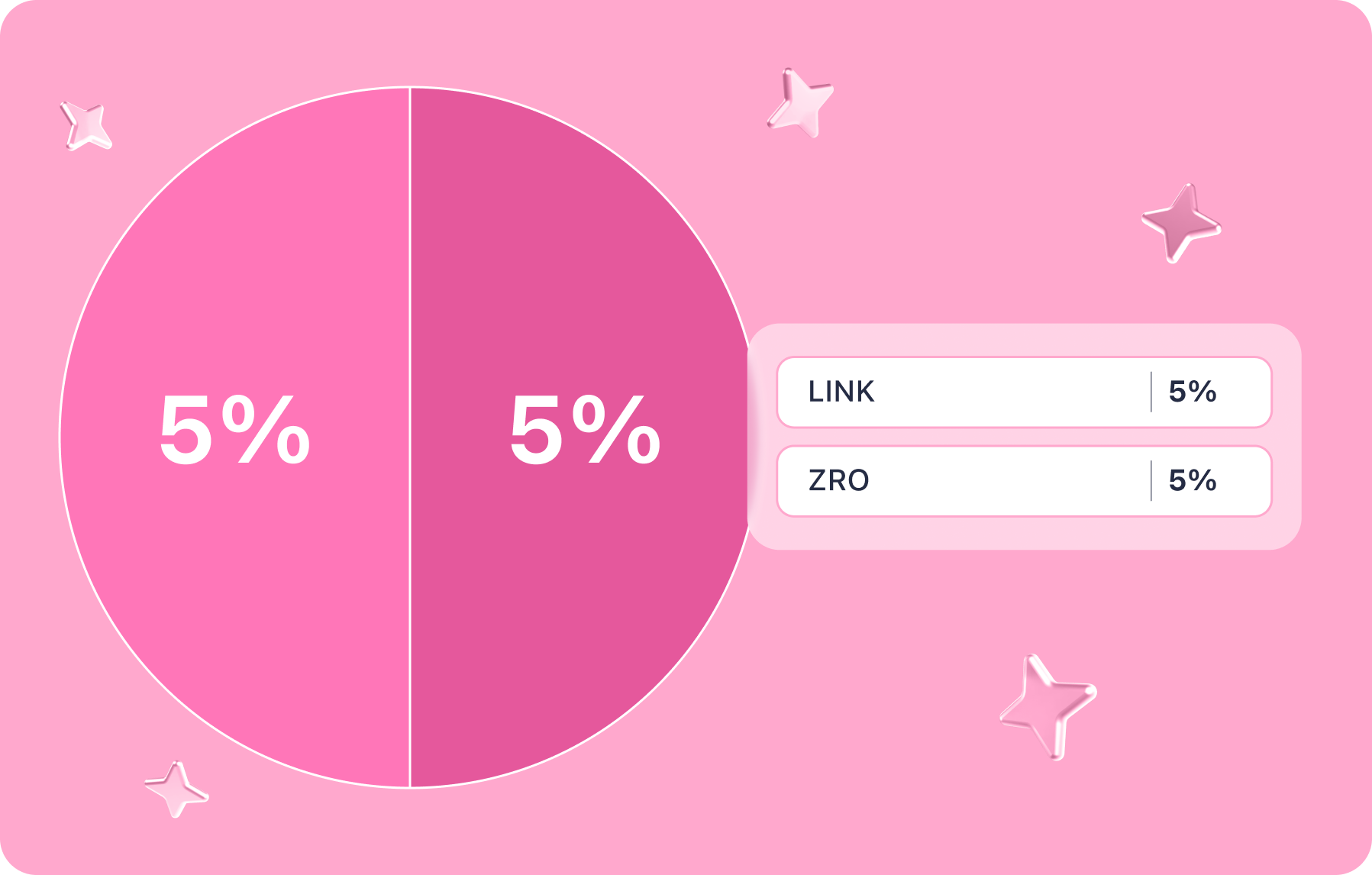

Infrastructure Projects (10%)

- ChainLink (LINK) - 5%

Chainlink is one of the leading infrastructure projects on the crypto market. It is an oracle service, which provides data from external sources to smart contracts, enabling them to fulfil their functions.

It recently launched Digital Assets Sandbox - a solution that will enable financial institutions to launch asset tokenization processes in a few days. Chainlink cryptocurrency, LINK, has good potential for growth in the current market cycle.

- LayerZero (ZRO) - 5%

One of the market leaders in omnichain liquidity and network interoperability, LayerZero allows easy exchange of assets across different networks. ZRO was flooded behind exchanges not too long ago.

The next token unlocking will be only in June 2025, so the asset has growth potential, and its 5% in this crypto portfolio is well deserved.

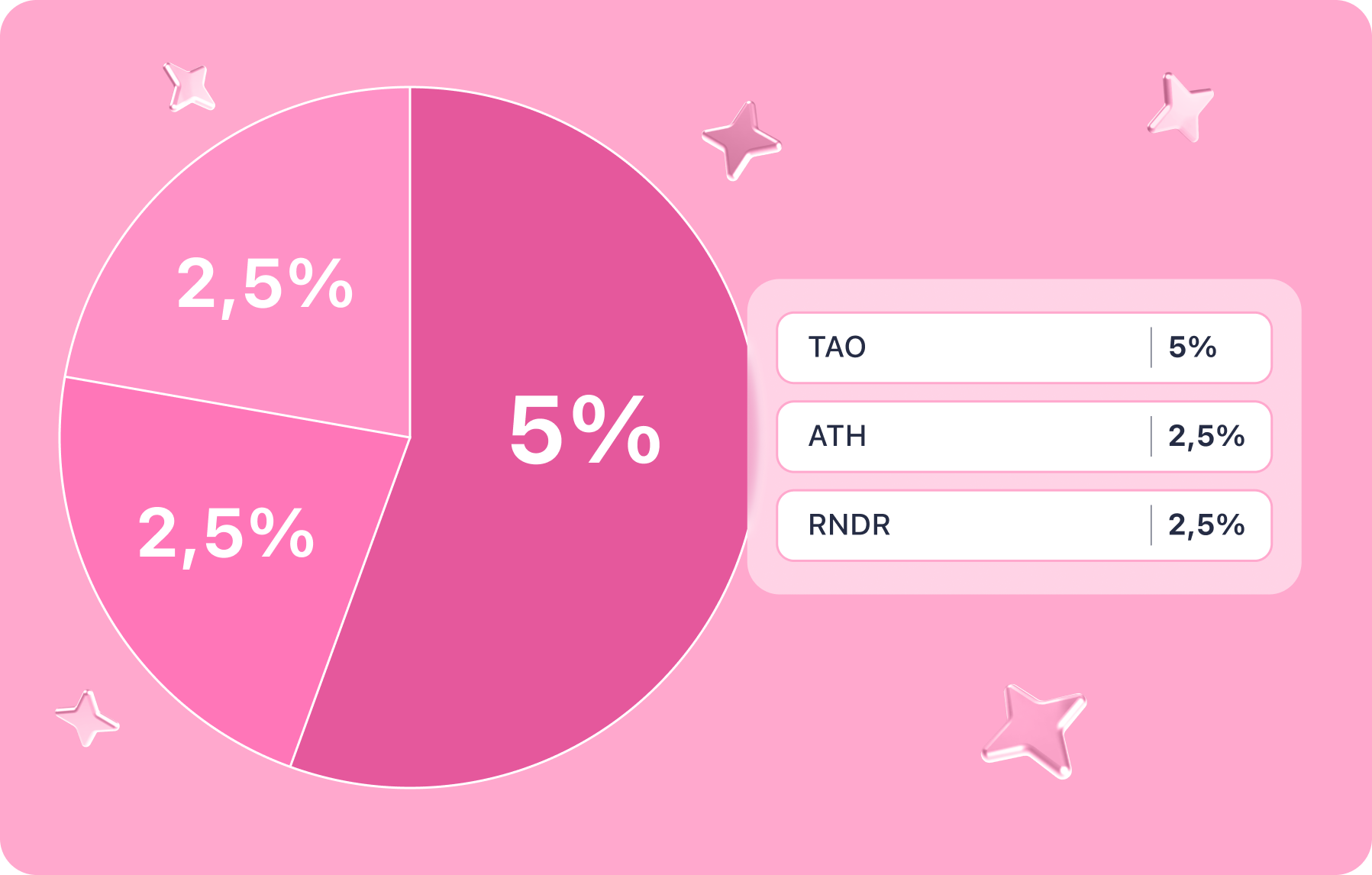

AI Projects (10%)

- Bittensor (TAO) - 5%

Decentralized network for creating and combining various machine learning models combined with blockchain technology (built on Substrate with Polkadot support).

Bittensor cryptocurrency, TAO is used to reward miners, manage the protocol and pay transaction fees.

- Aethir (ATH) - 2.5%

A project combining AI and DePin narratives, a decentralized network to provide cloud compute resources for AI, gamification and other areas.

AI is used for steaking, managing and rewarding Aethir node operators. It is one of the solid AI projects that has made its way into this diversified crypto portfolio.

- Render (RNDR) - 2.5%

A high-performance distributed GPU network that creates a marketplace of computing technologies between GPU vendors and consumers.

Render is revolutionizing the process of creating digital products. Its cryptocurrency, RNDR, is a great fit in this crypto portfolio.

Users can get all of the coins mentioned in this portfolio on SimpleSwap or via the widget below this article.

Summary

In an environment marked by crypto market uncertainty, this carefully curated diversified portfolio aims to maximize returns over the next 12 months by focusing on fundamentally strong assets with long-term growth potential.

The crypto portfolio is diversified across several categories, with 70% allocated to Layer 1 projects like Ethereum, Bitcoin, Solana, and Ton, which are expected to drive significant growth due to their established technology and market positions.

Additionally, 10% is dedicated to promising DeFi projects such as AAVE and Maker, while another 10% is allocated to infrastructure projects like ChainLink and LayerZero, essential for the ecosystem's development.

The final 10% targets innovative AI projects, including Bittensor and Render, which combine advanced technologywith practical applications.

This crypto portfolio management aims to balance risk and reward, positioning the portfolio to benefit from multiple growth drivers within the crypto market.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.