StarkNet Fundamental Analysis

Key Insights

- StarkNet has garnered substantial investment, worth $282.5 million, from prominent funds, including that of Vitalik Buterin, reflecting strong confidence in its potential.

- StarkNet uses Zero-Knowledge Proofs technology, specifically the STARKs version, to create a platform focused on minimizing transaction costs and enhancing scalability for smart contracts.

- StarkNet plans to transition to decentralized governance through the STRK token, providing users with an opportunity to actively participate in decision-making and benefit from the ecosystem.

StarkNet is a Layer 2 solution for Ethereum scaling, a decentralized ZK-Rollup platform developed by the StarkWareteam using Zero-Knowledge Proofs (ZK-Proofs) technology.

What Is StarkWare

StarkWare is an Israeli technology company founded in 2018 that specializes in developing blockchain scaling solutions, mainly for Ethereum, using advanced Zero-Knowledge Proofs (ZK-Proofs), particularly their version, STARKs (Scalable Transparent Argument of Knowledge).

StarkWare is considered one of the leaders in blockchain innovation, particularly in the context of increasing network capacity and reducing transaction costs.

StarkWare was founded by Eli Ben-Sasson, Uri Kolodny, Alessandro Chiesa, and Michael Riabzev. Eli Ben-Sasson is a professor who was one of the original researchers and developers of Zero-Knowledge Proofs and is one of the creators of STARKs technology.

Ben-Sasson’s research and development played a key role in creating the scaling solutions that are now used in StarkWare projects. Eli Ben-Sasson is a recognized expert in the field.

StarkNet is StarkWare's flagship ZK-Rollup solution that provides a common platform for smart contracts with scalability and reduced transaction costs.

StarkNet is designed to create a decentralized ecosystem where any dApp can be run using powerful ZK-Proofs.

The project is built on STARKs technology, a more performant and transparent version of ZK-Proofs that does not require trusted installation, unlike ZK-SNARKs. This makes the solution more scalable, cheaper and suitable for use in large systems.

How StarkNet Works

StarkNet uses the ZK-Rollup mechanism to scale computation by storing data on the Ethereum core network (Layer 1). It is based on the following logic:

Rollups collect transactions outside the core network (L2), which significantly reduces the cost and load on the L1 network.

At the same time, the end result of these transactions (in the form of a proof) is transmitted to the core network. In the case of ZK-Rollups, Zero-Knowledge Proofs are used, allowing Ethereum to ensure that all transactions are valid without having to verify each one.

STARK Proofs provide the ability to quickly and securely validate transactions on L1 even when transaction volume is high.

This allows StarkNet to achieve high throughput and significantly reduce transaction fees, which is especially important when the Ethereum network is overloaded.

StarkNet Technology

Technological aspects of StarkNet.

StarkNet uses the Cairo programming language to develop smart contracts and computing. It is a next-generation smart contracts programming language. It supports some new features, such as smart wallets or account abstractions, that are built into the Cairo language from the beginning. Many developers familiar with Rust prefer to program in Cairo rather than Solidity.

While StarkNet is currently managed by the StarkWare team, their plan is to gradually transition to a fully decentralized governance structure where the community will make key decisions through a governance mechanism using the STRK token staking.

StarkNet is tightly integrated with Ethereum, and many projects already running on Ethereum can seamlessly migrate their solutions to StarkNet to improve scalability and reduce transaction costs.

StarkNet Architecture

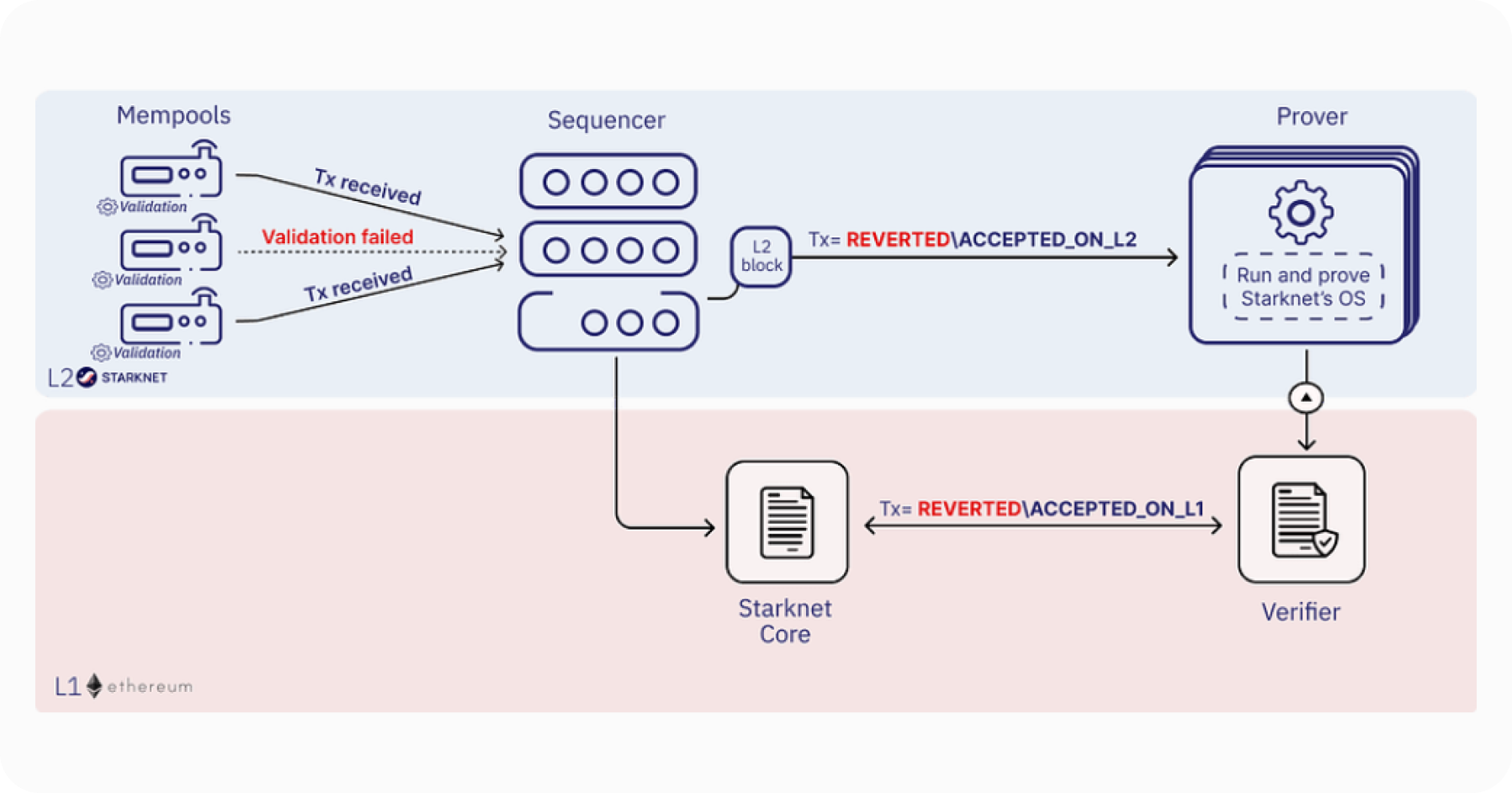

A StarkNet transaction starts when a transaction arrives at a gateway that serves as a mempool, this stage can also be managed by a sequencer. The sequencer receives transactions, organizes them, and creates blocks. It works similarly to validators on Ethereum or Bitcoin.

The provider generates proofs for created blocks and transactions. It uses the Cairo VM to execute programs that can be verified, creating the execution traces needed to generate STARK proofs.

L1, in this case Ethereum, hosts a smart contract capable of verifying these STARK proofs. If the evidence is valid, the StarkNet state root on L1 is updated.

StarkNet Technology Advantages

Scalability

One of the key advantages of StarkNet is its ability to scale Ethereum transactions. STARK proof-of-stake allows it to process thousands of transactions per second with minimal fees.Security

Since transaction totals are verified on the Ethereum core network, the security of the entire system is on the same level as Ethereum, making StarkNet a very secure platform.Reduced fees

One of the main reasons for implementing Layer-2 solutions is the high gas fees on the Ethereum network. StarkNet significantly reduces the transaction costs for users.Support for complex computations

With STARKs and the Cairo language, StarkNet can support complex computations that can be time consuming to run directly on Solidity.

Future of StarkNet

Full decentralization of the network through the creation of governance mechanisms that will allow the community to make key decisions. To date, the test phase of the STRK token staking has been launched.

Improved performance through STARK proof-of-concept optimization and reduced transaction processing time.

More integrations with Ethereum, including future network updates.

StarkNet is expected to play an important role in the future of Ethereum as one of the main layer 2 solutions for network scaling.

StarkNet: Comparison With L2 Solutions For Ethereum

When comparing StarkNet to other popular Layer 2 solutions, it can be noted that platforms utilizing ZK-Rollup, such as StarkNet and zkSync, offer higher security and scalability due to proof-of-work.

These solutions offer low fees and fast transaction validation, making them more suitable for long-term scaling and use in a variety of decentralized applications.

On the other hand, Optimism and Arbitrum are based on Optimistic Rollup technology, which allows them to ensure that projects can easily migrate from Ethereum due to full EVM compatibility.

However, these solutions face scalability limitations and take more time to validate transactions due to the need to verify ford proofs.

Investing In StarkNet

The StarkNet project has managed to attract an impressive $282.5 million in investments, which shows the high interest and confidence of investors in its potential.

Among the funding participants are such reputable funds as Multicoin Capital, Sequoia Capital, Paradigm and Polychain Capital, which are known for their ability to identify promising blockchain technologies and projects. StarkNet is seen as one of them.

Interestingly, Vitalik Buterin, co-founder of Ethereum, also invested in StarkNet, which underlines the importance and reliability of this solution for the future of decentralized applications and the Ethereum ecosystem as a whole.

STRK Token

StarkNet has its own STRK token, which represents an important element of the ecosystem and can be considered as an investment asset.

With the launch of staking on the main network, which is currently in the testing phase, users will have the opportunity to actively participate in the life of this Layer 2 solution, receiving rewards for their investment and support of the network.

STRK token is actively traded on all major liquid exchanges, which ensures its availability and convenience for investors.

Moreover, STRK token can be used in various DeFi protocols, which opens up additional opportunities to profit in STRK tokens. We have already prepared a couple of good options for you: Ekubo Protocol and Nostra.

Overall, having the token and its functionality within StarkNet adds value to the project by providing users with opportunities to actively participate and benefit from the ecosystem.

Issuance and Distribution of Tokens

Early contributors (20.40%)

A significant share of STRK tokens is allocated to early contributors to the project, which incentivizes their participation and contribution to the development of StarkNet.

Investors (18.17%)

Investors receive STRK tokens for funding the project, which provides the necessary liquidity and resources for further development.

Grants including development partners (12.93%)

A part of STRK tokens is allocated for grants for development partners, which helps to attract new developers and teams to create applications on StarkNet.

StarkWare (10.76%)

Tokens allocated to StarkWare itself, supporting its long-term interests and technology development.

Strategic reserve (10.00%)

Reserve STRK tokens for strategic use, such as for future partnerships or programs.

Community rebates (9.00%)

This STRK token segment is for community rewards to help keep users active and engaged.

Foundation treasury (8.10%)

Foundation Treasury tokens can be used to fund various initiatives and projects.

Community provisions (7.20%)

Resources to provide for various community needs and support community growth.

Donations (2.00%)

A portion of STRK tokens are earmarked for charitable purposes, which helps improve the project's image and support community initiatives.

Community provisions (1.80%)

Additional resources to provide for community needs.

Users can get any cryptocurrency for fiat or crypto on SimpleSwap.

Summary

StarkNet is an advanced Ethereum scaling solution based on zk-STARK technology that combines high performance, security and fee savings.

The use of STARK proof-of-concept allows the project to significantly scale the network, handle complex computations and keep transaction costs low, making StarkNet a powerful tool for further development of decentralized applications.

The project has attracted significant attention from investors, including major funds such as Paradigm, Sequoia and Multicoin Capital, which confirms a high level of confidence in its long-term prospects. Adding to the confidence is the fact that Vitalik Buterin himself invested in StarkNet.

The launch of STRK token staking will give users the opportunity not only to maintain network security, but also to participate in making key decisions on platform management.

STRK token may be of interest as a potential asset in the portfolio, given the strong community support, unique technologies and growth prospects of the project in the field of Layer 2 solutions on Ethereum.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.