Bitcoin Additional Yield Strategies

Key Insights

- The recent introduction of spot Bitcoin ETFs in the U.S. has elevated Bitcoin's status as a credible investment option, and has allowed institutional and retail investors to gain exposure to Bitcoin through regulated channels, broadening BTC's appeal as a legitimate financial asset.

- Investors can generate additional yield on their Bitcoin by staking it on centralized exchanges or participating in decentralized lending protocols, and whereas staking on CEX offers a simple, passive strategy with varied yields, decentralized lending involves risks like smart contract vulnerabilities and lower returns.

- Newer approaches, like BTC liquid staking, using solutions like Babylon and Lombard, facilitate Bitcoin staking without converting it into wrapped assets, allowing users to contribute to network security while participating in DeFi ecosystems.

Bitcoin is the most famous cryptocurrency, the first crypto asset to be mined, and the start of the blockchain. Bitcoin is seen as digital gold, an alternative to existing fiat money and payment system. In addition, BTC can be used as a hedge against inflation, macroeconomic and political crises.

Recently, BTC has been attracting more and more attention from institutional and retail investors. A big step in the acceptance of Bitcoin as a legitimate investment tool was the launch of spot Bitcoin ETFs in the US. Investors were able to invest in the first cryptocurrency within regulated investment products managed by leading investment funds.

However, not all BTC users have access to regulated BTC-based investment products. For most crypto market participants, the most affordable way to invest in BTC is to buy it on centralized marketplaces or DEX and hold it in an exchange account/wallet.

In this case, the yield from BTC will be expressed only in the growth of its value over time. However, there are ways to get additional yield on your BTC. These ways differ in terms of risk and profit potential, and below we look into each of them in greater detail.

Bitcoin Staking on CEX

A simple way to get additional yield from BTC is to stake it on centralized exchanges that offer various programs to generate yield from crypto assets.

It is important to note that since the Bitcoin blockchain runs on the Proof of Work consensus algorithm, the concept of staking is not used in it, as it is a feature of blockchains with the Proof of Stake consensus algorithm and its various variations.

Staking BTC is not staking in the literal sense of the term, but merely refers to the ability to contribute your assets (BTC) to certain pools for additional returns. CEX offer different options for depositing your BTC with different yields.

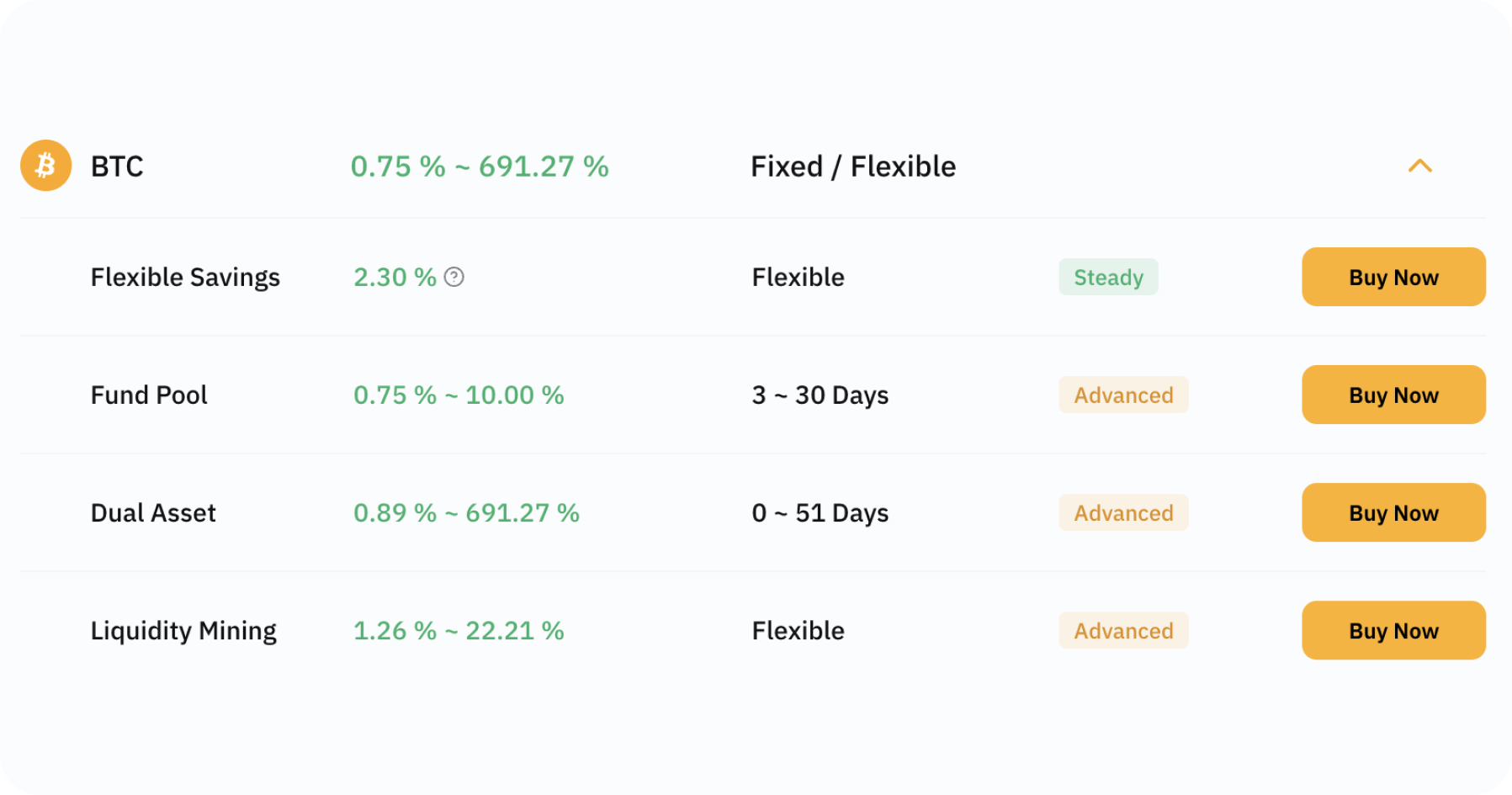

For example, Bybit exchange offers APR on BTC from 0.75% to 691% through Savings, Liquidity Mining or Dual Investment programs. To participate, you need to choose a program, asset retention period (where applicable) and deposit your BTC.

APR to BTC on Bybit exchange

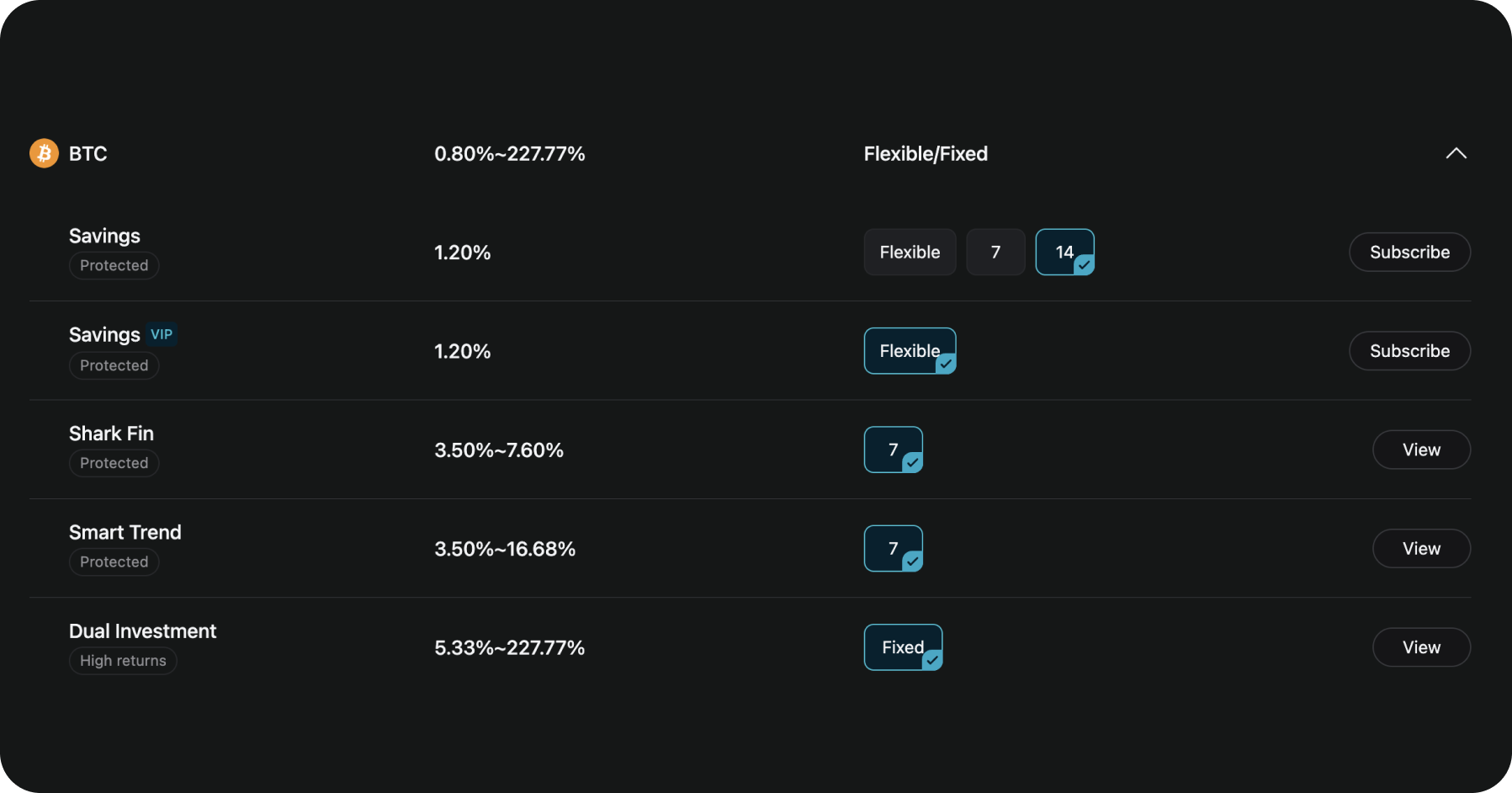

Bitget exchange in turn offers programs to get yield from BTC with APR from 0.8% to 227%. The duration of the programs is from 7 to 14 days and can be flexible.

APR to BTC on Bitget exchangex

Staking BTC on centralized exchanges is an easy way to generate additional profits from your assets. It is a passive strategy that does not require active monitoring and rebalancing. The downside is the need to hold BTC on a centralized exchange and accept the risks associated with CEX.

Participation in Lending Protocols

Decentralized lending protocols allow borrowing crypto assets against other crypto assets, increasing capital efficiency and empowering users in DeFi.

In lending protocols, one can participate not only as a borrower, but also as a lender, lending their assets to pools from which loans will then be made. For example, one can lend BTC to the available pools of lending protocols.

The leading TVL lending protocol AAVE has a BTC pool with a current APY of 0.04%. To participate, you need to make a deposit of WBTC on the Ethereum network into the corresponding pool on AAVE.

This strategy is also passive and does not require active management. The downside is the need to use a wrapped version of BTC rather than a native coin.

You also need to consider the risks of using decentralized protocols: hacks and smart contract bugs. Also, the current APY in lending protocols is very low and loses even to the APY on stablecoins.

Wrapped BTC pool on AAVE

BTC Additional Yield Strategy: Provision of Liquidity on DEX

Decentralized exchanges operate on the basis of liquidity pools, which act as counterparties for transactions.

Liquidity pools are set by liquidity providers who lock up assets in the pool. Liquidity providers receive commissions from the DEX in the pool for providing liquidity.

The most common way to participate in a pool is to deposit 2 tokens, for example BTC and USDT in equal shares. Since BTC is a popular crypto asset, there are many BTC pools with different tokens. As a BTC holder, you can become a liquidity provider on decentralized exchange and earn extra yield on your assets.

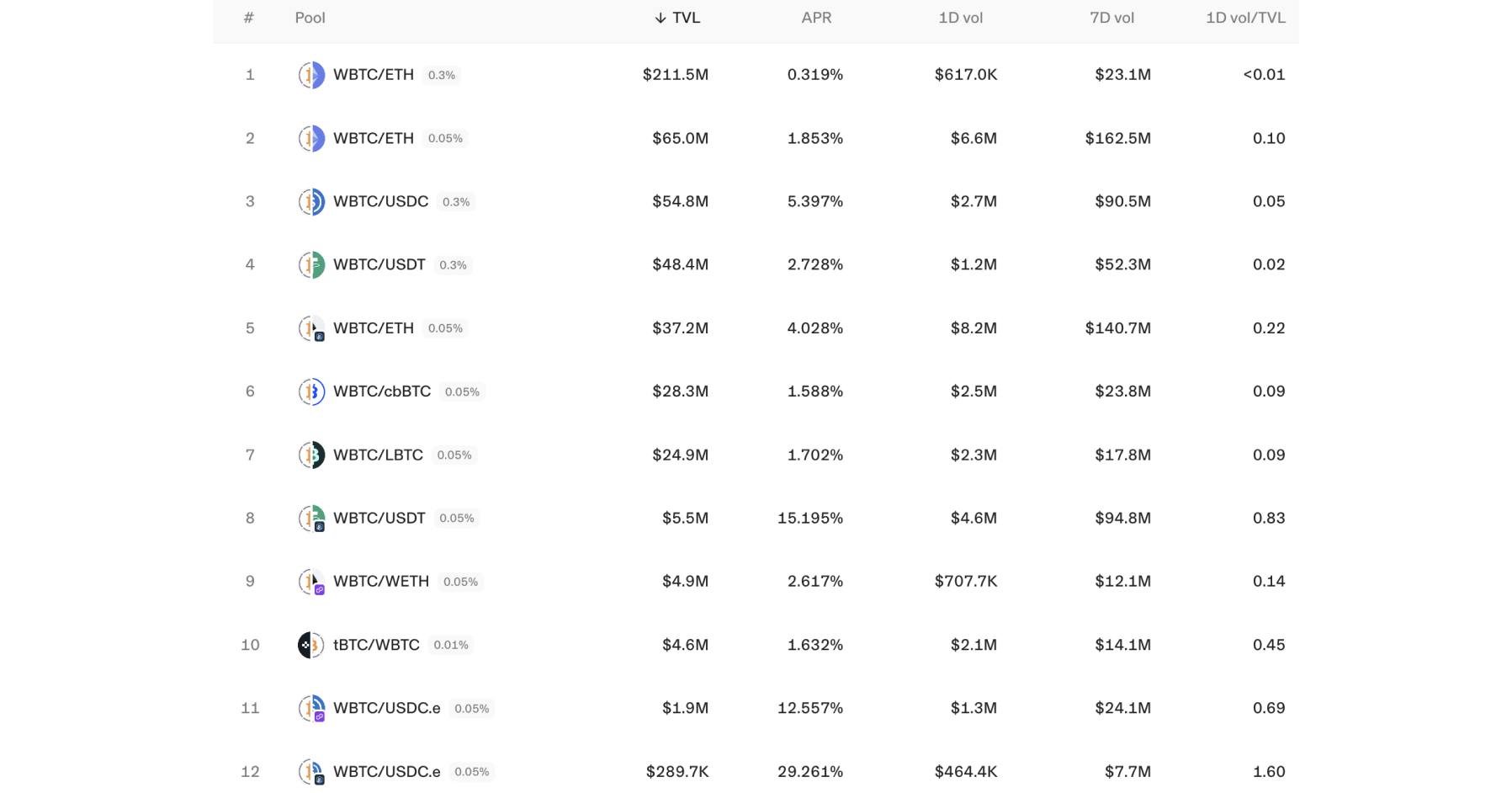

Let's consider pools with BTC on the largest DEX by trading volume, Uniswap.

Recall that in case of working with DeFi protocols in different networks, you will have to use not native BTC, but its wrapped version, for example, Wrapped Bitcoin (WBTC). Uniswap offers several pools with WBTC. These are mostly pairs with stablecoins, ETH or other versions of wrapped Bitcoin.

At the time of writing, the best yield is the WBTC/USDC.e pool on the Arbitrum blockchain, the pool's APR is 29.3%. The safest pairs such as WBTC/cbBTC have an APR of about 1.5%.

Yield of pools with WBTC on Uniswap

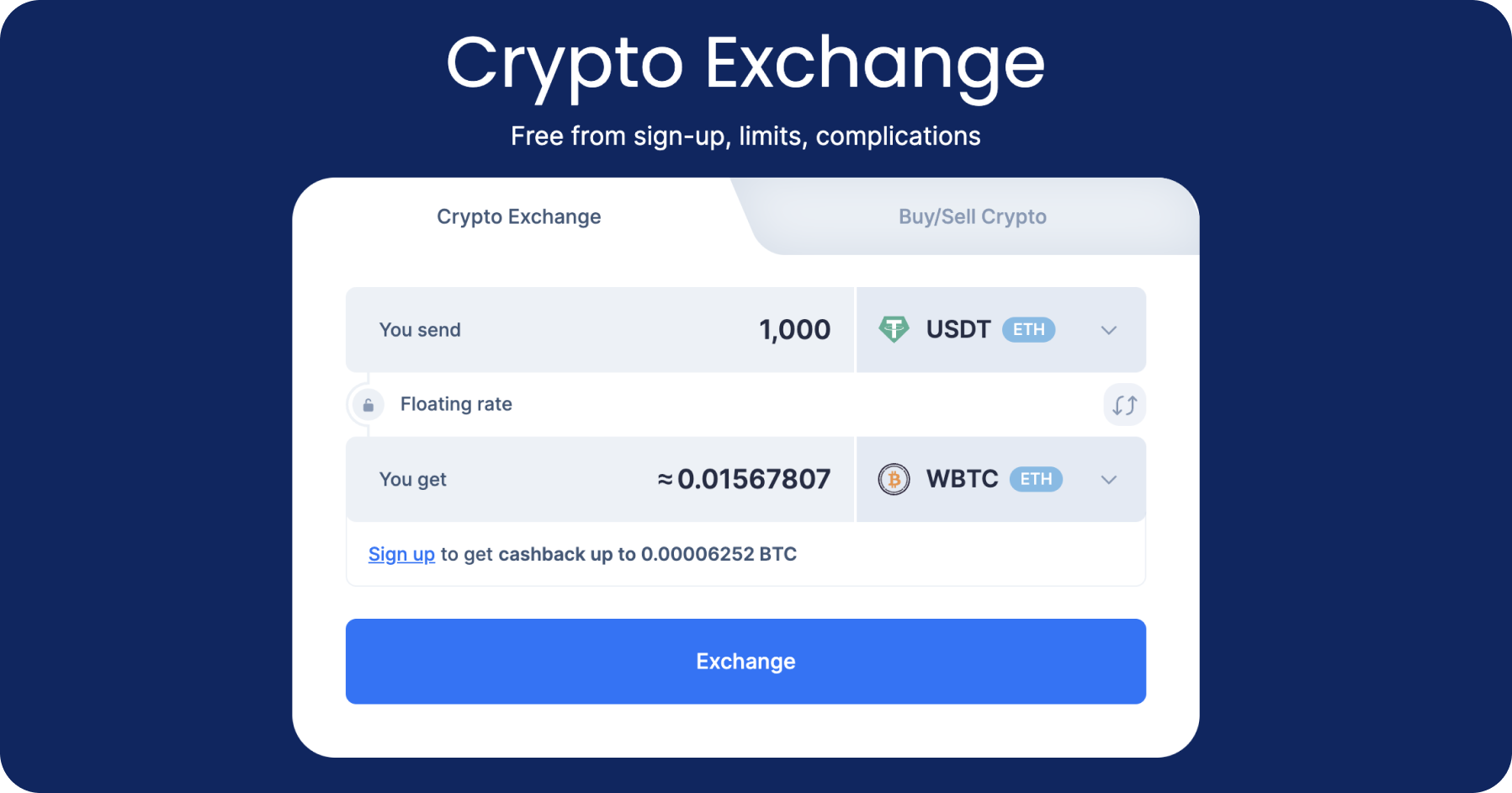

To participate as a liquidity provider on DEX, you will need to have two tokens, for example WBTC and cbBTC. We remind you that you can buy WBTC and other assets on SimpleSwap safely and with minimal commissions.

After purchasing tokens, deposit them in equal proportions into the appropriate liquidity pool and confirm the transactions in your wallet. You then become a liquidity provider in the pool and receive rewards from transactions in the pool.

Providing liquidity on DEX is an advanced strategy that requires knowledge and understanding of the mechanics of DEX pools, volatile losses and trading ranges. This strategy is active and requires constant monitoring and rebalancing. It is suitable for more advanced users.

BTC Liquid Staking

BTC liquid staking represents a new direction in the Bitcoin ecosystem and an additional source of profit for BTC holders.

Since Bitcoin itself runs on a Proof of Work consensus algorithm, it does not have a staking function. However, BTC can be used to secure other networks with the Proof of Stake consensus algorithm.

BTC is used similar to ETH for staking and validating the operation of protocols called AVS (Actively Validated Services). BTC stakers receive a return for providing assets to the staking in a similar way to ETH stakers.

At the moment, several solutions for Bitcoin staking are being developed and have already entered the market, both natively (on the Bitcoin network) and on other blockchains. Let's take a closer look at the most interesting of these solutions.

Babylon

Babylon introduces a new concept of crypto economic security, connecting BTC holders and Proof of Stake networks in need of robust security.

Babylon develops an infrastructure for Bitcoin staking as a guarantee for the integrity of validators with the ability to slash staked assets.

A key feature of Babylon is its native BTC staking capability. When using Babylon, BTC holdings remain on the BTC network without the need to convert it to wrapped versions on other blockchains.

Lombard

Lombard creates an additional utility for BTC and seeks to integrate it into decentralized finance. Lombard has developed its own solution for this task, LBTC.

LBTC is a BTC liquid staking token (LST token) that allows holders to generate native returns from providing economic security to Proof of Stake networks via Babylon, while participating in DeFi activities.

LBTC is a cross-chain yield bearing token backed by 1:1 native BTC. It can easily move between networks, generating income for holders and it does not fragment liquidity.

A key feature of Lombard is the ability to simultaneously generate yield from steaming BTC through Babylon and using it in the DeFi ecosystem. For example, it is possible to provide liquidity on DEX in pairs with LBTC.

LBTC Yield Opportunities on the BNB Chain. Source: https://www.lombard.finance/app/defi/

Solv Protocol

Solv Protocol is developing a comprehensive BitcoinFi ecosystem that extends the use of BTC in DeFi protocols.

The core component of Solv Protocol is SolvBTC, a BTC in the Solv ecosystem that can be used across multiple networks and provide liquidity for the BitcoinFi ecosystem.

SolvBTC runs on all major blockchains including Bitcoin's own network, Ethereum, BNB Chain, Arbitrum, Base and others. Each SolvBTC is backed by native Bitcoin at a 1:1 ratio.

Solv Protocol provides BTC holders with the ability to generate income using Liquid Staking (LST) tokens. Users can convert SolvBTC into an LST token, such as SolvBTC.BBN, and receive staking income through Babylon's infrastructure. SolvBTC.BBN can be used to generate additional revenue in DeFi, for example by staking in affiliate protocols.

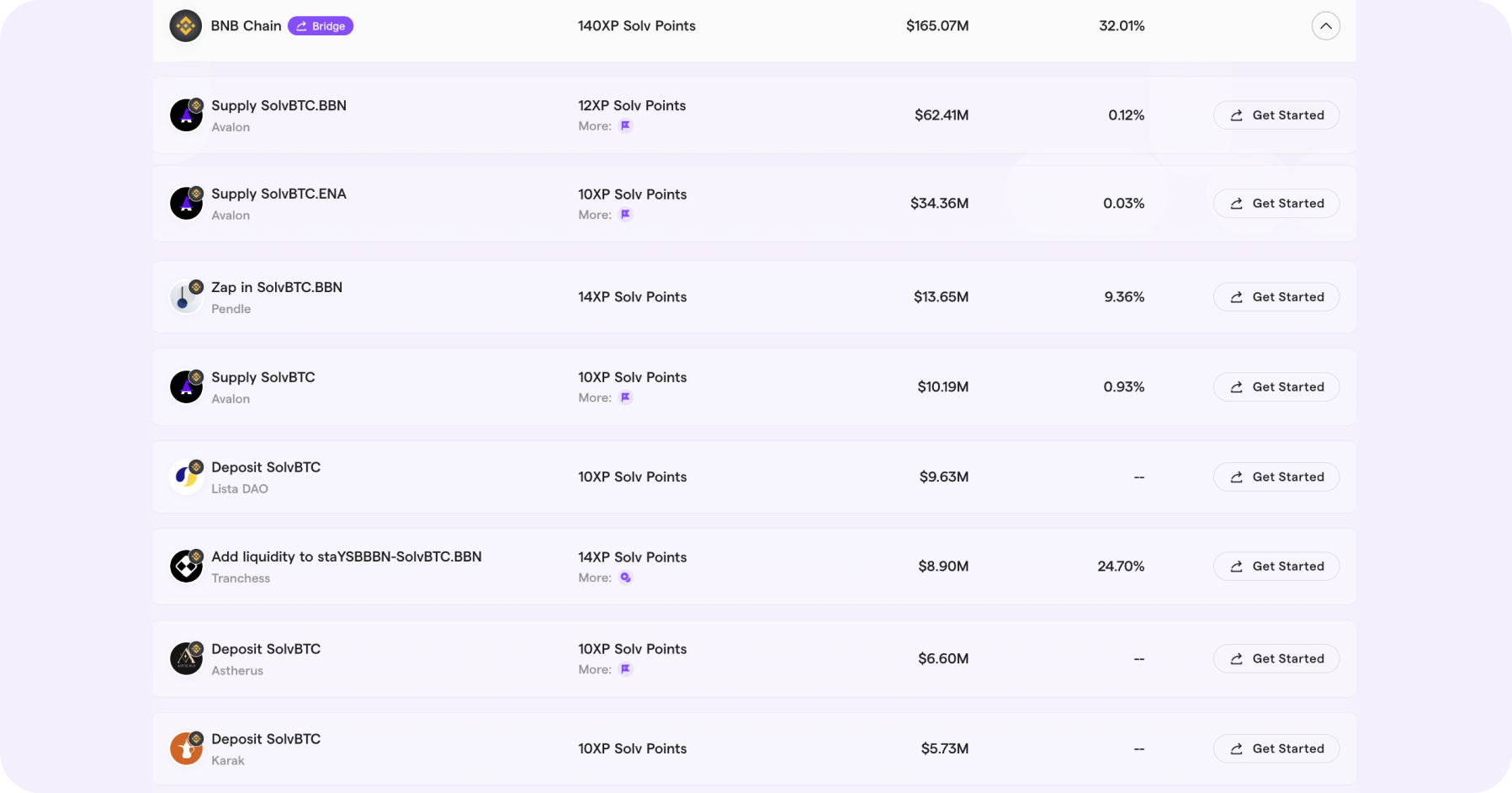

SolvBTC Yield Opportunities on the BNB Chain. Source: https://app.solv.finance/liquidity

Summary

Bitcoin, as the pioneering cryptocurrency, continues to strengthen its position as a digital alternative to traditional currencies and a hedge against inflation and economic instability.

With the recent launch of spot Bitcoin ETFs in the U.S., institutional interest has grown, making BTC more accessible through regulated investment products.

However, for many market participants, centralized and decentralized exchanges remain the primary avenues for acquiring Bitcoin.

Additionally, various strategies — such as staking on centralized exchanges, participating in lending protocols, and providing liquidity on DEX—offer opportunities for BTC holders to earn additional yields, each carrying different levels of risk and complexity.

The emergence of BTC liquid staking further expands these possibilities by integrating BTC into Proof of Stake ecosystems, allowing users to secure networks while generating returns.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.