BTC Capital Increase Strategy: Trading with Altcoins

Key Insights

- The strategy of accumulating capital in BTC by trading with altcoins growing faster than the underlying assets (BTC, ETH) involves working in the market when the dominance of BTC decreases and the so-called alt season begins.

- This crypto strategy uses the mechanics of averaging the price of the asset by buying the selected altcoin during drawdowns, as well as negative scenarios of the whole market development (negative news background, hacking of exchanges, etc.).

- The goal of the strategy is to increase the capital in BTC by 30-50% in the medium term (usually 2-3 months, according to the duration of the altcoin season), the strategy provides for both short-term and medium-term transactions.

What Are Altcoins

Altcoins, short for alternative coins, refer to all cryptocurrencies other than Bitcoin. They are named as such because they present alternatives to both BTC and traditional fiat currencies. Since the launch of the first altcoins in 2011, thousands have emerged, each offering unique features and functionalities.

While earlier altcoins focused on improving Bitcoin’s limitations—such as enhancing transaction speeds or reducing energy consumption—more recent altcoins serve a wide range of purposes tailored to the goals of their developers.

There are various categories of altcoins, including stablecoins, mining-based coins, staking-based coins, and governance tokens. The specific type of altcoin depends on how it operates and what objectives it seeks to achieve.

Despite their differences, many altcoins share a common function with Bitcoin: acting as a decentralized, peer-to-peer payment system and a store of value.

Some altcoins, however, distinguish themselves by offering faster transaction speeds or heightened privacy features, while other altcoins are designed for specific, narrowly defined use cases that deviate from Bitcoin’s original purposeas a payment network.

What Is Alt Season

Altcoin season, or alt season, is a period in the cryptocurrency market characterized by a decline in Bitcoin's dominance as more investment flows into altcoins. BTC dominance refers to the proportion of Bitcoin's market capitalization relative to the total market cap of all cryptocurrencies.

When altcoins receive a greater share of investment than Bitcoin, it signals the start of an alt season.

Often, when the price of Bitcoin rises sharply, altcoins tend to follow, which can reduce Bitcoin’s overall market dominance. In other cases, the emergence of innovative projects or influential figures in the crypto space can spark an alt season, leading investors to explore alternatives beyond Bitcoin.

Altcoin season occurs when altcoins consistently outperform BTC, causing a significant drop in the Bitcoin dominance ratio. This shift is usually triggered by new trends or developments in the crypto industry, which encourage the launch of multiple new projects.

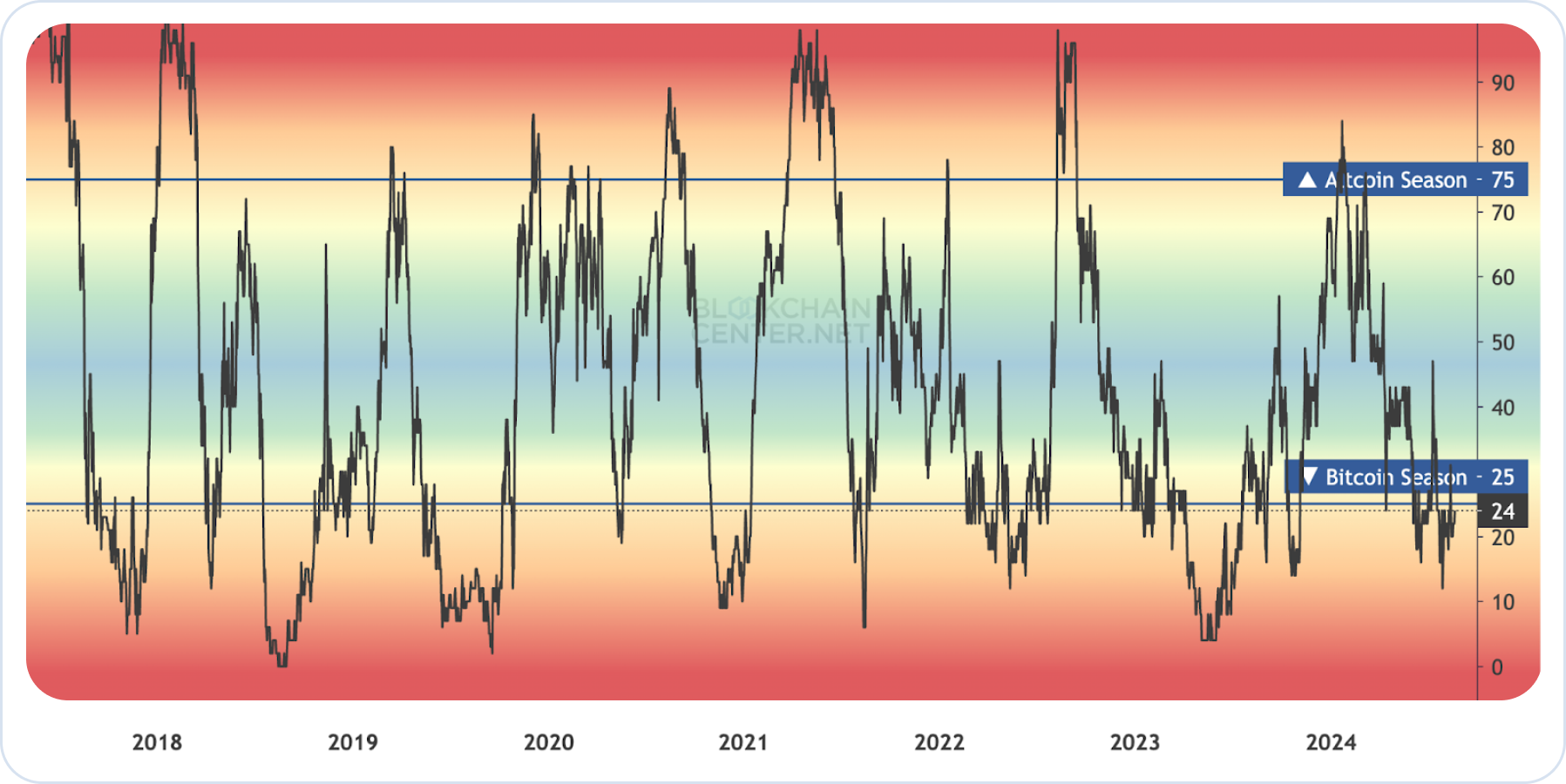

While there is no definitive way to predict the onset of an alt season, certain tools, like the one provided by Blockchain Center, can help gauge market sentiment. According to this tool, an alt season is defined as a three-month period where 75% of the top 50 altcoins outperform Bitcoin.

During an alt season, investors shift their attention from Bitcoin to other promising digital assets, resulting in increased trading volume and a bullish outlook for these smaller cryptocurrencies.

Trading With Altcoins: Key Points

In this part of the article we deal with what is needed to understand in order to successfully implement this crypto strategy of capital increase in BTC.

- Determination of the beginning of the alt season

Here we look at the decreasing dominance of BTC and the increasing dominance of altcoins with their growing tog volume. In such a market, there is an increase in the ETH/BTC ratio in favor of Ethereum.

When Ethereum grows faster than BTC there is a capital flow from BTC to ETH, which is further accompanied by the growth of fundamental altcoins.

TOTAL3 represents the capitalization of the top 125 cryptocurrencies excluding the capitalization of BTC and ETH. Let's look at the example of 2022 to see how we can define altcoin season.

- Determination of the level of the altcoin season

This can be done by using the Blockchain Center portal, which presents an index of the top 50 altcoins that have shown more percentage growth over 3 months than BTC.

At the moment we have Bitcoin season going (24%), which is good for accumulating fundamental altcoins in order to increase BTC after the start of the altcoin season. If this index is above 75 and consolidates above that level - the altcoin season starts.

It is also important to note that the strong growth in the capitalization of stablecoins (USDT mostly) also has a positive impact on the growth of altcoins in the near future, and can be said to be a harbinger of it.

Crypto Strategy Implementation

Here is what you need to do to perform the said crypto strategy.

- Analyze the state of the crypto market for the emerging altcoin season thanks to the information above, determine the decreasing dominance of BTC.

- Initially having and holding BTC, we exchange a part of BTC for fundamental altcoins, which will grow more dynamically than others, based on the analytics of professional market players. For example, let's take TON, an ecosystem project that shows growth even outside of the altcoin season.

- We divide our total capital BTC into 5 parts, for example 0.01 BTC per purchase. We need this in case of unforeseen circumstances and averaging our purchase at lower prices (asset accumulation).

- We buy TON for our BTC at 0.01 BTC on SimpleSwap.

- In case of a negative market scenario due to force majeure (news background, inflation rate in the USA, hacking of exchanges), when BTC/TON pair decreases, we determine support levels and buy again at that level, thus averaging the price of the asset against BTC. We leave the deposit for possible next iterations.

- After some time (from 2 weeks to 2 months), we fix 30-50% profit back into BTC (also using SimpleSwap), thus increasing its amount.

- BTC capital can be used to accumulate several altcoins (3-5), thus diversifying your portfolio.

Important notes on strategy implementation:

- It is important to identify the incipient alt season

- It is important to identify the fundamental assets and their potential

- Position averaging in a negative scenario. Usually 3-4 iterations are enough when averaging and accumulating an asset.

- Splitting the deposit into 5-10 parts and spreading it over several assets (altcoins).

Summary

This crypto strategy of capitalizing on altcoin season revolves around recognizing a decline in Bitcoin's dominanceand leveraging the growth of altcoins to increase BTC holdings.

Altcoin season is marked by a capital shift from Bitcoin to altcoins, driven by various factors such as innovative projects or market trends.

The key to executing this strategy successfully is to analyze market conditions, select fundamental altcoins with strong growth potential, and use techniques like averaging purchases during market downturns.

By diversifying the portfolio and carefully timing transactions, traders aim to boost their Bitcoin holdings by 30-50%over the course of 2-3 months.

Properly identifying the start of altcoin season, choosing the right assets, and managing risk through position averaging are essential components of this approach.

The strategy can be applied both for beginners and experienced market players.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.