Crypto Portfolio: Asset Allocation Between Infrastructures and Ecosystems

Key Insights

- A diversified crypto portfolio, spread across core cryptocurrencies, infrastructure projects, DeFi platforms, Proof-of-Stake assets, and Layer 2 solutions, helps mitigate risks while maximizing potential returns.

- Regular rebalancing of the crypto portfolio every 6-12 months allows investors to adapt to market changes, innovative technologies, and market regulations

- Long-term investments in major cryptocurrencies like Bitcoin and Ethereum, alongside innovative blockchain technologies, allows for capitalization on future growth

In the rapidly evolving crypto market, the key aspect of successful investing is not only asset selection, but also portfolio management strategy.

A crypto portfolio is a mix of digital assets used for investment. To make balanced investments it's important to understand the concept of a crypto portfolio strategy, which helps balance risk and reward across different blockchain projects.

Here you can read the asset allocation strategy that spawned this crypto portfolio.

Cryptocurrency Portfolio Management Strategy

- Goal of Crypto Portfolio Management

Create a stable and high-yielding crypto portfolio that can withstand market fluctuations and effectively capitalize on growth opportunities.

- Crypto Portfolio Diversification

The diversified portfolio is divided into several key crypto assets categories for risk management and provision of access to different growth opportunities.

The right combination of diverse crypto assets in a diversified portfolio not only minimizes risks, but also maximizes potential returns.

Let's take a look at a cryptocurrency portfolio management strategy based on diversification and systematic rebalancing.

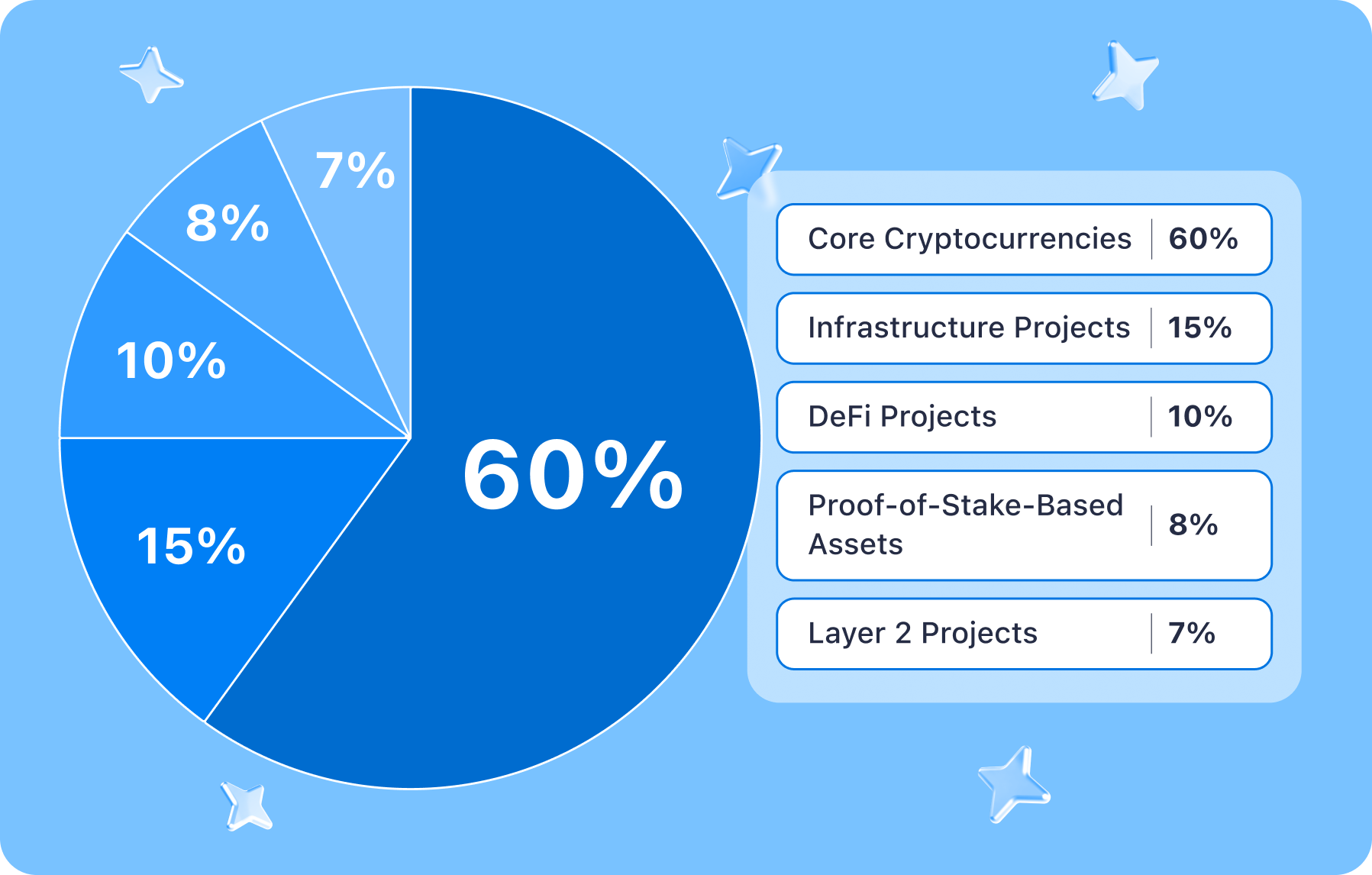

Crypto Portfolio Diversification

This crypto portfolio will see asset allocation between core cryptocurrencies, infrastructure projects, DeFi projects, P-o-S-based assets, and Layer 2 projects.

Core Cryptocurrencies

- Bitcoin (BTC): 40% of the portfolio. A fundamental asset that acts as digital gold.

Bitcoin provides a reliable store of value and liquidity benchmark. Bitcoin takes a crucial place in this diversified portfolio.

- Ethereum (ETH): 20% of the portfolio. Leading platform for smart contracts and decentralized applications.

Etherium, with its leading position in smart contracts and dApps, is important to the crypto portfolio. Including ETH into this diversified portfolio via asset allocation is well deserved.

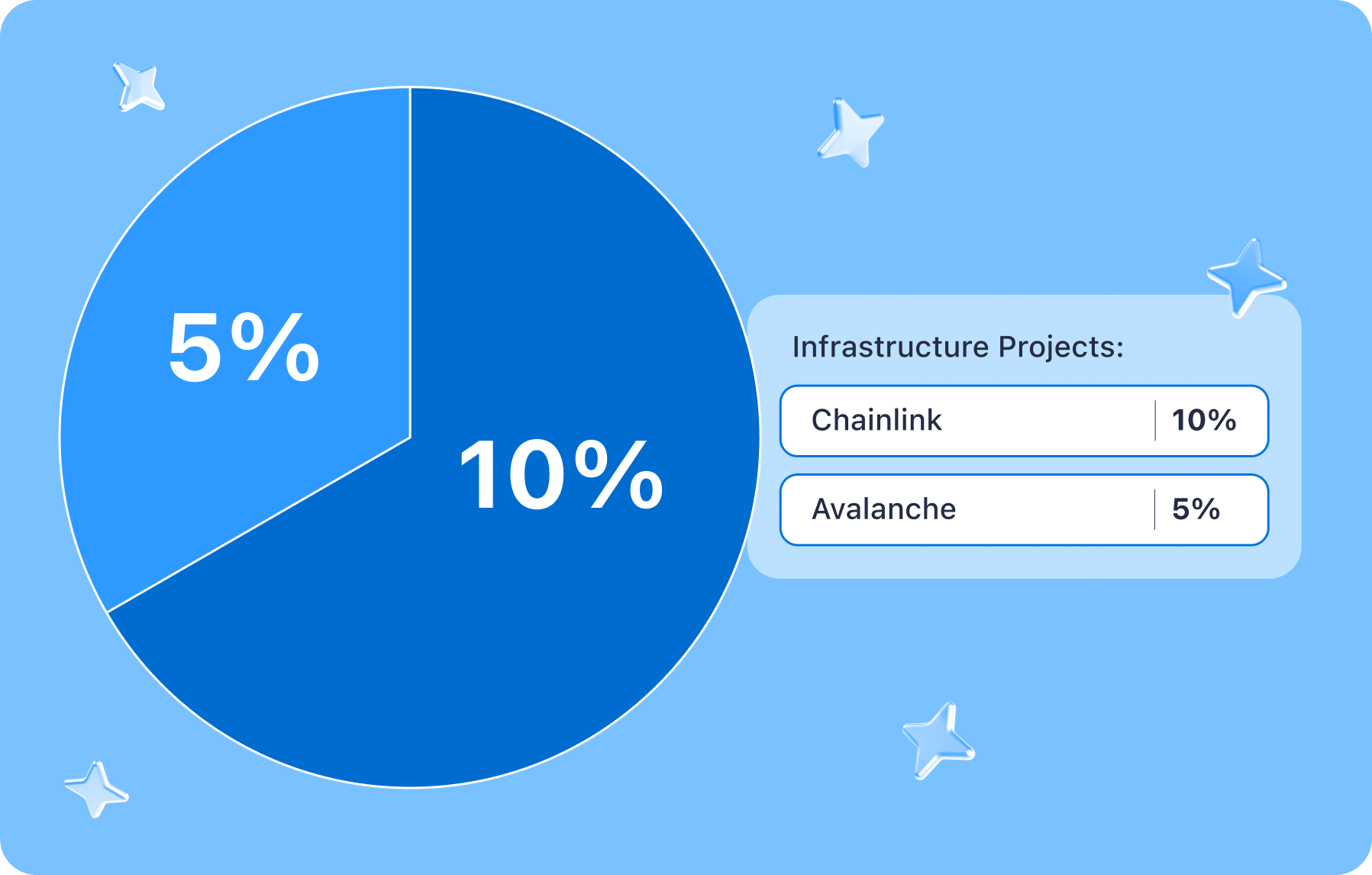

Infrastructure Projects

- Chainlink (LINK): 10% of portfolio. An oracle platform that provides access to external data.

Chainlink is an oracle service that provides smart contracts with external data, which is essential for many dApps, making Chainlink an important element of blockchain infrastructure. All of that earns Chainlink a spot in this crypto portfolio.

- Avalanche (AVAX): 5% of portfolio. High-performance blockchain platform for dApps

Offers a high-performance blockchain with fast transaction confirmation times and high throughput, making it suitable for building a variety of dApps, and eligible to appear in this crypto portfolio.

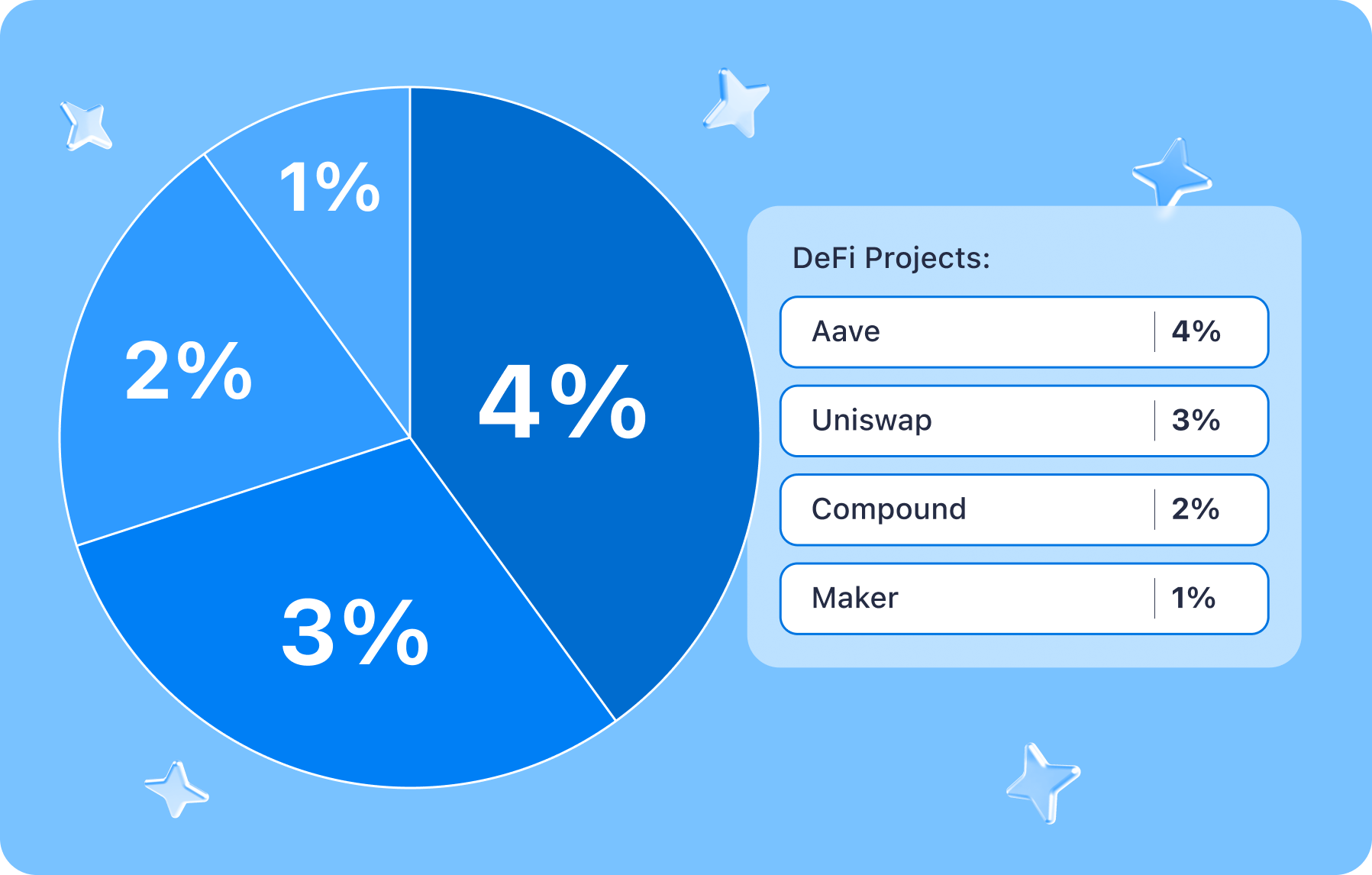

DeFi Projects

- Aave (AAVE): 4% of portfolio. A protocol for lending and borrowing.

AAVE is the leading DeFi lending protocol in terms of total volume. AAVE provides users with the ability to borrow and lend cryptocurrencies through the use of smart contracts technology

- Uniswap (UNI): 3% of portfolio. A decentralized exchange.

Uniswap is a DEX that streamlines the provision of liquidity. The Uniswap exchange is a decentralized platform that utilizes automated liquidity pools in lieu of order books to facilitate direct token swapping

- Compound (COMP): 2% of the portfolio. A protocol for borrowing and lending.

Compound is a prominent DeFi lending protocol that enables users to borrow against cryptocurrencies and earn interest on their crypto assets by adding them to lending pools.

- Maker (MKR): 1% of the portfolio. A platform for creating stable DAI coins.

The Maker protocol is the 3rd largest blockchain protocol in terms of blocked assets (TVL) according to DefiLlama rankings.

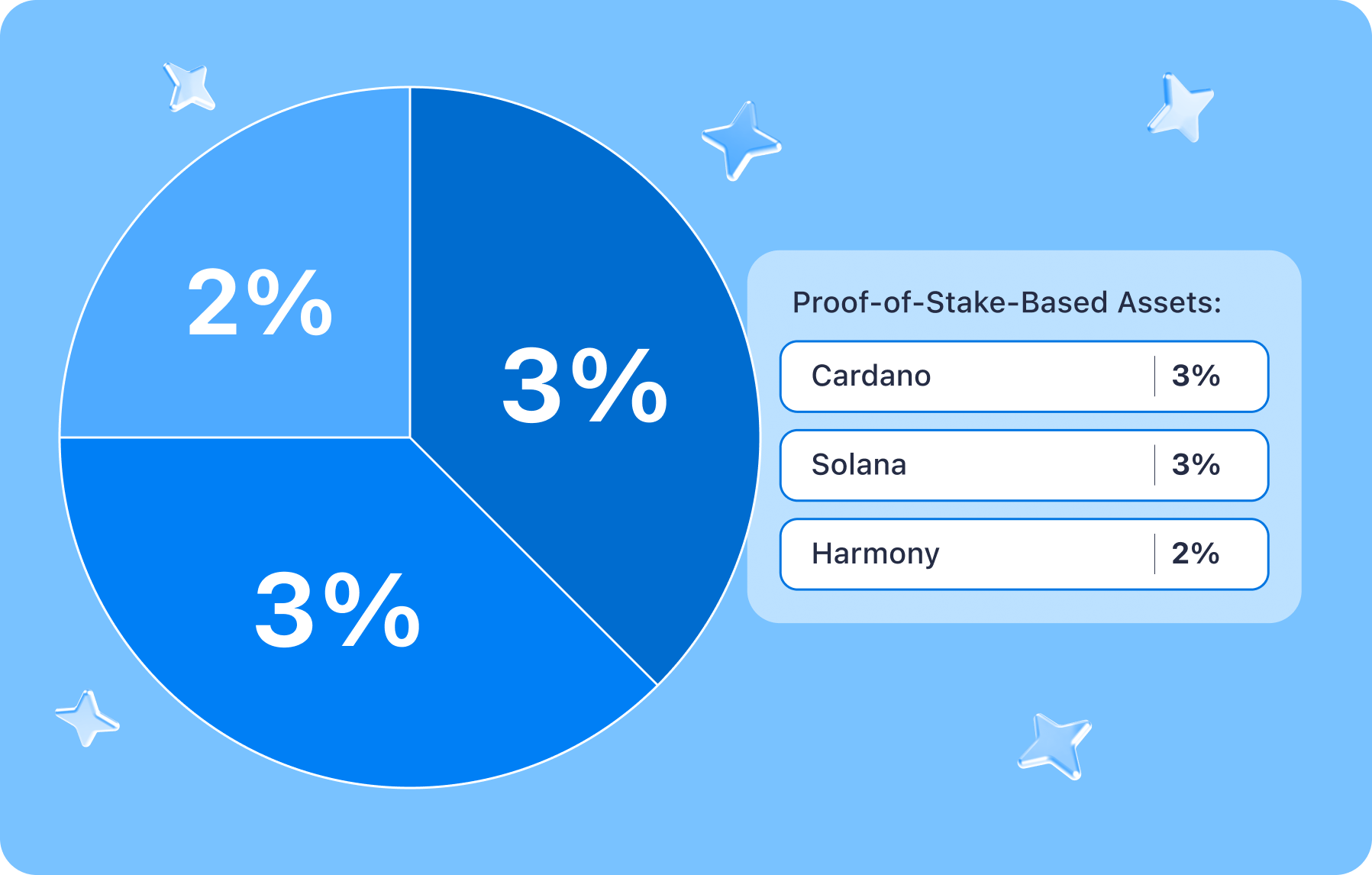

Proof-of-Stake-Based Assets

- Cardano (ADA): 3% of portfolio. Blockchain with a focus on security and scalability.

This blockchain aims to provide a high degree of security and the ability to scale to support a variety of dApps.

- Solana (SOL): 3% of portfolio. A high-performance, low-latency blockchain for dApps.

SOL cryptocurrency is fast and has low transaction costs, which could open up new use cases for blockchain and accelerate the growth of innovative DeFi products.

- Harmony (ONE): 2% of portfolio. Blockchain for improved performance and scalability.

Harmony is a blockchain that utilizes the Proof-of-Stake algorithm to ensure the security and efficiency of its network. ONE is the native cryptocurrency of the Harmony network, serving as a multi-purpose token.

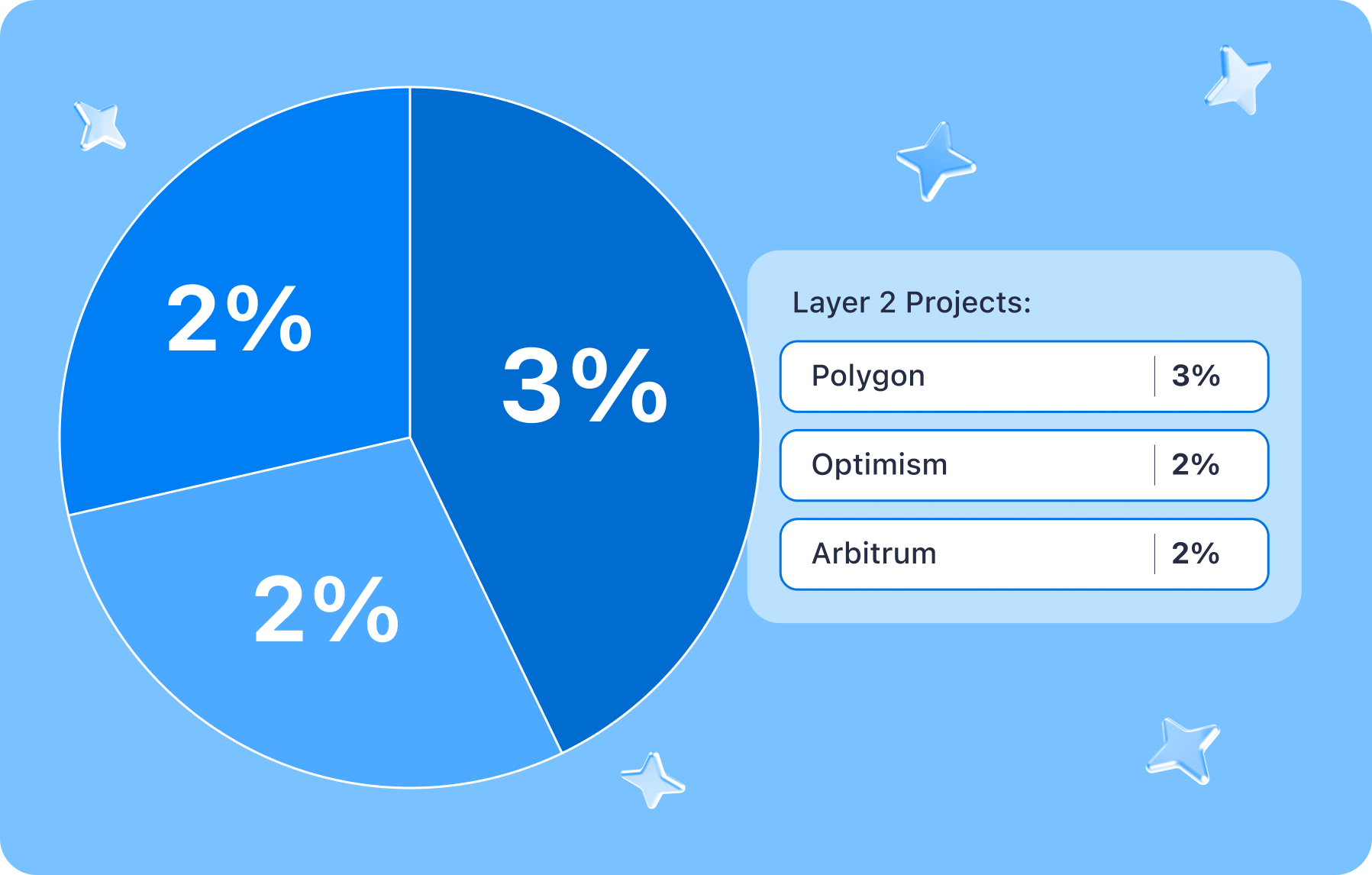

Layer 2 Projects

- Polygon (MATIC): 3% of portfolio. A scaling and cost reduction solution on the Ethereum blockchain.

This protocol improves the performance and efficiency of Ethereum by enabling faster and cheaper transactions.

- Optimism (OP): 2% of portfolio. A platform for improving Ethereum performance.

This project aims to increase Ethereum's bandwidth, reduce transaction fees, and make the network more scalable.

- Arbitrum (ARB): 2% of portfolio. A platform for fast and low-cost transactions on Ethereum.

Arbitrum is an Ethereum scaling platform that enables the creation of dApps with high performance and efficiency.

Crypto Portfolio Management

- Rebalancing

The crypto portfolio is reviewed and rebalanced every 6-12 months. This allows crypto market participants to adapt to market changes, new technologies and regulation while maintaining an optimal asset mix.

- Monitoring

Careful analysis of the crypto market and regulatory changes helps to respond to potential risks and opportunities in a timely manner.

- Long-term outlook

The crypto portfolio management strategy is focused on long-term investments, given the expected growth of core cryptocurrencies (BTC and ETH) and innovative technologies in the sector.

Users can get coins mentioned in this article on SimpleSwap or via the widget below this article.

Summary

This approach to cryptocurrency portfolio management is designed for investors who are ready for the diverse opportunities and challenges of the crypto market, seeking stable growth of their investments while minimizing risks.

A well-constructed crypto portfolio balances risk and reward across various blockchain projects.

The goal of this crypto portfolio strategy is to create a stable, high-yielding diversified portfolio that can endure market fluctuations and capitalize on growth opportunities.

This is achieved through crypto portfolio diversification and systematic rebalancing, asset allocation among core cryptocurrencies, infrastructure projects, DeFi projects, Proof-of-Stake-based assets, and Layer 2 projects.

Regular rebalancing every 6-12 months ensures the crypto portfolio adapts to market changes and new technologies, while continuous monitoring addresses risk management and opportunities.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.