ETH Staking on Lido

Key Insights

- Lido Finance allows staking ETH to earn rewards without running validator infrastructure by getting stETH tokens representing the staked ETH.

- To start earning, send ETH to Lido Finance, confirm the transaction, and receive stETH that generates validator rewards.

- stETH can be added to Curve pools like ETH/stETH to further increase yields, while maintaining the ability to withdraw the original ETH. Holders can swap stETH to ETH in these pools.

Lido Finance is a project that allows users to benefit from staking Ethereum without having to have its own infrastructure. Instead, users can stake their ETH with Lido and then receive the validator rewards for their share of the staking. This brings the users passive income and helps to keep ETH in a safe place.

It is important to remember that interacting with the Ethereum blockchain requires a fee for each transaction.

What is Lido Finance

Lido Finance is a platform that allows users to earn rewards from staking their crypto assets without actually locking them up. This process is called liquid staking. With this platform, users can deposit their Ethereum and receive Lido crypto in return. These Lido tokens represent the users' stake in the Ethereum network and can be freely traded at any time while still earning the users Lido staking rewards.

The Lido platform is managed by Lido DAO, a decentralized autonomous organization. Lido DAO stakes users' ETH and issues Lido tokens in return. Lido staking rewards come from the rewards Lido DAO earns by running Ethereum validator nodes.

In other words, Lido DAO provides a liquid staking solution specifically designed for Ethereum, allowing users to stake proof-of-stake (PoS) cryptocurrencies trading their staked assets freely while still earning staking rewards.

The process works by issuing a tradable token that serves as a receipt for the staked crypto when users stake through Lido. In addition to Ethereum beacon chain, Lido supports liquid staking for Solana, Kusama, Polygon, Polkadot, and Terra Classic.

LDO, an ERC-20 token on the Ethereum blockchain, has a few key uses. LDO enables users to participate in governance, manage fee features and distribution, and control the number of node operators.

How to Perform ETH Staking on Lido

Lido ETH Staking Rate

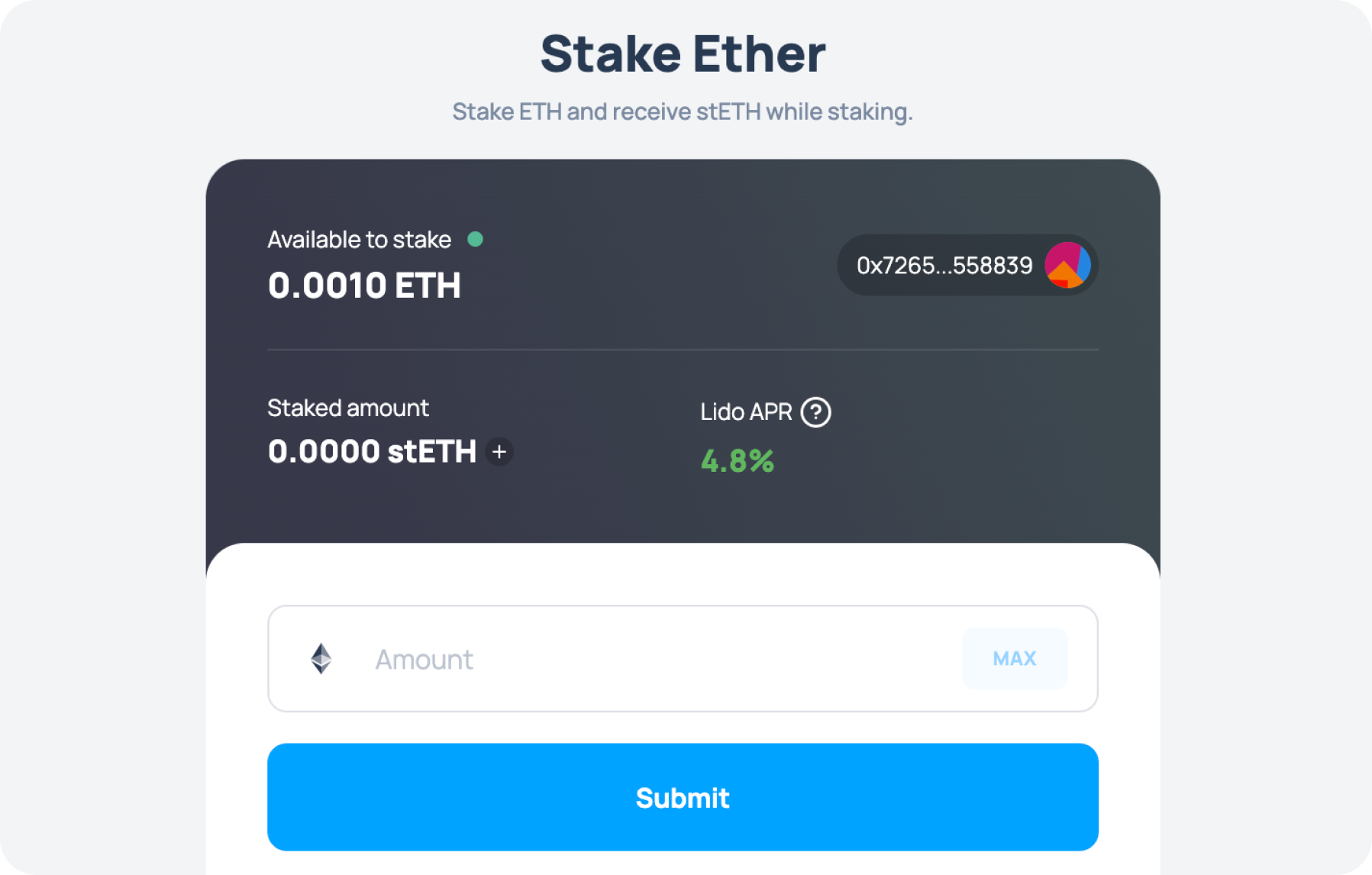

- Go to Lido Finance

Choose the Stake ETH option or Stake on the right.

Choose the amount of ETH to stake

Select your wallet to connect to Lido Finance

You can choose any wallet that supports Ethereum network, for instance, Metamask or Ledger.

- Confirm the transaction in your wallet

After that, your ETH will be blocked for staking on Lido Finance.

- Get stETH

Once your Ethereum tokens are locked into staking, you will receive Lido stETH, which is a share of the validator rewards. You can store stETH in your wallet and earn income from staking.

If you want to withdraw your funds, just sell your stETH on the exchange of your choice. Your original ETthereum coin will be unlocked and returned to your wallet. While staking ETH through Lido Finance may have risks such as losing funds as a result of a hack, Lido allows one to earn passive income with minimal effort.

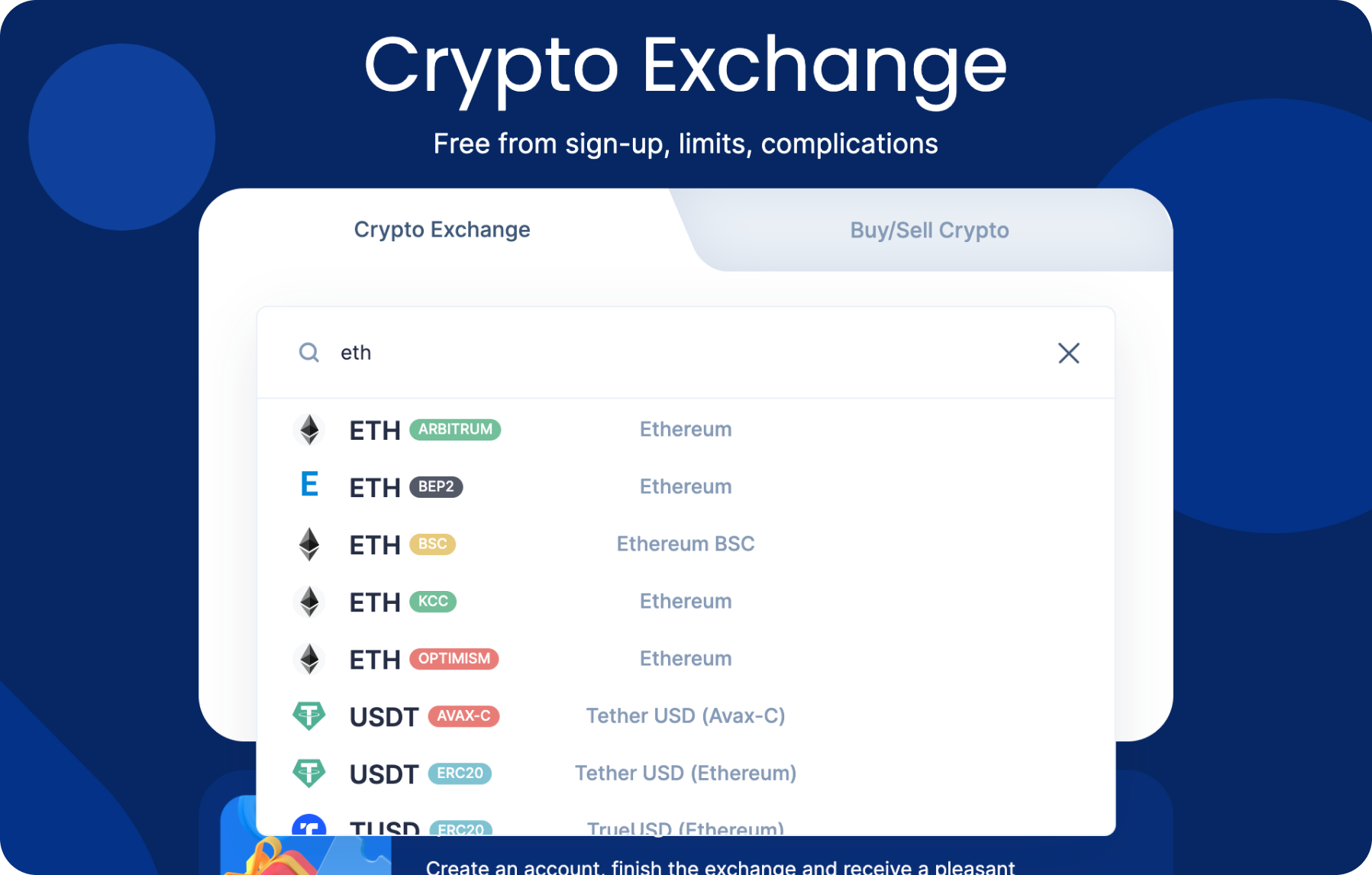

ETH Switching Between Blockchains

The Lido project uses the Ethereum blockchain for ETH staking. If you are accumulating ETH in the form of a token on any other blockchain but want to send them to work, here’s an easy way to do this.

- Go to SimpleSwap and choose tokens to exchange

For example, you want to exchange ETH (Arbitrum) for ETH.

- Click Exchange

Check the amount you will receive after the exchange. Make sure you agree with the exchange rate and the commission.

- Enter your wallet address and confirm your transaction

Send your tokens to the address. You’ll then need to wait for the confirmation of the transaction, which may take some time, depending on the speed of the network.

- Get ETH

Once the cross-chain transaction is confirmed, you will receive your ETH to the Ethereum wallet address you provided.

Exodus ETH staking is also a popular way for ETH holders to earn rewards on their holdings. The Exodus wallet offers an easy-to-use staking feature that allows users to stake ETH within the wallet interface.

Exodus ETH staking provides a straight-forward way to earn passive income without needing to interact directly with complex staking protocols.

To convert stETH back to liquid ETH, users can utilize decentralized exchanges. On these platforms, traders can easily swap stETH to ETH by connecting their wallet. This allows stETH holders to unlock the liquidity of their staked ETH whenever needed. Overall, stETH to ETH swaps provide flexibility for users of staking services like Lido.

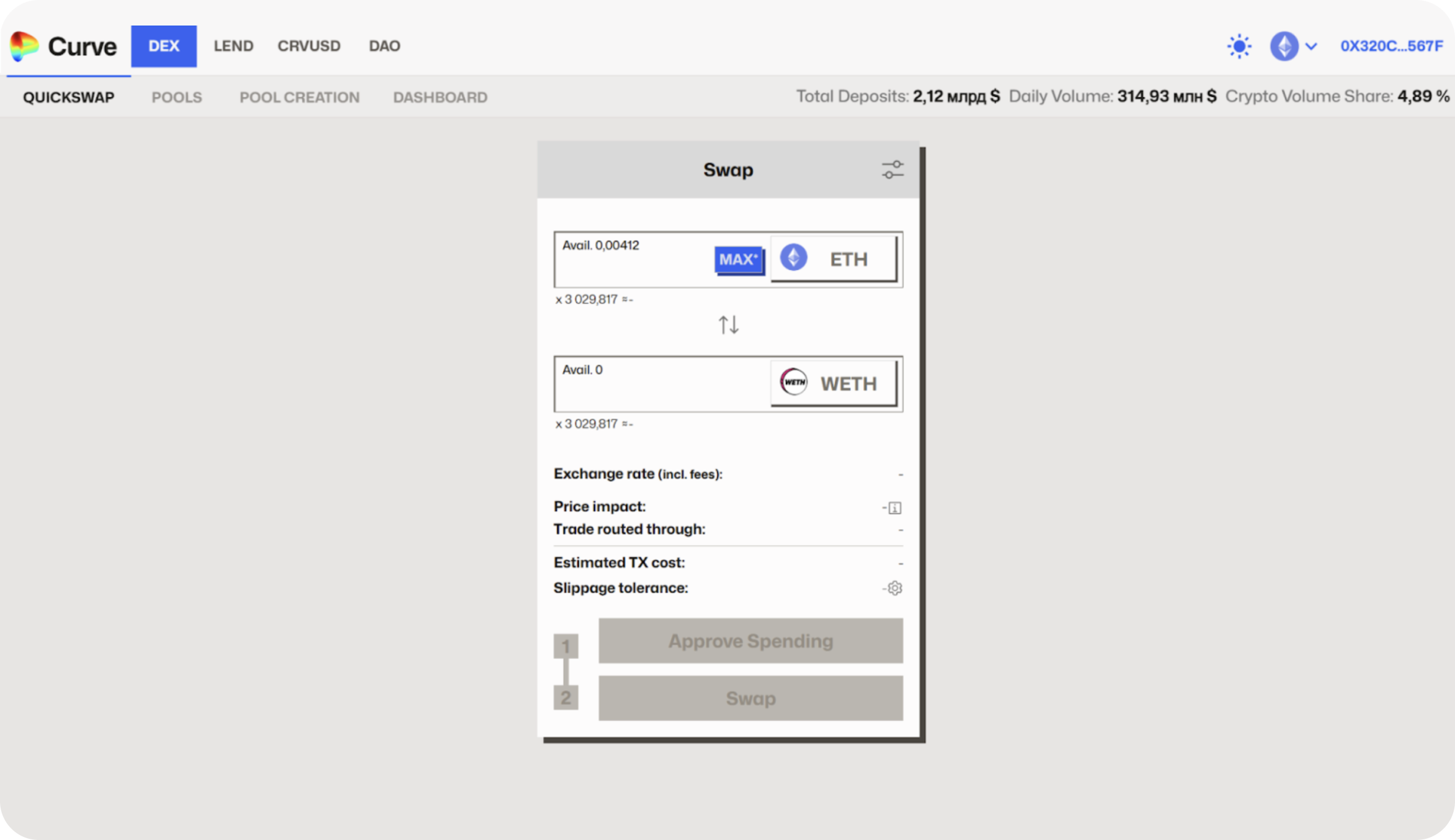

Adding stETH/ETH to a Pool

You can also add your stETH to the pool on Curve and earn even more.

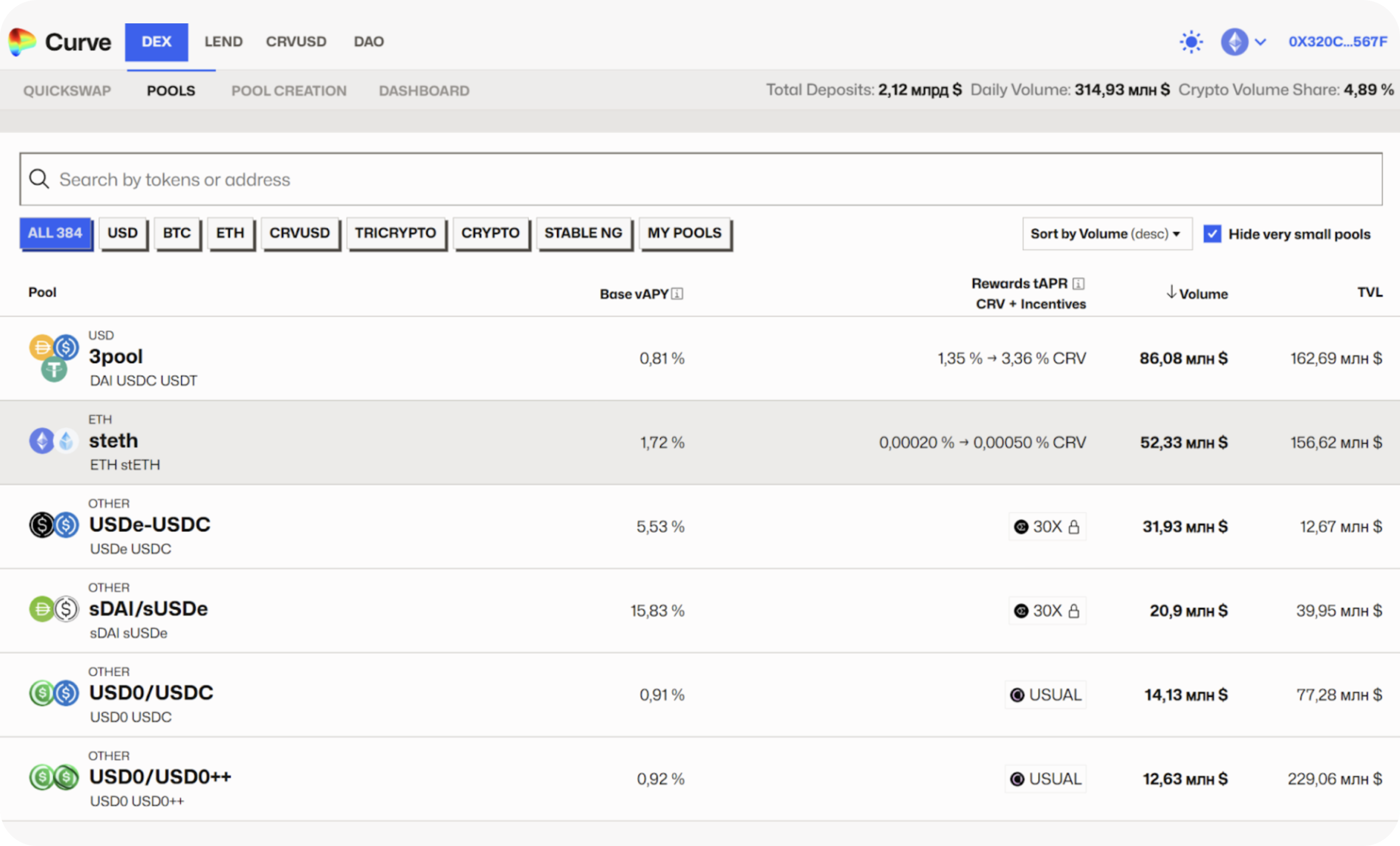

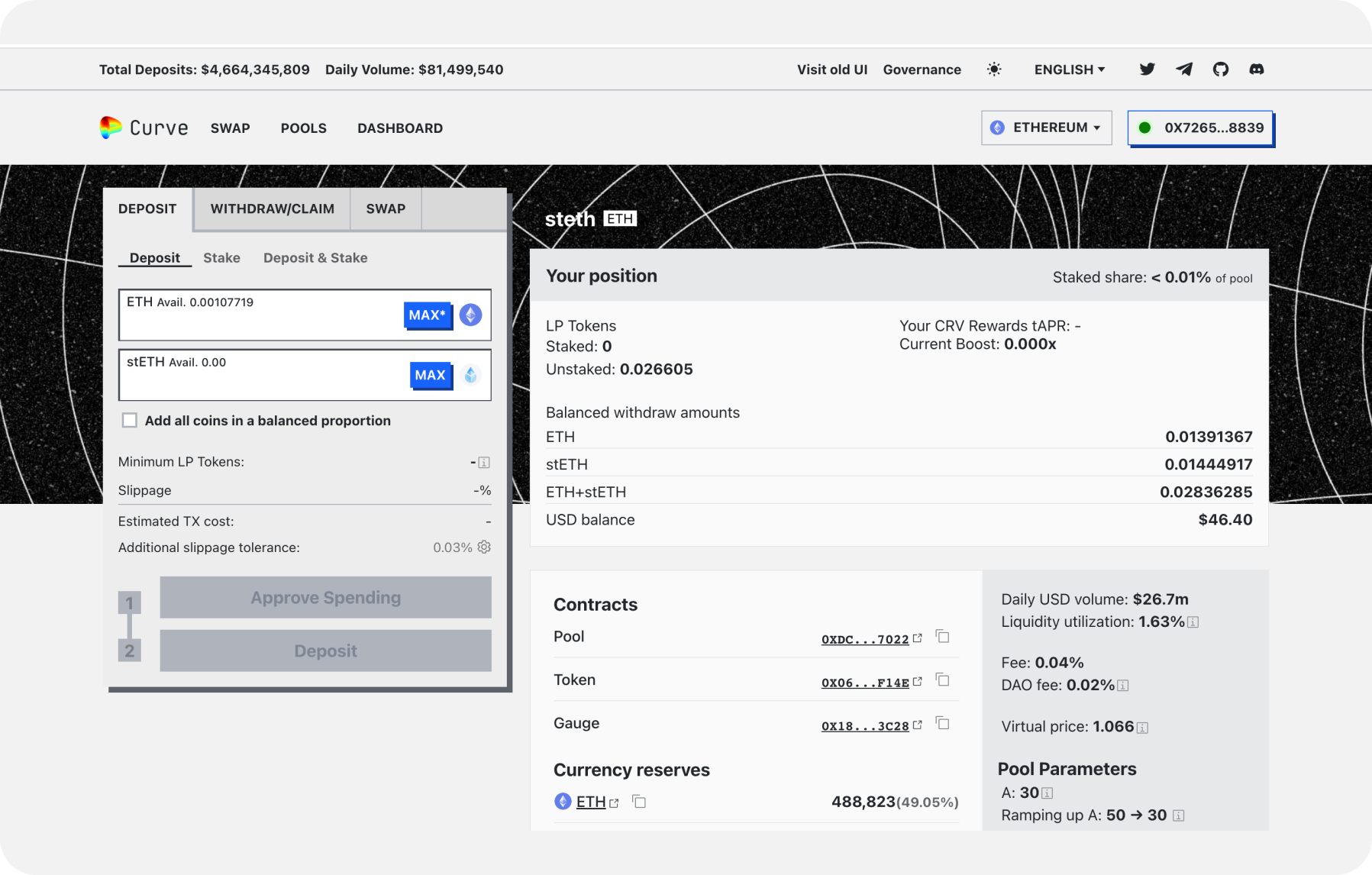

- Go to curve.fi and press Pools

- Choose a pool

Select the ETH/stETH pool to receive income in ETH and exchange stETH to ETH.

Click Deposit

- Enter the amount of stETH to add to the Lido finance pool

Confirm your transaction and wait for the confirmation of it, which may take some time, depending on the speed of the network.

After adding stETH to the pool, you become the owner of pool tokens in exchange for your stETH. To earn income, you must store your tokens in a pool. Each time new revenues are generated in the Lido staking pool, a share of the revenue is generated as well and distributed among all pool token holders.

- Click Withdraw (optional)

Select the amount and withdraw your tokens from the pool easily if you want to.

Please note that fees may apply in the process of adding stETH to the Lido finance pool and generating income. The exchange rate may change depending on market conditions. Make sure you understand all the terms and risks associated with adding stETH to the pool at Curve before making a trade.

Users can get LDO, ETH and any other coin for fiat or crypto on SimpleSwap.

Summary

Lido Finance is a platform that facilitates liquid staking, enabling users to earn rewards from staking their crypto assets without locking them up. By depositing Ethereum into the Lido platform, users receive Lido tokens, representing their stake in the Ethereum network, which can be freely traded while still accruing staking rewards.

Managed by Lido DAO, a decentralized autonomous organization, Lido Finance stakes users' ETH and issues Lido tokens in return. These tokens serve as a receipt for the staked crypto, allowing users to trade their assets whileearning staking rewards.

The LDO token, an ERC-20 token on the Ethereum blockchain, allows users to participate in governance, manage fee distribution, and control the number of node operators.

In this article we also provided step-by-step instructions of how to perform ETH staking on Lido, how to switch between blockchains, and how to add stETH to the liquidity pool.

Overall, Lido Finance offers a streamlined solution for Ethereum staking, providing liquidity, earning potential, and ease of use. By leveraging Lido's liquid staking, users can optimize their yield generation while maintaining flexibility and security.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.