2024 Crypto Recap

This blog post will cover:

- The ETF frenzy

- The Year of Telegram Apps Hype

- Airdrops

- Meme Coins

- Politics and crypto

2024 is coming to an end, and what a year it was for crypto! We’ve seen unprecedented highs and unexpected lows, changes in policy, new concepts, and so much more. In this article, we’ll take a look at all of the important events that have made this year so memorable.

The ETF frenzy

The news surrounding ETFs was hard to escape in 2024. It all started, as always, with Bitcoin.

January 10: Approval of Bitcoin ETF

The approval had been long anticipated, with lots of applications from funds repeatedly rejected by the U.S. Securities and Exchange Commission (SEC). In the fall of 2023, the market was drowning in false information on ETF approvals, causing extreme volatility in Bitcoin and leading to significant liquidations for traders.

On the evening of January 9, the SEC's official X (formerly Twitter) account posted an announcement of a spot Bitcoin ETF approval.

Bitcoin reacted by surging to $48,000.

About 20 minutes later, the SEC's account issued a retraction, stating that their account had been hacked.

Following the news, Bitcoin fell by over 6% to $44,700, worsening market volatility and triggering more liquidations.

And then right after all this drama, on January 10, the SEC actually approved the spot Bitcoin ETF. The market initially rallied but then quickly reversed on January 11, closing with a significant decline. From its peak on January 11, Bitcoin fell 21% by January 23.

The chart shows the candle for the day before the approval, the rise following it, and the drop after:

Source: Trading View

March 14: Bitcoin Hits a New All-Time High

Two months after the ETF launch, Bitcoin reached $73,777, setting a new all-time high. For the first time in Bitcoin's history, this occurred before a halving, which happened on April 20.

This milestone fueled expectations of an altcoin season, attracting a wave of new investors. However, there was no altcoin rally. Instead, Bitcoin’s dominance grew, suppressing altcoin performance, which led to a long bear market. The BTC ATH stood at $107,756.83 (December 16, 2024) at the time of research.

July 22: Approval of Ethereum ETF

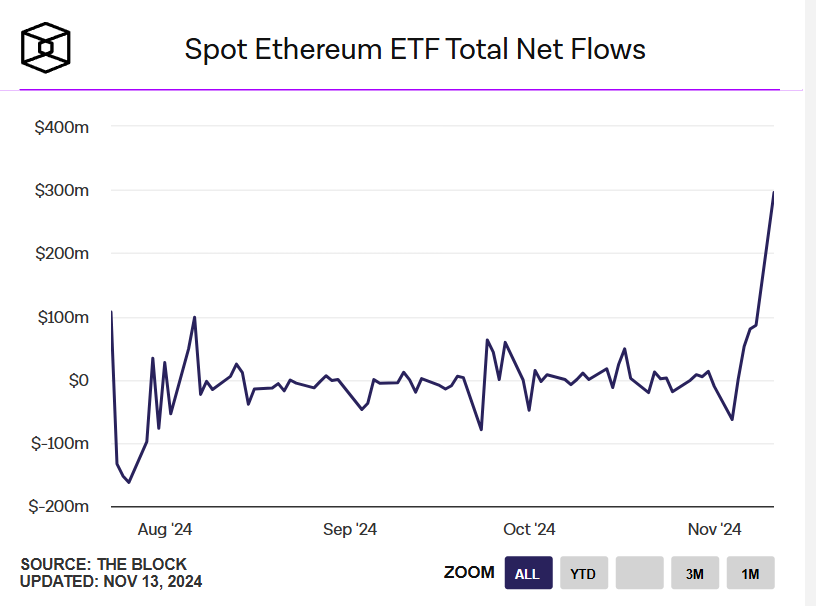

The SEC approved the first spot Ethereum ETF, sparking interest in ETH and opening opportunities for institutional investment. However, ETH's price plunged nearly 40% immediately following the ETF launch and traded sideways for three months, testing investors’ patience. Starting in November, ETH saw renewed growth as ETF inflows increased.

Source: The Block

Here you can see the spot ETF Net flows.

Source: Trading View

And here’s how the asset’s price was changing in the same time period.

The Year of Telegram Apps Hype

In 2024, Telegram mini-apps integrated with the TON blockchain became one of the biggest trends of the year. The partnership between Telegram and TON paved the way for broader adoption of crypto and Web3, engaging tens of millions of users in the blockchain ecosystem.

January: Notcoin

One of the first and most notable projects was Notcoin (NOT), which implemented a "tap-to-earn" mechanism in its mini-app. Users earned NOT tokens by performing simple actions and social tasks. For many, the Notcoin drop was an unexpected surprise, with active participants receiving tokens worth from about $200 to $300. Initially, few believed in Notcoin, and participation was limited. But once the drop was distributed, those who missed out experienced FOMO, while participants became obsessed, tapping around the clock.

The success of Notcoin and the listing of its tokens sparked a wave of new Telegram mini-apps.

March: Hamster Combat

As the Telegram hype grew, Hamster Kombat became one of the most discussed TON blockchain mini-apps. Its initial results were impressive: 300 million registered players, 32 million daily active users, and over 55 million connected TON wallets. Expectations were high for Hamster Combat to follow in Notcoin's footsteps.

However, the HMSTR token drop disappointed most users, leading to panic, tears, and widespread complaints in the community. Despite six months of relentless tapping, participants received drops worth only $10–40. Safe to say, the success of Notcoin was not repeated.

The airdrop criteria covered 129 million players, but the rewards fell far below expectations. The token's listing on major exchanges like Binance further disappointed users. HMSTR's price plummeted 31.4% within an hour of listing and ended September down 50.4% from its starting price.

The small airdrop rewards and rapid price decline led to heavy dissatisfaction, marking Hamster Combat as one of the year’s biggest letdowns.

Airdrops

Now is the good time to discuss airdrops, something that captured so much attention in 2024, and for a good reason.

February: StarkNet Airdrop

In 2023, the Layer 2 Ethereum solution Arbitrum shocked the community with a generous retroactive airdrop, starting a new era of such rewards. Inspired by Arbitrum’s success, many joined the race for free tokens from new projects.

When a promising Layer 1 or Layer 2 project, such as StarkNet (L2 for Ethereum), is under development, the community starts creating wallets and performing various activities in the testnet, followed by the mainnet. This helps the development team attract active users, generate organic engagement, and even collect transaction fees within the network. As a reward for participation and support, the team often distributes tokens through retroactive airdrops.

However, as retroactive airdrops gained popularity, services offering help with completing required activities appeared. These services created wallets and automated tasks using scripts. Such artificial accounts are called sybils. They, of course, didn’t help achieve the project’s goals because the activities were performed for profit, not genuine network use.

Additionally, the market saw an influx of users who created dozens, hundreds, or even thousands of wallets. They performed minimal activities on each account, hoping to qualify for drops on every one of them.

StarkNet launched on the mainnet in February 2024 and distributed its long-awaited STRK token. The airdrop included a strict condition: wallets had to hold at least 0.005 ETH. This excluded many sybil accounts and caused frustration among "drop hunters" who expected larger rewards.

ZkSync, Scroll and L0 drops

In 2024, the highly anticipated airdrops from major projects like ZkSync, LayerZero, and Scroll captured significant community attention. ZkSync and LayerZero distributed their tokens in June, while Scroll followed in October.

If we skip the details, the conclusion is straightforward: they all fell short.

Initially, enthusiasm for retroactive airdrops was high, with users actively participating in testnets, creating wallets, and completing various tasks. However, after the token distributions, community sentiment changed. Expectations weren’t met, leaving many airdrop hunters disappointed with the token amounts they received.

Ironically, despite the criticism StarkNet faced during its airdrop in February, the community now thinks it’s one of the best of the year in contrast to the underwhelming distributions by ZkSync, Scroll, and LayerZero.

HYPE drop

In November, Hyperliquid’s HYPE token airdrop became the largest in crypto history by paper value. With over 94,000 eligible addresses and 87% of the 310 million tokens claimed, the total airdropped value stood at $7.6 billion in December 2024. The DeFi platform surprised the crypto community with this generous drop, especially with the more established projects falling short.

Meme Coins

This year will be remembered for its meme coin obsession. Early gains from SHIB, PEPE, DOGE, and FLOKI were followed by explosive growth in newer coins. For example, the GOAT token skyrocketed by 250,000% in just two weeks.

After the U.S. elections, Trump announced the creation of a DOGE Department led by Elon Musk. DOGE surged 200% in a week following Musk’s tweet.

The Rise of Memes and the Decline of Structural Projects

Meme coins thrived despite lacking technological innovation, driven by virality and strong communities. Meanwhile, fundamental projects like StarkNet, ZkSync, and Avalanche suffered significant losses. STRK, for instance, dropped over 70% from its post-listing high and remained in the $0.40 range for months.

Some believe that major players might intentionally suppress the prices of more serious projects to eventually redirect investors' capital toward riskier and less technologically advanced assets, such as meme coins.

Others argue that meme coins represent a new cryptocurrency economy where the demand for technology and innovation takes a back seat to the demand for entertainment and play. In this reality, riding on emotions, trends, and memes can become just as significant a part of the crypto market as technological innovation.

In either case, this phenomenon highlights fundamental shifts in how cryptocurrencies and blockchain projects are perceived in 2024, where hype and spectacle can play just as crucial a role as innovation and technology.

Politics and crypto

This year, another thing that hugely impacted crypto was politics.

September 17: Federal Reserve Rate Cut

The U.S. Federal Reserve lowered its base interest rate by 50 basis points to a range of 4.75%-5.0% in September. This marked the first rate cut since 2020 and increased investor confidence in crypto as suitable assets in a low-rate environment.

November 7: Another Fed Rate Cut

The Federal Reserve lowered interest rates by 0.25 basis points once again in November, positioning cryptocurrency assets as a possible alternative to traditional investments.

November 5: Bitcoin Sets a New Record Post-U.S. Elections

Donald Trump's election victory coincided with Bitcoin rising to $76,400, eventually reaching $90,000 by November 12. During the Bitcoin2024 conference in the summer, Trump promised favorable conditions for the crypto industry, which fueled market optimism.

Key Trump’s cryptocurrency promises include:

Introducing Bitcoin as a Strategic Reserve for the U.S.: This is supposed to make the country’s economic position stronger on the global stage.

Ban on Creating CBDCs: In response to concerns over state-controlled digital currencies, Trump pledged to block the introduction of a digital dollar, ensuring citizens' financial independence.

Firing Gary Gensler: Trump promised to remove SEC Chair Gary Gensler, who has faced criticism for his strict regulation of the crypto industry, and replace him with more crypto-friendly officials.

Making the U.S. the Crypto Capital of the World: Trump envisioned the U.S. as a global crypto hub, supporting innovation and attracting investment to the crypto industry.

Using Bitcoin to Reduce National Debt: As an unconventional step, Trump announced his plans to use Bitcoin for restructuring the U.S. national debt, demonstrating his view of cryptocurrency as both a reserve and a financial tool.

Supporting Crypto Innovation to Boost the Economy: Trump believes investing in cryptocurrencies and blockchain could elevate the U.S. economy, promoting advanced technologies.

Ending Crypto Industry Crackdowns: He promised to lift restrictions imposed during the Democratic administration, giving crypto companies the opportunity to operate freely and attract investment.

Protecting the Right to Mine and Hold Cryptocurrencies: According to him,Americans will be guaranteed the right to mine and store crypto assets without government interference.

Creating a Cryptocurrency Advisory Committee: This committee will develop legislative recommendations based on input from experts and crypto enthusiasts.

Revising Regulations for the Crypto Industry: New legislative initiatives will be crafted by specialists committed to advancing the crypto industry, leading to more favorable regulatory changes.

Well, we’ll see which promises are going to come true very soon.

These are the most important events of the year. 2024 wasn't just another year in crypto - it was the year when digital assets once again showed that they are a global financial force that everyone should take into account.

On a less serious note, happy holiday season! From our whole team - we hope that you had a wonderful and profitable year, and we wish you all the best in 2025!

SimpleSwap reminds you that this article is provided for informational purposes only and does not provide investment advice. All purchases and cryptocurrency investments are your own responsibility.