Market Overview: September 2024

This blog post will cover:

- State of the Market in September

- FED Cuts Rates as China Faces Fiscal Stimulus

- Tap-to-Earn: The End of the Trend?

- Sui Surges by 122% in September

- Conclusion

September brought unexpected gains to the crypto market, defying seasonal trends and opening new avenues for growth. In this article, we'll take a look at what happened in the market last month.

State of the Market in September

Historically, September has been a bearish month for the crypto market, with Bitcoin (BTC) averaging a price return of -5.58%. However, despite initially pessimistic outlooks this year, both Bitcoin and the broader crypto market experienced solid growth. After hitting a local low at the start of the month, BTC ended September with a 7.11% price increase. If you decide to trade, our Analytics team has prepared a guide on trading crypto, and an instruction on how to read cryptocharts.

BTC Price Performance in 2024. Source: CryptoRank

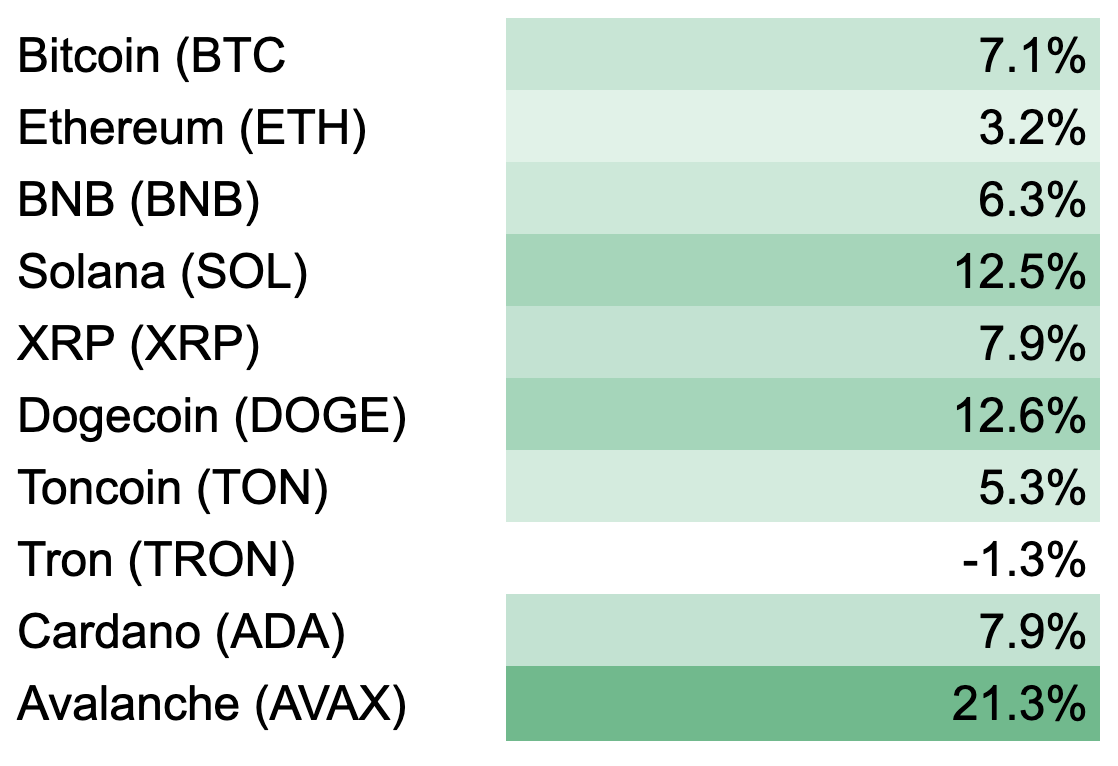

Other major cryptocurrencies followed suit, posting impressive growth:

Tron (TRX) was the only top 10 cryptocurrency (excluding stablecoins and stETH) to show a price decline, down by 1.3%. Here you can find a technical analysis of DOGE, and furthermore you can take a look at fundamental analyses of Ethereum and Avalanche.

Top 10 Crypto Assets Performance in September (Excluding stablecoins and stETH). Source: Coinmarketcap

A key metric to note is the TOTAL3 index, which tracks the total crypto market capitalization excluding BTC and ETH. In September, TOTAL3 broke through its long-standing trendline and exited its trading channel, signaling a potential rise in altcoins in the coming months. A crypto strategy that might be of use here is one emphasizing the ascending trend.

Total Crypto Market Cap Excl. BTC and ETH. Source: TradingView

BTC dominance remained high throughout the month, peaking at 54.6% before cooling to 53.2% by the end of September. High BTC dominance indicates that investors are still hesitant to buy altcoins and pursue riskier strategies in the current market environment. Bitcoin remains a truly global asset.

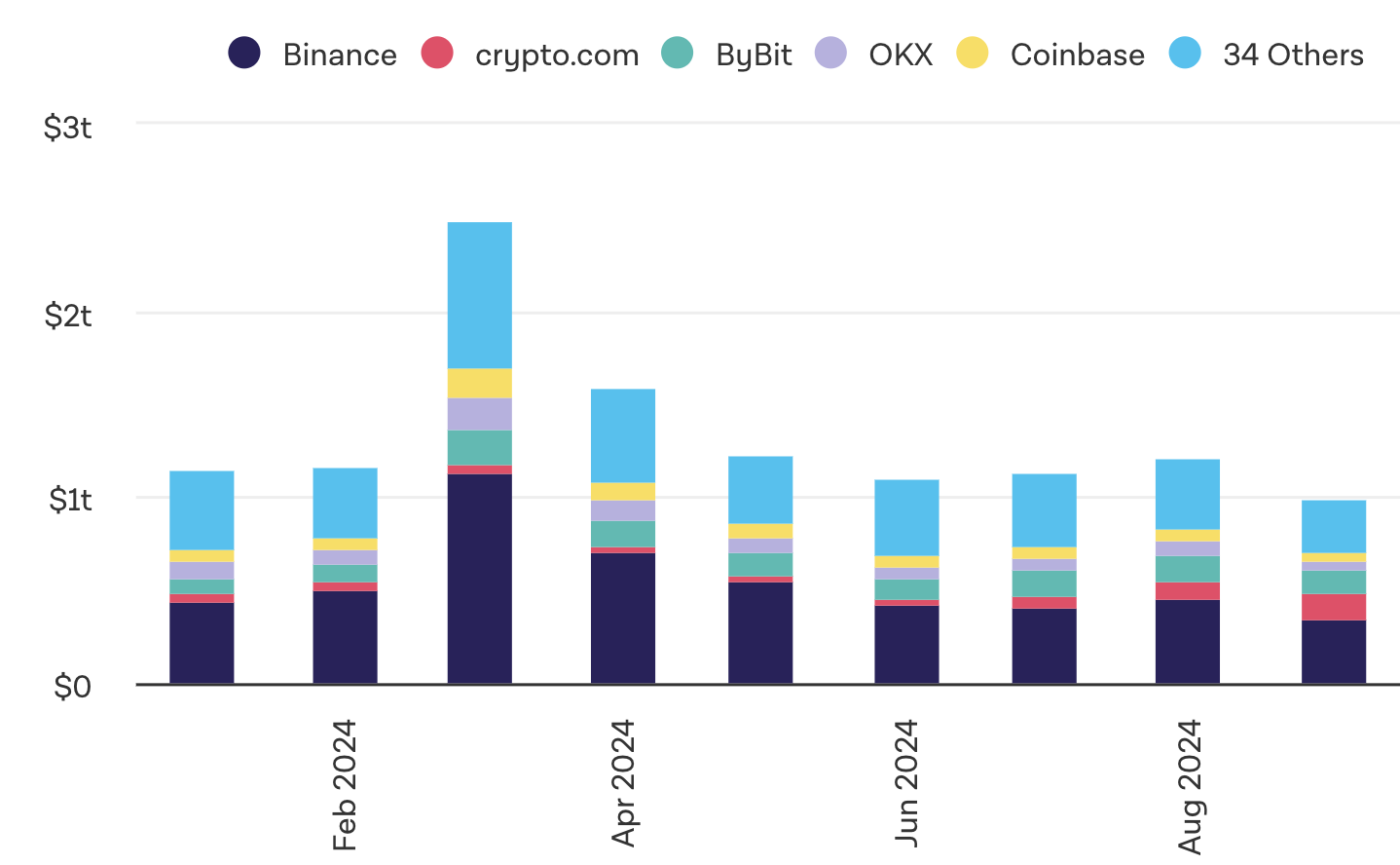

Despite the price growth of BTC and altcoins, trading volumes were notably low. The spot trading volume on leading centralized exchanges (CEX) hit its lowest level of 2024 at $987 billion. This was also the first month in 2024 when spot trading volume dropped below $1 trillion.

Spot Trading Volume on CEX. Source: The Block

FED Cuts Rates as China Faces Fiscal Stimulus

In September, two major macroeconomic developments influenced the global financial landscape:

FED’s Rate Cut: The Federal Reserve began easing U.S. monetary policy by cutting the key interest rate by 50 basis points, with another cut expected by year-end. This rate reduction, combined with growing confidence in a “soft landing” for the U.S. economy, supported by strong macroeconomic data, is a positive signal for the crypto market. Historically, lower interest rates benefit riskier assets like cryptocurrencies, as investors adopt higher-risk strategies in pursuit of greater returns. Read more about the impact of macroeconomic factors on the crypto market in our latest article. Following the rate cut news, both stocks and crypto assets reacted positively. The S&P 500 surged to a new all-time high, while Bitcoin showed more modest growth. However, the true effects of this monetary easing on the markets will likely unfold in the coming months.

China’s Fiscal Stimulus: China’s government allocated a $114 billion fiscal stimulus package to boost its economy, leading to the largest weekly gain in its stock market since 2008. Despite the ban on cryptocurrencies in mainland China, the country's economy still plays a significant role in the global crypto market. This financial boost could have a positive effect on the crypto sector in the coming months.

Tap-to-Earn: The End of the Trend?

Telegram mini-apps, integrated with the Ton blockchain, emerged as a major trend in 2024. The partnership between Telegram and Ton has paved the way for broader crypto and Web3 adoption, potentially onboarding millions of users into the blockchain ecosystem. Notcoin (NOT) led this trend by introducing the "tap-to-earn" mechanic within its Telegram mini-app. Users earned NOT tokens by completing simple activities and social tasks. The success of Notcoin and its token listing sparked a wave of new Telegram mini-apps that aimed to replicate Notcoin's success.

Hamster Combat became the most prominent project in this space, showing impressive results: 300 million players, 32 million daily active users, and over 55 million connected Ton wallets. However, the HMSTR token launch and airdrop were disappointing for most users. Only 129 million players were eligible to receive the airdrop, with an average allocation per wallet ranging from $10 to $60. The token listing on major exchanges, including Binance, was equally underwhelming. One hour after listing, the token price dropped by 31.4%, continuing to fall throughout September, ending the month with a 50.4% price loss.

HMSTR Token Price. Source: TradingView

Small airdrop allocations and the declining token price led to widespread disappointment among users. The primary motivation for participating in projects like Hamster Combat was the potential to earn money, as these apps did not provide real utility or entertaining activities. Moving forward, Telegram mini-apps need to focus more on providing utility or developing engaging mechanics that enhance user retention. The simple "tap-to-earn" model is unlikely to sustain long-term interest, so projects must prioritize user-friendliness and genuine value.

The highly anticipated launch and token drop of Blum are worth keeping an eye on, as they focus on delivering real value and utility for users. If successful, Blum could inspire a new generation of consumer apps integrated with blockchain technology within the Telegram ecosystem.

Overall, despite setbacks in the tap-to-earn space, the Telegram ecosystem and Ton blockchain remain significant trends that deserve close attention. With more emphasis on utility and engaging content, these platforms could lead the way for innovative blockchain-based applications in the future. Here you can gain extra knowledge on the surge of derivatives DEXs.

Sui Surges by 122% in September

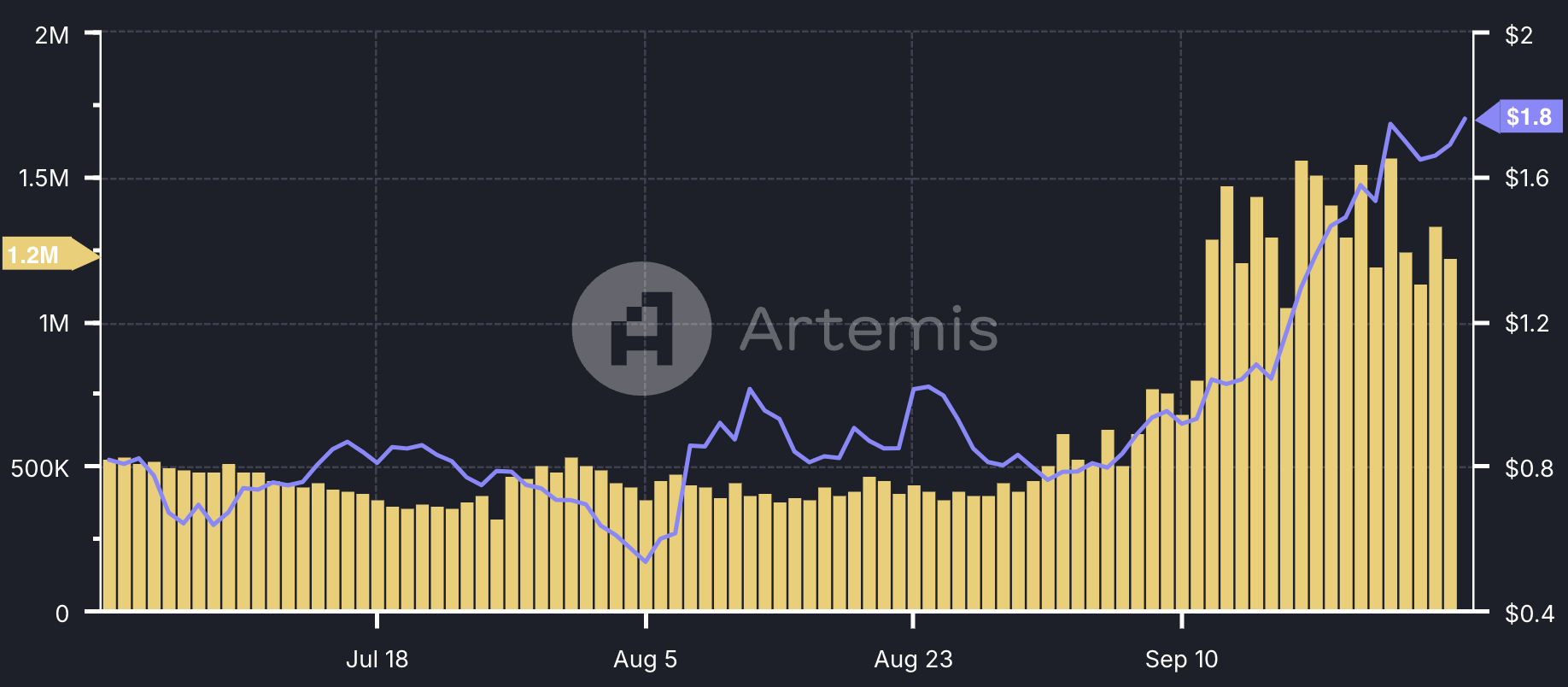

Layer 1 blockchain Sui (SUI) emerged as one of September’s top gainers, with a 122% price surge. Sui's increasing popularity is due in part to its use of the Move programming language, which enhances smart contract security and enables parallel transaction execution. Sui saw significant growth in the DeFi, memetrading (SimpleSwap’s Analytics team prepared a guide on memecoin trading which you can find here), and SocialFi sectors, with active addresses on the network increasing from 511,000 to over 1 million. Moreover, we have a TradingView account where SimpleSwap’s analysts share trading scenarios every week (please note that they do not constitute any financial advice).Feel free to use it as a source for new trading ideas.

Sui Active Addresses and Price. Source: Artemis

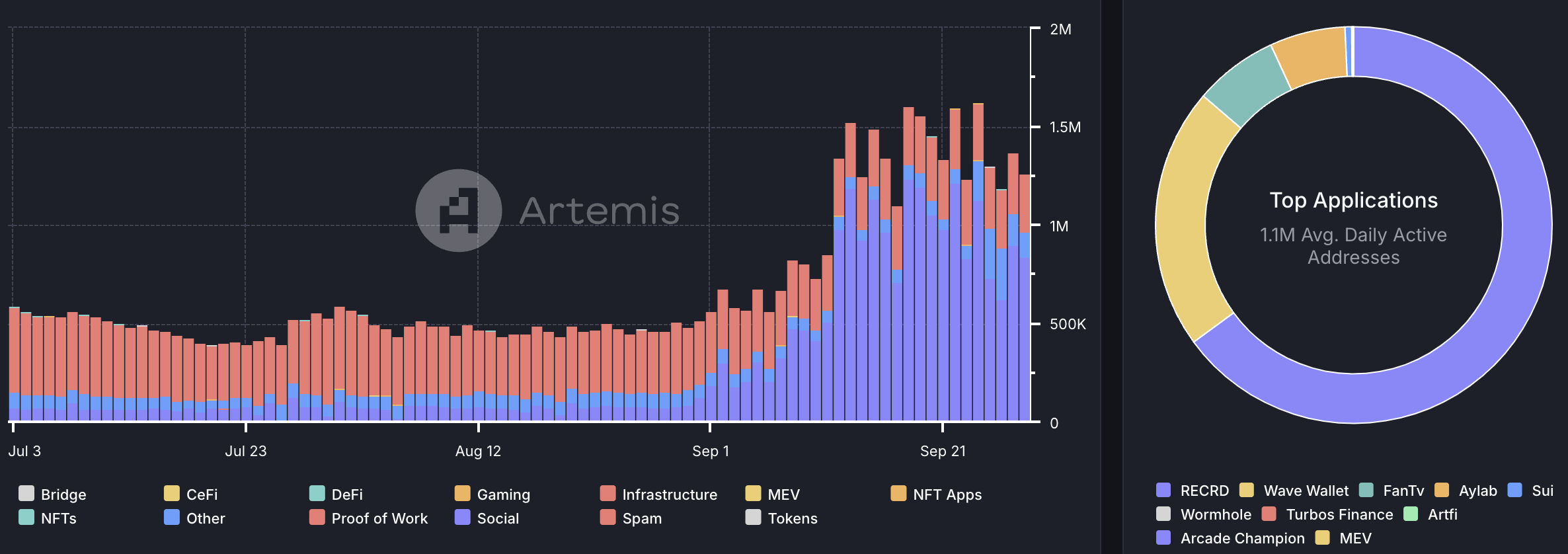

A key driver of this growth was RECRD, a new video-sharing platform on Sui that allows creators to monetize content as tradable digital assets. RECRD was responsible for nearly 60% of Sui’s active addresses in September. To gain further knowledge on Sui, please see its fundamental analysis that our Analytics team has prepared.

Sui Active Addresses by Categories. Source: Artemis

Conclusion

September 2024 marked a turning point for the crypto market, showing signs of recovery after months of decline. Positive macroeconomic factors, such as U.S. rate cuts and China’s fiscal stimulus, contributed to a more optimistic outlook for the coming months. Historically, Q4 has been favorable for the crypto market, and we may see further growth in Bitcoin and altcoins during this period.

However, geopolitical uncertainties and the upcoming U.S. presidential elections could still impact market dynamics. Investors should remain cautious and thoroughly assess all risks before making any financial decisions.

SimpleSwap reminds you that this article is provided for informational purposes only and does not provide investment advice. All purchases and cryptocurrency investments are your own responsibility.