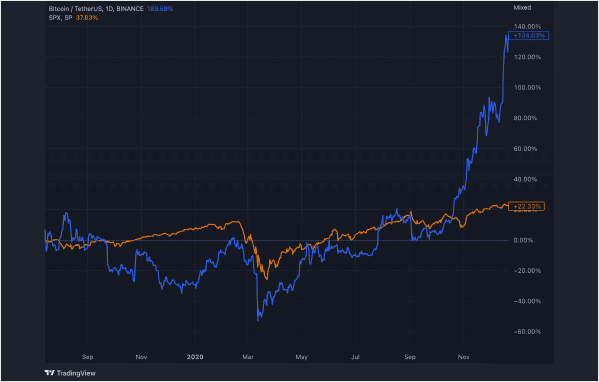

BTC and S&P 500 Indexes Correlation

Key Insights

- The increasing interest in crypto among investors drives demand for both BTC and S&P 500 stocks, thus the correlation with stocks rises.

- The growing integration between the crypto and tech sectors, with companies like PayPal adopting crypto, boosts interest in Bitcoin and S&P 500 tech stocks.

- Global economic factors may prompt investors to seek diversifying assets, driving their prices up together.

The correlation between Bitcoin index and the S&P 500 leading US stock exchange index has been noted over the past few years. While there are many factors that influence both traditional market and crypto market movements, there are several possible reasons why Bitcoin and the S&P 500 move together.

The graphs here and below are taken from TradingView (SimpleSwap’s financial analyst provides market ideas and scenarios, check it out for more information).

The relationship between Bitcoin and the S&P 500 may be due to the growing interest in digital currencies among investors. There is an opinion that many of them are investing in Bitcoin as an alternative to traditional assets such as stocks.

If this is true, the increase in interest in Bitcoin could lead to an increase in demand for shares, including companies of the S&P index.

Further BTC & S&P 500 Indices Correlation Factors

It should be noted that the interaction between cryptocurrency market (namely BTC index) and the technology sector has only been expanding. Cryptocurrencies have become popular with technology companies looking for new ways to finance their services. Companies like PayPal have already integrated crypto into their payment systems.

If the technology sector continues to accept crypto, this could lead to an increase in the shares of S&P 500 index high tech companies.

Last but not least, there are global economic factors such as inflation and market uncertainty. Investors may seek safety in alternative assets such as gold and Bitcoin. In this case, the rise in Bitcoin cryptocurrency price could coincide with the rise in the price of gold and other “safer” assets. Such assets can be purchased for crypto or fiat on SimpleSwap.

If equity markets face uncertainty, as happened during the COVID-19 pandemic in 2020, investors may stop taking risks and start selling stocks. This could lead to a fall in the S&P 500 index and an increase in demand for Bitcoin.

Thus, the correlation between Bitcoin and the S&P 500 may be present due to

- Growing interest in crypto

- Interaction of crypto with the technology sector

- Global economic factors (inflation, volatility, etc.)

However, this correlation doesn't mean a causal relationship between Bitcoin and the S&P 500 movements. It could just be a coincidence. Markets have their own dynamics and do not always move together. Despite this, an investor can't ignore the possible correlation between Bitcoin and the S&P 500. It should be noted that if this correlation does exist it’s also important for crypto investors to know how S&P indices, in turn, affect the BTC cryptocurrency price (for instance the fall in S&P index might lead to a increased demand for Bitcoin).

Summary

If you are interested in investing in Bitcoin, you need to consider the correlation between BTC stock and S&P 500 stock when building your portfolio. If two assets move in the same direction, an investor can use one asset (in our case, Bitcoin) as a hedge to protect their portfolio from potential risks in the market of another asset (in our case, S&P 500).

The correlation between Bitcoin and the S&P 500 can be explained by several factors. While these factors don't guarantee Bitcoin and S&P indices will move in the same direction, but knowing the correlation between crypto market and traditional financial market are important for investors who want to make informed investment decisions.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.