Ripple Fundamental Analysis

Key Insights

- Ripple benefits from a large market cap and liquidity for its XRP token, but faces risks related to regulation, competition, and potential centralization issues.

- Ripple has an active developer community working to improve the protocol, but needs to attract more users and partners for long-term success.

- Partnerships with financial institutions help drive XRP utility and financial stability, but market volatility and regulatory uncertainty remain key challenges.

What Is Ripple

Ripple was crafted as an open and decentralized blockchain-based protocol.

Its core mission was to streamline global payments and transfers by obviating the need for intermediary banks, thus significantly reducing time lags and transaction costs. This approach of the Ripple project empowered banks and payment providers to swiftly and securely transfer funds.

Project History and Founders

The history of the Ripple project dates back to 2012 when Ryan Fugger, Chris Larsen, and Jed McCaleb came together to establish OpenCoin, later rebranded as Ripple Labs.

Ripple Labs' vision was to develop a cutting-edge protocol for seamless money transfers worldwide, featuring swift transactions with minimal transaction fees.

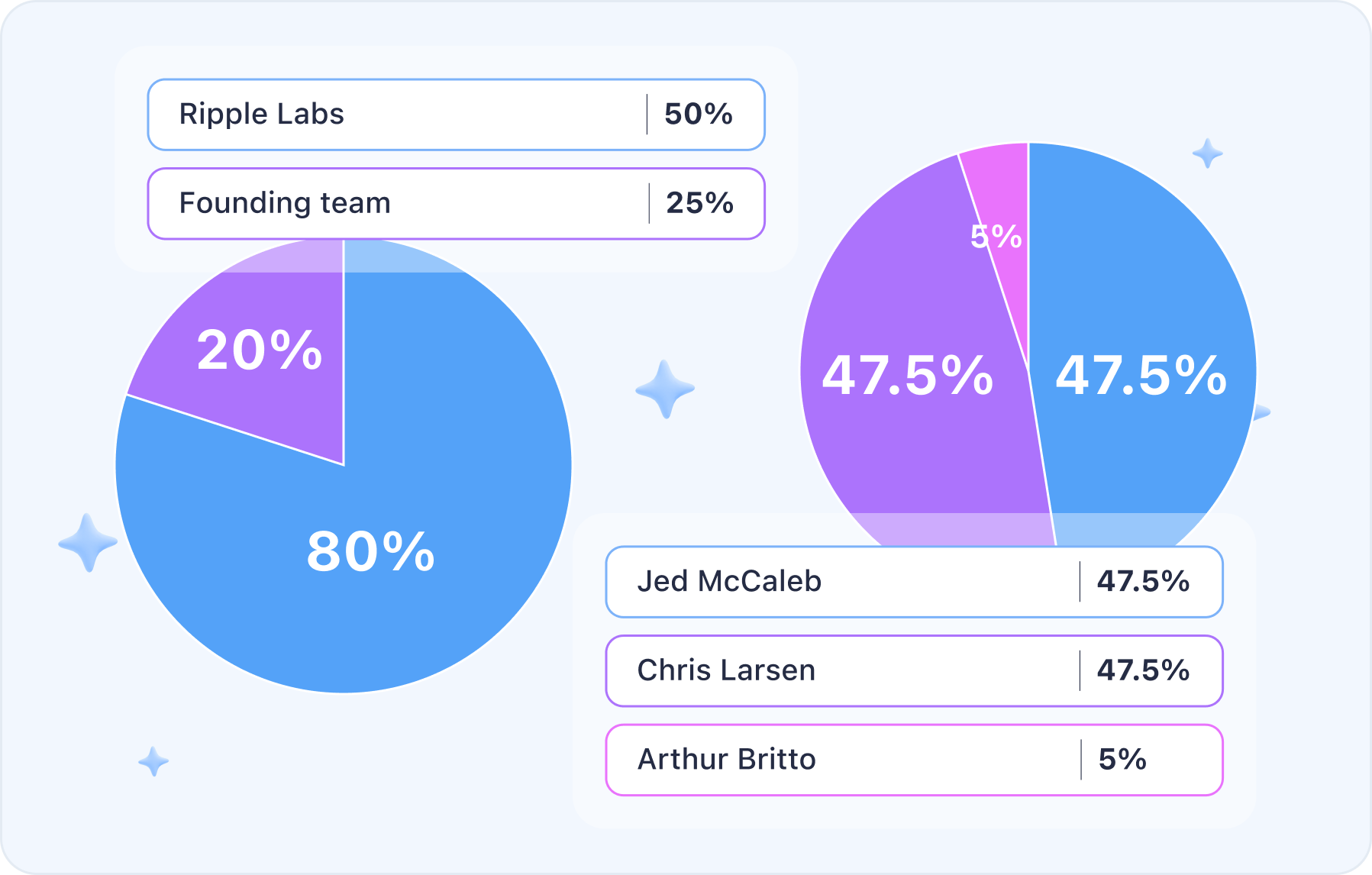

Initial Token Distribution and Ripple Market Cap

The initial distribution of XRP tokens took place in 2012, with a release of 100 billion XRP tokens. Rather than being offered through a public crowdfunding campaign, a substantial portion of the tokens was allocated to Ripple Labs' founders and diverse investors.

Users can get XRP tokens on SimpleSwap.

Nonetheless, a strategic Ripple token release program was unveiled, designed to maintain market liquidity and encourage the protocol's widespread adoption.

Ripple Labs devoted significant efforts to forging partnerships with major financial institutions and banks, effectively disseminating Ripple technology on a global scale. This resulted in an upsurge of involvement in the protocol, with XRP serving as a bridge currency for exchanging various assets on the platform.

As of the present, the Ripple market cap (XRP) stands at an impressive $36,599,177,130, securing its prominent position as the 5th most valuable crypto in the market. The Ripple protocol remains in continuous evolution, alluring new partners from the financial sector seeking innovative solutions.

Ripple exemplifies a groundbreaking project, catering to the facilitation of global financial transactions and payment solutions for the world's financial institutions, while Ethereum, in contrast, is geared towards the development of dApps and smart contracts.

Competitive Environment Analysis

- SWIFT

SWIFT, a traditional financial system, facilitates international bank transfers and messaging among financial institutions.

Although SWIFT holds sway in global financial operations, its Achilles' heel lies in the exorbitant costs and time-intensive nature of international payments. Unlike Ripple, SWIFT lacks the utilization of blockchain technology, potentially impeding its efficiency and speed.

- Stellar (XLM)

Stellar (XLM), a blockchain platform co-founded by Jed McCaleb, a former member of the Ripple team, also sets its sights on providing instantaneous and cost-effective global payments.

Stellar's primary strengths lie in its focus on micro-payments and its potential to cater to banking institutions. Nevertheless, when compared to Ripple, Stellar may face challenges in terms of network participation and decentralization.

- Bitcoin Cash (BCH), Litecoin (LTC)

Bitcoin Cash (BCH) and Litecoin (LTC), as crypto spin-offs from Bitcoin, seek to address transaction speed and scalability issues. These currencies also offer capabilities for swift and economical payments. Nonetheless, Ripple crypto project maintains a distinctive edge in terms of broader adoption and application for international transactions.

- Ripple's Key Advantages

Ripple's preeminence stems from its active collaborations with major financial institutions and banks across the globe, solidifying its pivotal role in the blockchain space for international payments and fund transfers.

Backed by a robust team and unwavering investor support, Ripple's stability and trustworthiness remain unshaken.

- Ripple Key Challenges

A noteworthy concern revolves around the potential concentration of a significant volume of XRP coin in the hands of a select few holders, raising apprehensions regarding centralization and network control.

Furthermore, Ripple contends with critiques asserting that the protocol's decentralization might not be as all-encompassing as its creators assert.

Ripple continues to hold a leading position in the domain of international payment solutions and currency exchange. Nevertheless, formidable competition from other blockchain platforms and traditional financial systems necessitates ongoing evolution and refinement to sustain its market advantage.

Ripple Technology Assessment

In this section, we will examine the level of technical maturity of the Ripple project by analyzing technological solutions and innovations, the development process, and future plans.

Technical Maturity

Ripple was created in 2012, and since then, it has come a long way in its development and expansion of its technology. Ripple is boasting solutions for international payments and money exchange based on blockchain technology.

The Ripple project's level of technical maturity can be assessed as high, given its long and successful presence in the market.

Technological Solutions and Innovations

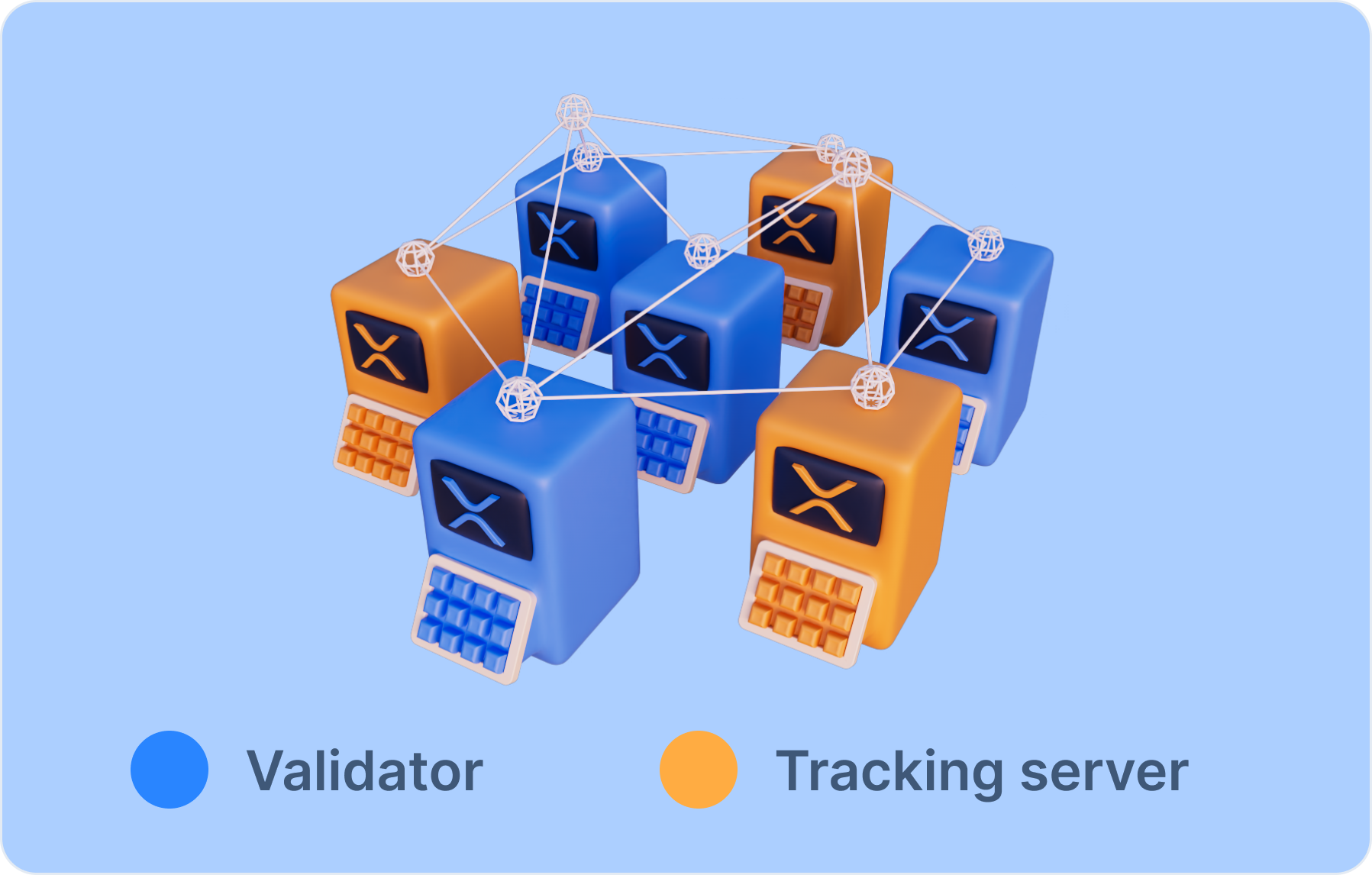

Ripple's primary innovation lies in the development of its proprietary consensus protocol known as the Ripple Consensus Algorithm (RCA) or XRP Ledger Consensus Protocol. This protocol enables swift and efficient transactions on the Ripple network, making it appealing to financial institutions and corporations.

Ripple is offering an open network, enabling swift and cost-effective money transfers spanning various countries and currencies. Notably, Ripple's technology boasts impressive transaction processing speed, usually taking around 3-5 seconds, significantly reducing waiting times for executing operations.

Moreover, Ripple positions itself as an economical option for remittances, providing low fees that appeal to users seeking savings on international transfers. These features of the Ripple network enhance its allure to a wide range of users and companies aiming to facilitate fast and budget-friendly global payments.

Development Process and Future Plans

Ripple remains dedicated to active development and continuous refinement of its technology. The Ripple Labs team, alongside the developer community, consistently endeavors to implement updates and enhance the protocol. Ripple also engages in collaborations with major banks and financial institutions, seeking seamless integration of its solutions into the existing financial infrastructure.

Looking ahead, Ripple envisions further advancements in its technology, focusing on scalability and bolstering network security. Additionally, they aim to undertake meticulous protocol optimizations to effectively address potential challenges and competition within the domain of international payments.

Ripple's technology showcases an elevated level of maturity while perpetually advancing, thereby ensuring its enduring relevance and efficacy in the realm of international financial transactions.

Ripple Project Team

The founders of Ripple Labs bring together a wealth of experience in technology and finance. Ryan Fugger's background in financial institutions, Chris Larsen's entrepreneurial ventures in the fintech sector, and Jed McCaleb's involvement in crypto and blockchain lay the groundwork for Ripple's innovative journey. The Ripple development team comprises skilled specialists in blockchain technology, cryptography, and programming.

The management of the Ripple project is characterized by professionalism and a well-structured approach. Their clearly defined goals and strategic roadmap are backed by transparent decision-making processes. The founders and senior executives actively engage with the community and partners, fostering user and partner satisfaction.

The Ripple project has a vibrant community of developers, partners, and users who actively collaborate and exchange ideas. This collaborative spirit contributes to the continuous development and improvement of Ripple's technology and reinforces the project's ecosystem. Ripple actively collaborates with major banks and financial institutions to promote its solutions and enhance the global payment landscape.

The Ripple team comprises experienced founders and skilled developers, effectively steering the project and ensuring seamless teamwork. However, like any venture, they face challenges and competition in the market, prompting them to continuously evolve and refine their offerings in the realm of international payments and financial solutions.

Ripple Token Distribution Mechanisms

Ripple cryptocurrency (XRP) is a crypto and platform designed for swift fund transfers and diverse financial transactions. The bulk of XRP tokens were created upon the platform's inception and are already in circulation. Unlike Proof-of-Work or Proof-of-Stake networks, there is no mining of new XRP tokens.

Instead, a mechanism known as transaction fee burning is implemented, serving as a means to safeguard the network and offer incentives for participants to support it.

When users conduct transactions on the Ripple network, a small XRP fee is charged to the sender, and these tokens are effectively removed from circulation through burning. This mechanism gradually reduces the overall supply of XRP over time.

Economic Incentive Models and Inflation

The Ripple network operates with all XRP tokens already in circulation, lacking an economic incentivization model akin to Ethereum's Proof-of-Stake mechanism. Instead, the platform's stimulation stems from its promise of rapid and cost-effective transactions for users and financial institutions.

Ripple Labs, the company driving the Ripple platform's development, holds a substantial amount of XRP, periodically selling a portion of it on the market as a means of funding.

The XRP burning mechanism serves the purpose of gradually reducing the token's overall supply, potentially influencing its market value. However, Ripple Labs governs the policies of XRP burning and selling, which may evolve based on their strategic considerations and platform requirements.

Governance and Decision Making Process

In comparison to Ethereum, where decision-making is based on improvement proposals (EIPs), Ripple follows a distinct governance model. Ripple Labs assumes the role of a central governing entity, responsible for determining and implementing changes and updates within the Ripple network. However, they do engage with the community and value feedback from users and partners.

Ripple Labs has faced criticism for the centralized nature of the platform and its substantial ownership of XRP. Changes to economic policies and management may be implemented, considering the interests of the community participants and the company's consensus.

Overall, Ripple offers mechanisms to ensure stability, while incentives are driven by the ongoing enhancement of transaction speed and financial operational efficiency, attracting users and institutional clients to their platform.

Ripple Risk Assessment

- Technical risks

Similar to other blockchain projects, Ripple faces the risk of technical issues. Vulnerabilities in the code, hacker attacks, or network malfunctions can impact platform stability and reliability.

- Competition risks

Ripple operates in the domain of instant international payments and competes with other projects and traditional money transfer systems. Competitors may offer alternative solutions that appeal to users and businesses.

- Regulation risks

Cryptocurrencies and systems like Ripple are susceptible to regulatory changes by different countries and authorities. Alterations in the legal landscape may affect the usability of Ripple for international payments.

- Partnership risks

Ripple's success heavily relies on its ability to attract partners such as banks and financial institutions. If key partners depart or alter their strategies, it could have a negative impact on Ripple's market position.

- Market volatility risks

Crypto in general is characterized by high market volatility. Ripple XRP price fluctuations can be significant and pose risks for investors and users.

It is important to note that Ripple enjoys strong commercial applications and support from major financial institutions, mitigating some of the risks mentioned above.

Community Analysis

Key Characteristics

- Appeal to financial institutions

Focus of Ripple on providing solutions for instant international payments attracts the attention of major financial institutions, who see potential in leveraging Ripple's technology to optimize their payment systems.

- Strategic partnerships

Ripple has established key partnerships with various prominent banks and financial companies worldwide, gaining support and trust from the professional financial community.

- Active developer community

Ripple has fostered an active developer community, working on technology improvements and creating new applications based on Ripple's platform.

- Technical progress

Ripple continually implements updates and enhancements to address growing user needs and scalability challenges.

Challenges and Issues

- Regulatory risks

Due to its involvement with financial institutions and global fund transfers, Ripple is exposed to regulatory risks and potential intervention from regulators.

- Competition with other platforms

Ripple faces competition from other projects offering alternative solutions for international payments and financial transactions.

- User adoption and support

Success of Ripple relies on attracting a large user and partner base. However, concerns about high transaction fees and the need for overall efficiency improvements may impact platform attractiveness.

- Lack of decentralization

Some communities criticize Ripple for its centralization and control over a significant amount of XRP tokens.

Overall, the Ripple community continues to actively evolve and explore avenues for enhancing the technology and attracting new users. Key partnerships and collaborations with financial institutions help sustain interest in the project and ensure its long-term viability.

Ripple Project's Financial Stability

- Ripple market cap and XRP liquidity

Market cap reflects the current value of all available XRP tokens in the market. A higher market capitalization generally indicates greater financial stability for the Ripple project. Active trading on crypto exchanges and the presence of liquid markets for exchanging XRP with fiat currencies and other cryptocurrencies also contribute to its stability.

- Attractiveness to investors and partners

Successful partnerships with major financial institutions and popularity among investors can also signify the financial stability of the Ripple project.

- Development level and updates

The number and quality of developers working on the Ripple platform and implementing improvements are crucial factors for its financial stability. Regular updates and platform development ensure competitiveness in the market.

- Community involvement

An active and dedicated Ripple community of developers, users, and investors who engage in discussions and support the project's development contribute to its stability and successful growth.

- Partnerships with financial institutions

Collaborations with significant financial institutions and the acquisition of new clients among banks and companies promote increased XRP utilization in international transfers and payments, influencing Ripple's financial stability.

However, as with any crypto project, there are risks, and the financial situation of Ripple may change over time depending on various factors in the crypto market and the financial industry.

Summary

Based on a thorough fundamental analysis of Ripple, it can be concluded that the project has its strengths and unique features. One of the key attractive characteristics of Ripple is its focus on solutions for international payments and money transfers. The Ripple technology allows for fast and low-cost interbank transactions, which can be appealing to financial institutions and businesses.

Collaboration with major financial institutions, such as American Express,Santander, MoneyGram, and others, confirms the interest in Ripple technology and its application in the global financial system.

However, one has to consider the risks associated with investing in the Ripple project. Competition in the field of international payments and blockchain technologies is high, and other projects are also striving to offer their own solutions for the financial industry.

In addition, regulatory risks and uncertainty regarding XRP's status as a security may impact the long-term sustainability of the Ripple project.

The community and the level of user and developer support also play a crucial role in the project's success. As of writing, Ripple has a broad user base and was actively supported by developers, but the situation may change over time.

By and large, investing in the Ripple project can be promising, especially considering its collaborations with financial institutions and its application in international payments.

As with any investment decision, though, it is advisable to assess the risksand potential crypto market volatility. Investing in Ripple should be done with a moderate level of investment, taking into account individual financial capabilities and risks.

Users can exchange all cryptocurrencies mentioned in this article for fiat or crypto on SimpleSwap.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.