USDT-OP Liquidity Pools on Velodrome

Key Insights

- Velodrome is an innovative DeFi trading platform on Optimism offering AMM liquidity pools like USDT-OP with high yields.

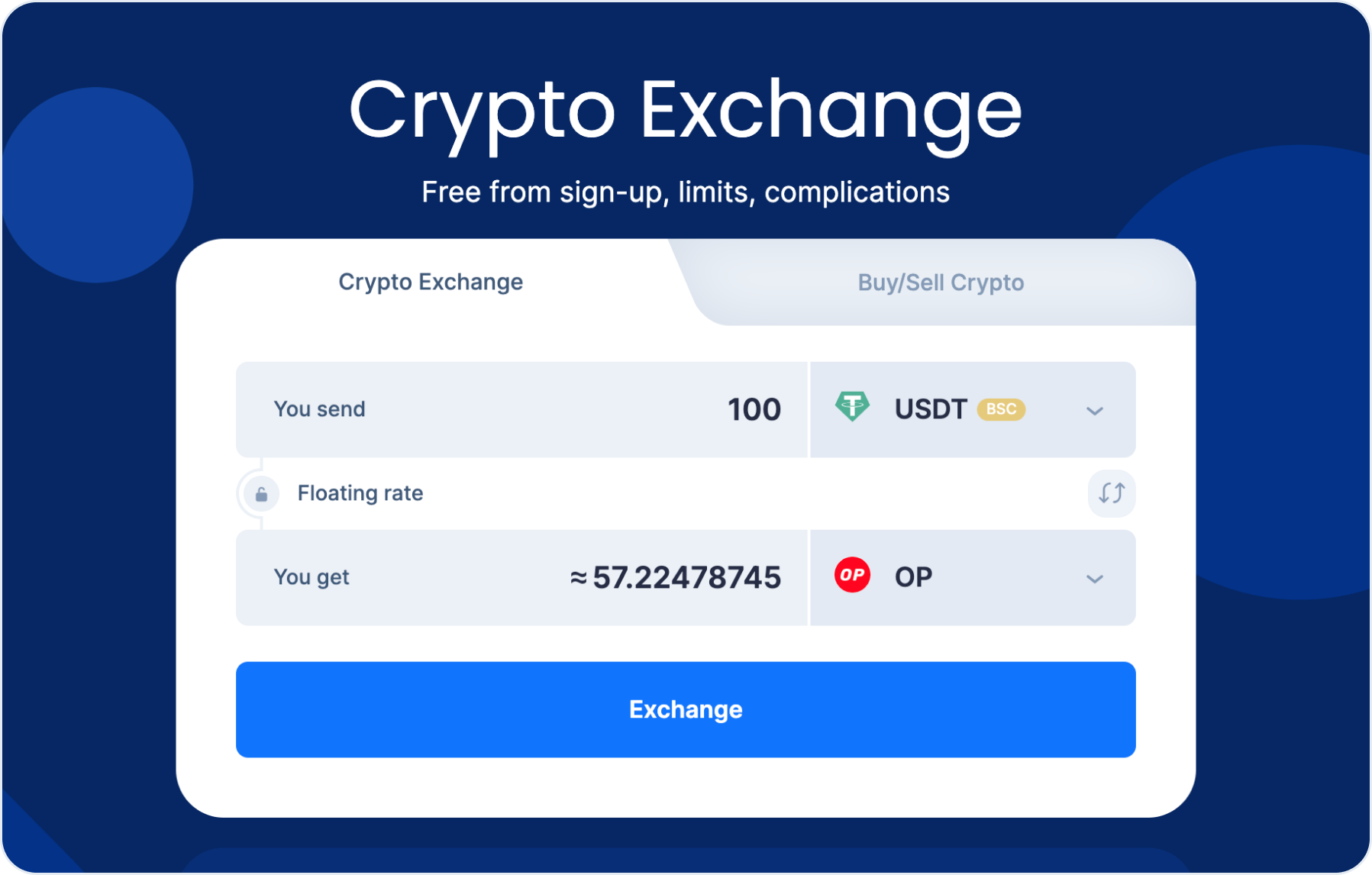

- To provide liquidity, get the OP tokens on Optimism, pair equally with USDT, and deposit the assets into the pool on Velodrome's website.

- Once deposited, stake the LP tokens to earn additional VELO rewards, monitor progress on the dashboard, and claim liquidity rewards.

What Is Velodrome Finance

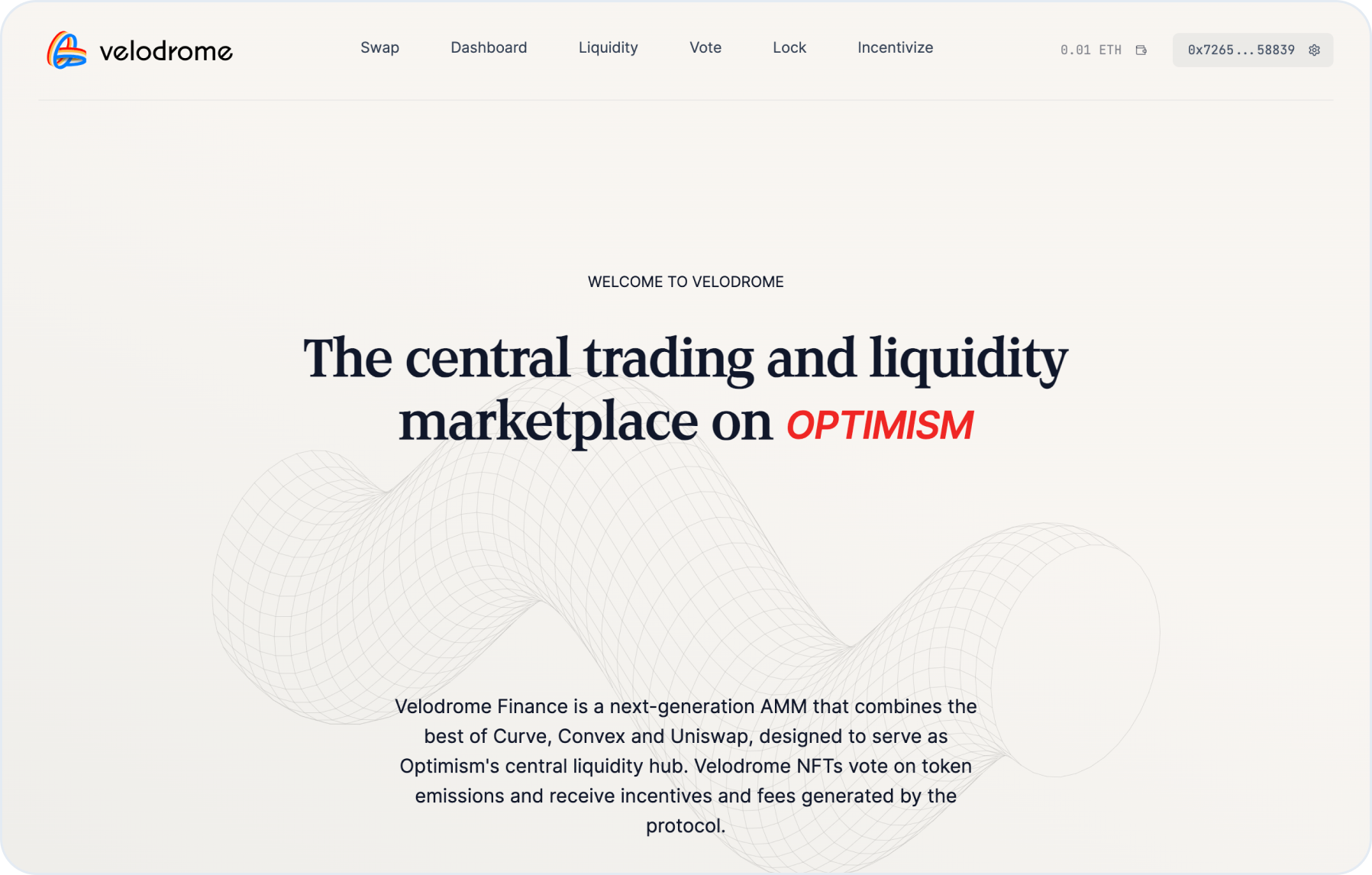

Velodrome Finance represents an innovative central trading platform and liquidity market operating on Optimism, a leading-edge technology in the DeFi sphere.

Velodrome Finance introduces unique opportunities for users and investors alike, drawing inspiration from successful platforms like Curve, Convex, and Uniswap. Positioning itself as a next-generation AMM, Velodrome Finance strives to establish a prominent role as a liquidity hub on the Optimism platform.

AMM (automated market maker) — a system that provides liquidity to the exchange and operates through automated trading.

This approach ensures heightened efficiency and performance, enabling users to execute transactions swiftly and dependably while incurring minimal fees.

What Is Optimism Crypto Protocol

Optimism is an Ethereum scaling product and is virtually a public benefit corporation with an open source codebase. Optimism is based on the Optimistic rollups technology, which is generally seen as a more viable solution in the short term due to some of the cryptographic complexities of other categories of rollups.

The Optimism protocol scales the Ethereum core network by collecting transaction data from its blockchain, aggregating it into individual packets, and then mass terminating those transactions. This data is then sent back to the Ethereum core network for validation in the form of another added block of data. By doing this, the fees required to complete the transactions are drastically reduced compared to if they were performed on Ethereum at the underlying level.

By building on Ethereum, Optimism aims to enhance the scalability and efficiency of Ethereum-based dApps, thereby contributing to the broader Ethereum ecosystem's growth and usability.

How to Use Velodrome

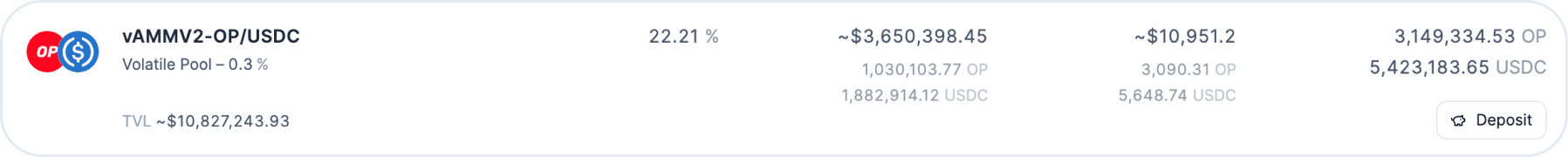

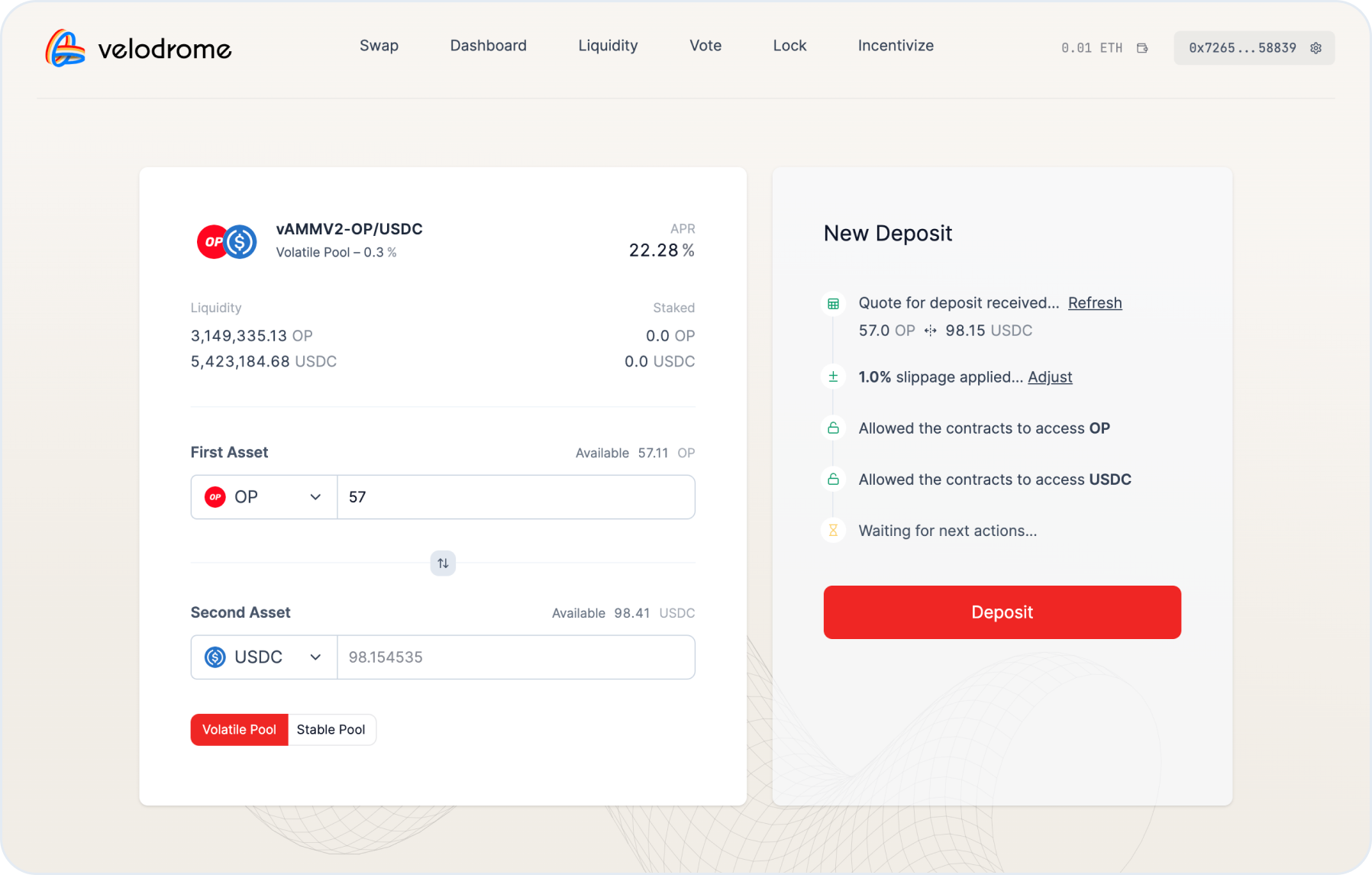

Here's a step-by-step breakdown with a yield of 22.21%

- Integrate the Optimism network into your wallet

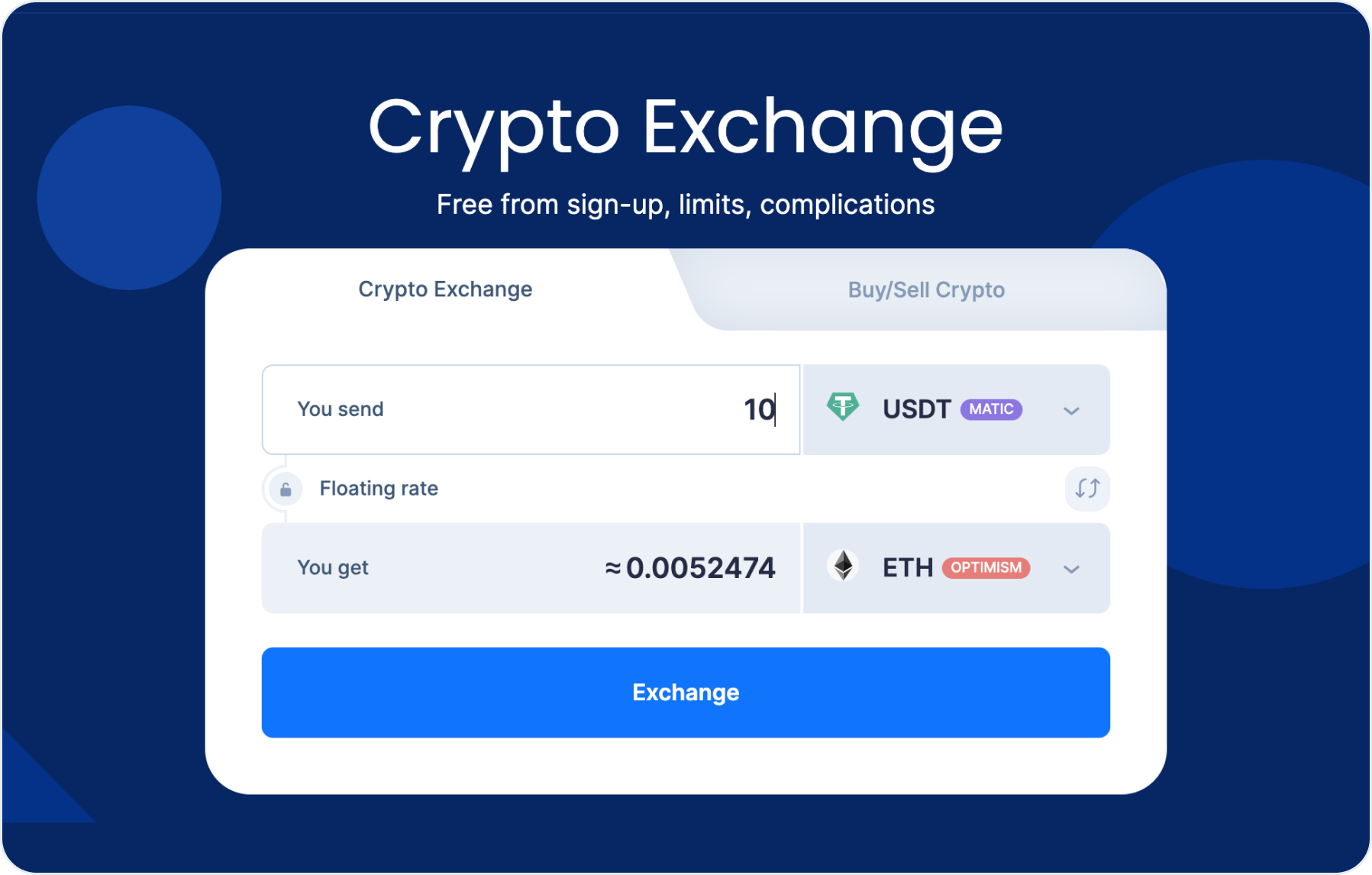

Allocate a minor portion of ETH on Optimism in your wallet on SimpleSwap to cover transaction fees

This helps establish a balanced pool composition.

- Visit the official website of the protocol on Velodrome Finance

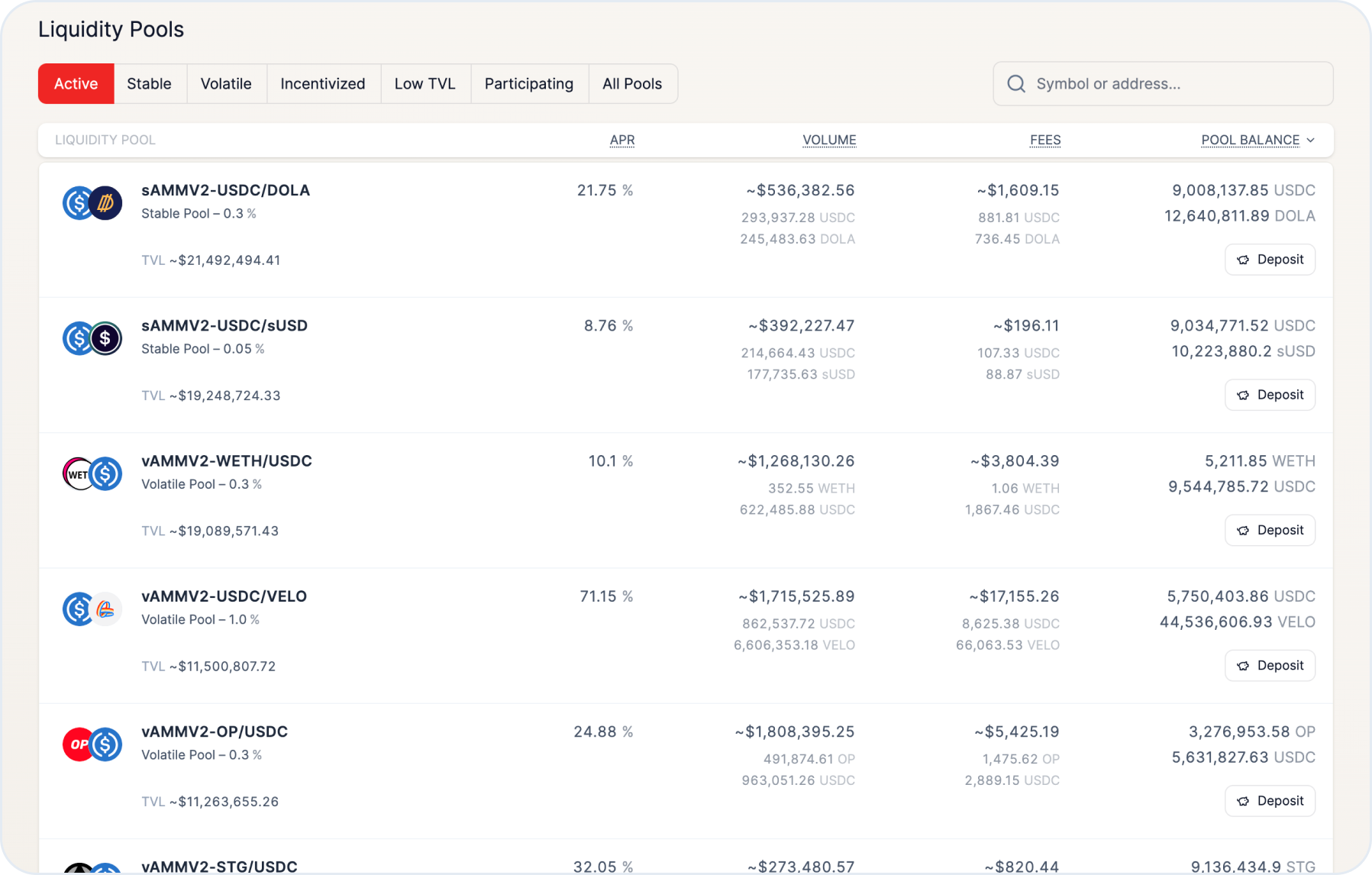

- Access the Liquidity section

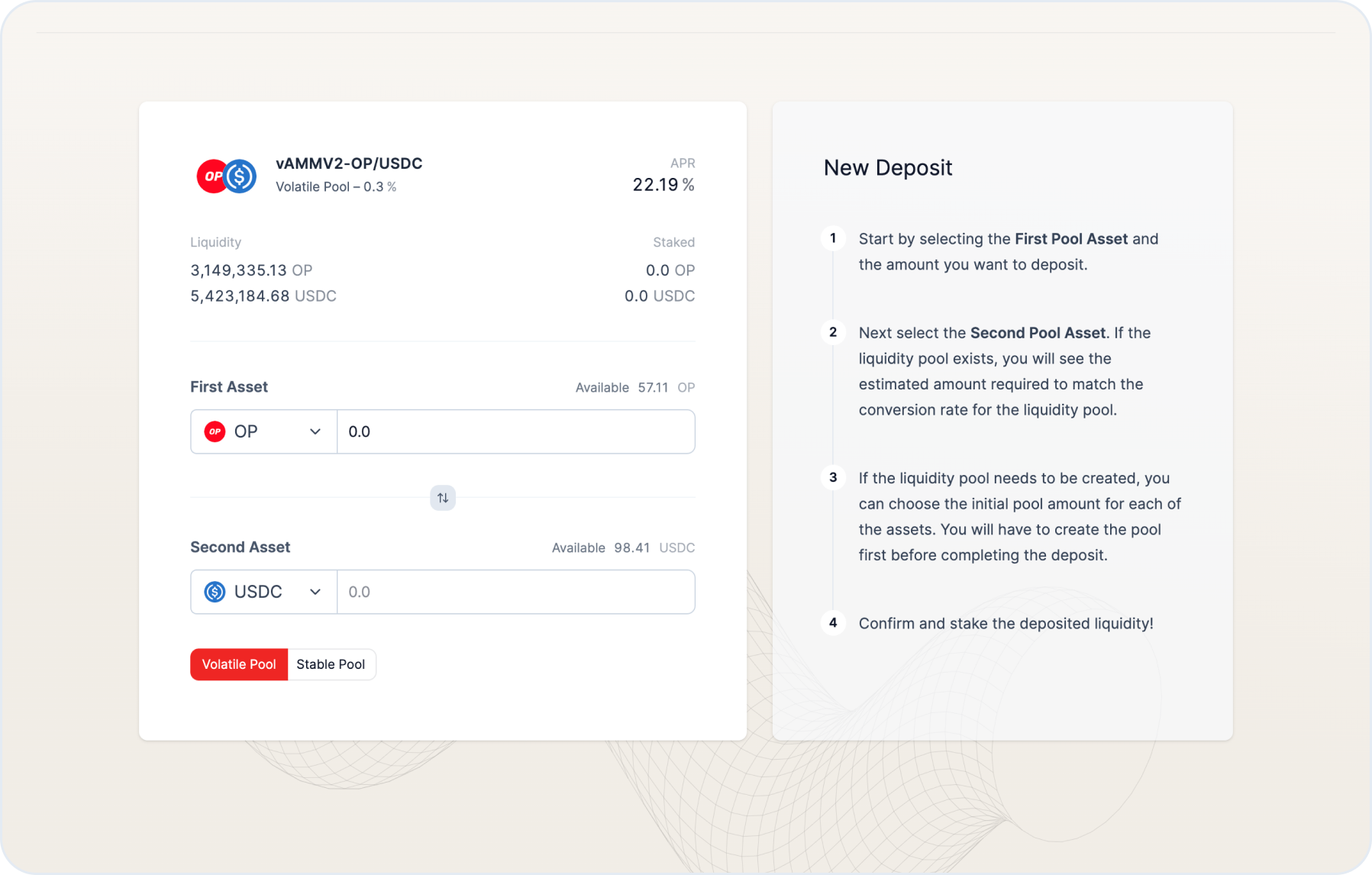

- Select the USDC / OP pool carefully, initiating your engagement

- Deposit your assets into the pool and confirm the action by clicking Deposit

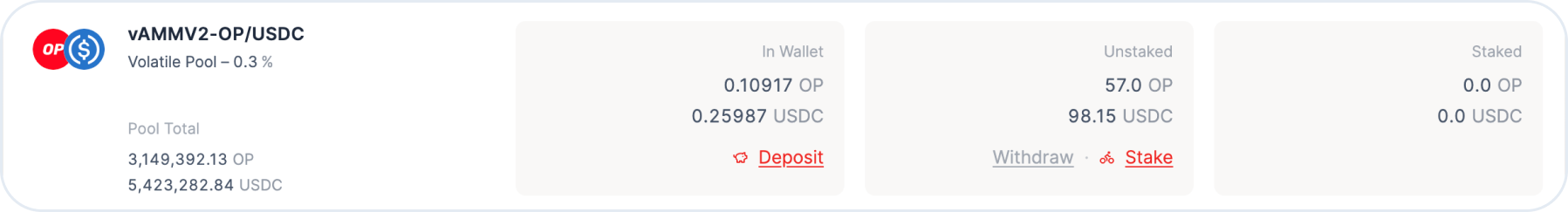

- Navigate to the Dashboard area to monitor the progress of your newly formed pool.

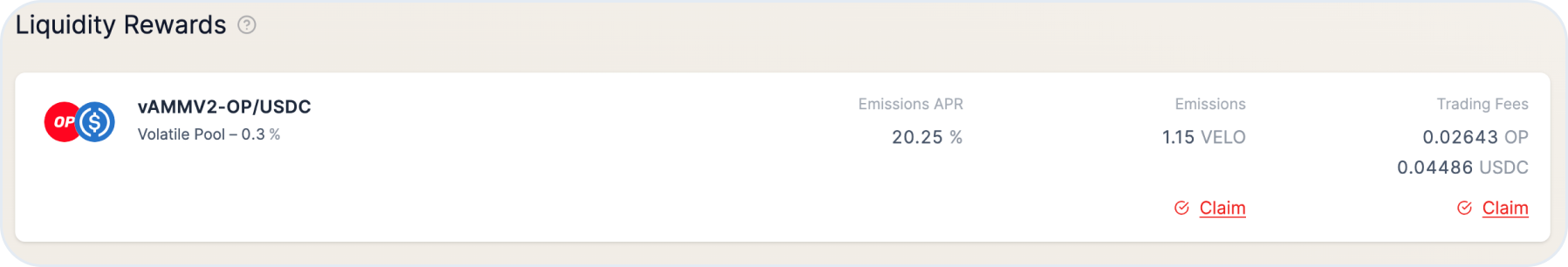

- Stake your LP tokens to generate additional profit in VELO tokens

Voila! Feel free to claim your liquidity rewards or wait to generate more.

Users can get all coins mentioned in this article on SimpleSwap.

Summary

Here we delved into Velodrome trading platform on Optimism which is in turn based on Ethereum. Optimism allows for much lower fees for transactions as it would be on the very Ethereum network on an underlying level. Velodrome Finance claims to be the next-level automated market maker (AMM).

Furthermore, in this article we provided a detailed step-by-step guide on how to use Velodrome from the start to claiming liquidity rewards.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.